Record Import VAT and Duty

When you import goods from your vendors who are based out of your country, you might incur additional charges. These additional charges maybe due to custom duties and their related taxes. You can record these additional charges by recording import VAT in Zoho Books. Let’s see how you can record import VAT in Zoho Books.

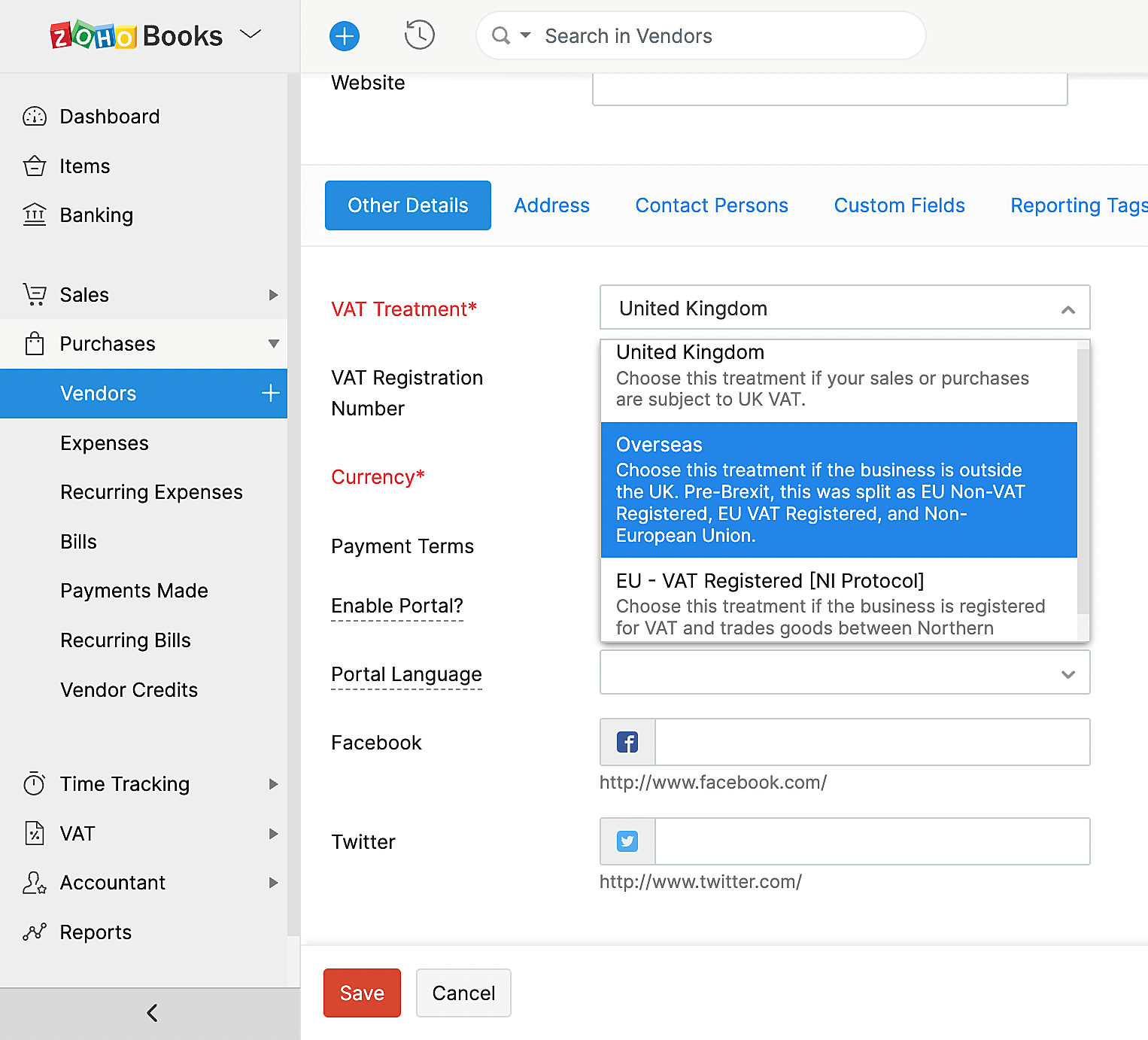

Create Overseas Vendor

To record import VAT in Zoho Books, you need to first create an overseas vendor. To do this:

- Click Purchases in the left sidebar and select Vendors.

- Click + New in the top right corner.

- Enter the details of your vendor.

- Select the VAT treatment as Overseas.

- Click Save.

Record Import VAT and Duty

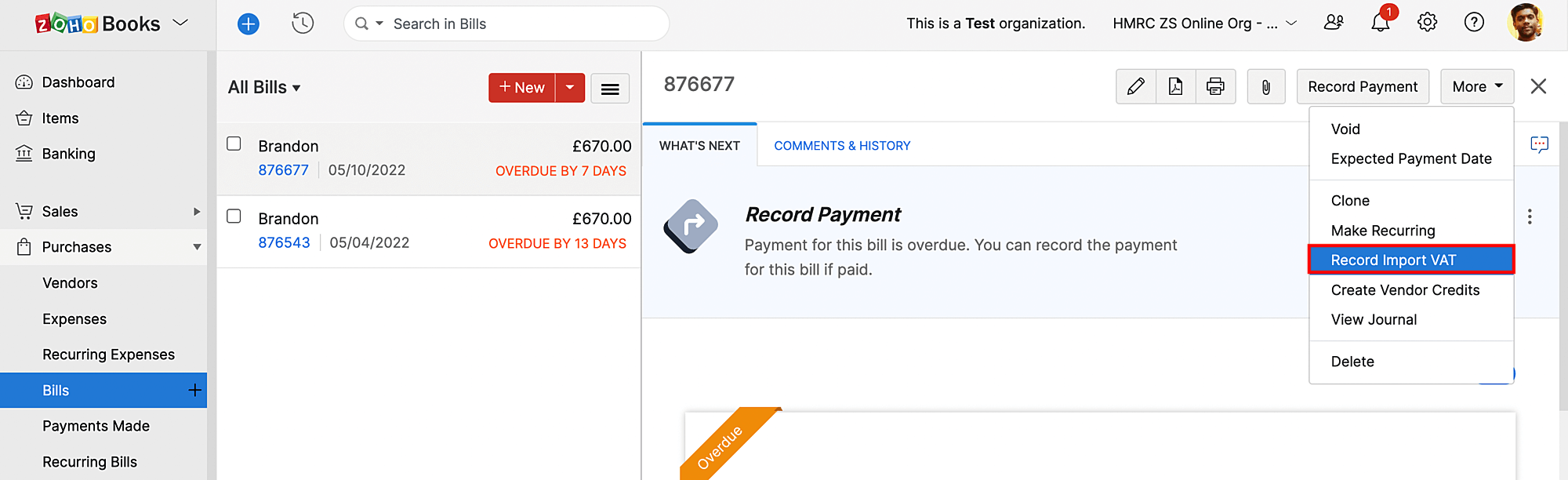

Once you’ve created your overseas vendor, you will be able to record import VAT after creating a bill for that vendor. To do this:

- Select a bill you’ve created for your overseas vendor.

- Click the More option in the top right corner and select Record Import VAT.

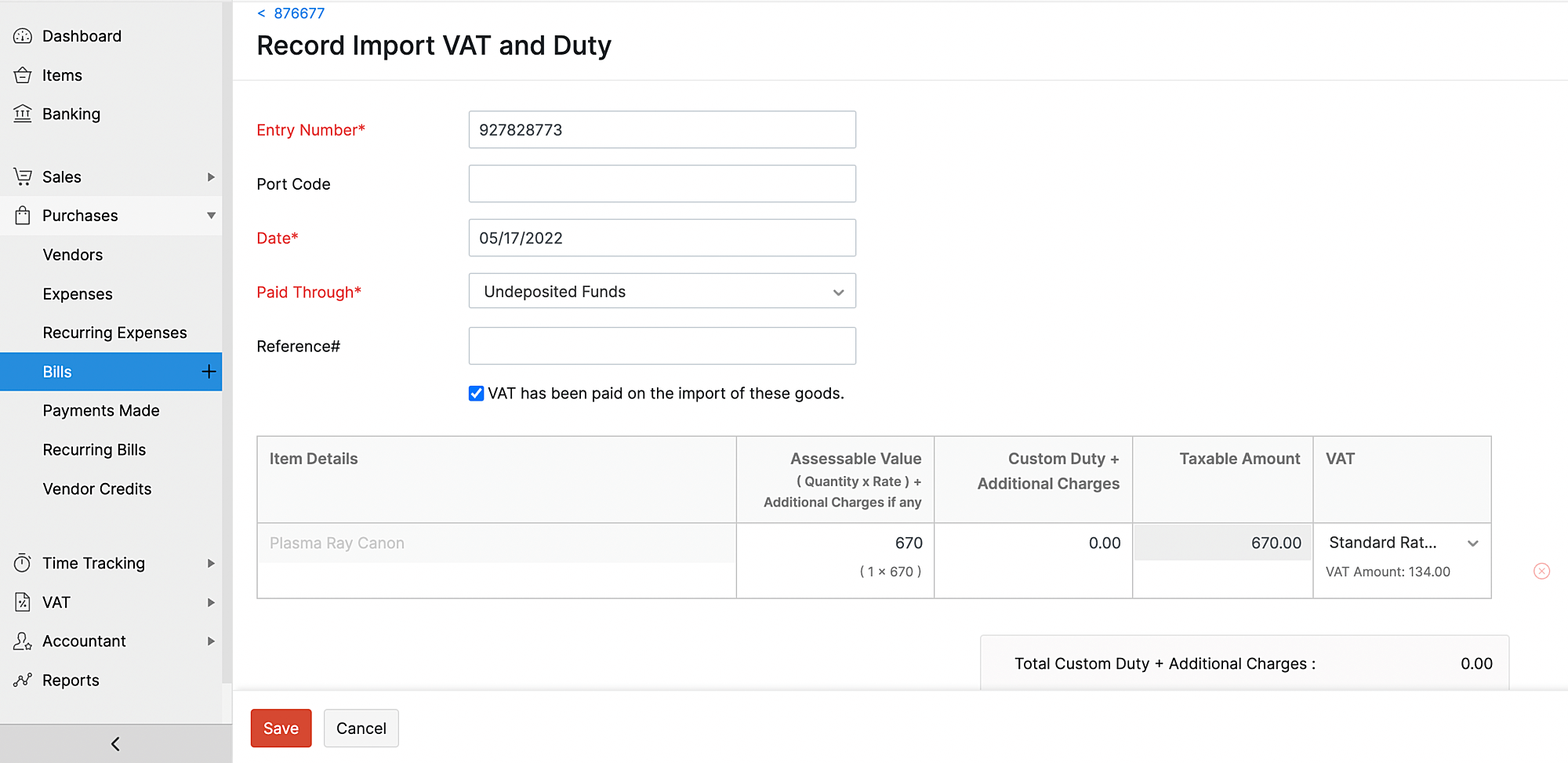

- Enter the Entry Number and Port Code.

- Enter the date and the paid through account.

Postponed Import VAT

If you haven’t paid import VAT during the time of import, it is known as Postponed Import VAT.

If you have incurred postponed import VAT, the import VAT that you are recording will be included during the VAT filing return.

If you have already paid import VAT during the time of import, enable the VAT has been paid on the import of these goods option while recording import VAT.

- Next, enter the Assessable Value of the goods and their Custom Duty + Additional Charges.

- Select the VAT rate.

- Click Save.

Yes

Yes