Construction Industry Scheme

What is CIS

The Construction Industry Scheme (CIS) allows subcontractors to make regular contributions towards their national insurance and pay their taxes. Under CIS, contractors working in the construction industry deduct money from subcontractor’s invoices and pass it on to HMRC. This deduction is considered as an advance payment towards the subcontractor’s tax and National Insurance. Learn more about what’s covered under CIS from the UK Government’s website.

Who Should Register for CIS

If you’re a contractor involved in construction business in the UK, it is mandatory that you register for CIS. It is not compulsory for subcontractors to be registered for CIS, however, deductions are taken from your payments at a higher rate if you are not registered.

Enable CIS in Zoho Books

Warning: You cannot disable CIS in your organisation after you create a transaction under CIS. You can disable CIS only after you delete all transactions under CIS.

Enabling CIS let’s you deduct money for services covered under CIS in transactions. Setting up CIS in Zoho Books is easy and can be done in a few clicks. Here’s how:

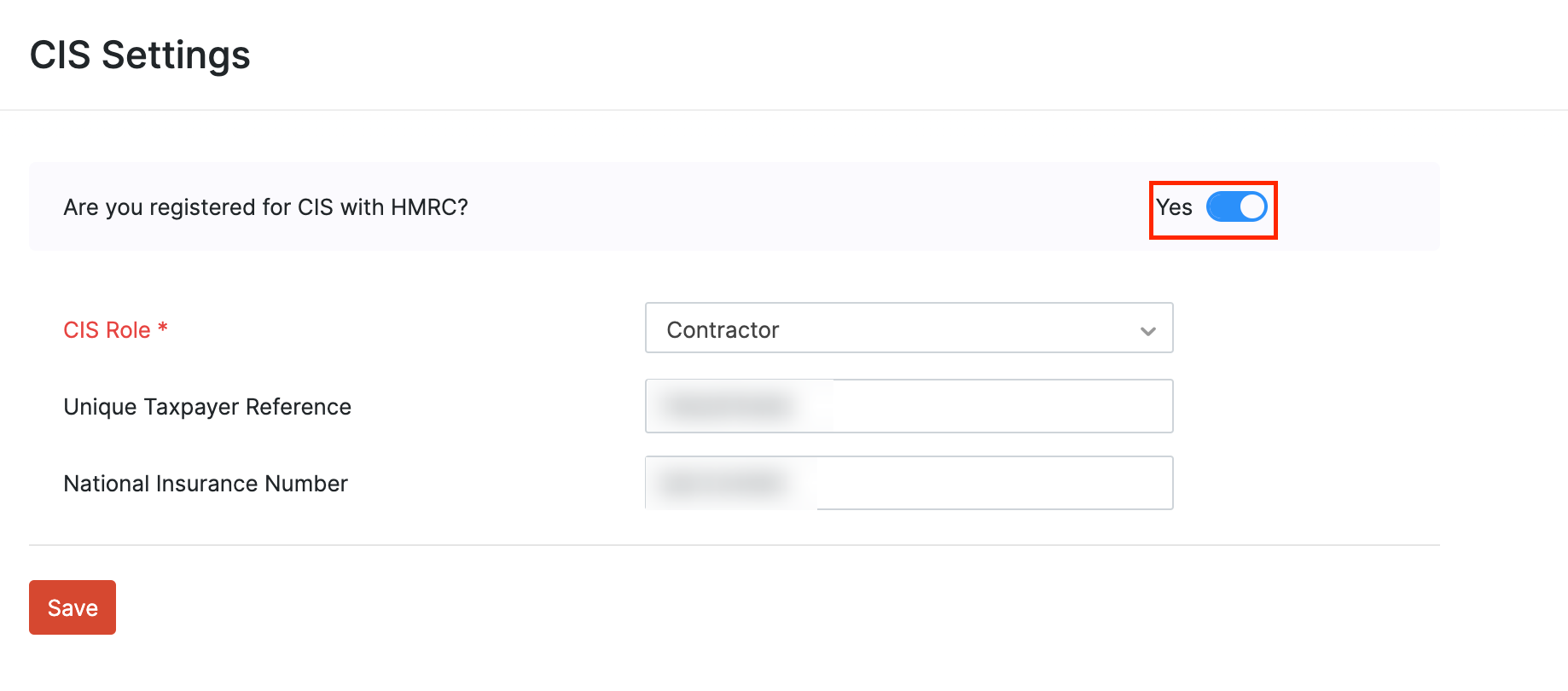

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click Construction Industry Scheme.

- Click the toggle next to Are you registered for CIS with HMRC? to enable CIS in your organisation.

- Enter the necessary details in the fields below.

| Field | Description |

|---|---|

| CIS Role |

|

| Unique Taxpayer Reference | Enter your Unique Taxpayer Reference Number |

| National Insurance Number | Enter your National Insurance Number. |

| CIS Deduction Rate | If you are a subcontractor, select the CIS Deduction Rate from the dropdown menu. This will be used in all the invoices which you send to a contractor. |

- Click Save

Add a Contractor or Subcontractor

Contractors can add subcontractors as vendors to bill them for their services and subcontractors can add contractors as customers to send them invoices. This allows you to manage all their transactions and payments with ease. Here’s how:

- Click the Customers or Vendors module under Sales or Purchases on the left sidebar.

- Click +New button on the top-right corner to create a new customer.

- Check the Enable CIS tracking for this Customer/Subcontractor option.

- Enter the UTR and National Insurance Number.

- If you are a contractor who is adding a subcontractor as your vendor, select the CIS Deduction Rate from the dropdown menu

- Click Save.

CIS in a Transaction

Prerequisite: CIS tracking must be enabled for the customer or vendor if you want to create transactions under CIS for them.

Note: CIS is not supported in Retainer Invoices, Expenses and Recurring Expenses.

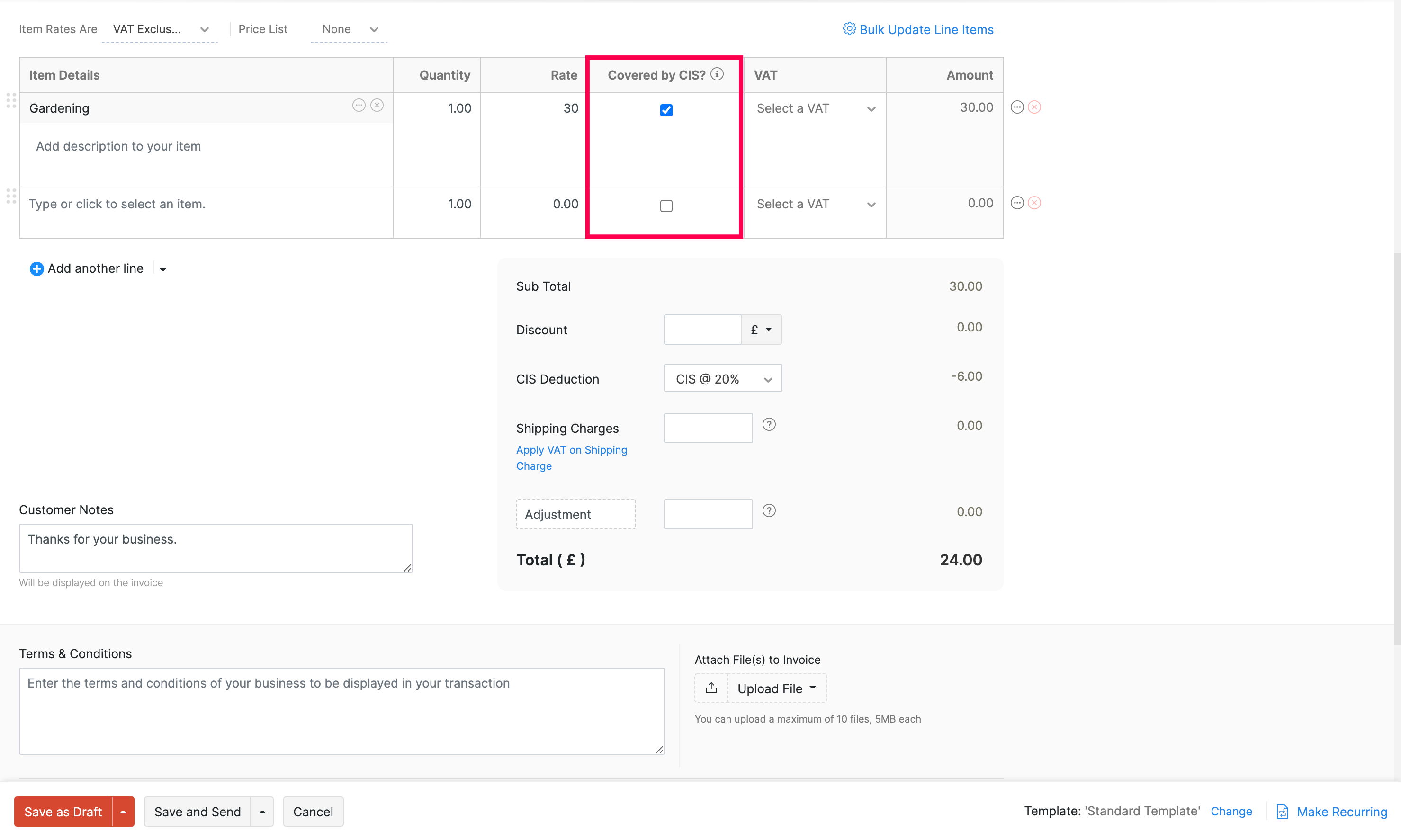

CIS in Sales Transaction

When you send an invoice to your contractor, you can choose the services which come under CIS. Here’s how:

- Create a new invoice.

- After filling in the necessary details, check the Covered by CIS? checkbox if a service comes under CIS.

Zoho Books will automatically calculate the deductions using the CIS Deduction rate which you provided in the CIS Settings for the services you choose.

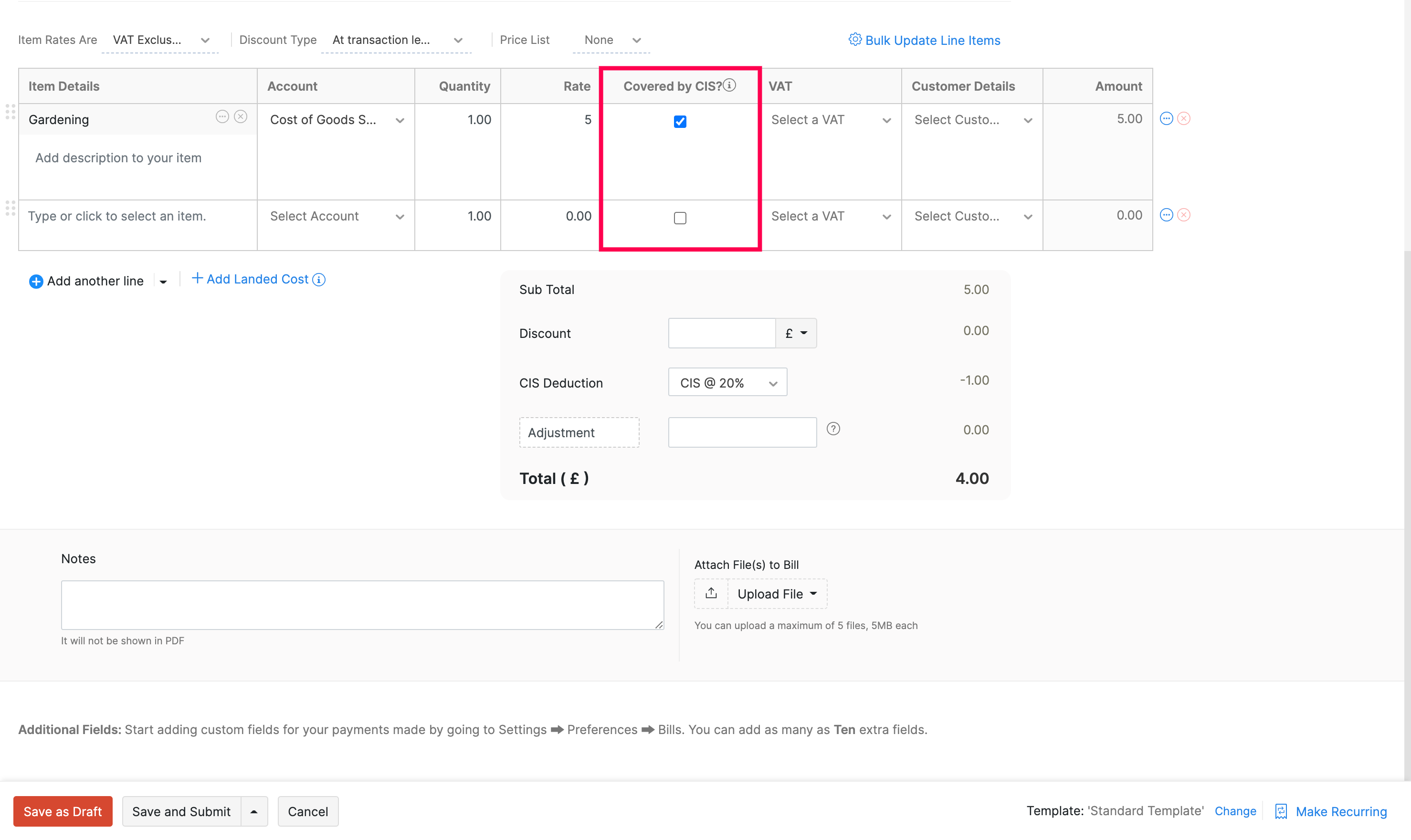

CIS in Purchase Transactions

When you send a bill to your subcontractor, you can choose the services for which you deduct the amount on their behalf. Here’s how:

- Create a new bill.

- After filling in the necessary details, check the Covered by CIS? checkbox if a service comes under CIS.

Zoho Books will automatically calculate the deductions using the CIS Deduction rate that you provided when adding a subcontractor as a vendor for the services you choose.

CIS Reports

You can view a detailed report of all the transactions raised under CIS for both contractors and subcontractors, total amount liable to deduction and deducted amount. Learn more.

Yes

Yes