Filing VAT Returns

What is a VAT Return?

VAT Returns are tax forms that registered businesses submit to the HMRC on a quarterly basis (or on a monthly basis based on your reporting period). The return contains details of your total sales and purchases, the amount of VAT payable refundable from HMRC.

How do I file my VAT Returns?

You can file your VAT returns online using Zoho Books or if you are filing your return offline, you can just generate your returns using Zoho Books.

Generate and Submit VAT Returns Directly from Zoho Books

Prerequisites:

- Enable the option Submit your returns directly through Zoho Books under Settings > Taxes & Compliance > Taxes > VAT Settings > VAT Return Settings.

- Grant permission to Zoho Books to communicate with the HMRC on your behalf after enabling direct filing. Learn More.

Once you configure your VAT settings, you will be able to generate your reports in Zoho Books. The steps involved are:

Generate VAT Returns

To generate your VAT Return in Zoho Books:

- Go to the VAT Filing module in the left navigation bar.

- Click Generate VAT Return and the return will be generated in the Draft status.

- A return summary and a detailed report of your tax will be available.

- Click any amount adjacent to a box to view a drill down of all the transactions in the return details section.

Finalise VAT returns

Once a VAT Return summary and a detailed report are generated, you can make adjustments, verify and submit your returns. To do this:

- Click Adjust in case there are any changes to be made to the transactions. A journal entry will be added automatically to record the adjustment.

- Mark the option Include previous period’s unfiled transactions in case any transaction was not recorded in the previous returns.

- Check the return details and click Finalise Return.

- Confirm your action by clicking Yes in the pop-up that appears and the status will now be Finalised.

Note: Any transactions added to this period after finalising will not be available in this return. You can however convert it back to the Draft status by clicking Edit Return.

Submit VAT Return

Once you’ve verified your return, you can submit it to the HMRC.

- Click Submit to HMRC to submit your VAT return.

- Declare that the information provided by you is true by marking the check box in the pop-up that appears.

- View the amount to be paid or reclaimed. The payable amount is denoted in positive and reclaimable in negative.

- Ensure that all the details are right and click Submit. The status of the return will now be Submitted to HMRC.

You can then make your payments to the HMRC and Record Payment/Claim in Zoho Books.

- Navigate to the Unpaid/Unclaimed tab to record all your claims and payments.

- Click Record Payment/Claim and enter the amount paid or reclaimed and click Save.

Go to the All Returns tab to view all the returns filed along with their details such as Filing Status, VAT Payable, Vat Reclaimable, Balance Due, and Payment Status.

Note: You can view the changes made to a return and add comments for discussion in the Comments and History section available in the top right corner of the VAT Filing page.

Generate VAT Returns from Zoho Books and Submit Them Offline

If you are exempt from filing your taxes digitally, Zoho Books helps to generate the return so you file can your taxes to the HMRC. To do this:

Go to the VAT Filing module in the left navigation bar.

Click Generate VAT Return and the return will be generated in the Unfiled status.

Mark the option Include previous period’s unfiled transactions in case any transaction was not recorded in the previous returns. You can view a summary as well as the Return Details box-by-box. In the return details:

- Click any amount adjacent to a box to view a drill down of all the transactions.

- Click Adjust in case of any changes to be made to the transactions. A journal entry will be added to record the adjustment.

File your return to the HMRC referring the VAT Return generated by Zoho Books. Learn How.

Click Mark as Filed once you’ve filed your return to the HMRC.

- Choose your Date of Filing in the screen that follows and confirm your action. The report status will now be Filed.

Note: Once you’ve marked your return as filed, this cannot be undone.

- Navigate to the Unpaid/Unclaimed tab to record all your claims and payments.

- Click Record Payment/Reclaimed and enter the amount paid or reclaimed and click Save.

Go to the All Returns tab to view all the returns that were filed along with their details such as Filing Status, VAT Payable, Vat Reclaimable, Balance Due, and Payment Status.

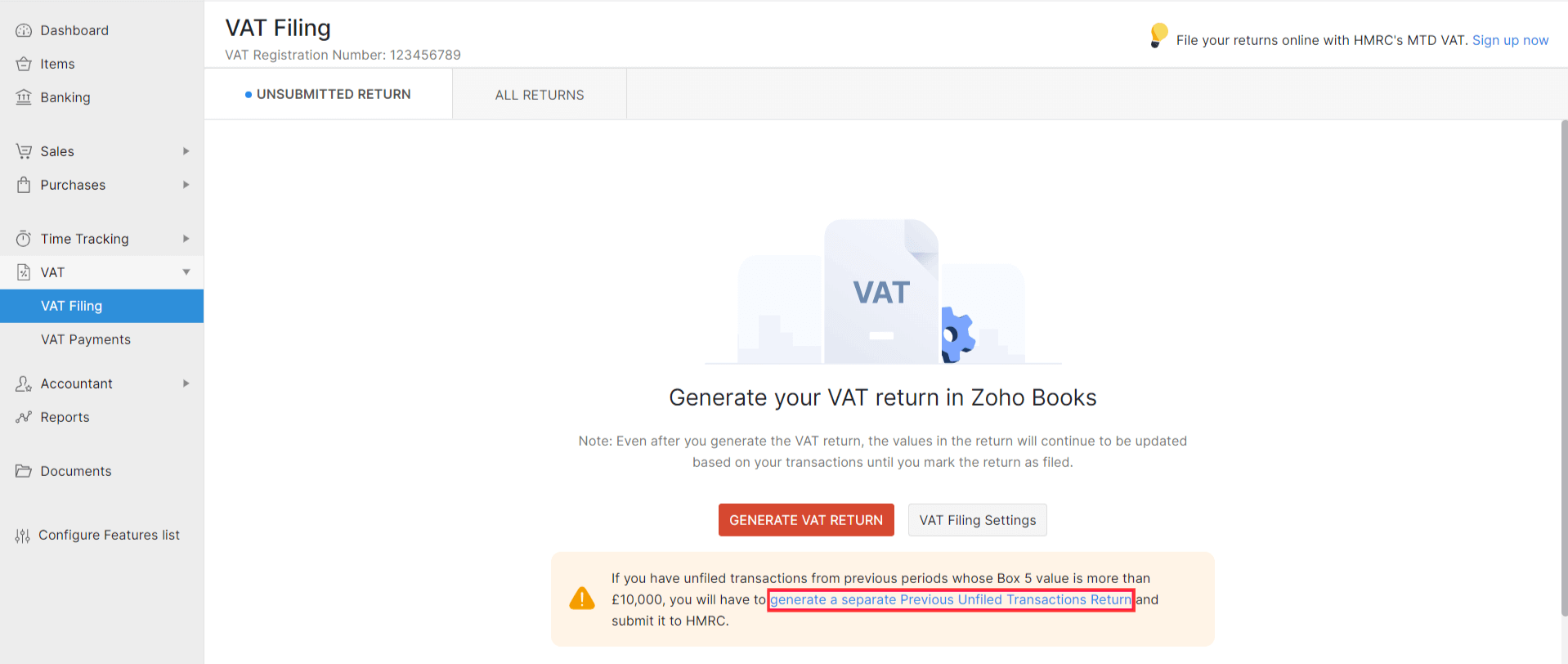

Generate Previous Unfiled Transactions Return

As per HMRC guidelines, if the value of VAT Payable or Reclaimable from the previous periods’ unfiled transactions is more than GBP10,000, you will have to report them to HMRC separately. Here’s how you can do this:

- Go to the VAT module and select VAT Filing.

- In the Unsubmitted Return tab, click generate a separate Previous Unfiled Transactions Return.

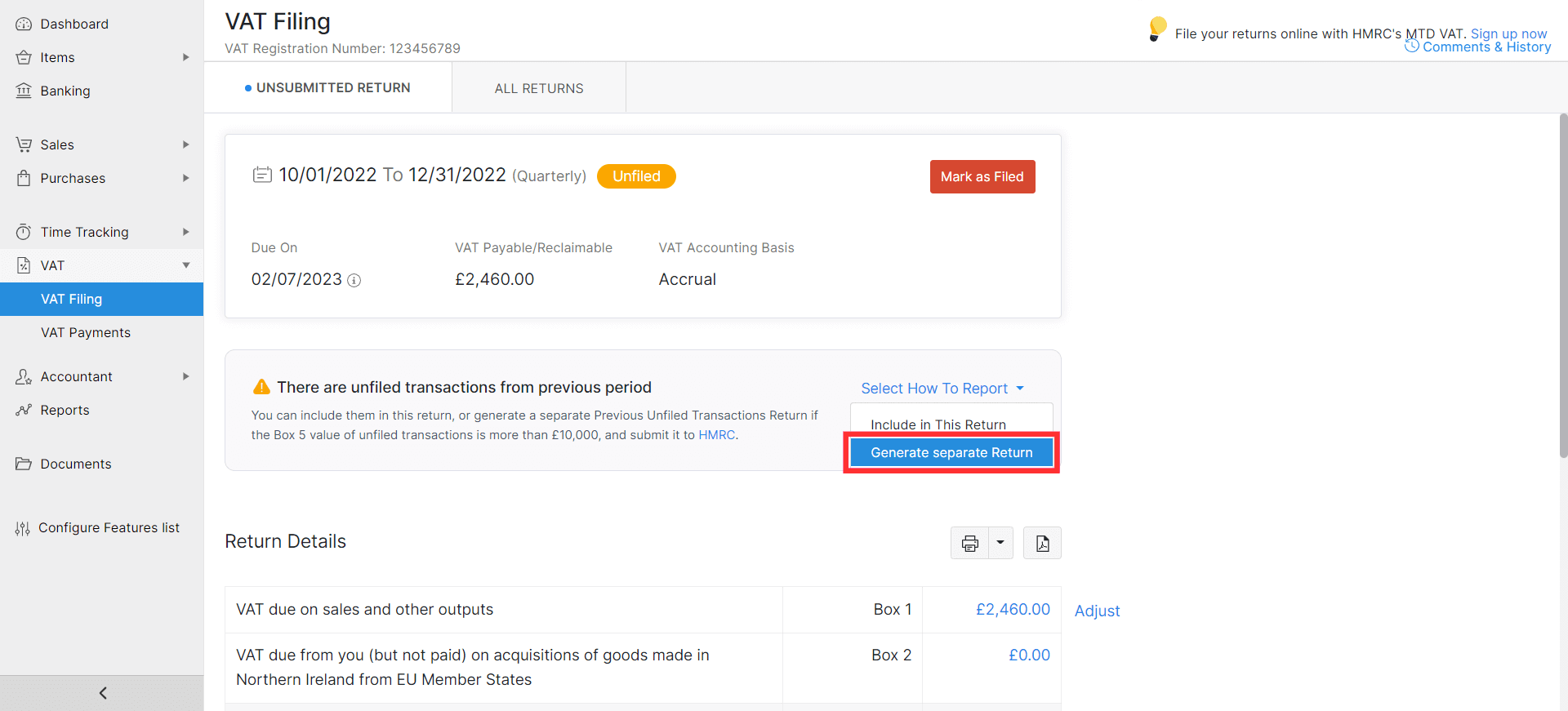

- If you have already generated a VAT return for this period, click the Select How To Report button and select Generate Separate Return from the dropdown.

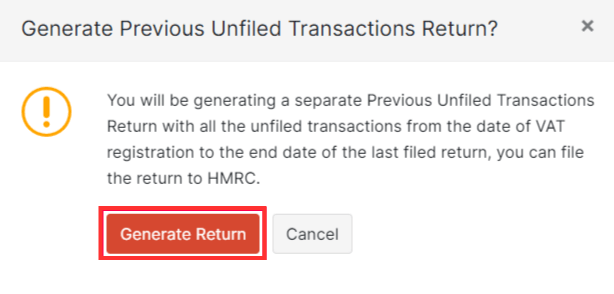

- In the popup that appears, click Generate Return.

- Once you have generated a return for the previous unfiled transactions, you will be redirected to the All Returns tab. The previous unfiled transactions return will also be listed here.

Submit the previous unfiled transactions to HMRC by yourself. You can refer to the box values of the previous unfiled transactions while submitting them in HRMC.

Once you have filed the previous unfiled transactions in HMRC, you can record the same in Zoho Books by clicking Mark as Filed for the return.

Yes

Yes