Overview - e-Invoicing

Note: This feature is available only for certain plans of Zoho Books. Visit the pricing page to check if it’s available in your current plan.

Introduction to e-Invoicing

In the GST regime, the Government introduced e-Invoicing to standardise the way business-to-business (B2B) invoices are reported to the GST system. This ensures that all invoices are submitted to the GST portal in a common, machine-readable format. You can download our detailed e-book on e-Invoicing to understand more about e-Invoicing in India and its benefits.

Is e-Invoicing necessary for your business?

Starting 1 August 2023, the Government of India has mandated e-Invoicing for businesses and corporations that have an annual aggregate turnover of ₹5 crores or more.

Read more on when and how e-Invoicing was introduced.

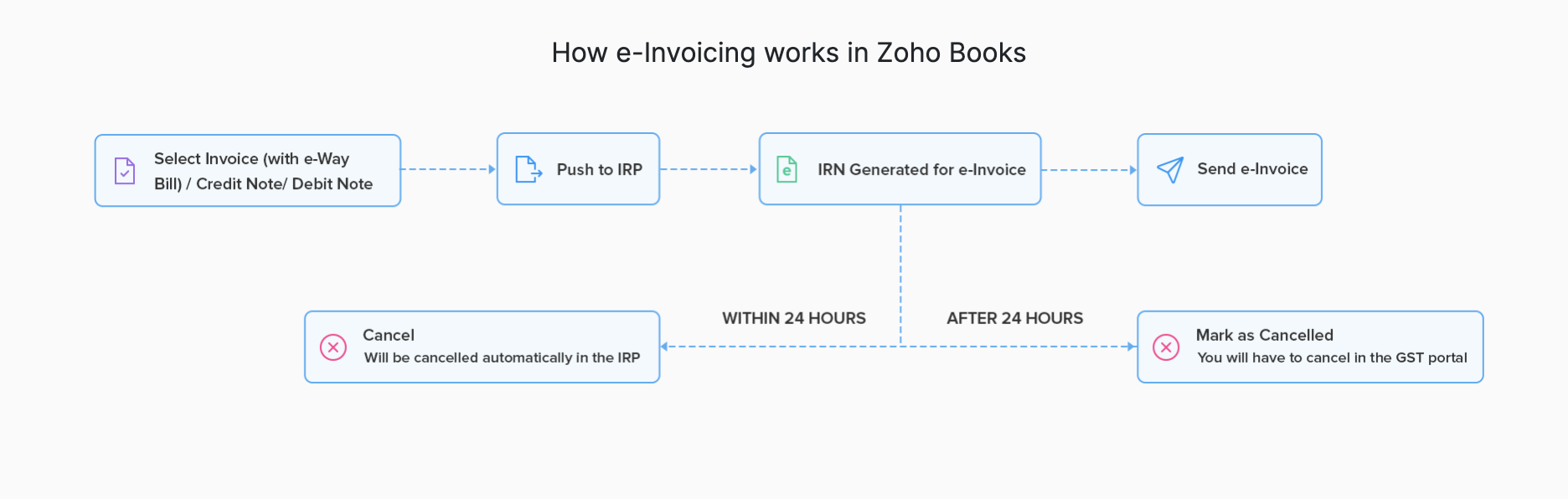

How does e-Invoicing work in Zoho Books?

e-Invoicing in Zoho Books is a simple and hassle-free process. Since Zoho is a registered GST Suvidha Provider (GSP), you can connect Zoho Books with the IRP easily. Zoho Books helps you create invoices in the e-Invoicing format, by including all the mandatory fields mentioned in the e-Invoice schema.

These invoices can be pushed to the Invoice Registration Portal (IRP) at the click of a button. The IRP will then send a unique Invoice Registration Number (IRN) to identify this invoice, along with a QR code. You can include these in your invoice and send it to customers. Zoho Books also provides you the option to cancel e-Invoices if needed.

This help document gives an easy understanding on how you can use Zoho Books to stay compliant with e-Invoicing.

Next