Form 1099

Form 1099 is a group of tax forms that a business uses to report different types of payments to the IRS. These forms help the IRS keep track of various incomes, such as payments to independent contractors, interest, dividends, rent, retirement distributions, government benefits, and other types of non-employee income. Each type of payment has its own Form 1099 to ensure all income is reported correctly for tax purposes.

Note: You can currently generate only Form 1099-NEC and Form 1099-MISC in Zoho Books.

How Form 1099 Works

In Zoho Books, enable the Track payments made to this vendor for filing Form 1099 option while creating or editing a vendor to track the payments made to the respective vendor. Once enabled, all paid transactions of that vendor will be tracked as payments to be included in the Form 1099 report.

Next, you can easily generate Form 1099 for the applicable fiscal year by mapping the accounts to the corresponding boxes, selecting the vendors, and reviewing the details.

Once Form 1099 is generated, you can download it as a CSV file and file it in the IRIS Taxpayer Portal. After filing, you can mark the report as filed in Zoho Books and email the copy of the Form 1099 to your vendors.

Form 1099 Box Threshold Limits

In Zoho Books, businesses can generate Form 1099-MISC (Miscellaneous) and Form 1099-NEC (Non-Employee Compensation). Each box in the report has a threshold limit set by the IRS, and only vendors who have received payments meeting these limits will be included. Refer to the tables below for details on the different boxes and their minimum threshold limits for Form 1099 - MISC and Form 1099 - NEC.

Note: Boxes and thresholds are subject to change. Visit the IRS website for the latest updates.

Form 1099 - MISC

| Box | Payment Type | Minimum Threshold Limit |

|---|---|---|

| Box 1 | Rents | $600 |

| Box 2 | Royalties | $10 |

| Box 3 | Other Income | $600 |

| Box 4 | Federal Income Tax Withheld | $0 |

| Box 5 | Fishing Boat Proceeds | $600 |

| Box 6 | Medical and Health Care Payments | $600 |

| Box 7 | Payer Made Direct Sales of $5,000 or More | $5000 |

| Box 8 | Substitute Payments in Lieu of Dividends or Interest | $10 |

| Box 9 | Crop Insurance Proceeds | $600 |

| Box 10 | Gross Proceeds Paid to an Attorney | $600 |

| Box 11 | Fish Purchased for Resale | $600 |

Form 1099 - NEC

| Box | Payment Type | Minimum Threshold Limit |

|---|---|---|

| Box 1 | Nonemployee Compensation | $600 |

| Box 2 | Payer Made Direct Sales Totaling $5,000 or More | $5000 |

| Box 3 | Excess Golden Parachute Payments | $0 |

| Box 4 | Federal Income Tax Withheld | $0 |

Enable Form 1099 Tracking for Vendors

You can enable Form 1099 tracking for vendors who are independent contractors, freelancers, or receivers of reportable payments like services, rent, or interest. To enable:

- Go to Purchases on the left sidebar, and select Vendors.

- Click + New in the top right corner to create a new vendor, or select an existing vendor, and click Edit on the Details page.

- In the Other Details tab, check Track payments made to this vendor for filing Form 1099, and enter the vendor’s TAX ID.

- In the Form W-9 field, click Attach File to upload the Form W-9 if the vendor has provided it to your business. Read our help document to learn more about how Form W-9 works.

- Click Save.

Now, once you enable this option for the vendor, their transactions will be tracked. You can include the vendor in the Form 1099 report, and if the transactions mapped to the box meet the IRS threshold, they will be included in the generated report.

Generate Form 1099

Once Form 1099 payment tracking is enabled for a vendor, all paid transactions to that vendor will be tracked. Zoho Books will use these transactions to help you generate the Form 1099 report for the specified period. To generate Form 1099:

Go to Taxes on the left sidebar, and select Form 1099.

Click Generate Form 1099 in the top right corner.

In the page that follows, under the Map Accounts tab, fill in the following fields:

- Filing Year: Choose the year for filing Form 1099.

- Filing Form: Select either 1099-NEC or 1099-MISC.

- Once you select the filing year and form, the boxes will appear based on the type of Form 1099 you choose.

Note: You need to map the accounts to the boxes, and Zoho Books will calculate the values for each box based on the payments made to vendors in the fiscal year and the IRS-set thresholds. Check the threshold limit table for details on the IRS thresholds.

- Hover over the box you want to add accounts to and click Add Accounts. In the Select Account popup, under Recommended Accounts, you’ll see accounts filtered based on the accounts you used to record purchase transactions of Form 1099-tracked vendors. You can then select the account to match the box.

- If your account isn’t listed under Recommended Accounts, go to All Accounts to manually select the account you want to add for the box and click Select.

Click Next.

In the Select Vendors tab, you can filter the following vendors based on tracked transactions and the IRS Form 1099 threshold:

- Tracked and Qualified Vendors: This filter shows vendors whose payments meet the IRS thresholds for the selected boxes and have their accounts correctly mapped for tracking.

- All these vendors are preselected by default. If you don’t want to include a particular vendor, you can simply unselect them.

- If you want to exclude specific transactions with a vendor:

- Select the vendor for whom you want to exclude transactions.

- In the next page, go to the Reportable Payments tab.

- Hover over the transaction, and click Exclude to the right.

- Click Save to apply the changes.

- Tracked and Unqualified Vendors: This filter shows the vendors whose transactions are tracked and mapped to the correct boxes, but their transactions do not meet the IRS threshold for the mapped box. You can manually add their transactions to qualify them for the Form 1099 filing. Here’s how:

- Hover over the unqualified vendor and click Qualify Vendor.

- On the next page, go to the Non-Reportable Payments tab.

- Hover over the required transactions and click Include.

- Select the boxes to map the transactions.

- Click Save.

Note: When including a Non-Reportable Payment, vendors will qualify if they meet the IRS threshold. If not, they will remain under Tracked and Unqualified Vendors.

- Non-Tracked Vendors: This filter includes vendors whose payments aren’t tracked yet. Click Track Payments for 1099 to start tracking.

- Tracked and Qualified Vendors: This filter shows vendors whose payments meet the IRS thresholds for the selected boxes and have their accounts correctly mapped for tracking.

Insight: When you click Track for 1099 and the vendor doesn’t meet the IRS threshold for filing Form 1099, they will be moved under Tracked and Unqualified Vendors.You can manually record transactions for the vendor to qualify them to be included in the Form 1099 report. Once they do, they will be moved under Tracked and Qualified Vendors, where you can select them for Form 1099 filing.

- Click Next.

- In the Review tab, check each vendor’s Tax ID, Address, and box values.

- If any details are missing, a warning will appear for that vendor. Hover over the warning and click Add Now.

- In the Edit Vendor popup, fill in the details you’ve missed and click Save.

- If you want to exclude or include any reportable or non-reportable payments, click View Details to the right of the vendor.

- In the page that follows, under Reportable Payments, select a box, and click Exclude against the transaction you don’t want to include for the vendor.

- After reviewing the details, click Save and Generate at the bottom.

Insights:

- Reportable Payments are the total vendor payments from mapped accounts that qualify for IRS reporting.

- Non-Reportable Payments are the total vendor payments that don’t qualify for IRS reporting, either because they come from unmapped accounts or because payments from mapped accounts didn’t meet the threshold.

Export Form 1099 for Filing

Once you generate the Form 1099, you can export it as a CSV file compatible with the IRS. To export Form 1099:

- In the 1099 Report page, click Export for Filing in the top right corner.

- In the Organization Profile popup, fill in the following fields:

- Tax ID: Enter the 9-digit taxpayer identification number (TIN).

- Organization Name: This field will be auto-populated based on your business’s Organization Profile, but you can edit it if needed.

- Legal Business Name: Enter your business’s legal name if it differs from the organization name.

- Email Address: Provide your business email.

- Organization Address: The address will be auto-filled from your Organization Profile. If it isn’t, you can enter the address details manually. You’ll need to enter the phone number manually.

- Click Save and Proceed.

- In the next popup, click Export.

Now, the Form 1099 will be downloaded onto your device in CSV format, which is IRS-compatible. Once downloaded, you can file it directly with the IRS. Learn more about how to file E-file information in the IRIS Taxpayer Portal.

Mark Form 1099 as Filed Manually

After filing the generated Form 1099 with the IRS or the state’s tax authorities, you can return to Zoho Books and manually mark the Form 1099 as filed on the generated Form 1099 page. Here’s how:

- In the Form 1099 page, click the More icon in the top right corner, and select Mark as Filed from the dropdown.

- In the Mark Form 1099 %type% for %year% as Filed popup, complete the following fields:

- Filing Date: Choose the date you filed Form 1099 with the IRS.

- Filing Source: Enter the method used to file.

- Notes: Add any relevant notes if needed.

- Click Mark as Filed.

Now, the Form 1099 will be marked as filed.

Insights: You can undo the action by following the same steps above and clicking Mark as Unfiled from the dropdown.

Email Form 1099 to Vendors

Insights:

- If you’ve already provided your vendors with a physical copy of Form 1099, click the More icon in the top right corner, and select Mark as Sent in Zoho Books to update the status to Sent.

- If you want to email the Form 1099 to only specific vendors, select the vendors you want to send the email to, and click Send Email at the top.

Once you’ve marked Form 1099 as Filed, you can email its copy to the respective vendors in bulk. Here’s how:

- In the Form 1099 page, click Send Email in the top right corner.

- In the popup that follows, click Send Email to confirm.

Now, the Form 1099 will be scheduled to be sent to the respective vendors.

E-file Form 1099 in Zoho Books

Prerequisite: This option is available only if you’re on the paid plans of Zoho Books, and you’re* *filing forms for the Financial Year 2025.

Once you’ve generated the required Form 1099 in Zoho Books, you can file it directly to the IRS. Here’s how:

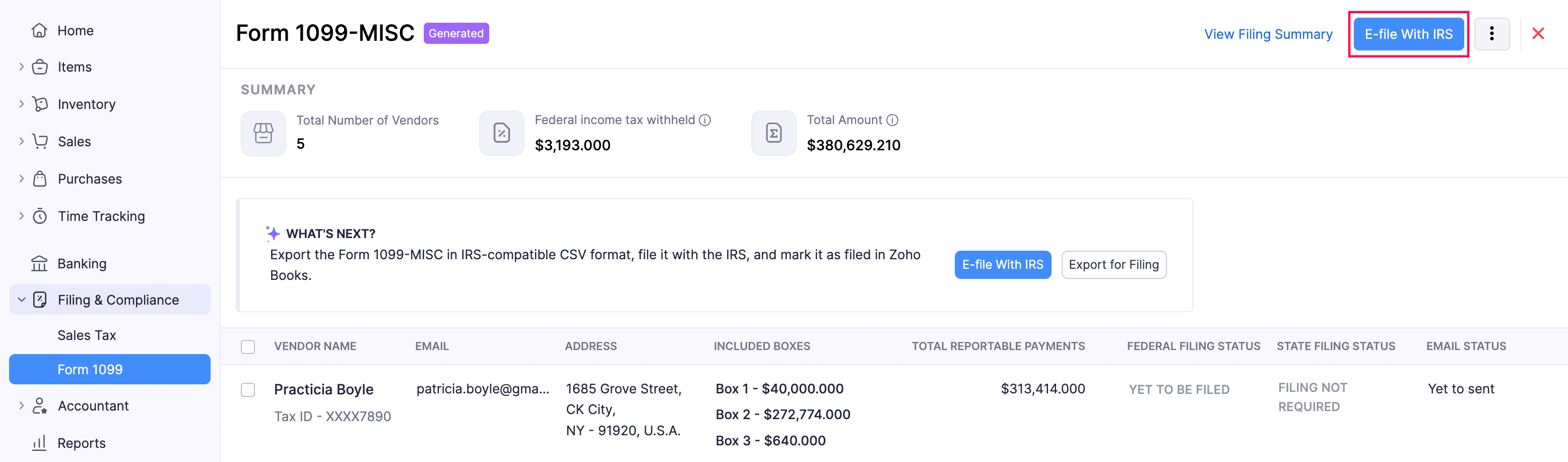

Go to Filing & Compliance on the left sidebar and select Form 1099.

Select the form you want to submit to IRS.

Click E-file With IRS in the top right corner.

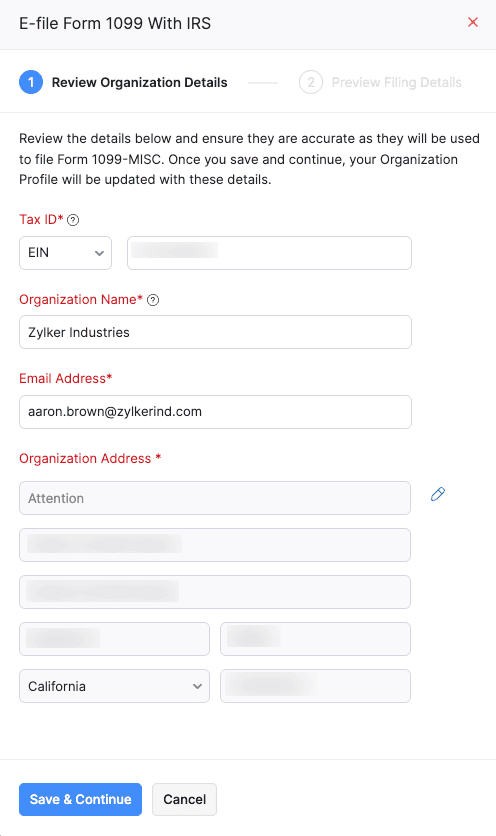

In the pop-up that appears, under Review Organization Details, enter your organization address details.

Click Save & Continue.

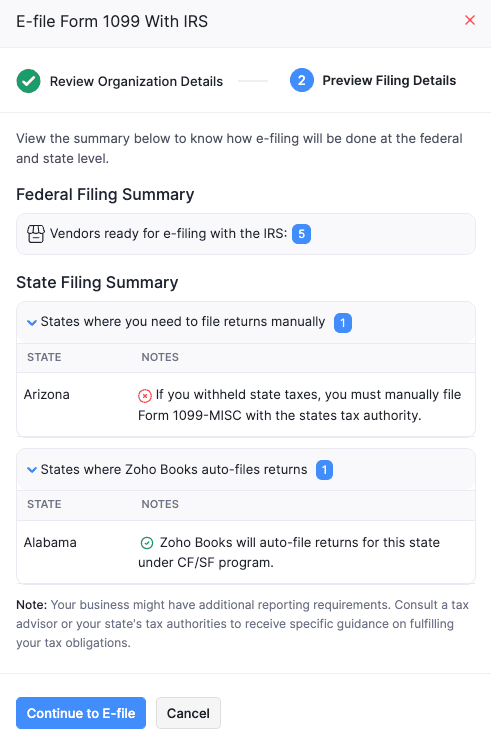

Under Preview Filing Details, view the summary of how the filing will be done at both state and federal levels.

Click Continue to E-file.

Insight: The filing summary shows how your 1099 forms are submitted at both state and federal levels, and who is responsible for each filing.

- In Zoho Books, you can file all your 1099 forms with IRS, as federal filing is mandatory.

- State filing requirements vary by state. Based on each state’s rules, the filing summary displays the applicable filing status, so you know whether state-level filing is required.

- For the states that participate in the IRS Combined Federal/State Filing (CF/SF) program, you can file your 1099 form with IRS in Zoho Books, and the IRS forwards the data to the respective state. In this case, no separate filing is required. If a state does not participate in CF/SF, you must file your 1099 form manually.

- Some states (such as Alaska) do not require 1099 filing. In these states, no state-level filing is needed.

- In the confirmation pop-up, read and agree to the terms, and click E-file With IRS.

The form will be submitted to the IRS, and it’s status will be changed to Submitted. The IRS will process your form and the form’s status will be updated to Accepted or Rejected. If rejected, you can download the rejection reasons as a CSV file.

Note: You can file a correction form in Zoho Books if your Form 1099 is rejected, or it is accepted, but contains missing or incorrect details.

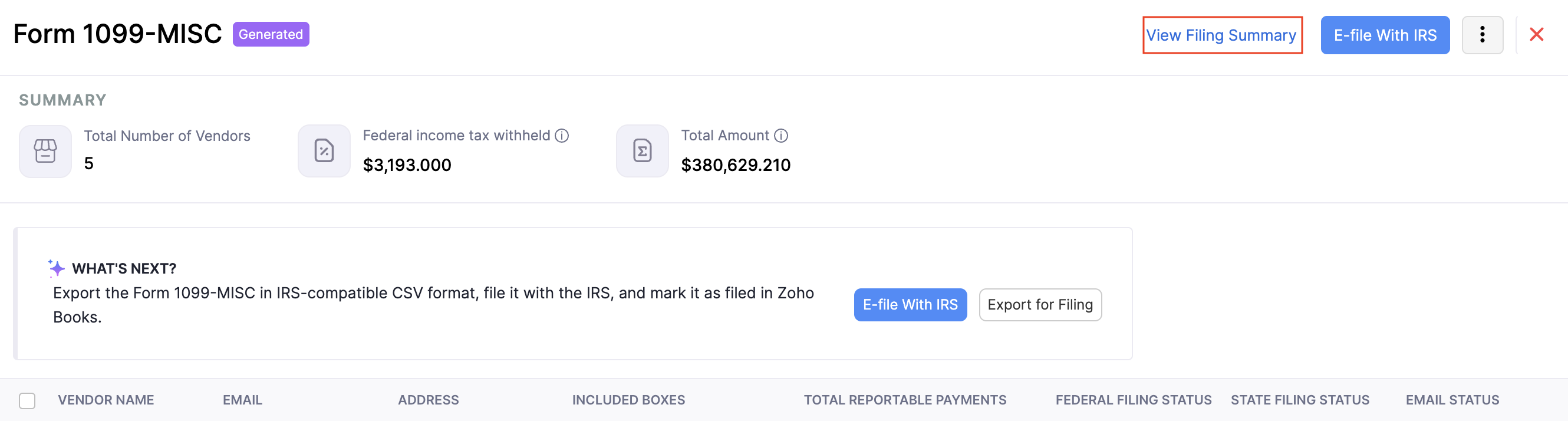

View Filing Summary

If you’ve submitted the form to IRS, you can see how the filing is done and the transactions are reported in the respective states. To do this:

Go to Taxes & Compliance on the left sidebar and select Form 1099.

Select the form you want to view the filing summary.

In the next page, click View Filing Summary at the top of the page.

The filing summary will be displayed.

File Correction Form

The Correction Form is a revised version of the Form 1099 that you’ve filed with IRS. If the Form 1099 you previously filed was either rejected, or contains incorrect or missing information like invalid addresses, TINs, or payment amounts. To fix this, you can generate a Correction Form for the respective Form 1099, and submit it to IRS directly from Zoho Books.

Note: You can file a Correction Form for one vendor at a time.

Scenario: Aaron generates the Form 1099- NEC for his vendor, Patricia, and the form is accepted by IRS. Later, he realizes that he has reported an incorrect payment of $5000, while the actual payment is $4500. To fix this, he generates a Correction Form, excludes the respective payment amounts, and files it with the IRS.

To generate a Correction Form:

- Go to Taxes & Compliance on the left sidebar and select Form 1099.

- Select the form for which you need to generate the correction form.

- In the next page, click the More icon next to the required vendor, and select Generate Correction Form.

- In the confirmation pop-up, click Continue.

- In the next page, click the dropdown icon next to the required vendor, and choose one of the following preferences:

- Manage Payments: If you want to exclude or include a vendor’s transactions from the Form 1099 filing.

- Edit Vendor: Edit the vendor’s details and file the correction form. For example, if you’ve provided an incorrect address for the vendor and filed the Form 1099 previously, you can generate a correction form, update the address, and submit it to IRS.

Insight: You can also change the accounts mapped to the respective boxes and generate a correction form for it. Note that the account you choose will also be carried forward for the next reporting period.

- Click Proceed to E-file.

- In the pop-up that appears, review your organization details and click Save & Continue.

Warning: Ensure that you don’t update your organization address after filing a Form 1099. The details in the Correction Form will be accepted by IRS only if the actual and the corrected forms contain the same organization address.

- Review your filing details at both federal and state levels and click Continue to E-file.

- In the confirmation pop-up, read and agree to the terms and click E-file Correction Form with IRS.

The correction form will be submitted to the IRS.

Note: If your correction form is rejected by IRS, the form for the respective vendor will be marked as Rejected in Zoho Books, and you can also download a CSV file to know about the reasons for rejection. If rejected, you can generate a correction form for the same and submit it to the IRS.

View Vendor Summary

If you’ve generated and submitted Form 1099 and the subsequent correction forms to IRS, you can view the list of such forms, along with it’s status. To view this:

- Go to Taxes & Compliance on the left sidebar and select Form 1099.

- Select the form for which you need to generate the correction form.

- In the next page, click the More icon next to the required vendor, and select View Vendor Summary.

The Vendor Summary will appear in the right pane. Click Download XML next to the required forms to download the forms in the XML format.

Other Actions in Form 1099

Download Form 1099

You can also download the Form 1099 in CSV format. Here’s how:

- Go to Taxes on the left sidebar, and select Form 1099.

- In the List View page, hover over and select the Form 1099 that you want to download.

- Click Download As in the top right corner, and select CSV from the dropdown.

Now, the file will be downloaded to your device in the CSV format.

View the Details of Vendors Filed in Form 1099

To view the details of the vendors included in Form 1099:

- Go to Taxes on the left sidebar, and select Form 1099.

- In the List View page, select the Form 1099 you generated to view the vendor details.

- In the Form 1099 page, hover over the vendor and click View Details.

Now, you’ll see the vendor’s details and their transactions you’ve included in the Form 1099 you generated and filed with the IRS.

Download Vendor Details as PDFs

To download the selected vendor’s details as a single PDF file:

- Go to Taxes on the left sidebar, and select Form 1099.

- In the List View page, select the Form 1099 you generated to download the vendor details as PDF.

- In the Form 1099-%type% page, hover over the vendor for whom you want to download the details, click the dropdown to the right, and select Download the PDF.

Now, the vendor’s details, along with the transactions from the Form 1099 you filed with the IRS, will be downloaded in the format used for filing in the IRIS Taxpayer Portal.

Bulk Download Vendor Details As a ZIP File

If you have multiple vendors in the Form 1099, you can download their details as separate PDFs in a single ZIP file. Here’s how:

- Go to Taxes on the left sidebar, and select Form 1099.

- In the List View page, select the Form 1099 you generated to download the vendor details as PDF.

- In the Form 1099-%type% page, select the vendors you want to include in the ZIP file.

- Click the ZIP icon at the top.

Now, the vendor details and their transactions will be downloaded as a ZIP file containing separate PDF files for each vendor.

Form 1099 Vendor Payments Report

The Form 1099 Vendor Payments report lists all transactions made to Form 1099-tracked vendors in Zoho Books. To view this report:

- Go to Reports on the left sidebar.

- Select Form 1099 Vendor Payments report under Purchases and Expenses.

In the report, you can view details such as vendor names, transaction dates, recorded accounts, payment methods, and the transaction amounts.

Filing Form 1099 with Yearli

You can integrate Zoho Books with Yearli and file Form 1099. Read our help document to know more about filing 1099 with Yearli.

Filing Form 1099 with Tax1099

You can integrate Zoho Books with Tax1099 and file Form 1099. Read our help document to know more about filing 1099 with Tax 1099.

Yes

Yes