CIS Reports

CIS Reports give you a detailed report of all the transactions raised under CIS for both contractors and subcontractors. There are two reports:

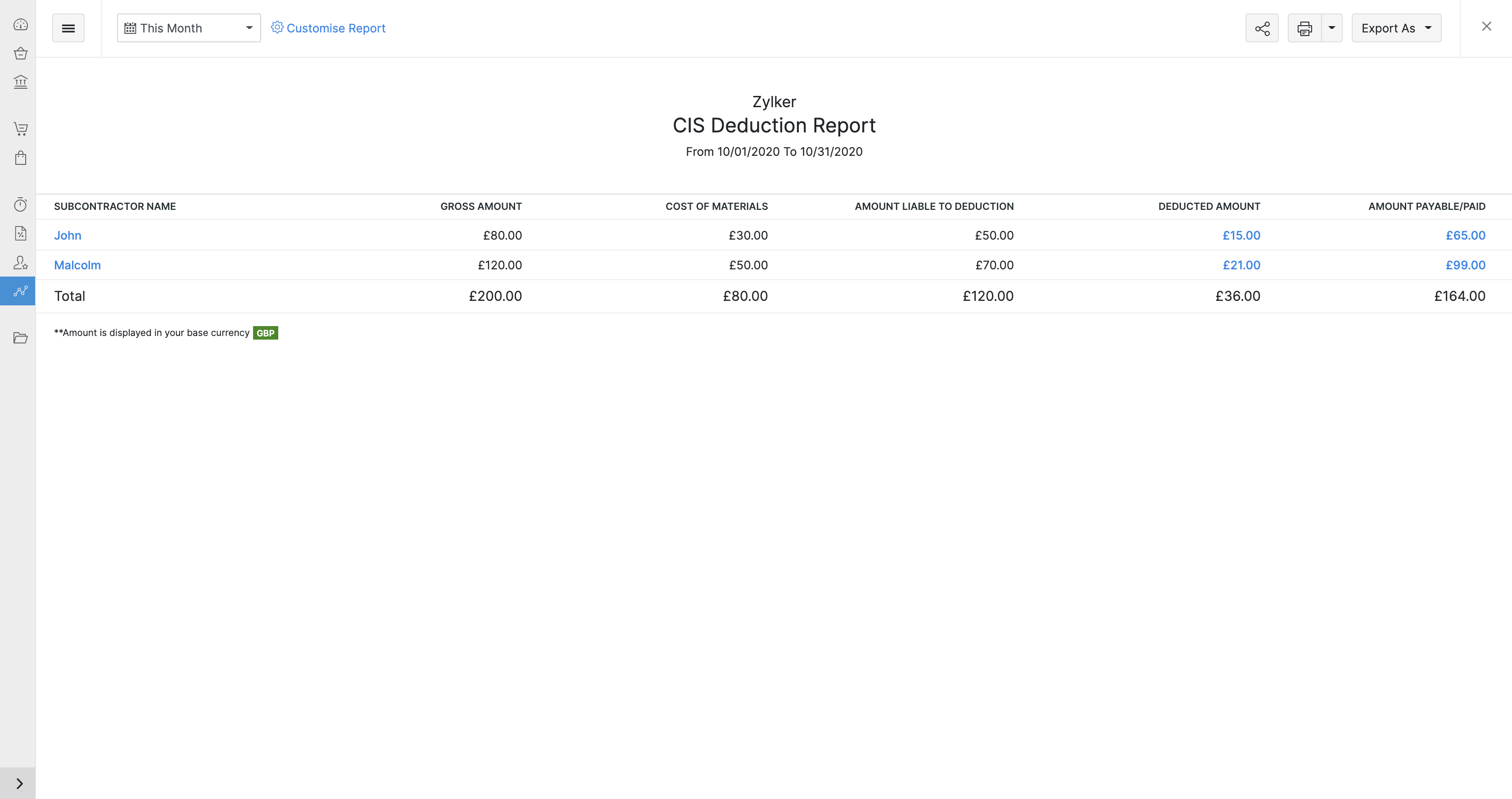

CIS Deduction Report

The CIS Deduction report gives you a summary of the money that a contractor has deducted from a subcontractor to pay HMRC on behalf of the subcontractor.

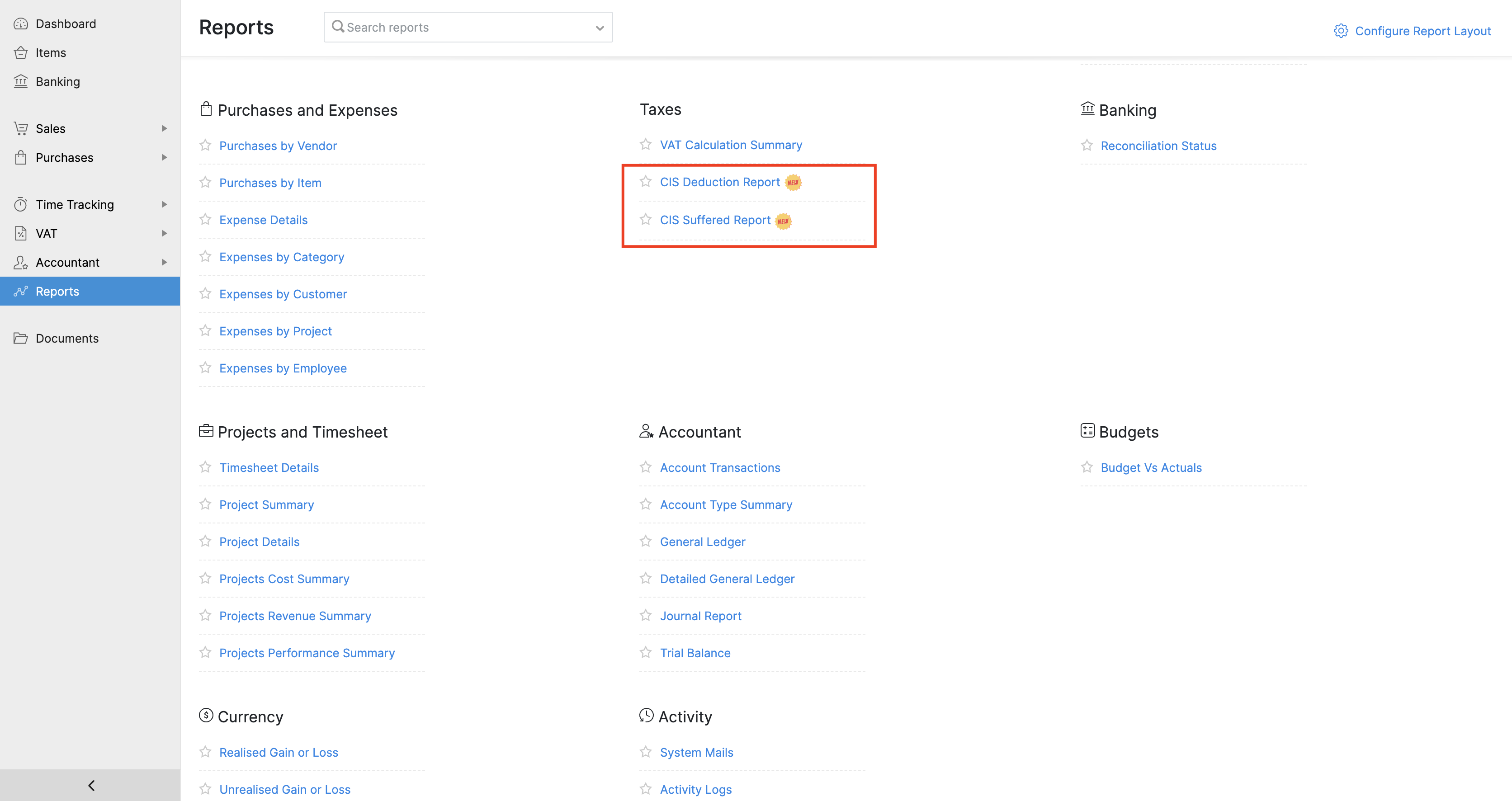

To view this report:

- Click Reports on the left sidebar.

- Select CIS Deduction Report under Taxes.

| Column Name | Description |

|---|---|

| Subcontractor Name | Subcontractor from whom money is deducted. |

| Gross Amount | Total amount that the subcontractor has billed you. |

| Cost of Materials | The cost of materials in all the transactions |

| Amount Liable to Deduction | Total amount to which CIS should be applied |

| Deducted Amount | Total amount deducted under CIS |

| Amount Payable /Paid | The total amount which you owe to the subcontractor |

- Click the amount in Deducted Amount or Amount Payable field, to view all the transactions created under CIS for the subcontractor.

Also, you can customise this report to filter and view specific parts of the report

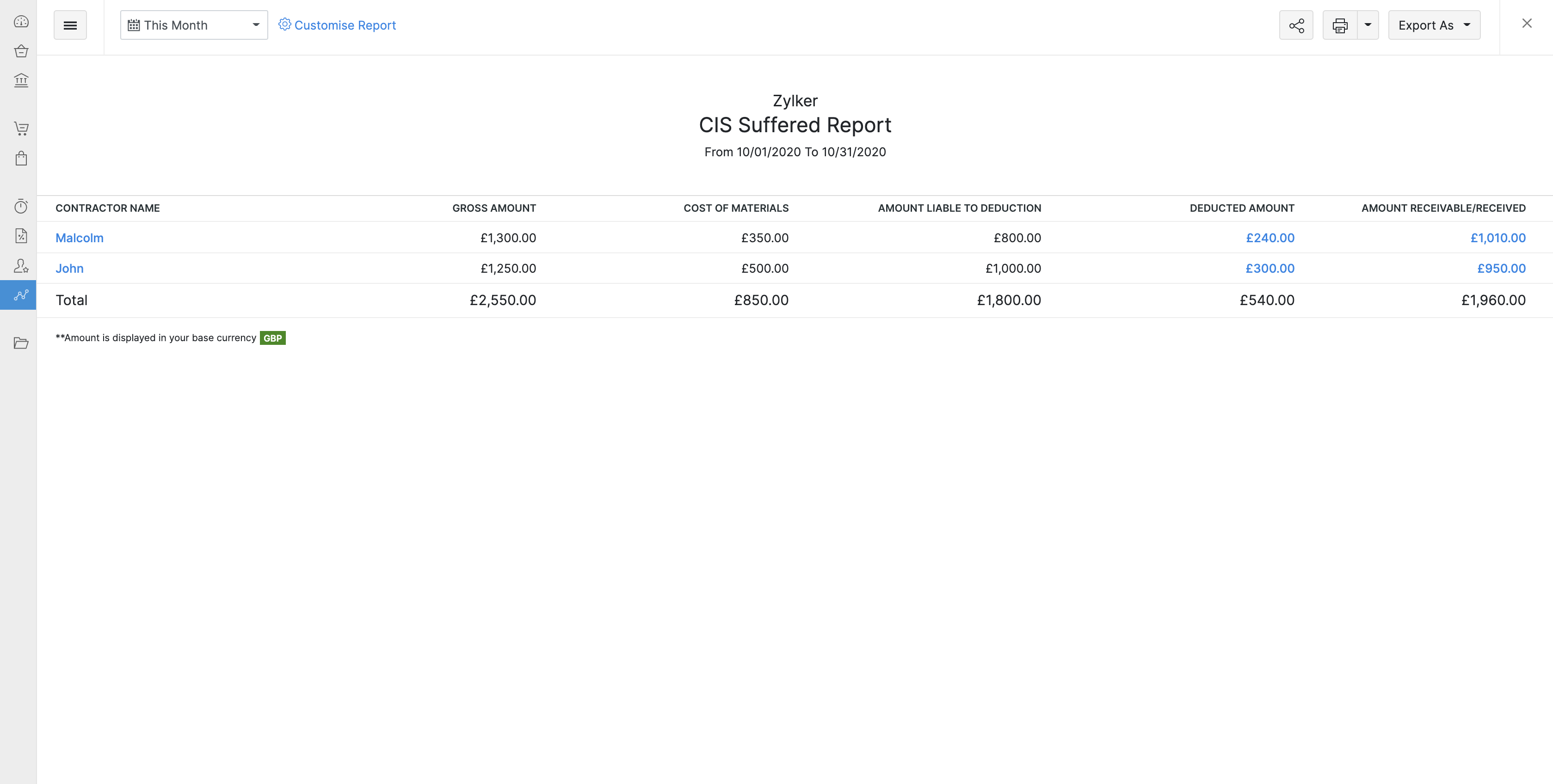

CIS Suffered Report

The CIS Suffered report gives you a summary of the money that a subcontractor has paid the contractor to pay HMRC on their behalf.

To view this report:

- Click Reports on the left sidebar.

- Select CIS Suffered Report under Taxes.

| Column Name | Description |

|---|---|

| Contractor Name | Contractor who deducts money from you |

| Gross Amount | Total amount that you have invoiced the contractor for |

| Cost of Materials | The cost of materials in all the transactions |

| Amount Liable to Deduction | Total amount to which CIS should be applied |

| Deducted Amount | Total amount deducted under CIS |

| Amount Payable /Paid | The total amount which you have received from the contractor |

Click the amount in Deducted Amount or Amount Receivable field, to view all the transactions created under CIS for the contractor.

Also, you can customise this report to filter and view specific parts of the report.

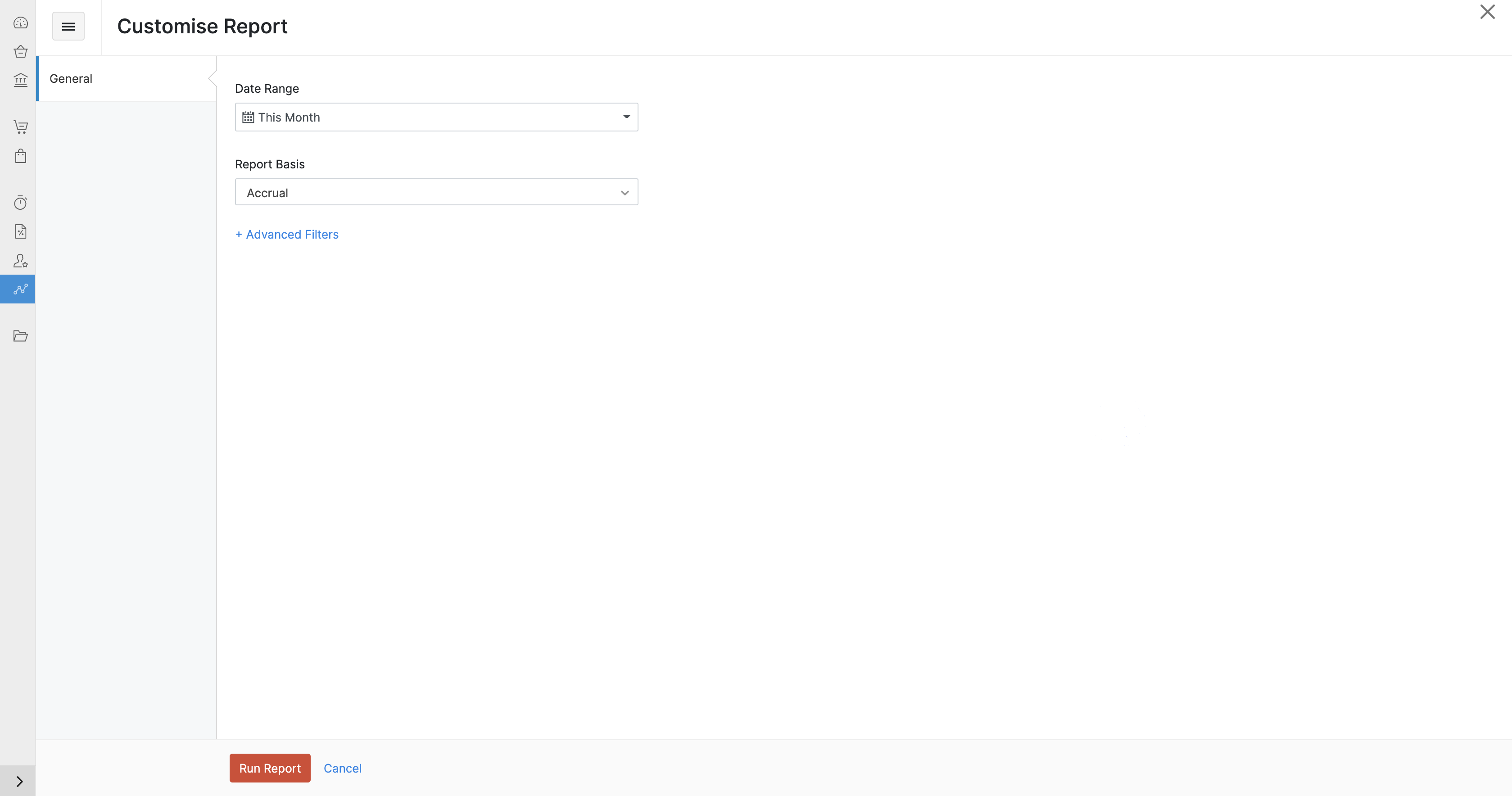

Customise Report

Customising a report allows you to view transactions by a contractor or a subcontractor and view all transactions created during a specific period.

To customise the report:

- Go to Reports > CIS Deduction Report or CIS Suffered Report under the Taxes section.

- Click Customise Report on top of the page.

| Fields | Description |

|---|---|

| Date Range | Select the period for which you want to generate the report. |

| Report Basis | Select if you want the report to be generated on Accrual or Cash basis. |

Note: Reports generated on cash basis will only include transactions for which payment is received/sent under CIS.

Note: Reports generated on an accrual basis will include all transactions sent under CIS.

You can use Advanced Filters to customise the report further. Here’s how:

In Customise report, click Advanced Filters.

- Select Contractor/Subcontractor name field.

- There are 2 comparators which you can select in Select a Comparator.

| Comparator | Function |

|---|---|

| Is in | Generates a report for all the transactions raised for the selected contractor/subcontractor. |

| Is not in | Generates a report for all the transactions excluding the transactions raised for the selected contractor/subcontractor. |

- Select the contractor/subcontractor.

You can add multiple advanced filters and customise the report the way you want to view it.

Yes

Yes