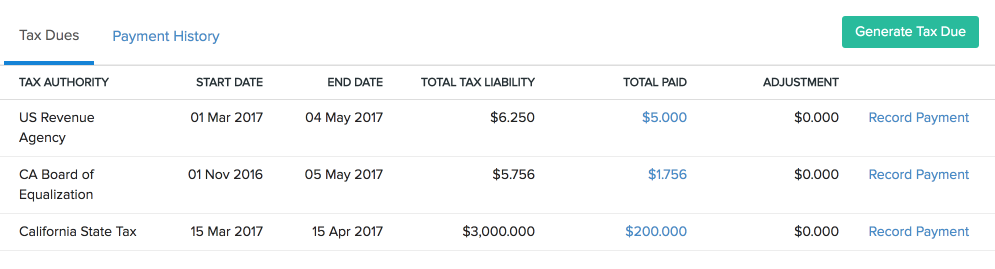

Tax Payments

Record tax payments

After you have paid the taxes you owe to the respective tax authorities, you can record those payments. Tax payments will be in accordance to the tax basis (accrual or cash) chosen in the organization profile. Before recording a payment, please make sure you’ve configured a bank account or a credit card. To record a tax payment, follow the steps below:

- Go to the Accountant module, select Tax Payments.

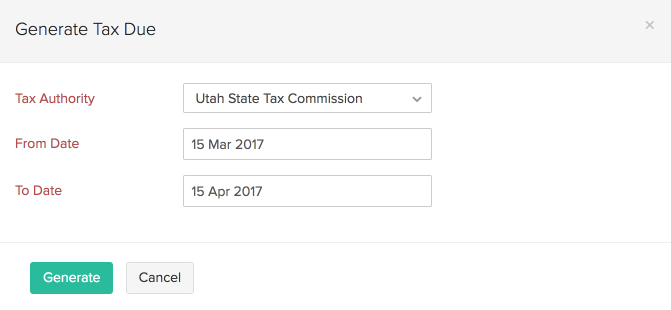

- Click the Generate Tax Due button in the top-right corner of the window.

- Select the Tax Authority from the dropdown.

- Select the From and To dates.

- Click Generate.

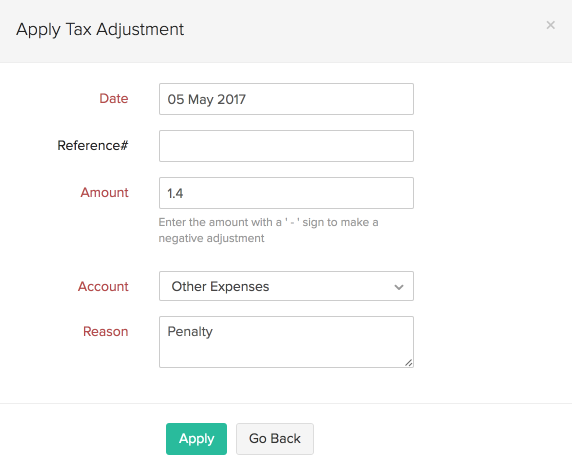

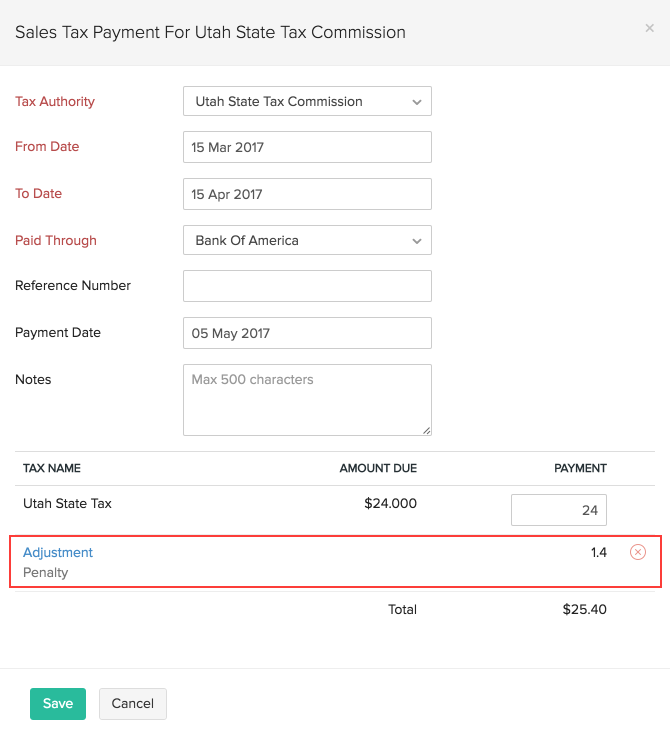

Record payments with an adjustment

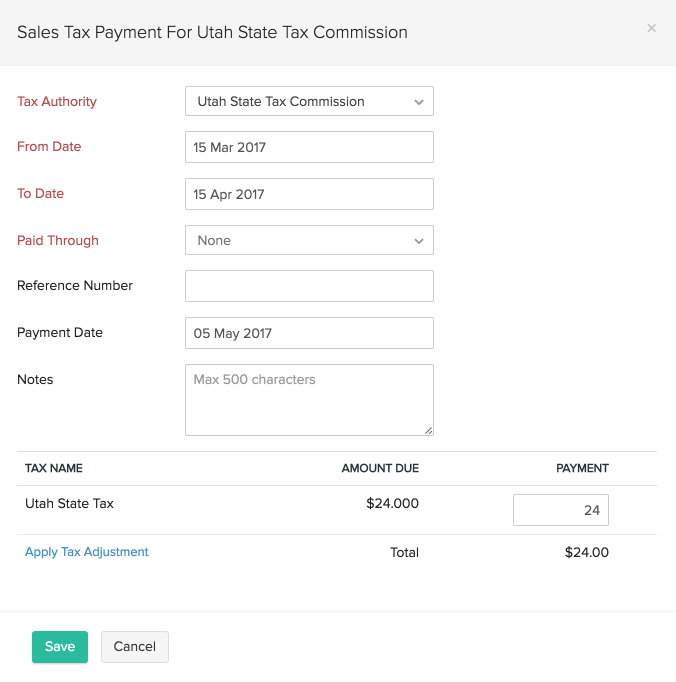

You can make an adjustment to the tax you owe in case of any rounding differences, penalties or discounts. To record a tax payment with an adjustment:

- Go to the Accountant module.

- Select the Tax Payment for which an adjustment has to be recorded and click Apply Tax Adjustment.

- Enter an adjustment Amount and select an appropriate Account.

- Note that the Account dropdown would contain expense accounts for positive adjustment amounts and income accounts for negative adjustment amounts.

- Enter a reason for the adjustment and click Apply.

Now that an adjustment has been applied, the corresponding payment has to be recorded. Click Save in the Record Tax Payment form to record the payment with the adjustment.

You can find the list of tax adjustments applied in Tax Adjustments tab.

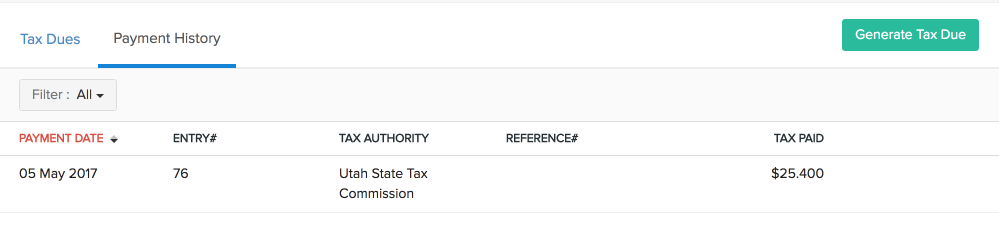

Payment History

To view the tax payments you have made:

- Go to the Accountant module and select Tax Payments.

- Click the Show Payment History page on the top-right corner.

Yes

Yes