IOSS Scheme

The IOSS (Import One Stop Shop) scheme was introduced on 1 July 2021 to ease the taxation process for businesses that import goods from overseas into the European Union member states.

When you record an invoice or credit note for these customers, you can track the tax applied on transactions as per the IOSS scheme.

Note: Tracking the tax as per IOSS is optional in Zoho Books.

Once you start tracking tax as per the IOSS scheme, you will also be able to generate dedicated reports that details the transaction type and the taxable amount.

Enable Tracking of IOSS Scheme

You have to enable tracking of IOSS scheme to track tax as per the IOSS scheme in Zoho Books. To enable tracking of IOSS scheme:

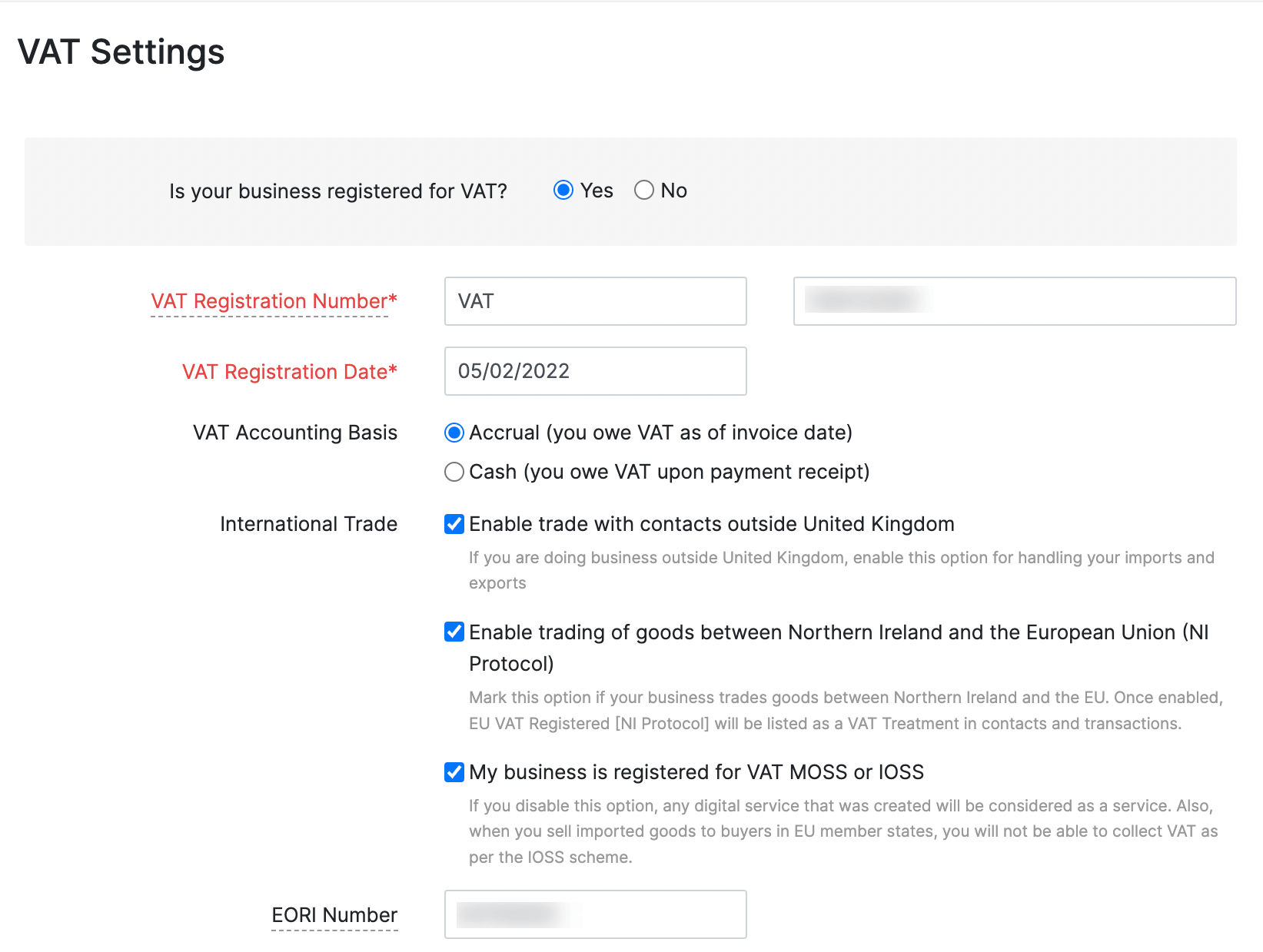

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Settings.

- Check the My business is registered for VAT MOSS or IOSS option.

- Enter your EORI (Economic Operators Registrations and Identifications) number.

- Click Save.

Insight: Your EORI number is used in all custom procedures when exchanging information with customs administrations and will be displayed on the invoices you send to your customers.

You will now be able to track tax as per IOSS scheme while recording an invoice or credit note.

Add IOSS Tax Rates

You have to add the tax rates as per IOSS schemes in Zoho Books to apply the IOSS tax rates on your invoices and credit notes.

To add IOSS tax rates:

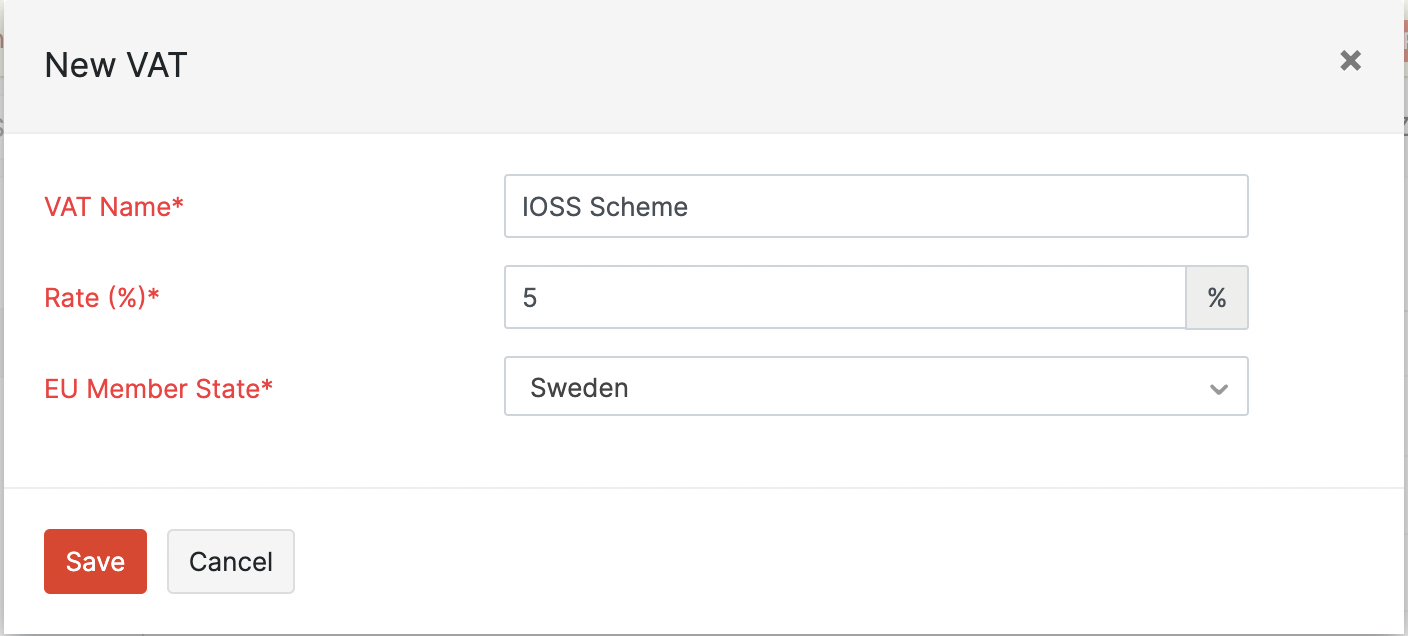

- Click Settings on the top right corner of the page.

- Click Taxes under Taxes & Compliance.

- In the Taxes pane, click VAT Rates.

- Click + New VAT.

- Enter the VAT Name and Rate.

- Select the EU Member State.

- Click Save.

You will now be able to apply these tax rates as per IOSS schemes on your invoices and credit notes.

IOSS Scheme in Sales Transactions

The IOSS scheme is applicable only on the sale of goods and services to an IOSS scheme registered customer. You can apply tax as per the IOSS scheme on invoices or credit notes.

IOSS Scheme Report

You can view a detailed report of all the transactions raised under the IOSS scheme. Learn More.

Yes

Yes