VAT in Sales

VAT is included in both the sales and purchase transactions of your business. There are different methods in which VAT is calculated on sales, according to the region and the VAT treatment of your customers. In Zoho Books, the VAT treatment of your contact is taken into account and the VAT associated with the item is automatically populated.

Sales Within the UK

For creating a sales (Invoices, Quotes, Sales Orders, Credit Notes) transaction that is within the United Kingdom,

- Select the customer whose VAT treatment is for United Kingdom.

- Add the item for which you are creating the sales transaction and select the VAT amount.

VAT treatment of your customer can be changed only for that quote, invoice or the order you create. Click on the notification, select the VAT treatment you prefer and click on Update.

You can also set the VAT treatment as a permanent change by checking on the Make it permanent? box.

Sales Outside UK

For sales (Invoices, Quotes, Sales Orders, Credit Notes) that are made outside the UK, you will be able to find the labels that will denote if its Goods that are being sold or a Service that is being rendered. If a service is billed in the same invoice where goods are being sold outside the UK, then the service will be associated to the goods and will be labelled Service Associated to Goods.

If sales are made to countries outside the UK, it will be recorded under Your total sales excluding VAT in the VAT return report.

For customers having currencies other than GBP, an Exchange Rate field is provided for you to enter the rate, and the value will be calculated.

Sales to EU-VAT Registered Customers [NI Protocol]

If you’re a business in Northern Ireland and you are selling goods to a customer who is in the EU and is registered for VAT, then the VAT can be Zero-Rated or a Zero Rate (0%) VAT can be charged on your export. To do this, you’ll have to enable the NI protocol from VAT settings and select the VAT treatment as EU-VAT registered [NI Protocol] for the customer.

To enable the NI Protocol in your organisation:

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Settings.

- Mark the Enable trading of goods between Northern Ireland and the European Union (NI Protocol) checkbox.

- Click Save.

VAT Claim for Bad Debt

There might be times where you would have paid VAT on an invoice that you haven’t received payment for, and due to unforeseen reasons the customer was not able to pay you for that invoice. In such a case, you can write off the invoice and claim back the VAT paid for that invoice from HMRC. Firstly, you’ll have to reclaim the VAT amount from the HMRC portal and then record it in Zoho Books.

Note: The period for reclaiming the VAT is six months from the invoice due date as per the HMRC.

To record the VAT claim in Zoho Books:

- Go to Sales > Invoices from the left sidebar.

- Select the invoice that you want to write off.

- Click Write Off from the Record Payment dropdown.

- In the following pop-up, select the Write Off date.

- Enter the Reason for the write off.

- Check the box Claim VAT for writing off this invoice.

- Select the Claim Date.

- Enter the Claim Amount.

- Click Write Off.

Note: The VAT relief option will not be available for cash based transactions as VAT is paid and recorded only after receiving the payment for that transaction.

When an invoice is written off and if VAT relief option is selected, a journal will be created automatically. This journal cannot be edited or deleted. If you cancel the write off, the status of the invoice will be reverted and the journal entry will be automatically deleted.

To cancel write off:

- Go to the written off invoice.

- Click Cancel Write Off the top of the page.

Output Tax Due on Disposal of Capital Expenditure Goods

If your organisation uses the Flat Rate Scheme, you can reclaim the VAT charged on the purchase of capital expenditure goods, provided the total value of the purchase, including VAT, is £2000 or more.

Suppose you’re selling capital expenditure goods, for which you had reclaimed VAT during purchase, to your customers. In that case, you will have to record the same in Zoho Books to calculate the output VAT in the UK VAT rate. Here’s how you can do this:

Go to the Sales module and select Invoices.

Click the + New button on the top right corner of the page.

Select the customer to whom you’re selling the capital expenditure goods.

Enter the required details.

Add the capital expenditure good as an item to the invoice.

Click the More icon next to the line item, select Show Additional Information, and select the appropriate Fixed Asset account applicable for the item.

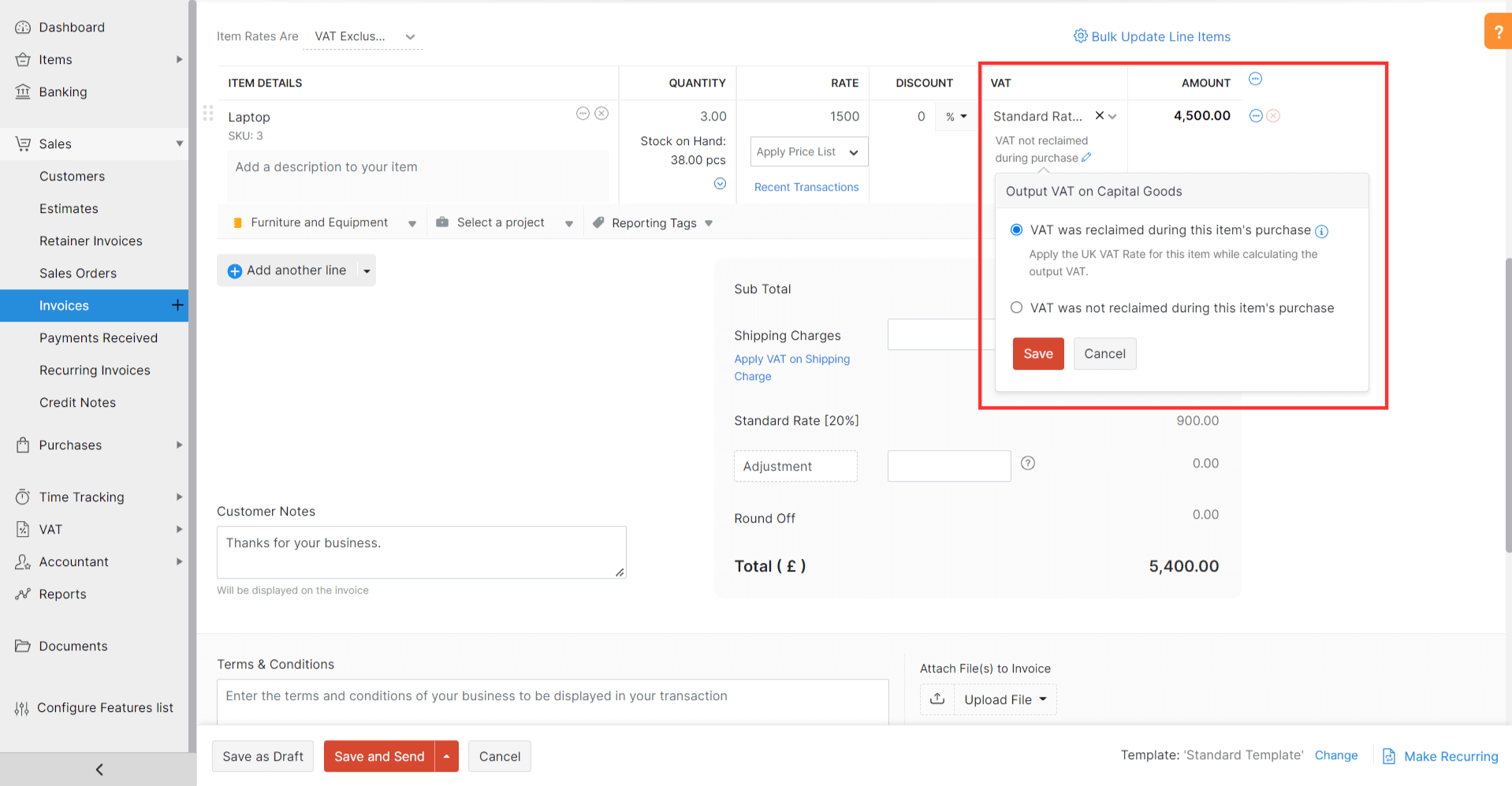

An edit icon will appear below the VAT rate of the respective line item. By default, VAT was not reclaimed during the item’s purchase option will be selected. In such cases, the output VAT for the item will be calculated in the flat rate percentage.

If you reclaimed VAT while purchasing the item, click the edit icon and select the VAT was reclaimed during the item’s purchase option. In such cases, the output VAT for the item will be calculated in the UK VAT rate, i.e. Standard, Reduced, or Zero rate.

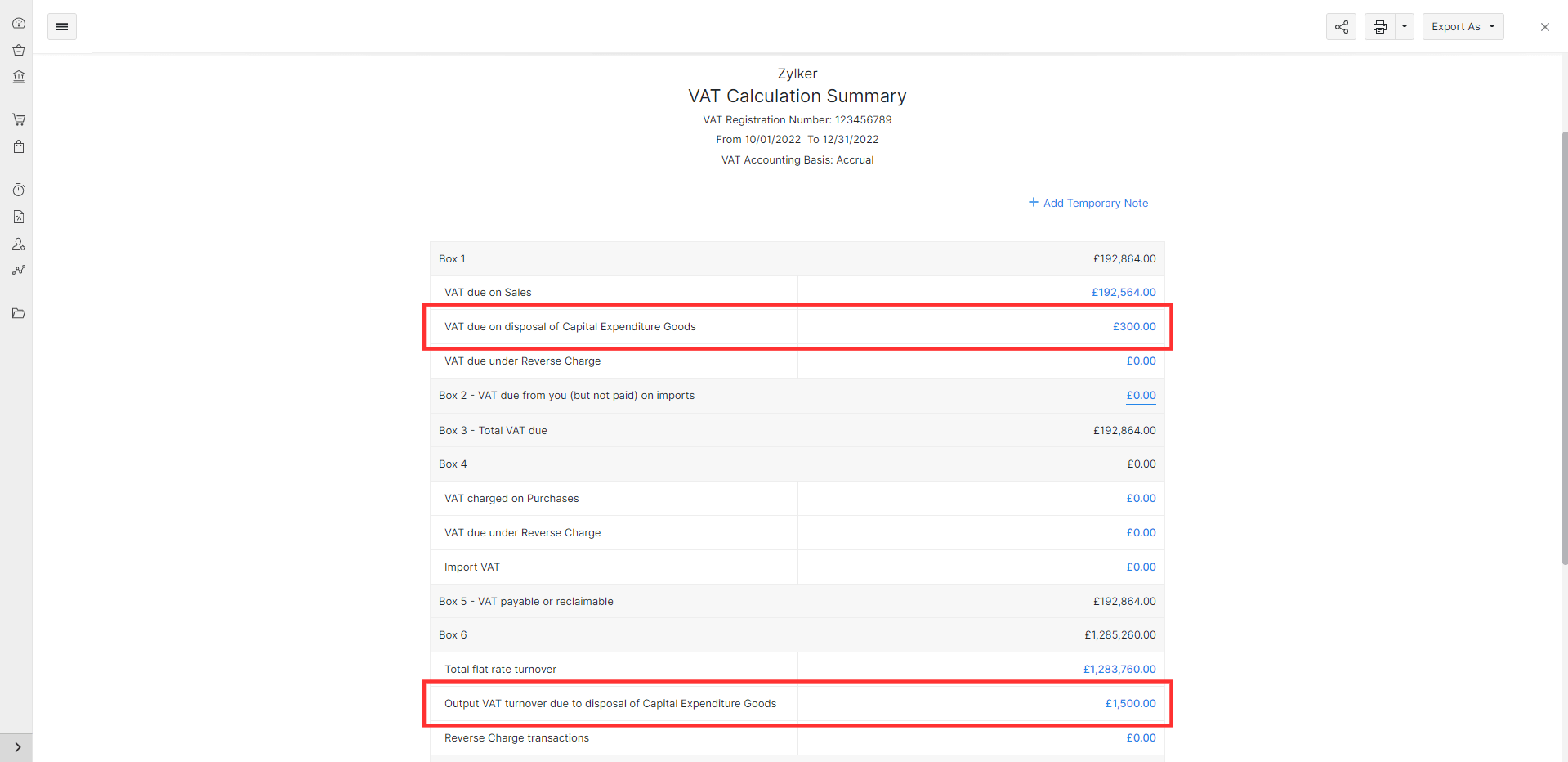

In the VAT Calculation Summary report, the calculation of Box 1 and Box 6 values will be based on the option you choose while creating the invoice for the capital expenditure goods.

- If you choose VAT was not reclaimed during this item’s purchase, Box 1 and Box 6 values will be calculated in flat rate percentage.

- If you choose VAT was reclaimed during this item’s purchase, Box 1 and Box 6 values will be calculated in the UK VAT rate.

Yes

Yes