Sales Tax Liability

You need to create a new organization and choose the US edition to make use of this feature. Below are a list of operations you can perform with sales tax.

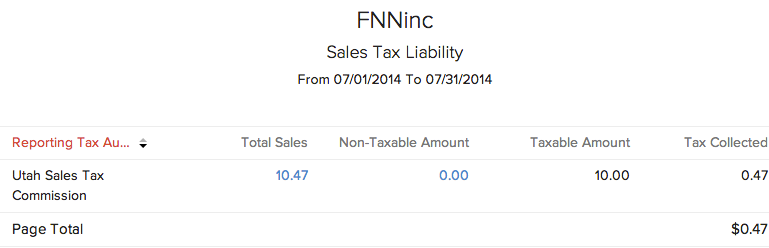

Sales Tax Liability Report

You can view detailed tax reports which displays clearly the taxable and non-taxable amount for a Tax Authority.

- Go to the Reports module from the sidebar.

- Navigate to the Taxes sub-tab and choose Sales Tax Liability.

- You’ll be able to see a table with sales with tax, sales, including the taxable and non-taxable amounts and also the actual tax collected.

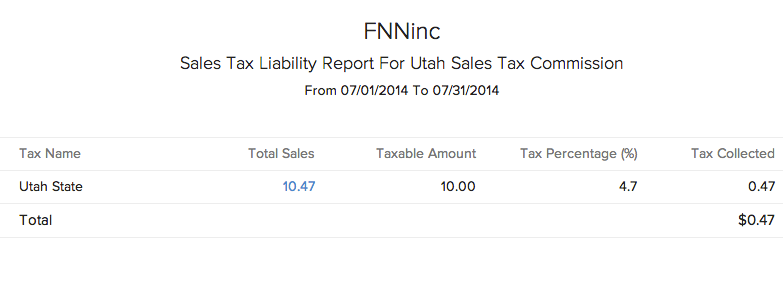

- Click on Sales to view a table containing the non-taxable sales, names of the taxes the tax authority collects along with corresponding total sales, taxable amount, tax percentage and the actual tax collected.

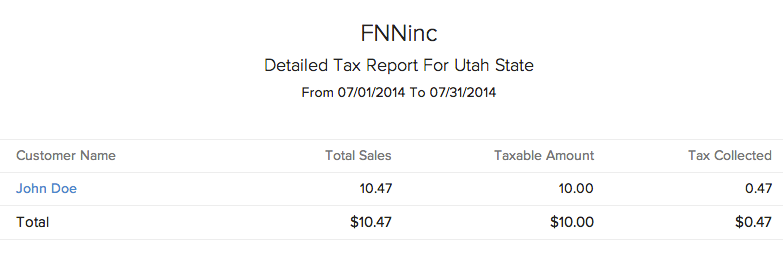

- If you further click on the Tax Name, you’ll be able to view the list of customers who are associated with that tax.

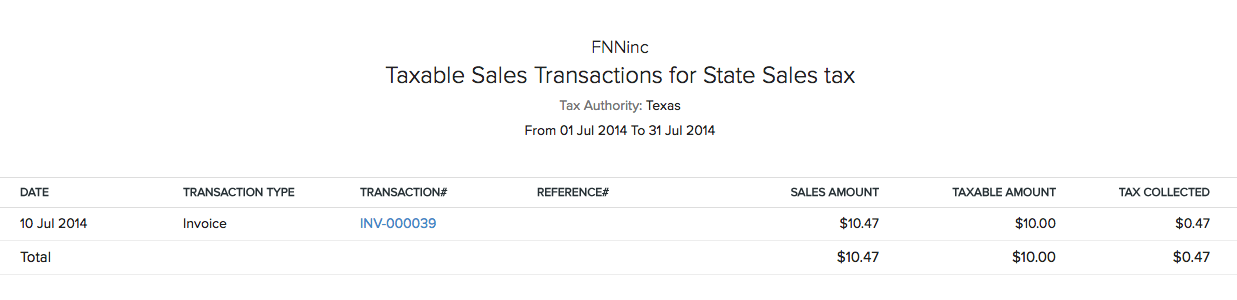

- Furthermore, if you click on Total Sales, you’ll be able to view a detailed report of the transactions for that particular tax.

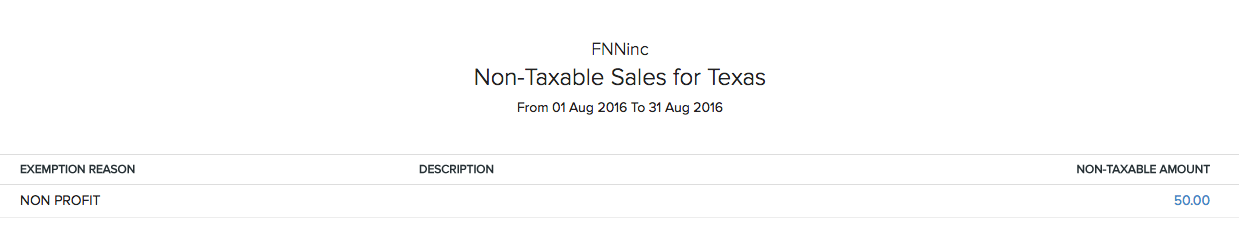

- Also, if you wish to view the non-taxable sales transactions, click on Total Sales next to Non-taxable Sales on your Sales Tax Liability report. You’ll be able to see the exemption reason, description and the non-taxable amount.

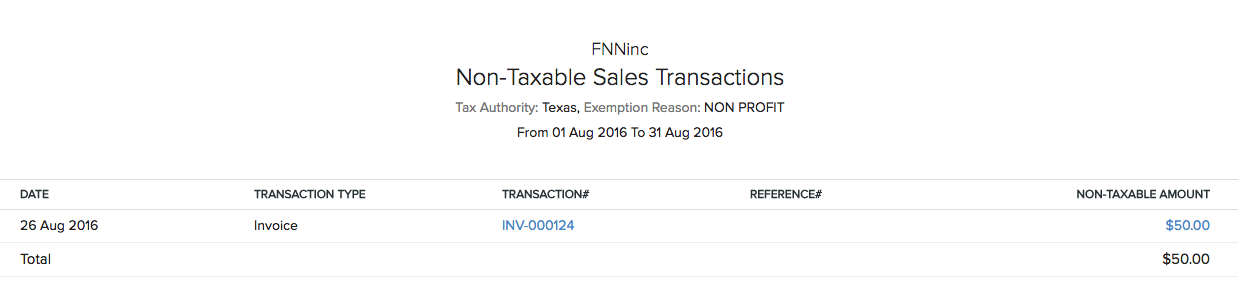

- If you click on the Exemption reason, you will be able to view a detailed report of all the Non-Taxable Sales transactions, for that exemption reason.

Terminologies

| Name | Description |

|---|---|

| Tax Name | It simply refers to the name you’d like to assign to a particular tax. For example, Austin can be the name assigned to the sales tax for the city of Austin. |

| Tax Authority | It refers to the organization in charge of collecting taxes in a specified region. For example, the Travis County Tax Office is the tax authority for Austin, Texas. |

| Rate | It refers to the tax rate for a particular region in percentage. For example, the tax rate in Austin, Texas is 8.25 (percentage). |

| Exemption Reason | Users have to enter why a customer/transaction/item is exempt from sales tax. For example, Child Care and Non Profit Organizations are exempt from tax. |

Yes

Yes