Filing With Tax 1099

Before you start the filing process in Tax 1099, ensure that you’ve set up 1099 tracking and generate the report in Zoho Books.

- Login to tax 1099.com using your credentials.

- In the tax1099 dashboard, click on the Zoho logo in Quick Import section on the left hand side of the screen.

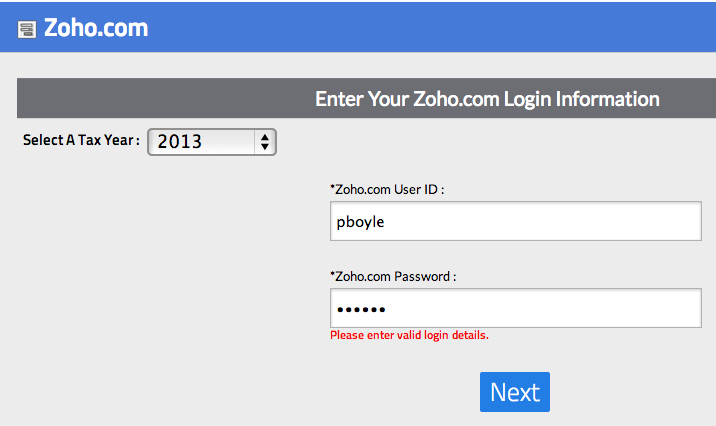

- Select the year for which you want to file 1099 and enter your Zoho Books credentials in the Import page.

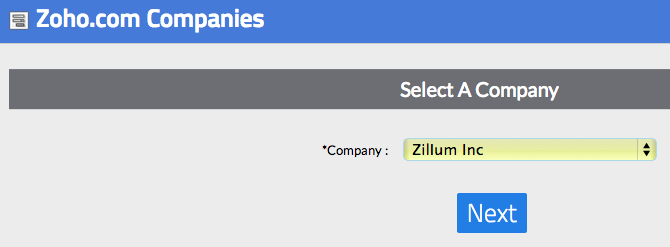

- Once you have successfully logged in, you have to select your organization’s name as entered in Zoho Books from the Company drop-down box and click on Next button.

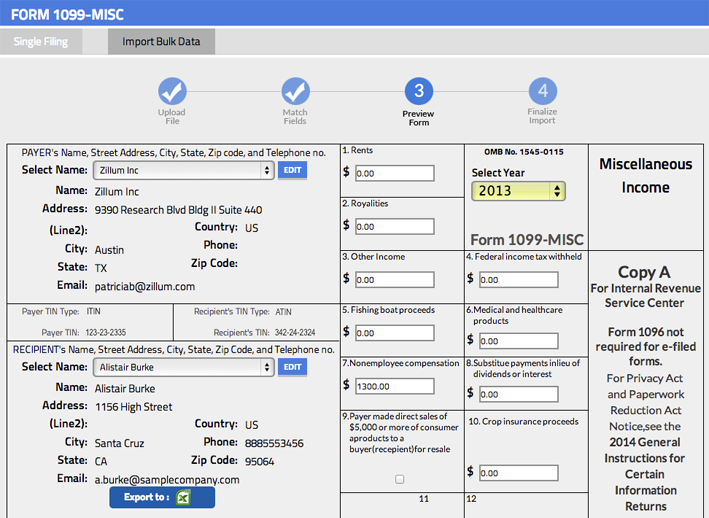

- You can find the payer and recipient’s information filled in the respective blocks in the Form 1099- MISC page. These details are directly fetched from your Zoho Books organisation. For each vendor, the appropriate amount will be populated in the respective boxes in the right hand side. You can verify the same in 1099 Reports in Zoho Books.

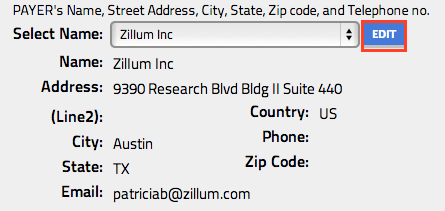

- You can edit your information by clicking on the Edit button in the Payer’s information box as shown in the screen below. An Edit Payer pop up window will appear, where you can make the necessary changes and click Update button to save changes.

Similarly, you can edit your vendor’s information by clicking on the Edit button in the Recipient’s information box. An Edit Recipient pop up window will appear, where you can make the necessary changes and click Update button to save changes. Once you are ready to move on the next step, click on Finalize button.

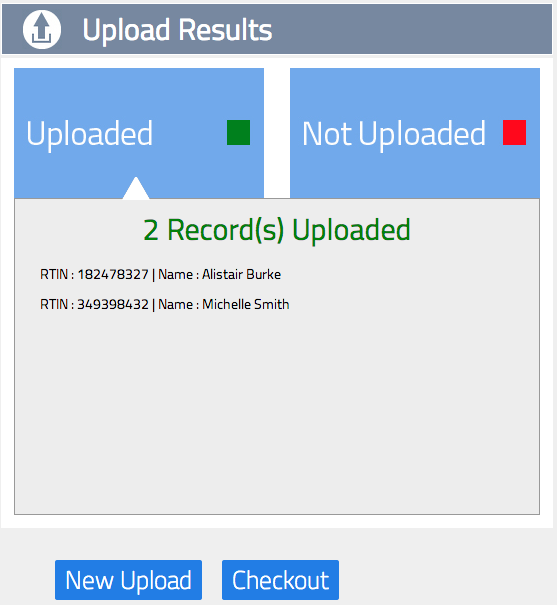

- The Upload Results page will display two tabs the number of records that are uploaded successfully and the records that have been failed to upload. Click on Checkout button to checkout the records that are uploaded.

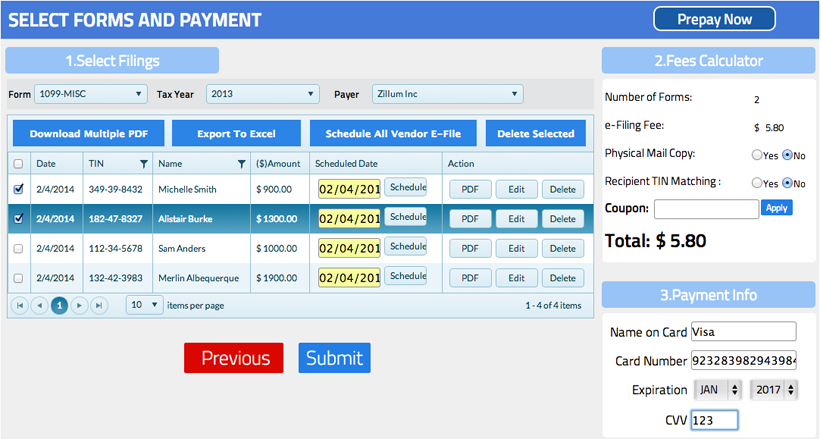

- On the Select Forms and Payment page, under Select Filings section, select those vendors for whom you wish to file 1099 for, by clicking the check box next to each vendors detail row. Once you make your selection, the Fee Calculator section on the right will automatically calculate the amount you need pay to file 1099s. Enter your credit card details under Payment Info section right below the Fee Calculator section and click on Submit button to file your 1099 MISC form.

Yes

Yes