Manage Clients

Manage Clients is a version of Zoho Books designed to cater to the accountants who manage the business finance of multiple clients. This guide will help you to make the most of the features that are available for accountants.

Note: You will be able to access this version of Zoho Books only if you’re a user with the Accountant role.

Add new clients

When you want to add a new client, a business or an organisation whose business finances you manage, you will have to create a new organisation for them. Once you create, you will be added as an accountant in that organisation and your client will be the admin of that organisation.

To add a new client:

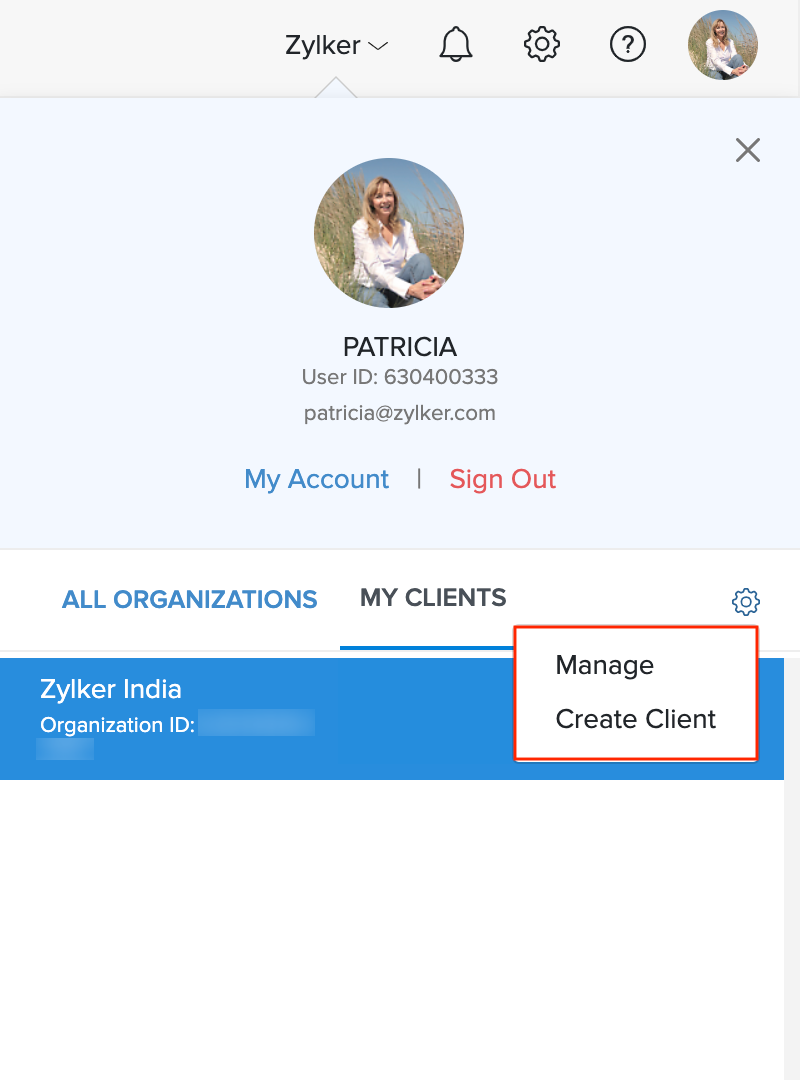

- Log in to an exisitng Zoho Books organisation.

- Click the organisation name in the top right corner of the window.

- Click the Gear icon and click Create Client to create a new organisation.

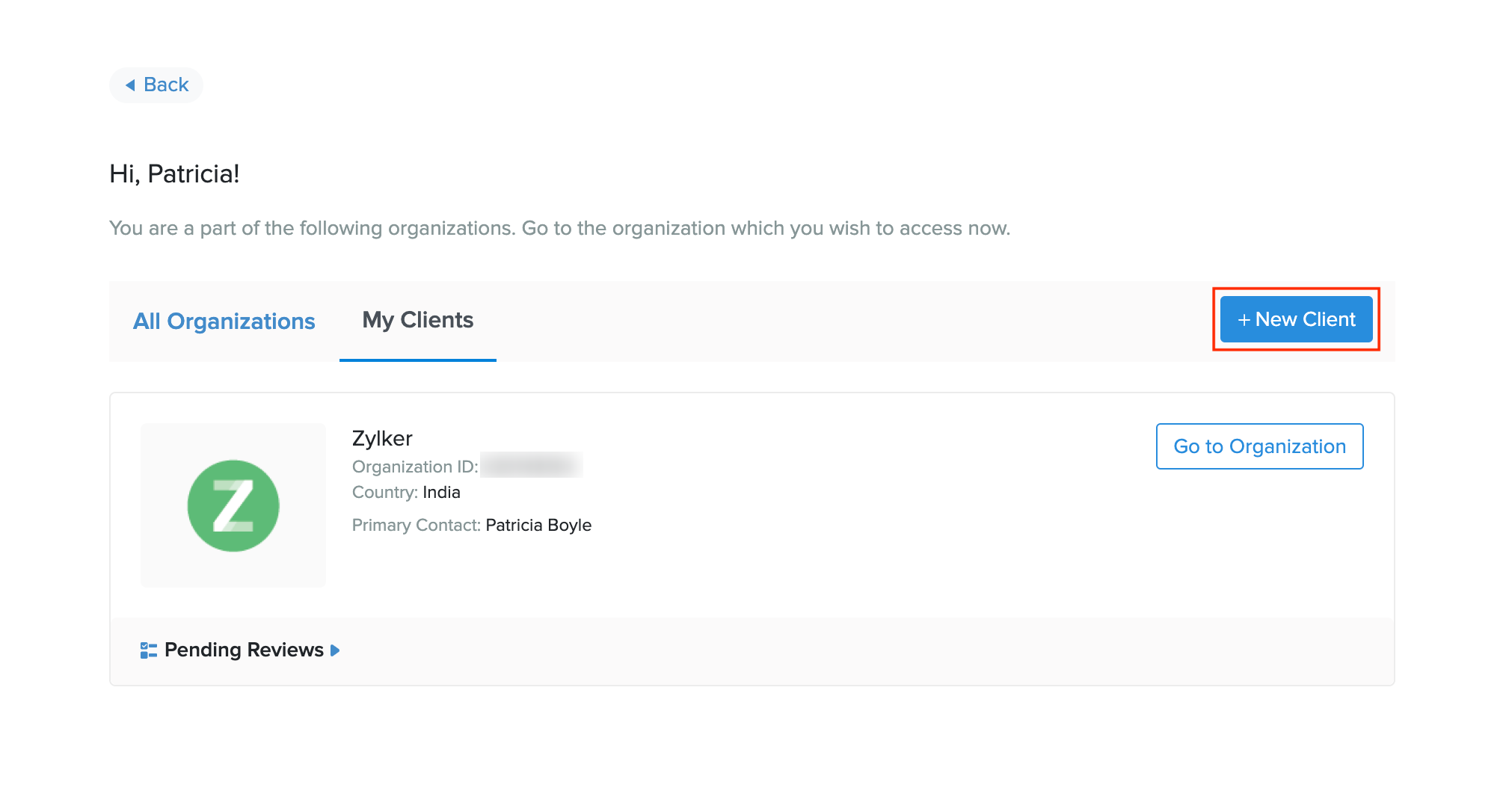

OR - Click the Gear icon and click Manage to go to the organisations page.

- Select the My Clients tab.

- Click the + New Client button.

- Click Continue after reading the content in the popup.

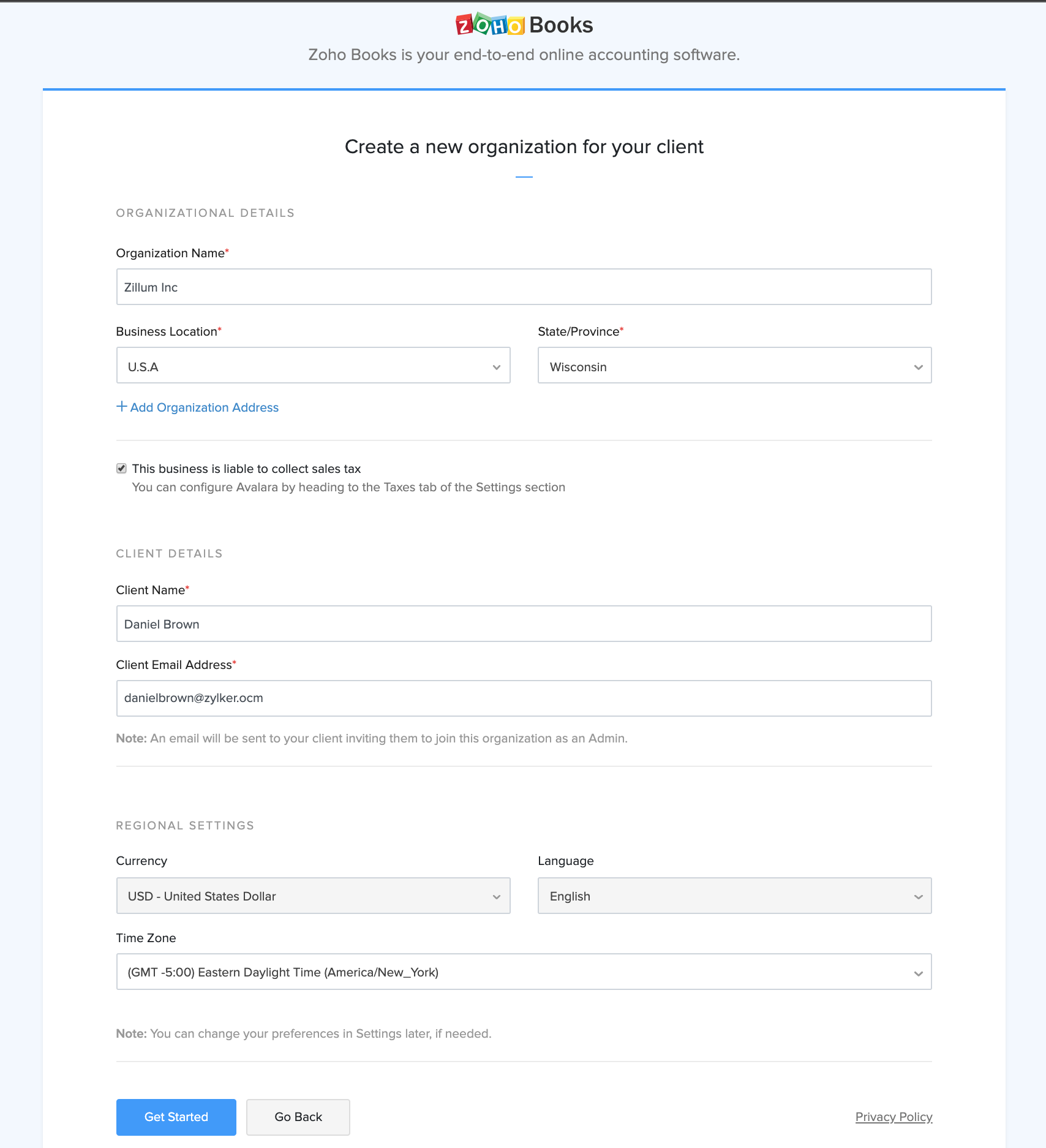

- Enter the client’s organisation details.

| Field | Description |

|---|---|

| Organisation Name | Enter your client’s organisation name. |

| Business Location | Select the country where your client’s business is located and choose the State/Province/Union Territory. |

| Client Name | Enter the name of your client. |

| Client Email Address | Enter your client’s email address that they will use to log in to Zoho Books. |

| Regional Settings | These will be pre-selected based on the business location. You can change the time zone, if needed. |

- Click Get Started.

A new organisation will be created and you will be added as a user with the Accountant role. Also, an email will be sent to your client’s email address to join the organisation as a user with the Admin role.

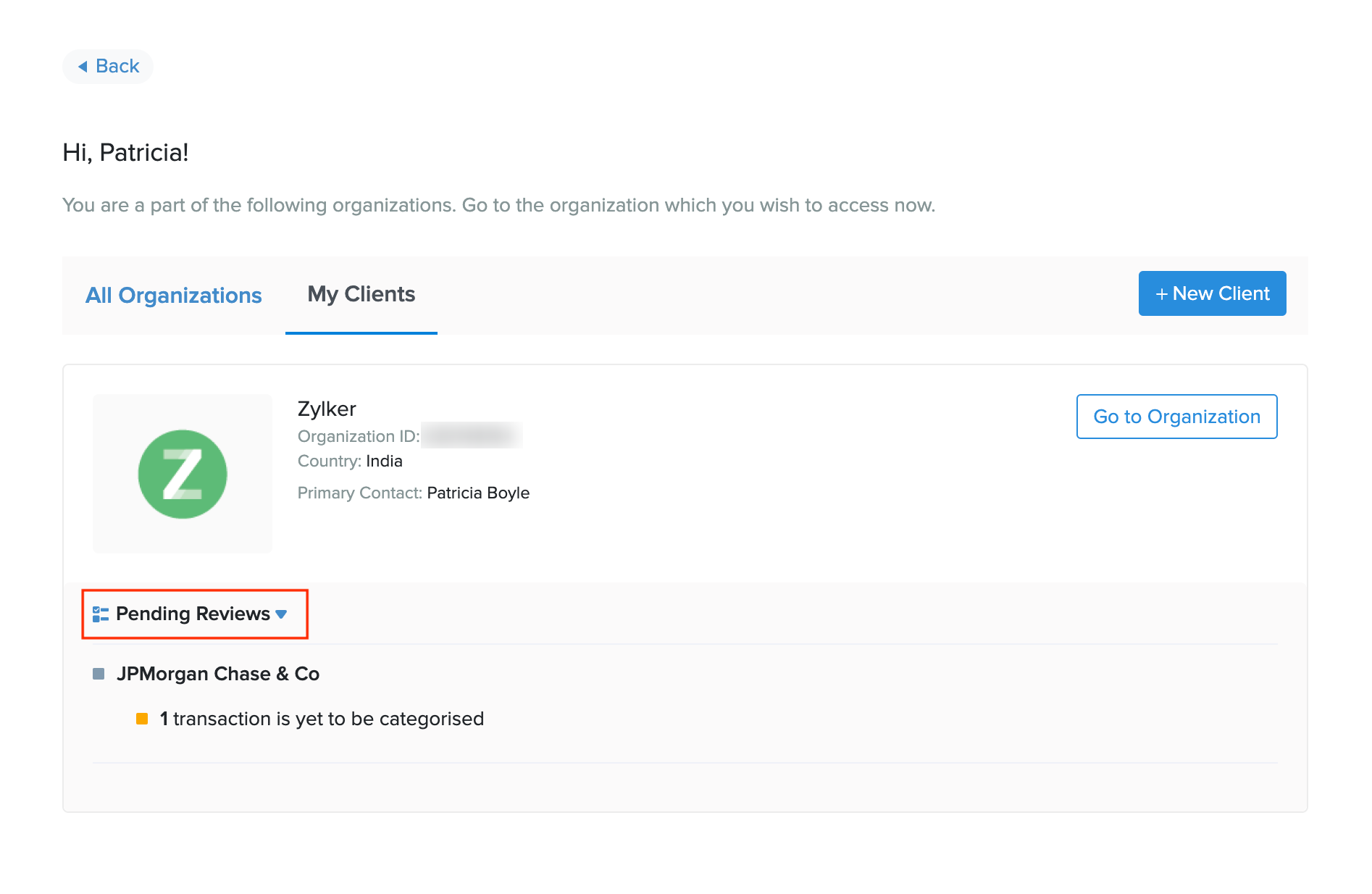

Manage Pending Reviews

Based on the activities in an organisation, Zoho Books will populate a list under the Pending Reviews tab so that you can review and perform actions related to it. The list will contain things to be reviewed based on the following scenarios, when:

- tax returns are generated or some action related to it needs to be done

- your client or other users have not accepted the invitation to join the organisation.

- there are pending tasks related to bank accounts such as pending reconciliation, uncategorised transactions, and

- recognised transactions.

- journal are present in the Draft status

- there are transactions that are pending approval

- there are documents that are yet to be associated to an entity

- there are bank statements that are yet to be added to a bank account.

Insight: The pending reviews will be displayed based on the permissions that has been configured for the Accountant role. If the Accountant role does not have permission to access a module, then tasks related to it will not be listed.

To view pending reviews:

- Click the organisation name in the top right corner of the window.

- Click the Gear icon and click Manage to open the organisations page.

- Select the My Clients tab. You can review the pending tasks of each organisation listed under the respective organisation.