BC PST Returns

Zoho Books helps you in filing and recording your BC PST returns for your business based out of Canada. BC PST Return report is generated with respect to the lines that are given in the Revenue Division - Ministry of Finance’s BC PST return filing form

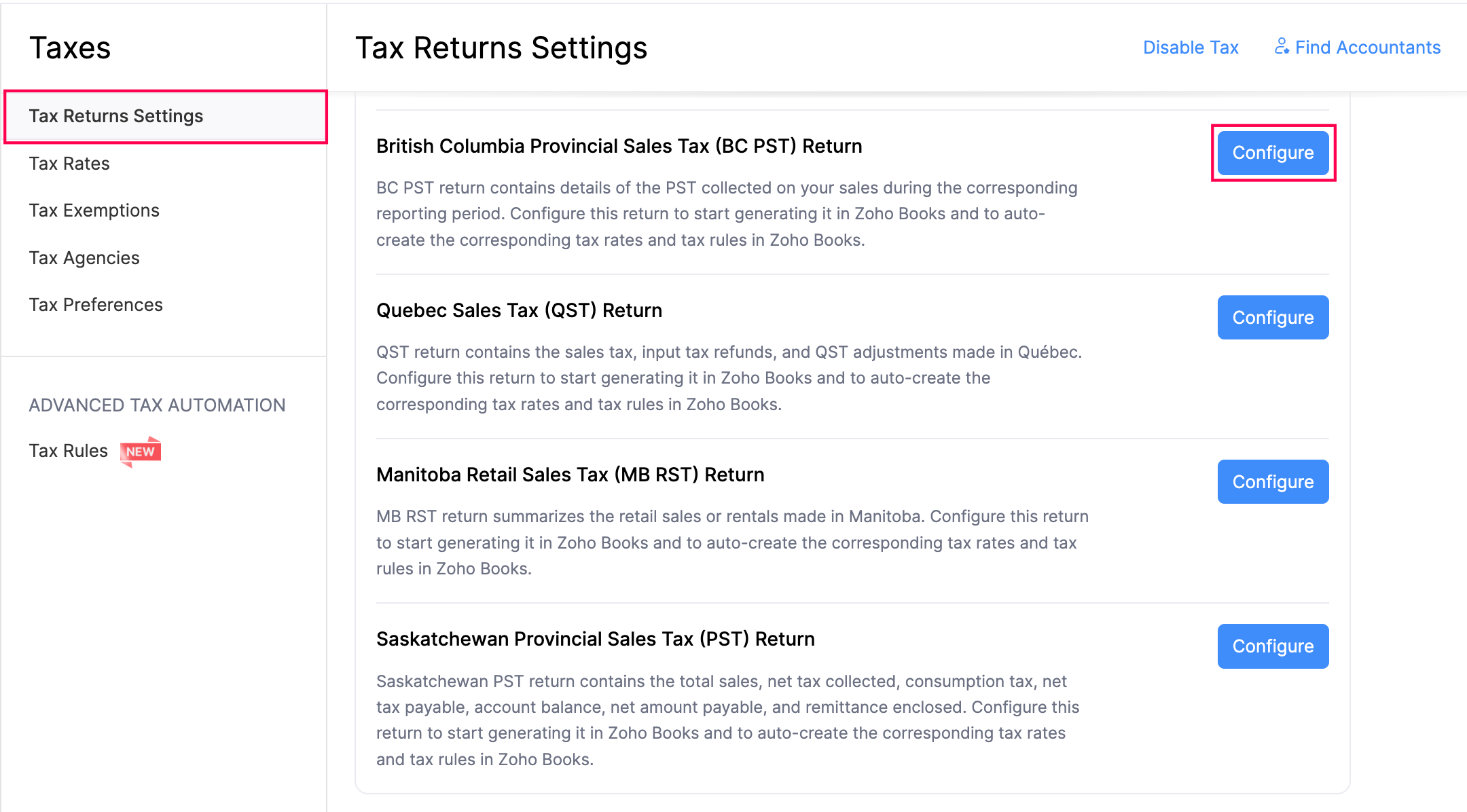

Setting Up Tax Returns

To enable tax returns in Zoho Books, configure the tax return settings first. Here’s how:

- Go to Settings.

- Select Taxes under Taxes & Compliance.

- Click Tax Returns Settings on the left sidebar.

- Hover over British Columbia Provincial Sales Tax (BC PST) Return, and click Configure.

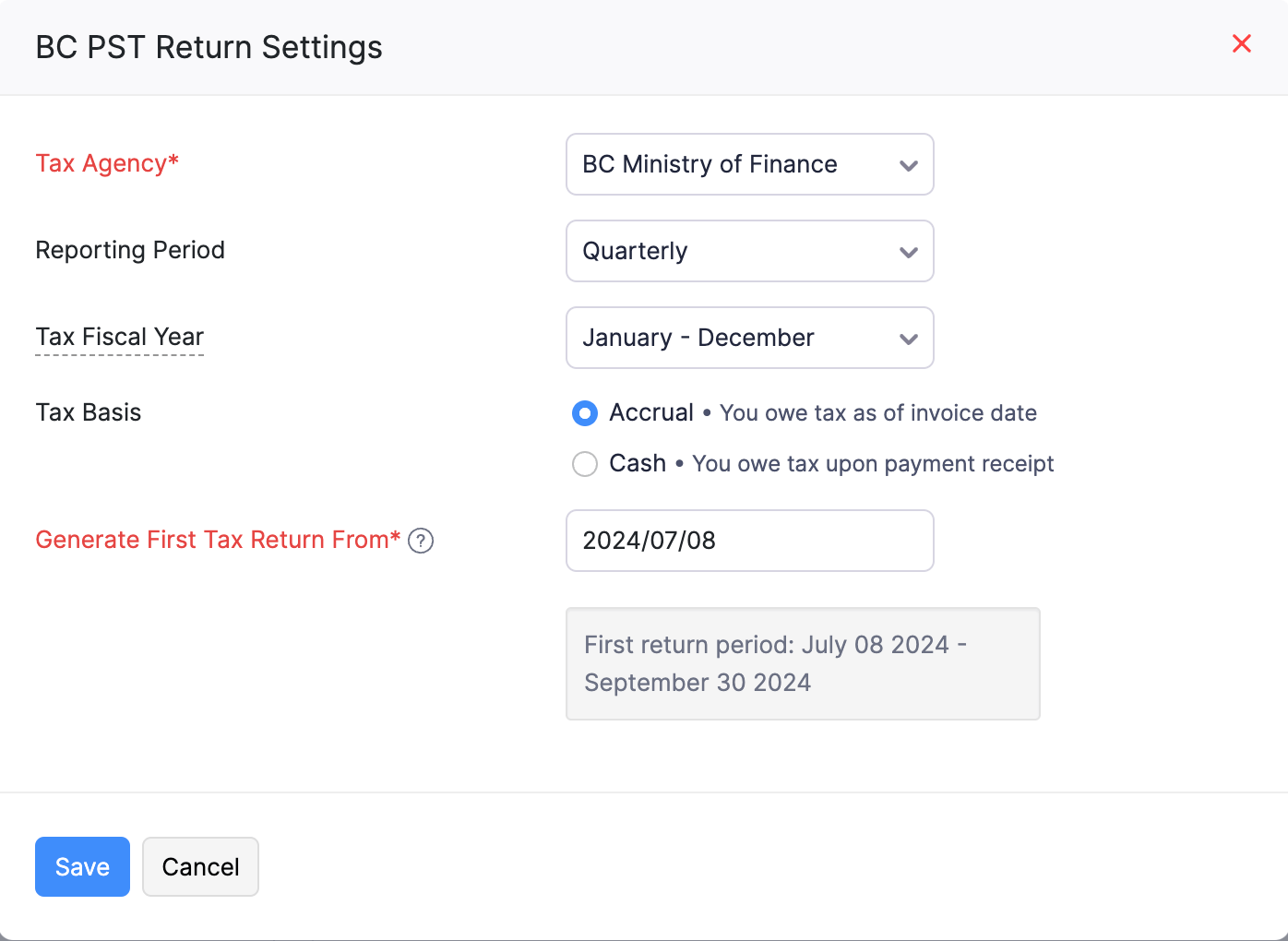

- In the pop-up, enter the following details:

- Tax Agency: Select the tax agency from the dropdown.

- Reporting Period: Select the reporting period as either Monthly, Quarterly, or Yearly.

- Tax Fiscal Year: Choose the fiscal year from the dropdown for filing your tax returns.

- Tax Fiscal Year: Choose either Accrual or Cash as the tax basis based on your preference.

- Generate First Tax Return From: Set the specific date for the first tax return based on your organization’s fiscal year.

- Click Save.

Now, your tax return is configured.

Generating Your Tax Return

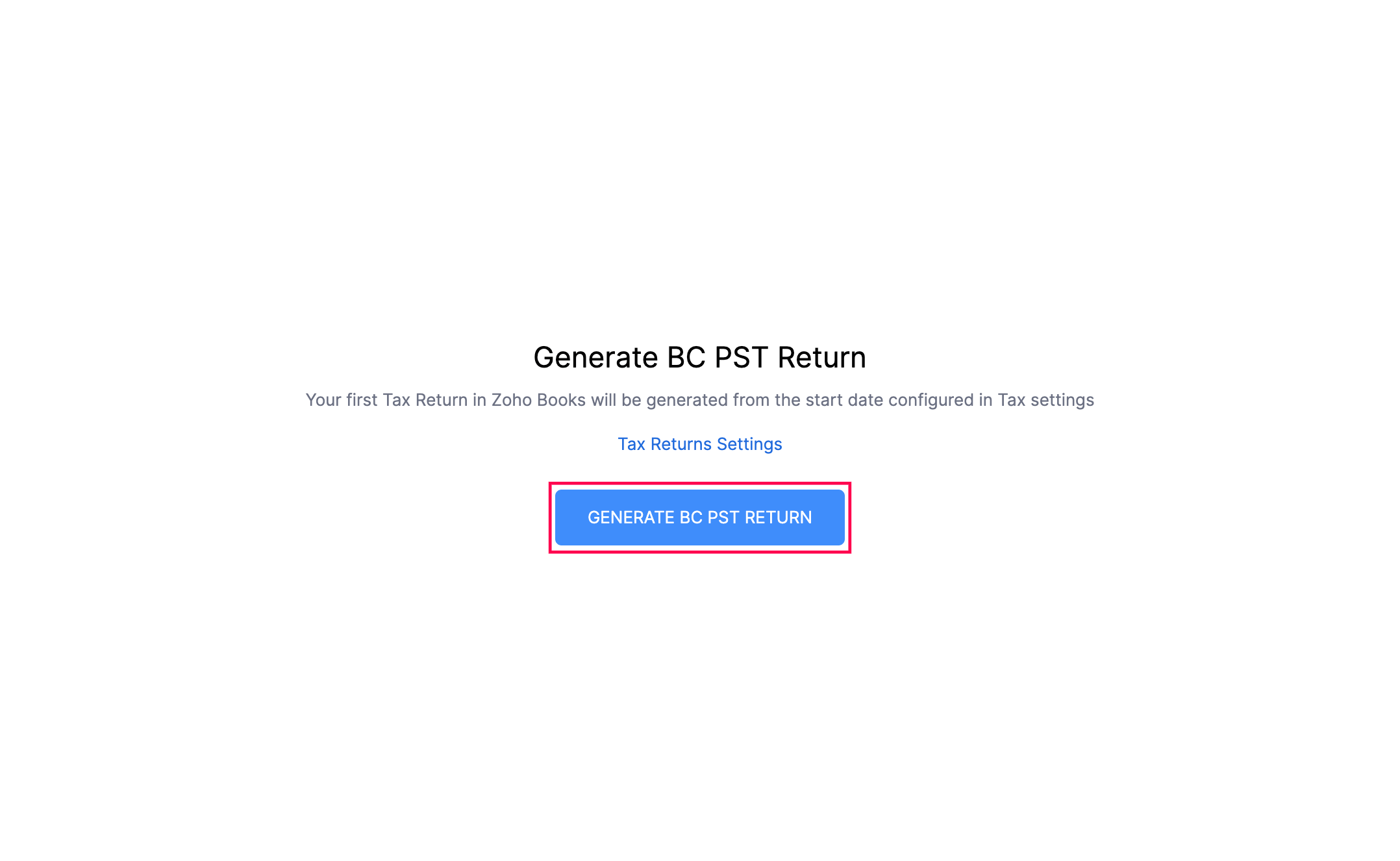

Generating your first tax return in Zoho Books is simple. After configuring the BC PST tax return, you can easily generate a tax return. Here’s how:

- Go to Settings.

- Select Taxes under Taxes and Compliance.

- Hover over British Columbia Provisional Sales Tax (BC PST) Return and click Go to Return>.

- You will be redirected to the BC PST Returns page, which is also accessible from the left sidebar under Tax Returns.

- Click Generate BC PST Tax Return.

Now, your tax return will be generated, which can be viewed or downloaded if necessary.

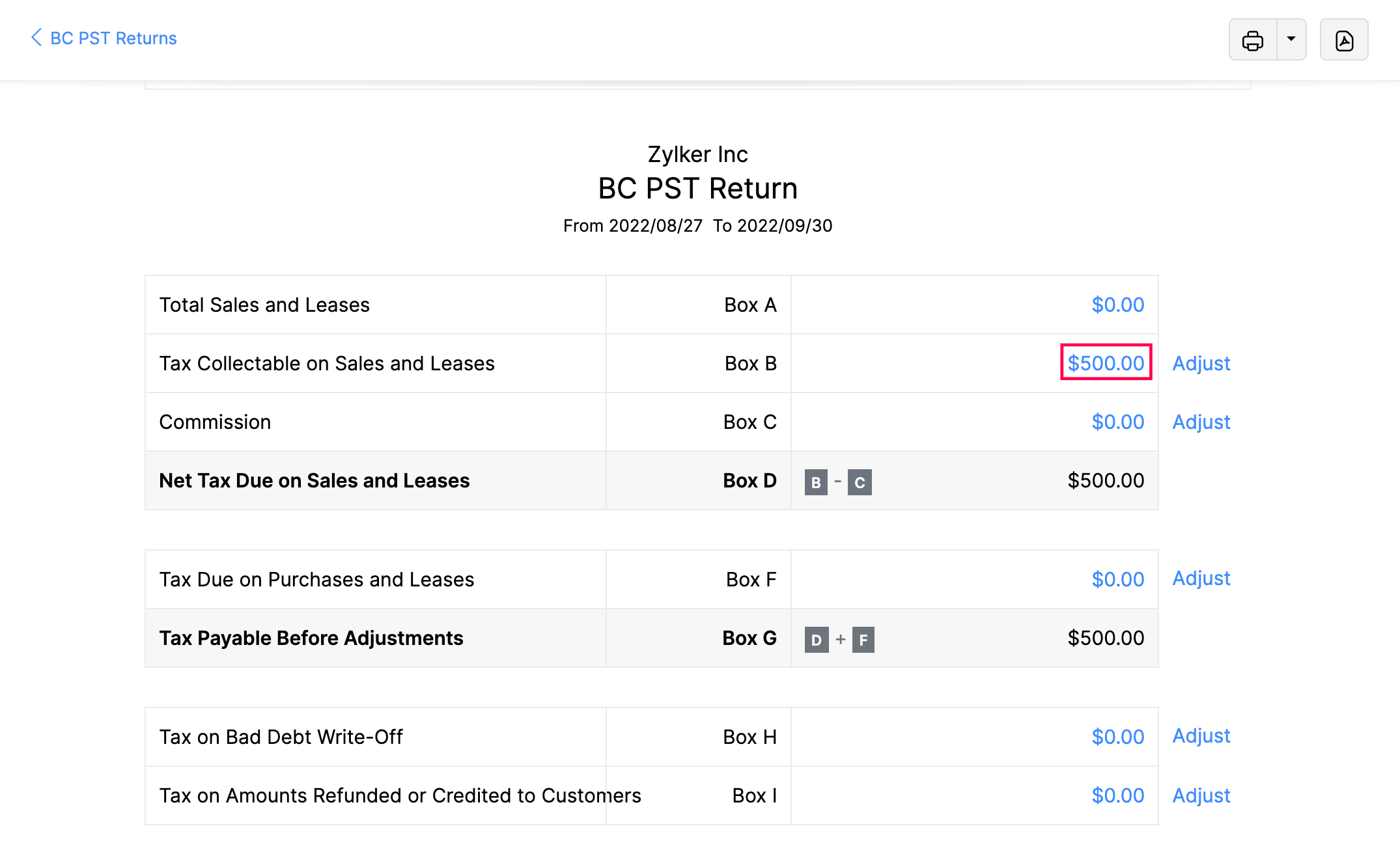

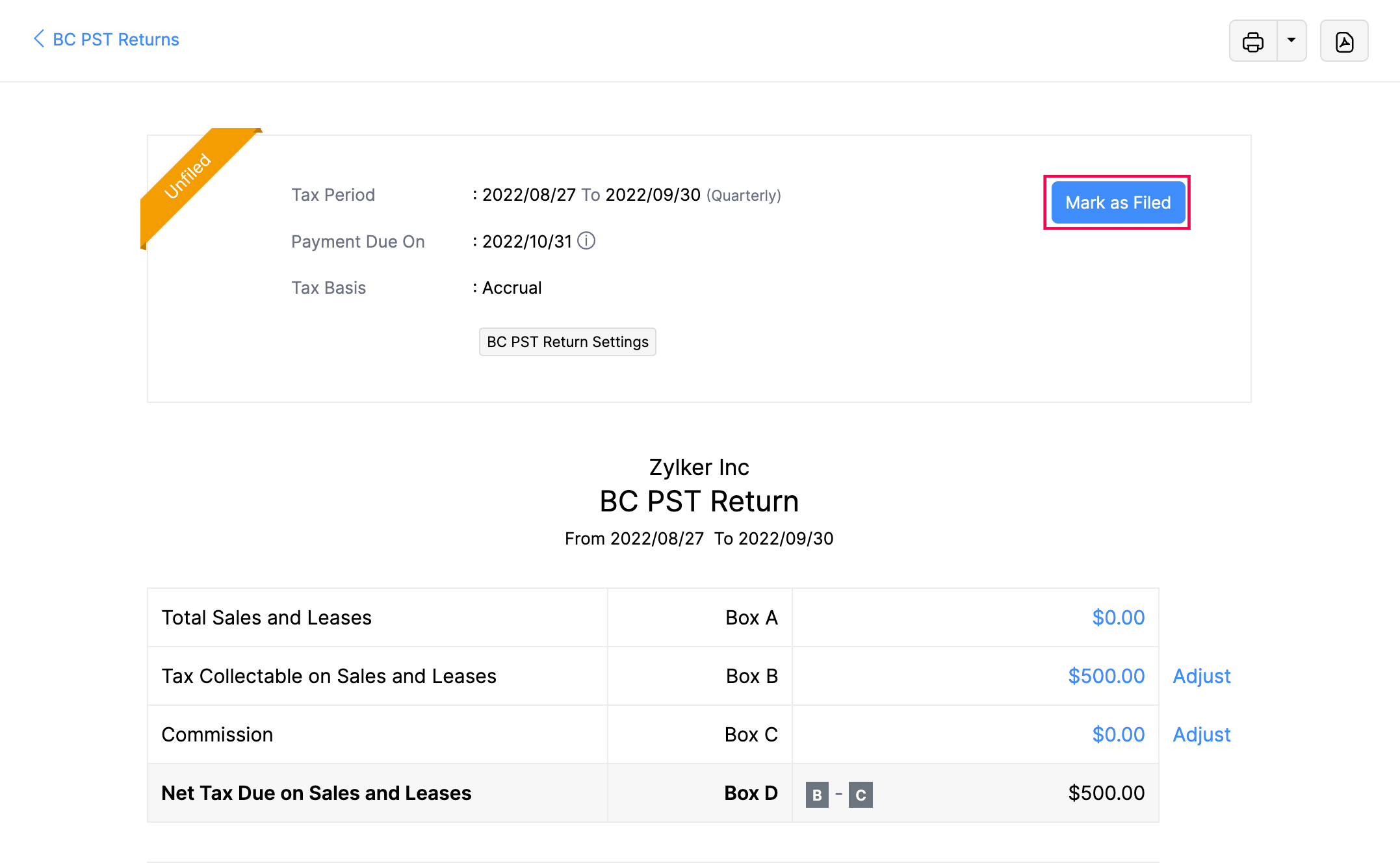

Tax Return Details

Click the numbers in the boxes to see detailed information for each entry. This lets you dive deeper into the data shown in the lines.

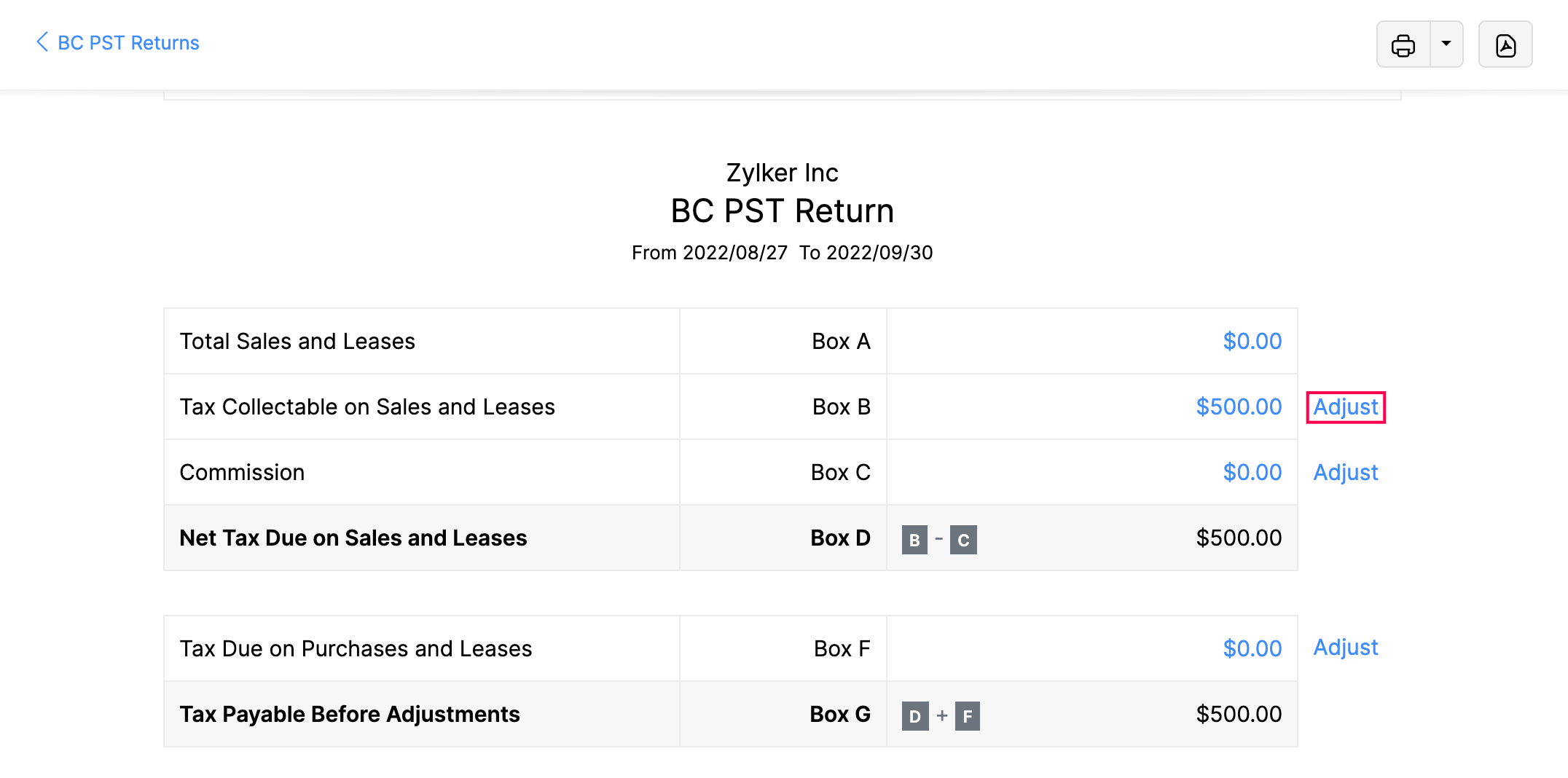

Adjustments in BC PST Tax Returns

The BC PST returns allows you to record adjustments in the corresponding lines of your tax return. Here’s how:

- Go to Tax Returns on the left sidebar, and select BC PST Return.

- Hover over and select the tax return.

- In the following page, click Adjust for the tax you want to make adjustments for.

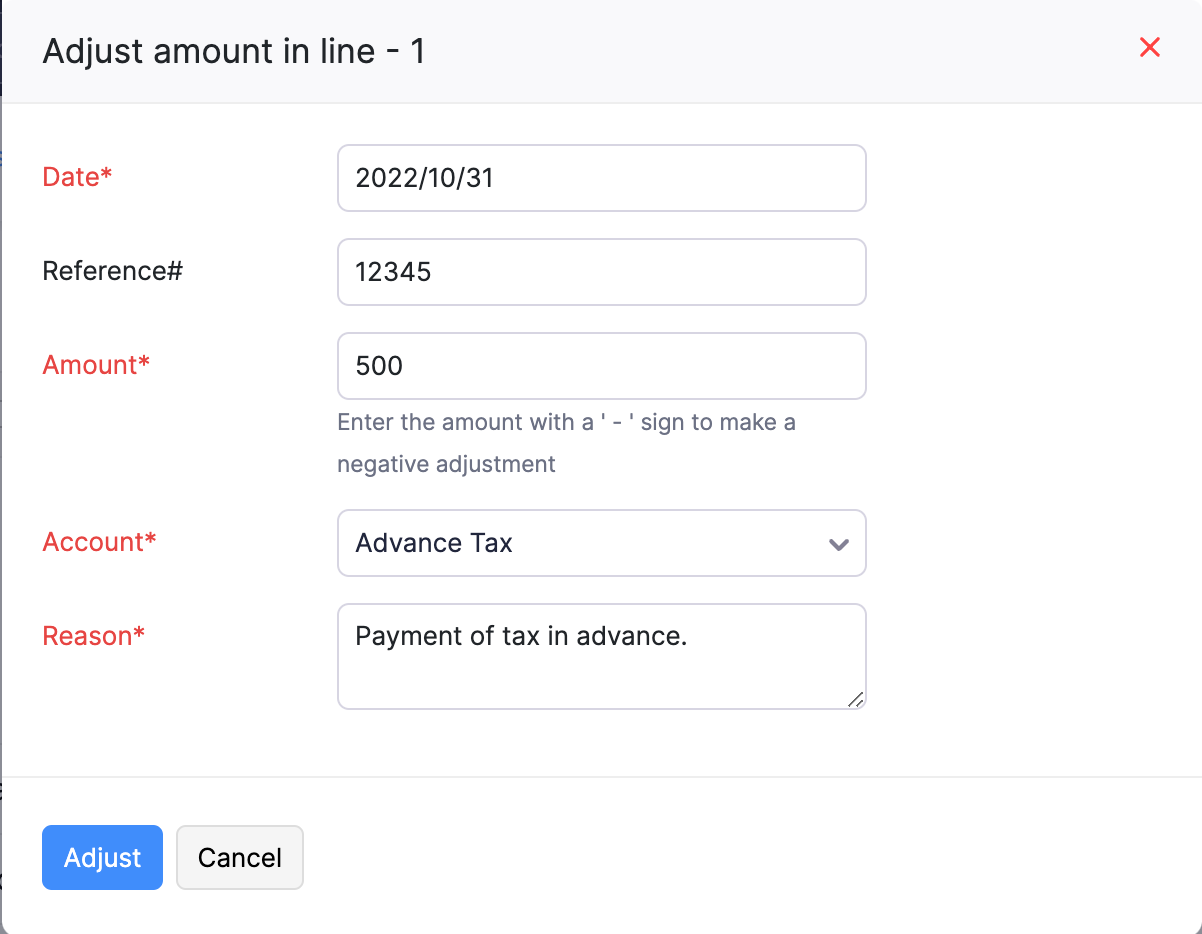

- In the pop-up, fill in the following fields:

- Date: Choose the date when the adjustment was recorded. The current date is selected by default.

- Reference#: Enter the reference number if applicable.

- Amount: Enter the adjustment amount.

- Account: Select an account where this adjustment will be recorded.

- Reason: Enter the reason for recording this adjustment.

- Click Adjust.

Now, the amount in the tax return will be adjusted accordingly.

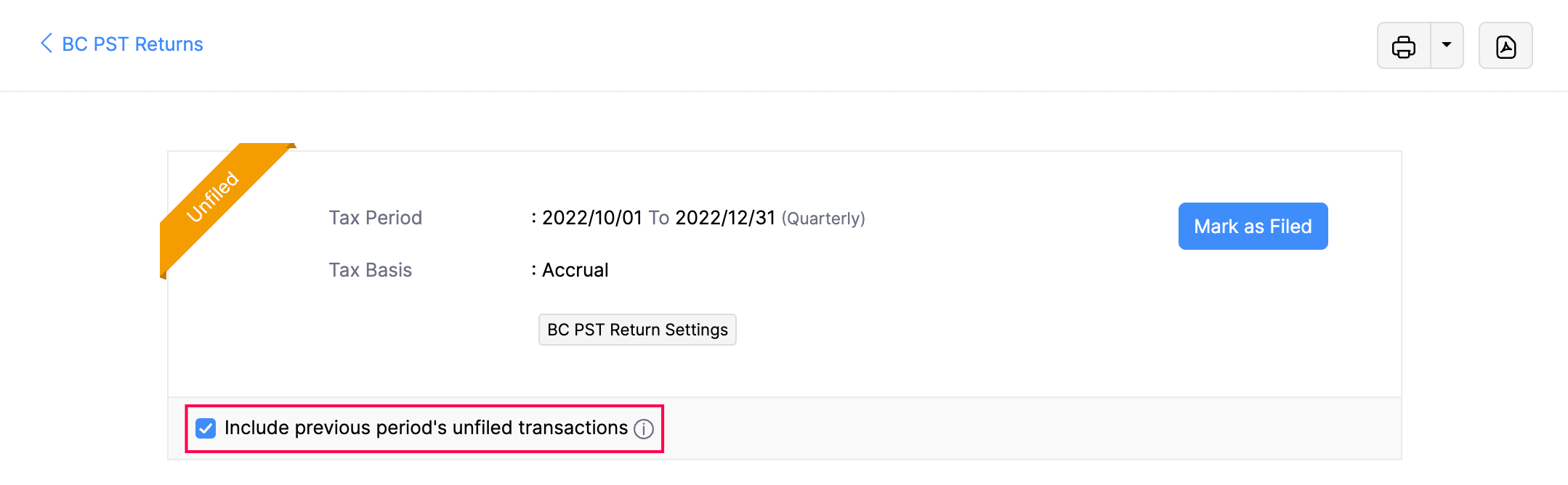

Include Previous Transactions

Sometimes, you may need to record a transaction for a previous BC PST return period, even if that return has already been filed. You can do this by recording the transaction with the previous date and including it in your current BC PST return.

To include previous transactions during filing:

- Go to Tax Returns on the left sidebar.

- Select BC PST Return.

- Hover over and select the unfiled tax return.

- On the next page, check the option Include previous period’s unfiled transactions.

- Click OK in the pop-up to confirm.

Now, any unfiled transactions from previous tax periods will be included in this tax return.

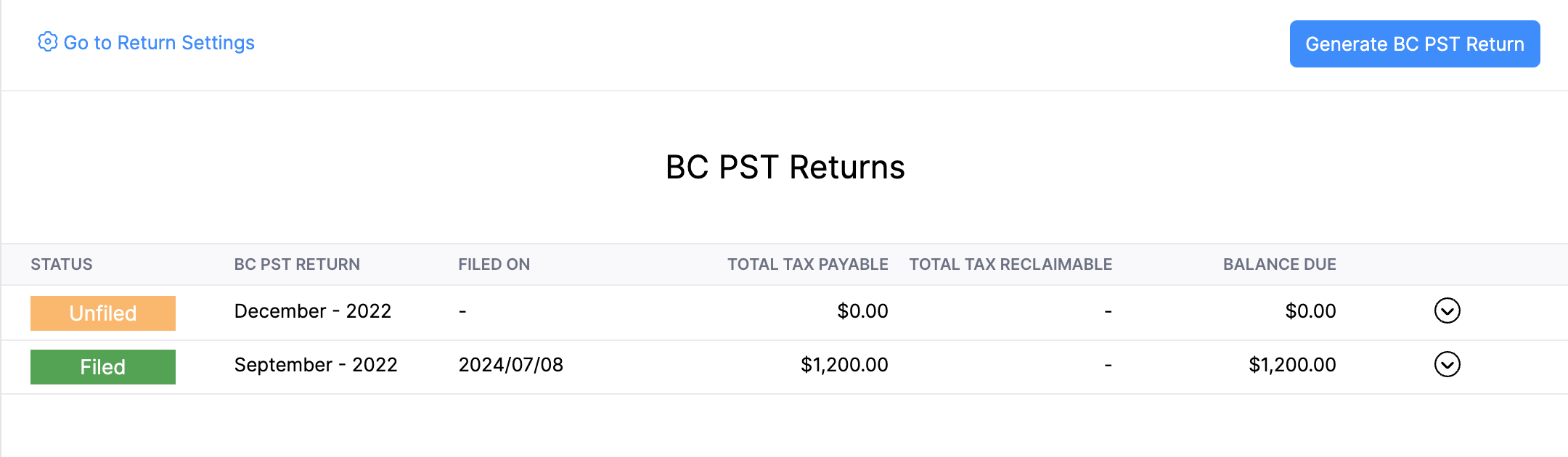

View BC PST Returns

To view returns:

- Go to Tax Returns on the left sidebar.

- Select BC PST Return.

Now, ##### ON THIS PAGE, you can view all the BC PST returns that have been recorded.

The Status shows if you have filed your BC PST return and the Balance Due indicates the amount you need to pay or claim for your return.

Note: You can only generate a new BC PST return after filing the previous return.

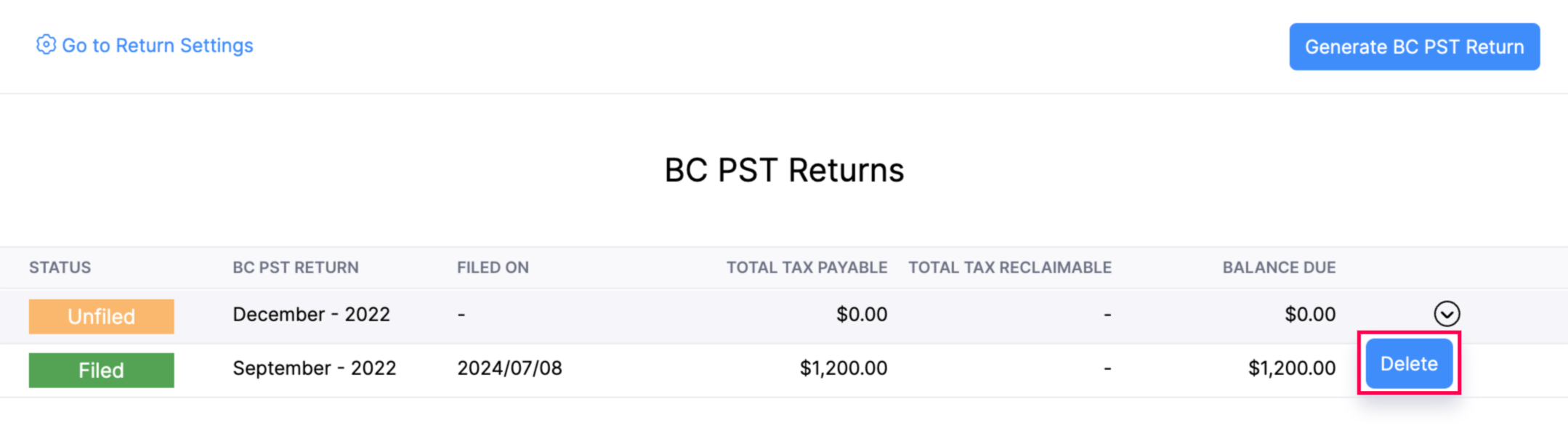

Delete BC PST Return

To delete a return:

- Go to Tax Returns on the left sidebar.

- Select BC PST Return.

- In the BC PST Returns page, hover over the tax return you want to delete, and click Delete from the dropdown.

Mark BC PST Return as Filed

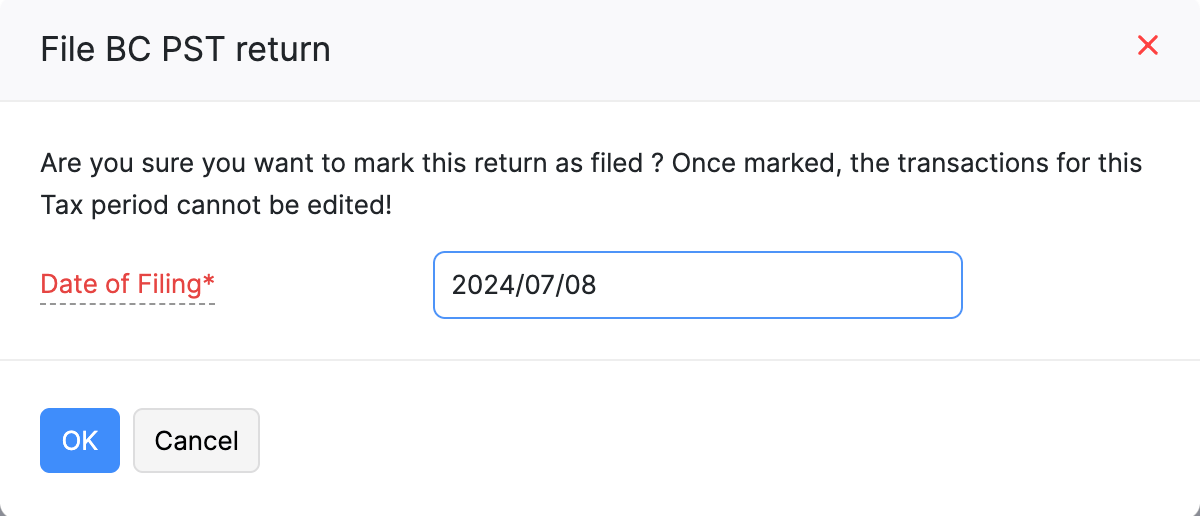

Warnings:

- Once marked, the transactions for the current tax period cannot be edited.

- Tax Return cannot be filed before the end of the reporting period

After filing your tax returns with the tax agency you can mark your BC PST return as filed. Here’s how:

- Go to Tax Returns on the left sidebar, and select BC PST Return.

- In the BC PST Returns page, select the tax return you want to file.

- In the following page, click Mark as Filed.

- In the pop-up, choose the Date of Filing based on your preference.

- Click OK to confirm.

Now, the tax return will be marked as filed.

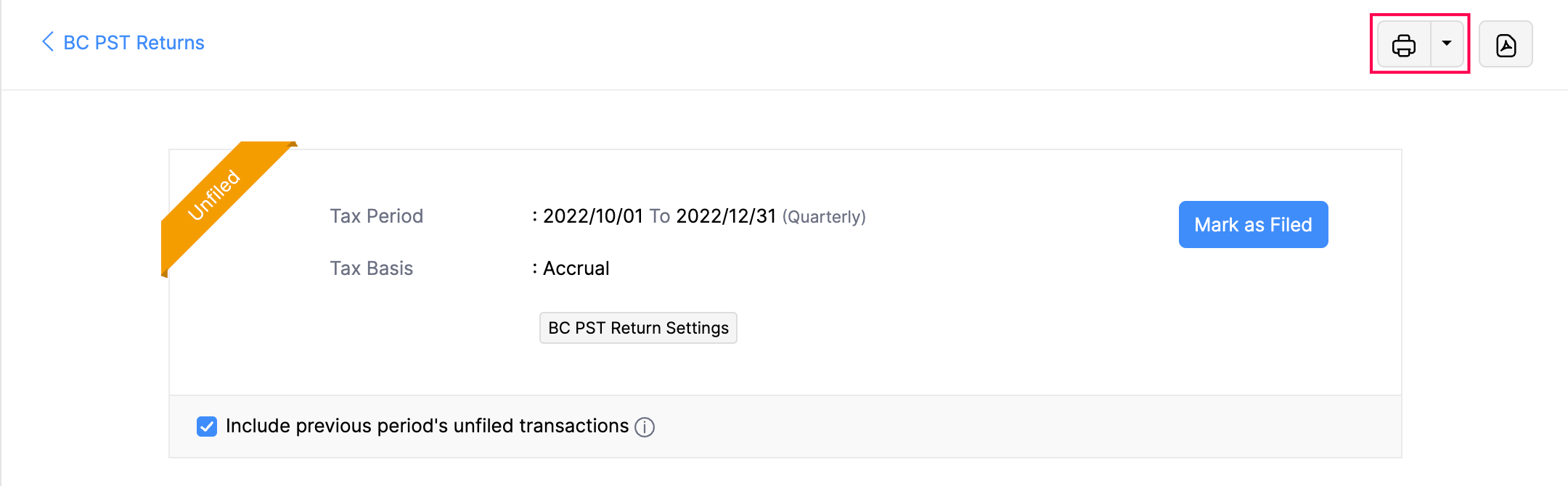

Print Tax Returns

To print tax returns:

- Go to Tax Returns on the left sidebar.

- Select BC PST Returns.

- Select the Print icon at the top right corner of the page.

- In the Preview pop-up, verify the document, and click Print.

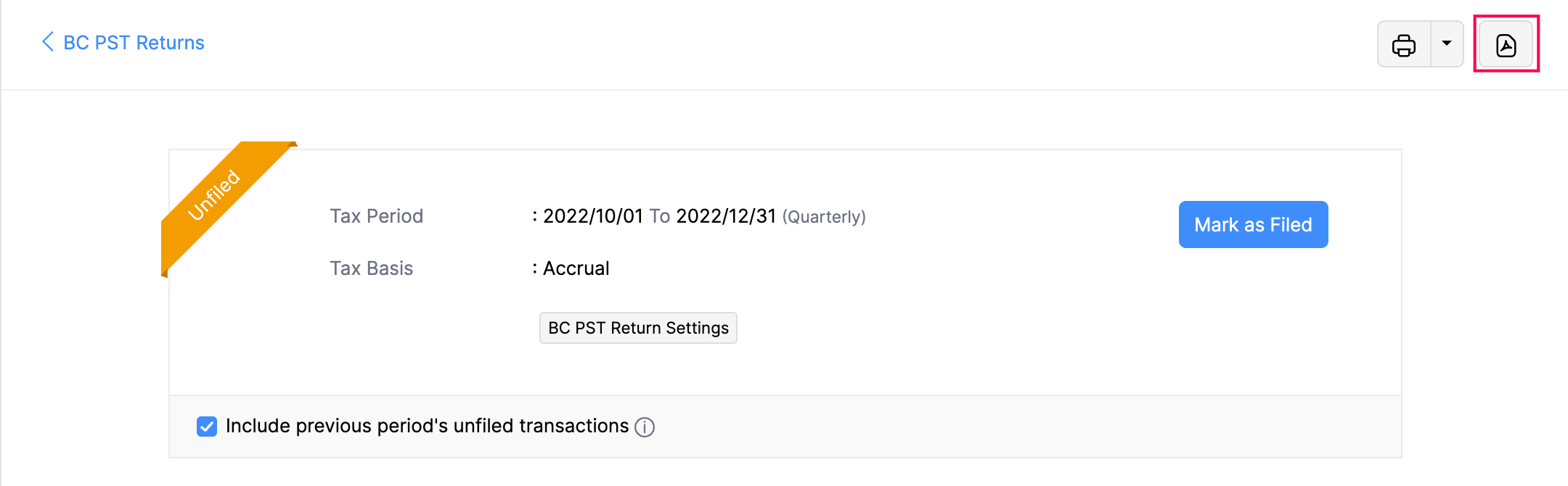

Export Tax Returns

To export tax returns:

- Go to Tax Returns on the left sidebar.

- Select BC PST Returns.

- Click the PDF icon at the top right corner of the page.

- In the Export Report as PDF pop-up:

- If you want to protect the file with a password, check the option I want to protect this file with a password.

- If you want to customize the format of the export, click Customize the details in the export file drop-down and enter the necessary details.

- Click Export.

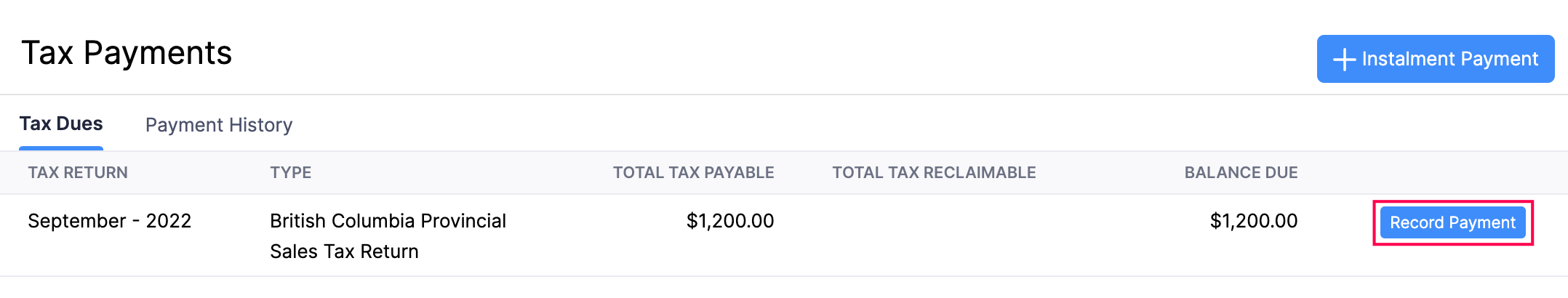

Record Tax Payments

You can record tax payments in three ways:

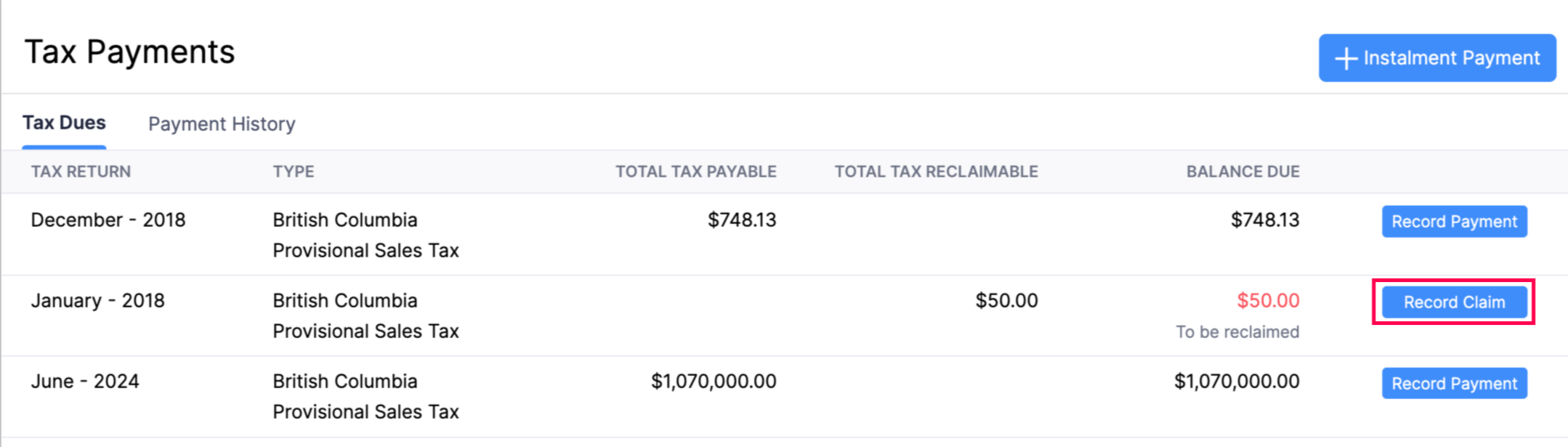

Directly from Tax Payments

Prerequisite: Ensure you have a bank account configured in your Zoho Books organization for recording and making payments.

Once you mark your BC PST return as Filed, you can record the payment for the tax. Here’s how:

- Go to Tax Returns on the left sidebar, and select Tax Payments.

- Under the Tax Dues tab, hover over any of the due taxes, and click Record Payment.

- In the Record Tax Payment pop-up, fill in the following fields:

- Paid Through: Select the bank account you want to use for the tax payment.

- Amount Payable: The full amount is taken by default, but you can modify it as needed.

- Payment Date: The current date is selected by default, but you can modify it as needed.

- Reference Number: Enter a reference number if required.

- Description: Add a description if needed.

- Click Save.

Now, your payment for the due tax will be recorded.

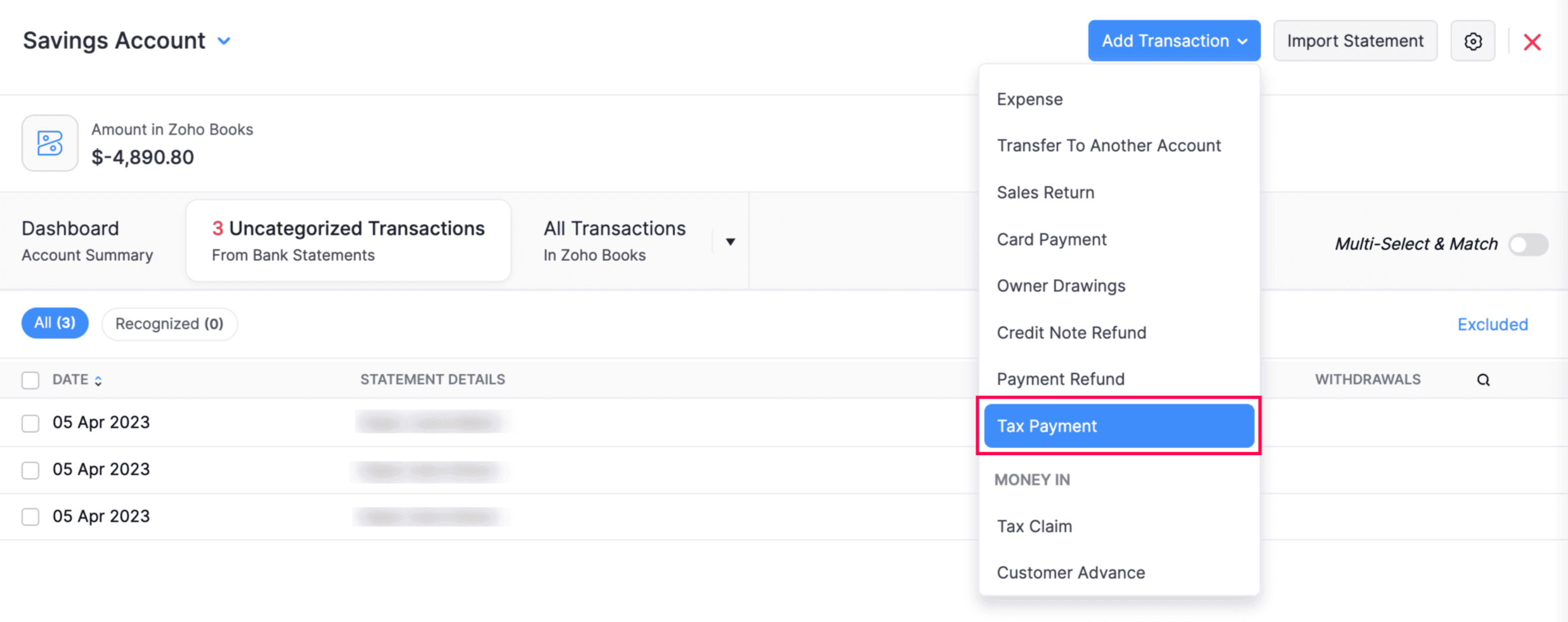

From a Bank Account

To record a tax payment from a bank account:

- Go to Banking on the left sidebar, and select a bank account you want to use for the payment.

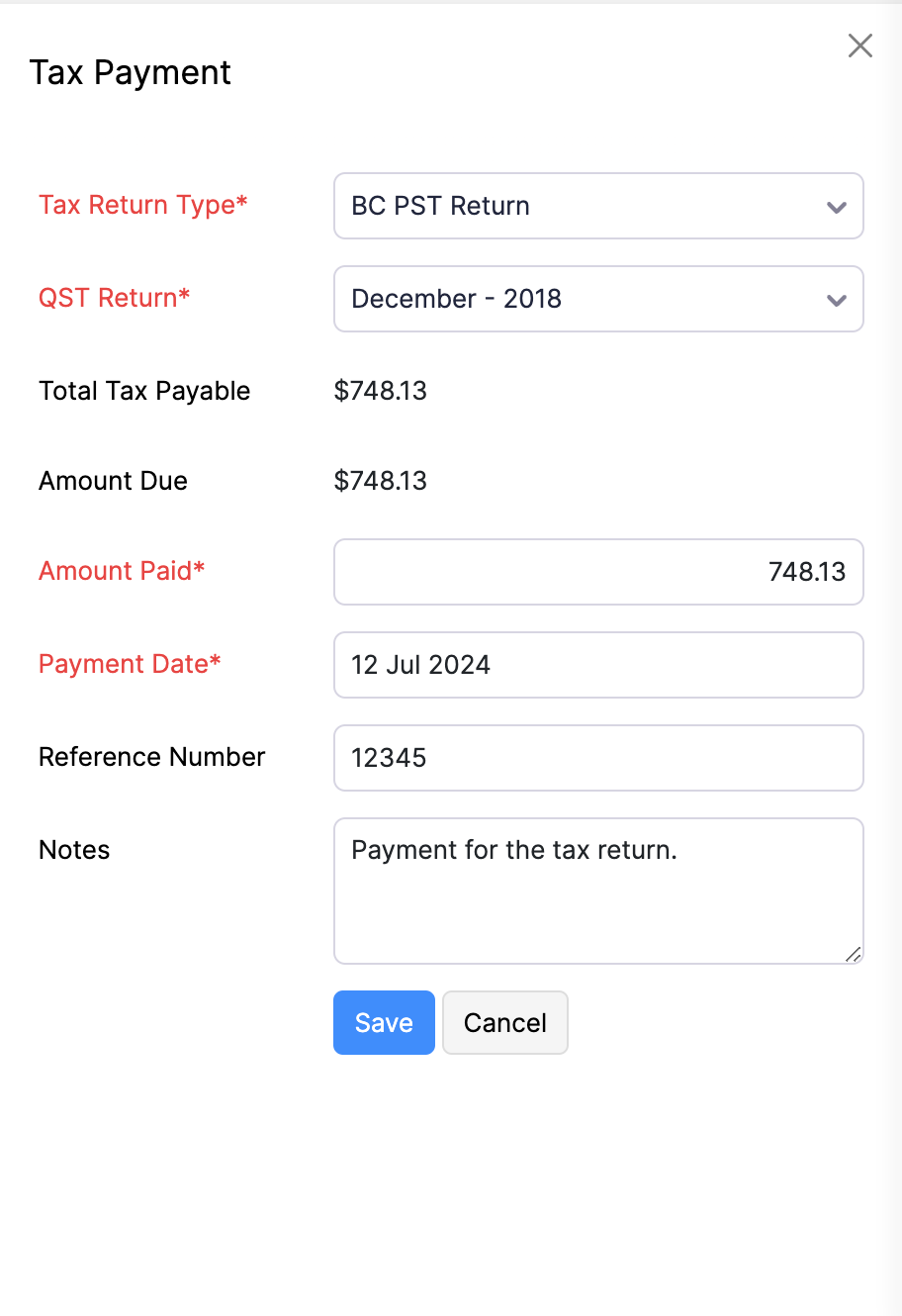

- In the following page, click Add Transaction at the top right corner of the page and select Tax Payment from the drop-down.

- On the right sidebar that appears, select the Tax Return Type from the dropdown and select the Filing Date from the other dropdown.

- Now, fill in the following fields:

- Amount Paid: This field will be auto-filled with the amount due. Adjust if necessary.

- Payment Date: This field will also be auto-filled with the current date. Change if needed.

- Reference Number: Enter a reference number if needed.

- Notes: Add any relevant notes.

- Click Save.

Now, the payment will be recorded for the tax due from the selected bank account.

By Recording a Claim

In Zoho Books, you can claim a refund or credit for overpaid taxes, tax exemptions, or rebates. Here’s how:

- Go to Tax Returns on the left sidebar, and select Tax Payments.

- Under the Tax Dues tab, hover over any of the due taxes, and click Record Claim.

- In the pop-up, fill in the following fields:

- Deposit To: Select the account where the amount will be deposited.

- Payment Date: Choose the payment date.

- Reference Number: Enter a reference number if necessary.

- Description: Add a description if needed.

- Click Save.

Now, your payment for the due tax will be recorded.

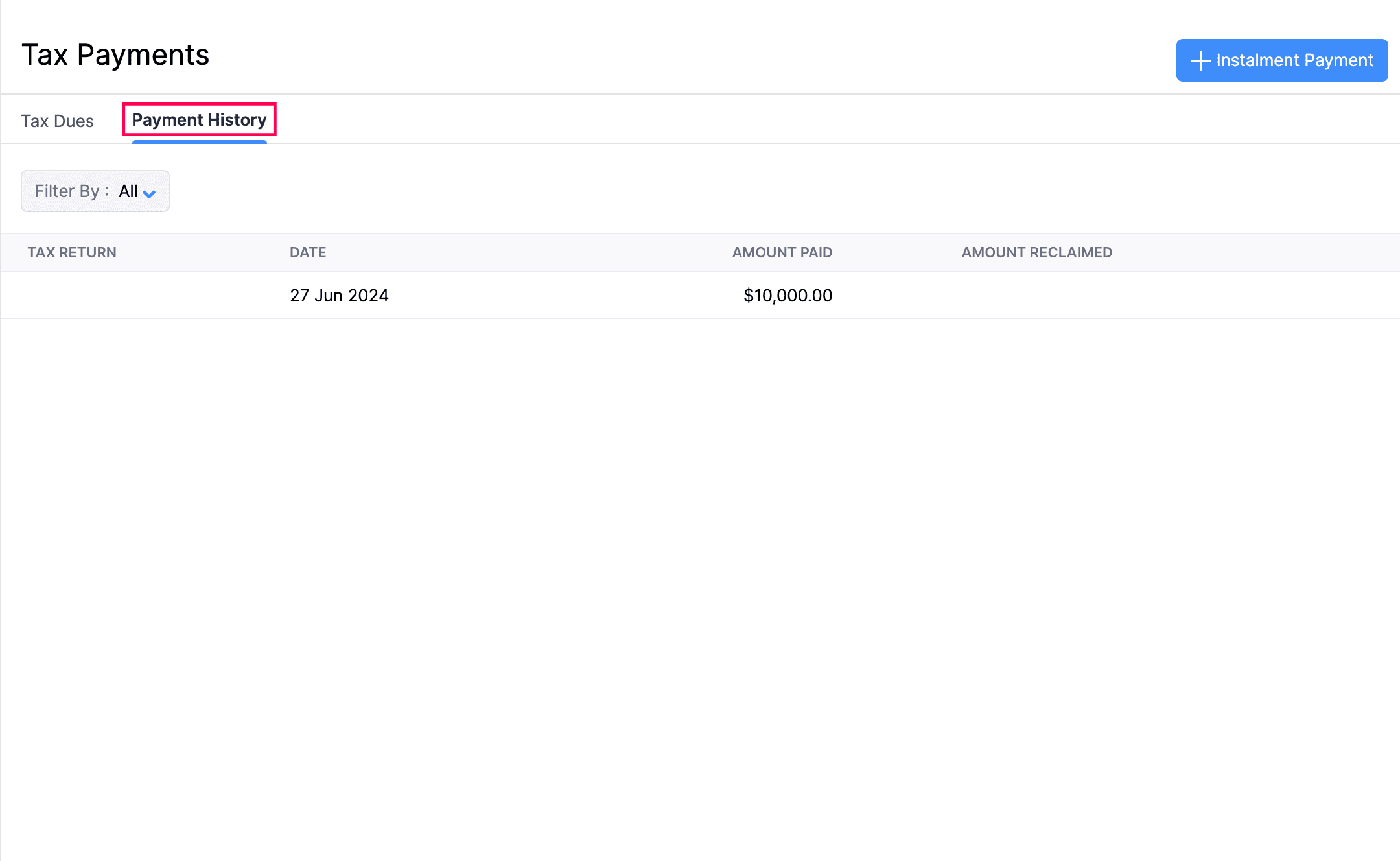

Payment History

You can view, edit and delete payments made in the payment history for the BC PST returns you’ve filed.

View Payment History

To view payment history:

- Go to Tax Returns on the left sidebar.

- Select Tax Payments.

- Click the Payment History tab at the top of the page.

Now, you can view all the payments made for due taxes.

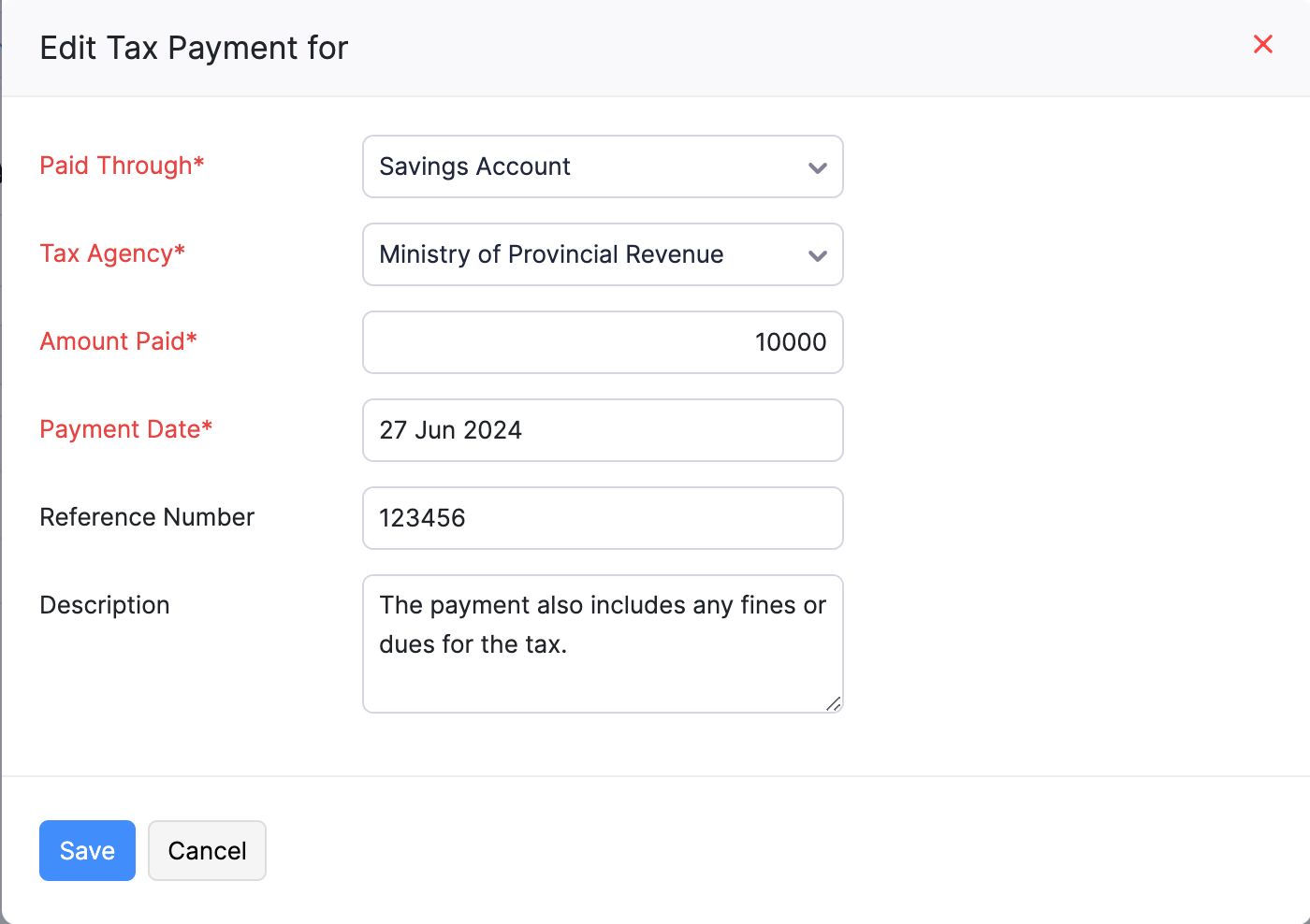

Edit Payments

To edit a payment:

- Go to Tax Returns on the left sidebar.

- Select Tax Payments.

- Click the Payment History tab at the top of the page.

- Hover over the payment you want to edit and select it.

- In the pop-up, edit the necessary payment details.

- Click Save.

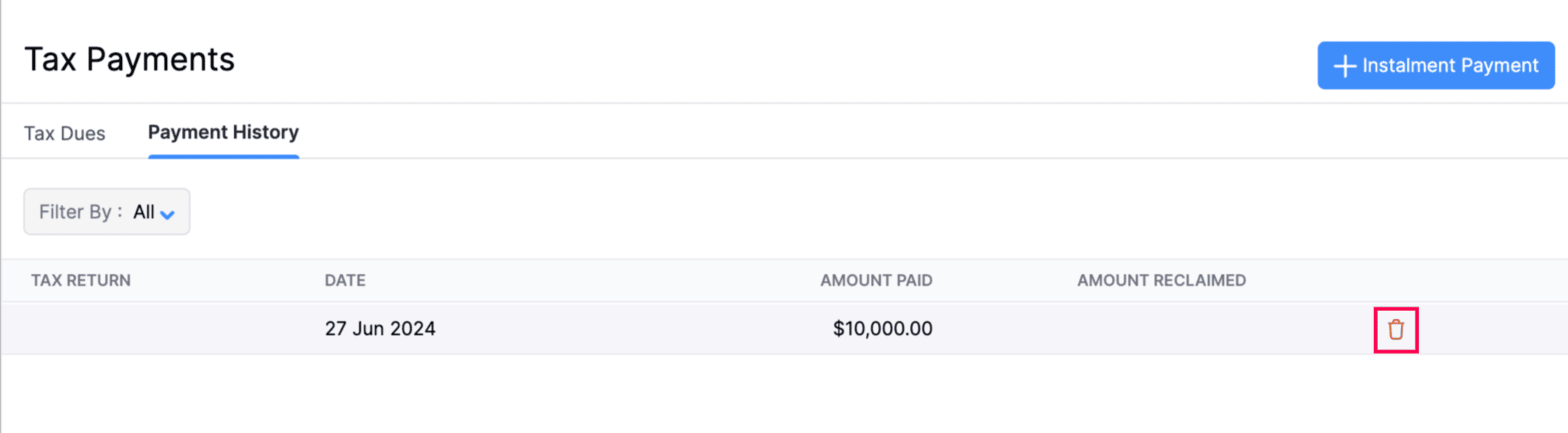

Delete Recorded Payments

To delete payments:

- Go to Tax Returns on the left sidebar, and select Tax Payments.

- Click the Payment History tab at the top of the page.

- Hover over the payment you want to delete and click the Delete icon.

- In the following pop-up, click OK.

Now, the tax payment will be deleted.

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!