e-Way Bills - Overview

What is an e-Way Bill?

In the GST regime, an e-way bill is an electronically generated document necessary for the movement of goods within the state or outside the state. An e-Way bill replaces the waybill, which was a physical document used in the previous VAT system.

An e-way bill has two parts:

- Part A contains the details of a consignor, consignee, supply type, item details, and transport mode.

- Part B contains details of the transporter.

If you’re initiating the movement of goods and transporting the goods by yourself, you have to furnish both Part A and Part B details. If you have outsourced the transportation of the goods, then the transporter must furnish Part B details. A consignor or the sender can also authorise a consignee, such as a buyer, transporter, courier agency and e-commerce operator, to fill PART A of the e-way bill on their behalf.

When Is an e-Way Bill Necessary?

e-way bill is mandatory at the time of movement of the goods as per the guidelines mentioned below.

e-way bill is necessary in the following cases:

- When you move goods of value more than Rs.50,000, irrespective of the mode of transport used.

- When you move any goods outside the state for Job Work (irrespective of its value, you must generate an e-way bill).

- When you transport handicraft goods (irrespective of their value, you must generate an e-way bill).

- When you transport goods up to a distance of 50 km, an e-way bill has to be generated with Part A details alone and does not require Part B details.

During the movement of goods, the person who transports the goods must carry either of the transport documents like invoice, bill of supply, delivery challan with the e-Way Bill Number mentioned on it.

But there are cases when e-way bills are not necessary even though goods are being transported from one place to another:

- When you supply goods of value less than Rs.50,000, irrespective of the destination.

- When you transport goods by non-motorised vehicles.

- When the place of departure is from the port, airport, air cargo station, or any station where the clearance is by the Customs Department.

- When you transport exempted goods, irrespective of the total value.

e-Way Bills in Zoho Billing

The e-Way Bill module will be automatically enabled for your Zoho Billing organisation as soon as you enable GST and enter your GSTIN in GST Settings.

Here’s how to enter e-Way Bill number for invoices:

Go to Sales from the left sidebar and select Invoices.

Select an invoice for which you want to add e-way bill details.

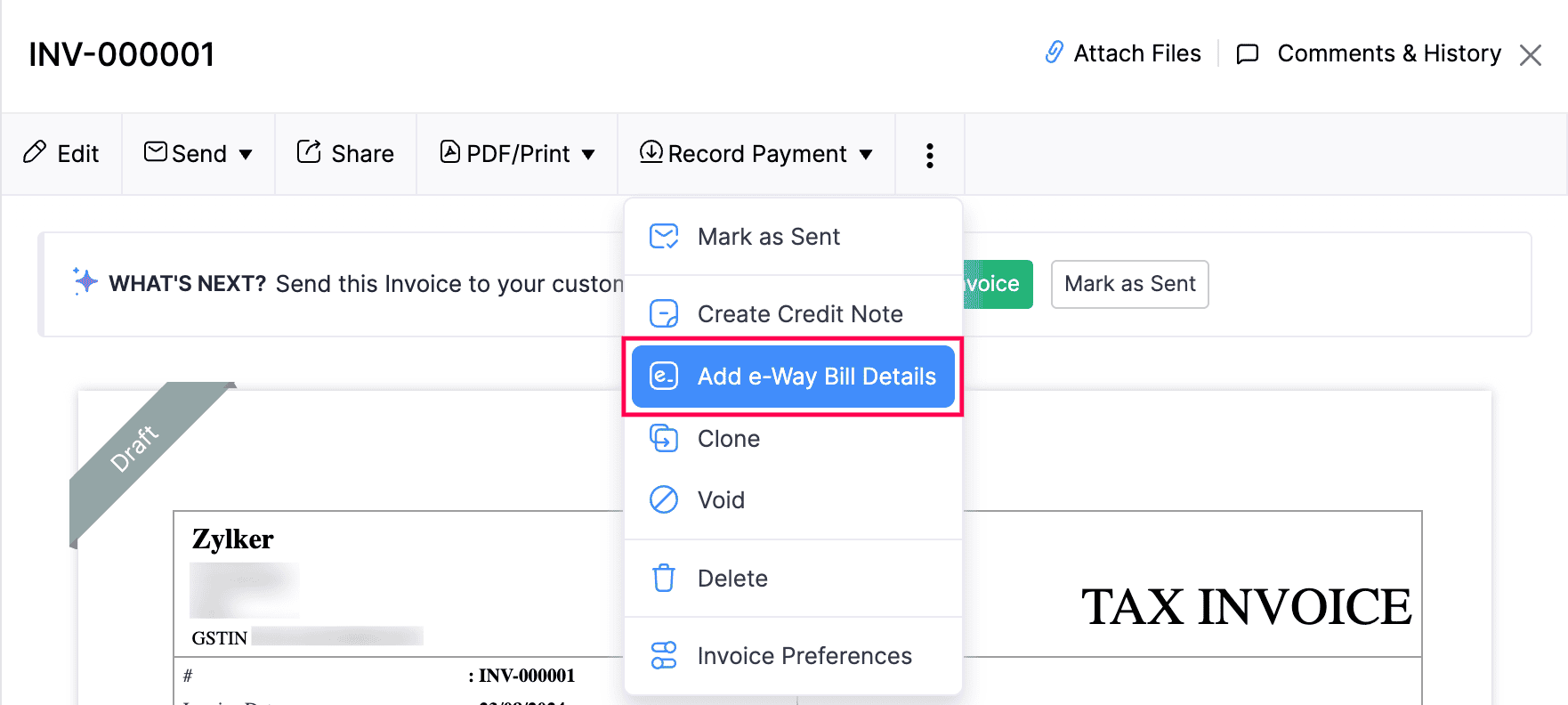

Click More and then select Add e-Way Bill Details.

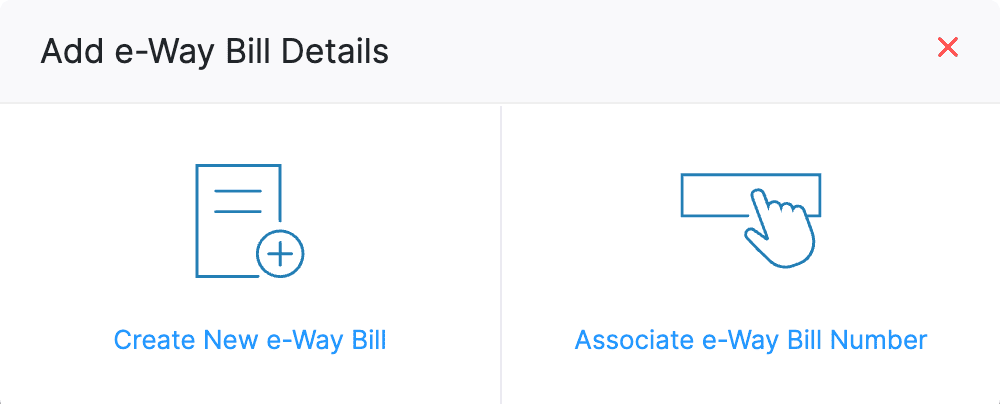

Click Associate e-Way Bill Number if you’ve already created an e-way bill for the invoice, or else click Create New e-Way Bill.

e-Way Bills in Zoho Billing

The e-Way Bill module will be automatically enabled for your Zoho Billing organisation as soon as you enable GST and enter your GSTIN in GST Settings.

Here’s how to enter e-Way Bill number for invoices:

- Go to Sales and select Invoices.

- Select the invoice for which you want to add e-way bill details.

- Click More and then select Add e-Way Bill Details.

- Click Associate e-Way Bill Number if you’ve already created an e-way bill for the invoice, or else click Create New e-Way Bill.

Statuses of e-Way Bills

The following table explains the types of statuses associated with each e-way bill:

| Status | Description |

|---|---|

| Not Generated | Transactions for which e-way bills have not been created yet. |

| Generated | Transactions for which e-way bills have been generated. |

| Cancelled | Transactions for which e-way bills are created and later cancelled for some valid reasons. |

| Expired | Transactions for which e-way bills have been created and have expired. |

| Excluded | Transactions that are excluded from the creation of e-way bills. |