GST/HST Returns

Zoho Books helps you in filing and recording your GST/HST returns for your business based out of Canada. GST/HST Return report is generated with respect to the lines that are given in the Canada Revenue Agency’s GST/HST return filing form.

In the next few steps, you will learn about the following,

- GST/HST Settings

- Generating your first Tax Return

- GST/HST Return Details

- GST/HST Returns List

- Recording Instalment Payments

- Adjustments in GST/HST Returns

- Including previous transactions

- Mark GST/HST Return as Filed

- Printing and Exporting a GST/HST Return

- Recording Tax Payments

- Payment History

GST/HST Settings

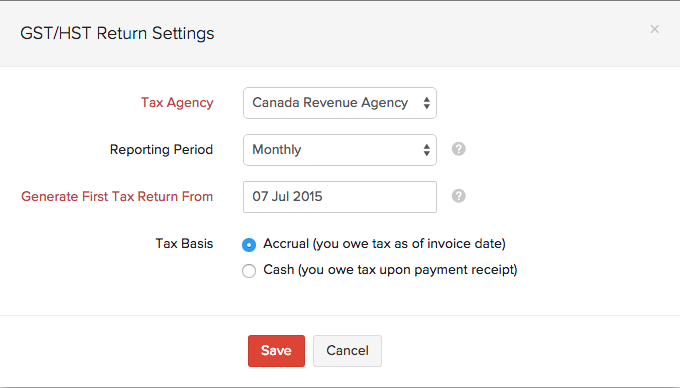

For ease of access to the settings page, click on GST/HST Return Settings present on top of the report table.

Clicking on that link will open this pop-up,

- Tax Agency: Select ‘Canada Revenue Agency’ from the drop-down.

- Reporting Period: You can choose your Reporting Period as Monthly, Quarterly or Yearly.

- Generate First Tax Return From: Select the date from which you wish to generate the report.

- Tax Basis: You can select either Accrual or Cash depending on the basis of how you run your business. Please note that this Tax Basis is different from your Organization’s Tax Basis.

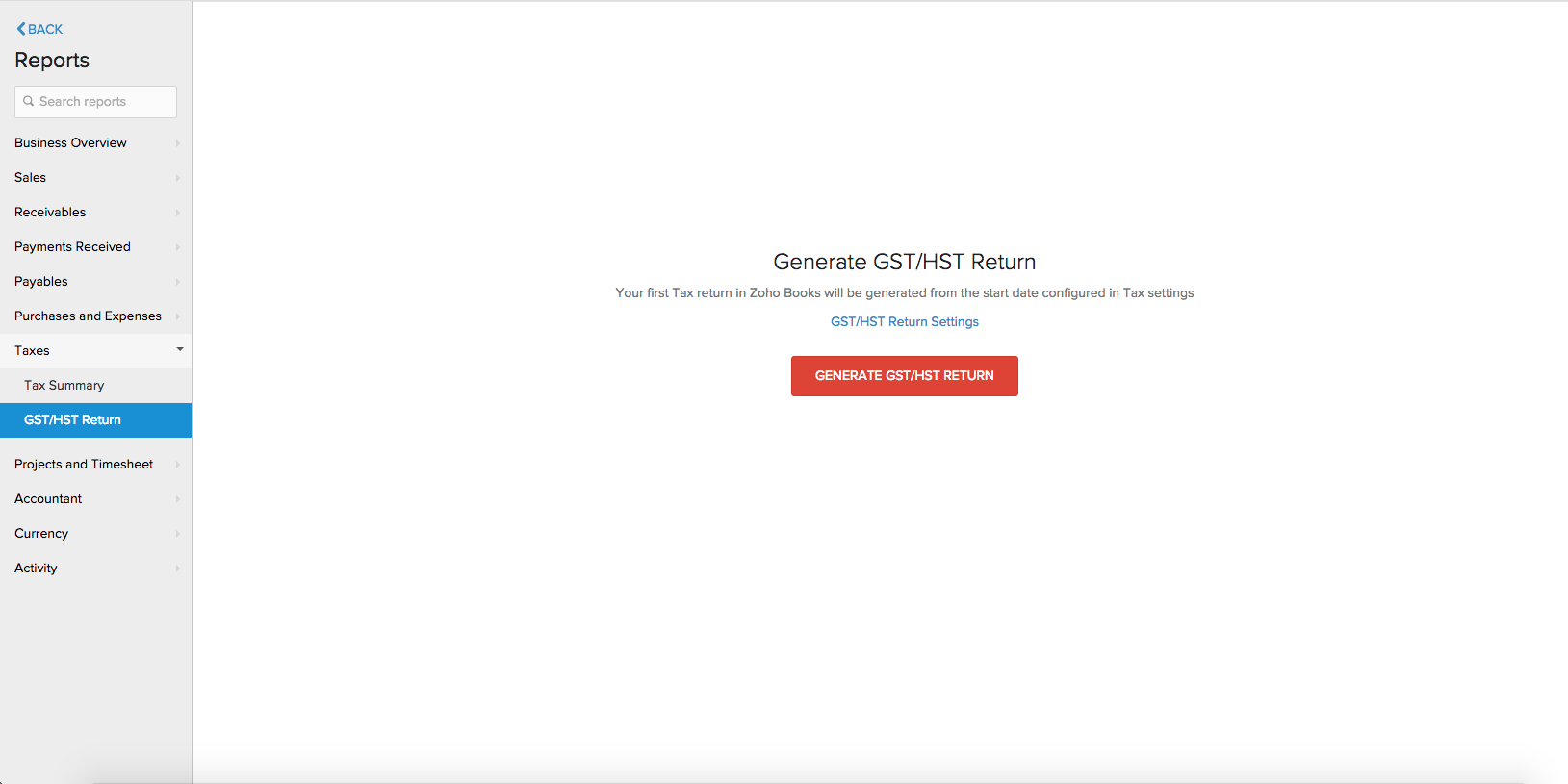

Generating your first Tax Return

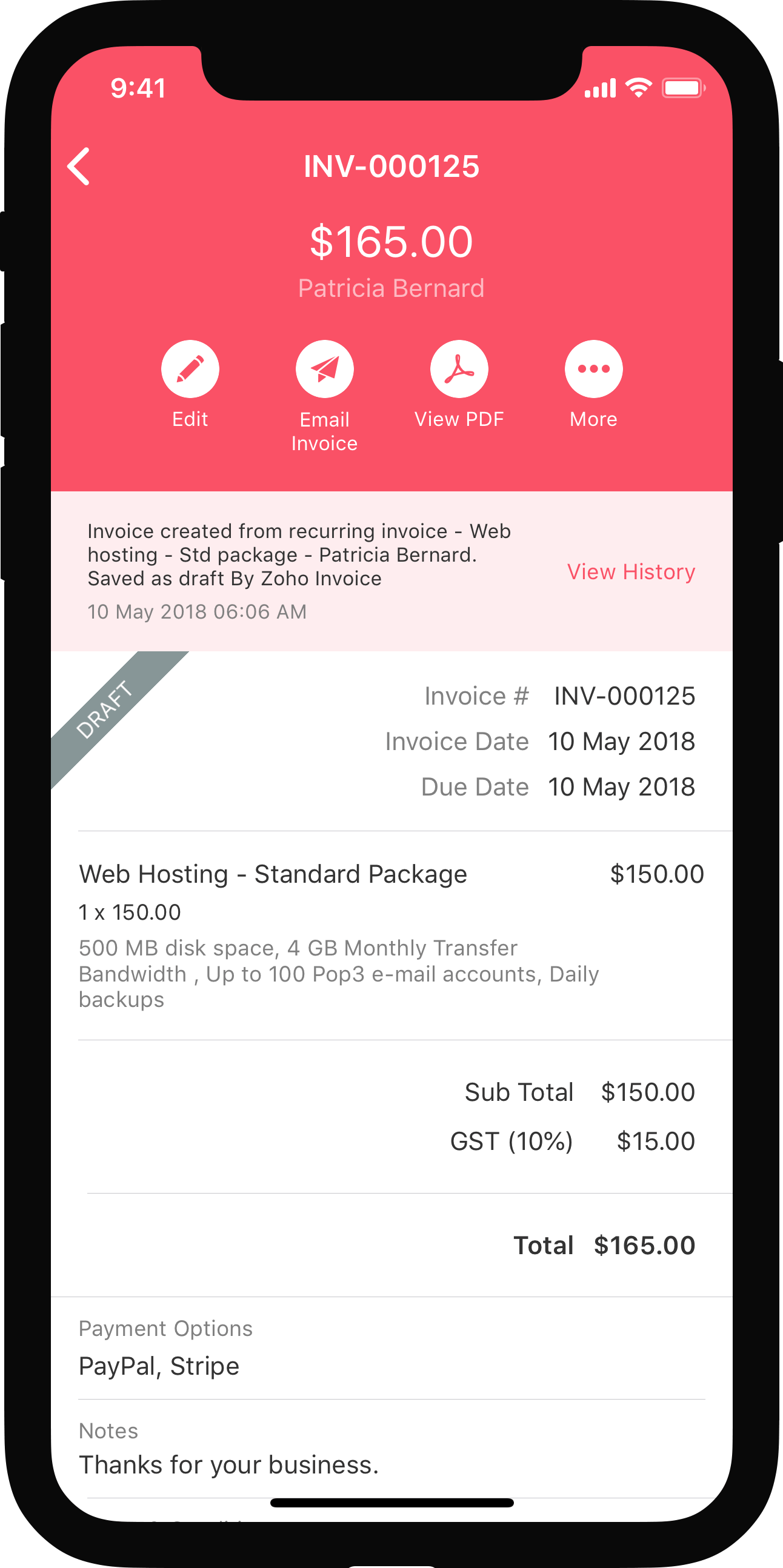

The process of generating your first Tax Return is really simple in Zoho Books. Navigate to Reports > Taxes -> GST/HST Return to access the report.

P.S: Please note that after generating a return, tax return settings cannot be modified. However, if you wish to update the settings, you will first have to delete all the generated returns.

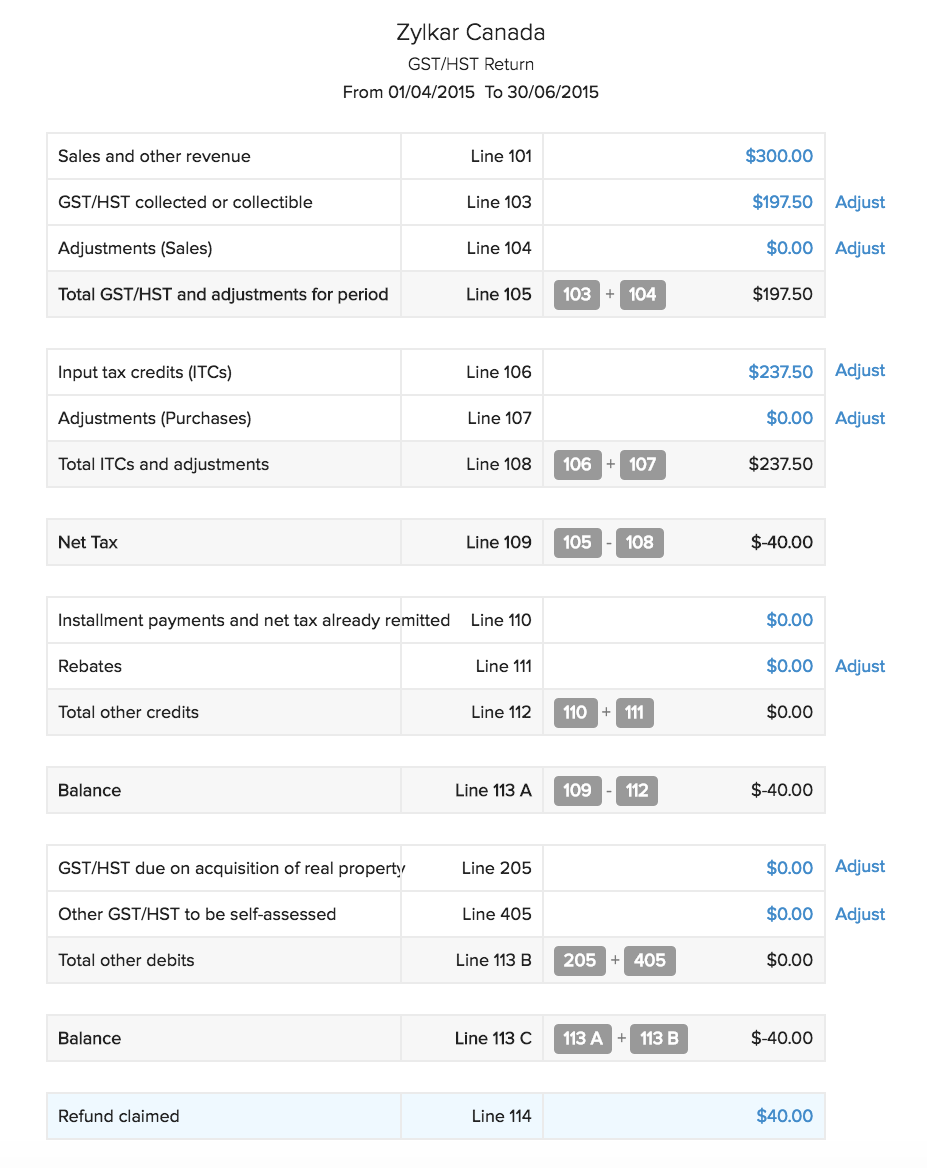

GST/HST Return Details

Learn more about filing your GST/HST Return line-by-line.

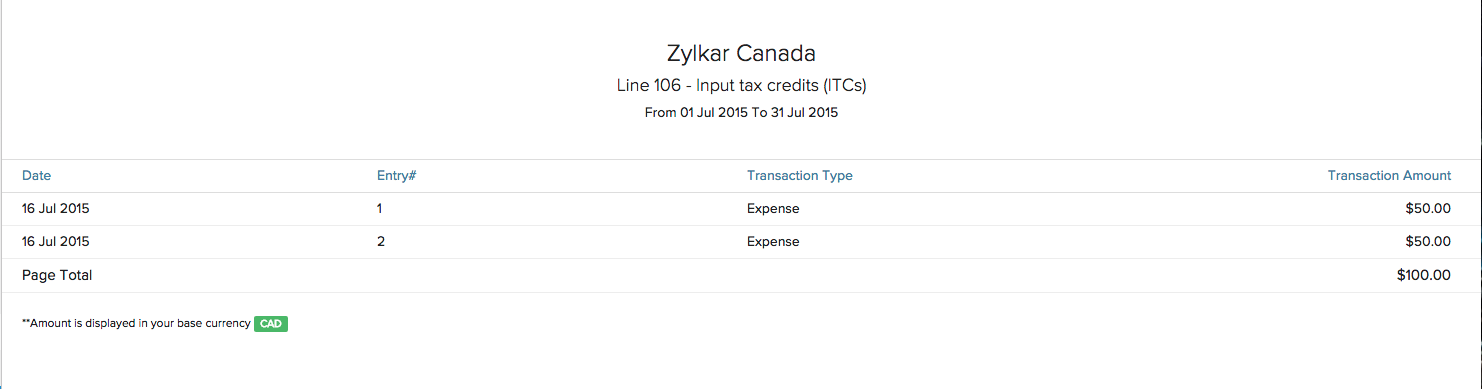

You can also make a deep dive into the numbers that are shown in the boxes. Just click on the amount shown in the lines and you will be able to view the details related to that box.

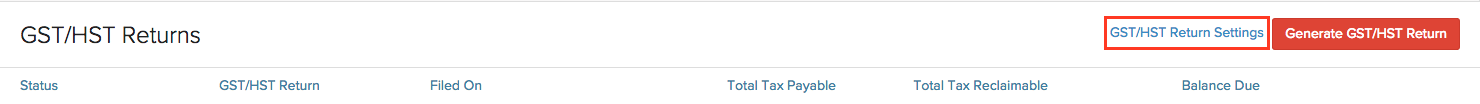

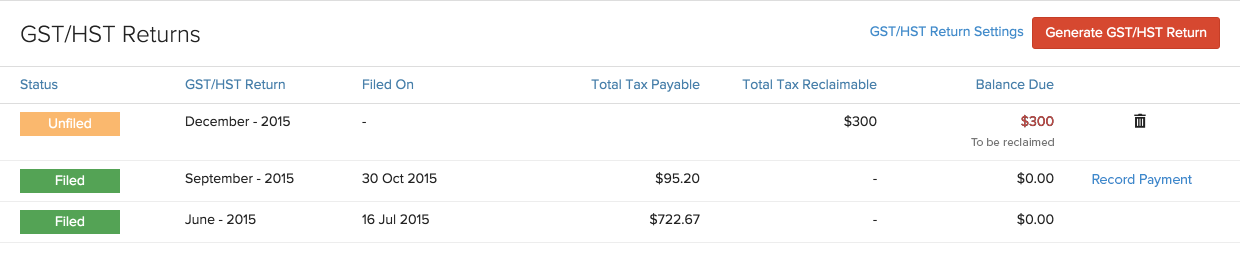

GST/HST Returns List

Navigate to Reports -> Taxes -> GST/HST Return to access the report. You can use this GST/HST return report from Zoho Books as a reference while filing your returns.

The Status denotes whether the GST/HST return is filed or not. The Balance Due will state the amount that has to be paid/claimed towards your return. You can generate a new GST/HST return report only after filing the pending GST/HST return. Also, the most recent report generated can be deleted by clicking on the Trash icon.

Recording Instalment Payments

If you are a business owner who files your tax returns annually, and your net tax is $3000 or more, you may have to make instalment payments to the Canada Revenue Agency.

Prerequisites:

- Instalment payments can be recorded only when the reporting period in the GST/HST Settings is set as “Yearly”.

- You must have a bank account with currency as CAD, configured with your Zoho Books organization, in order to record instalment payments.

These payments can be recorded seamlessly using Zoho Books. This is how you do it:

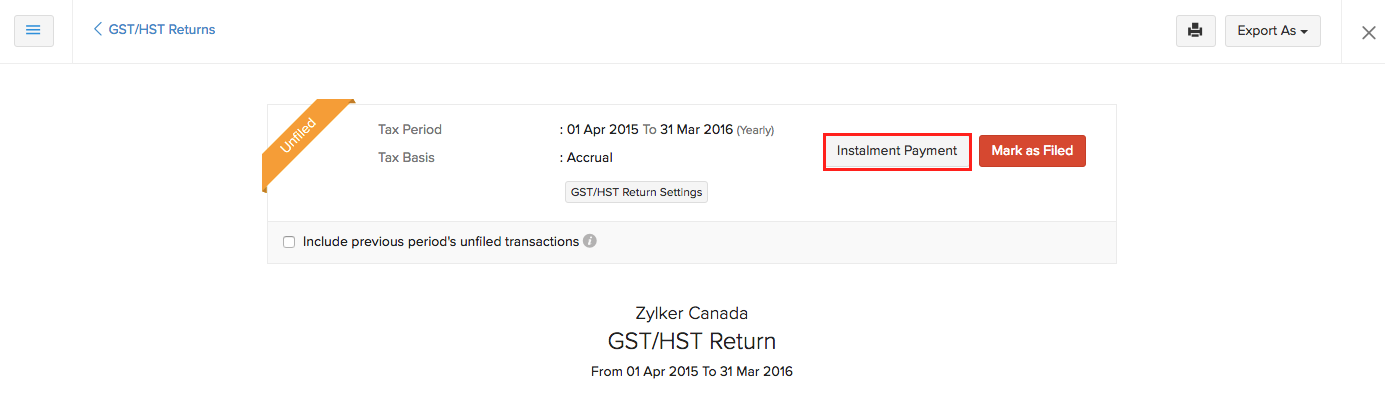

- Open the GST/HST Return report.

- Open the Unfiled return.

- Click on the Instalment Payment button, available on the top, as shown in the image below.

Instalment payments can be made only when the

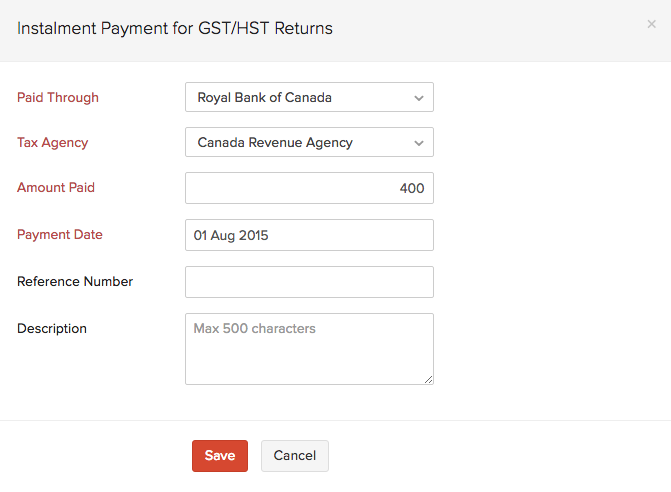

- In the pop-up that follows, type in the required details and remember to hit

.

.

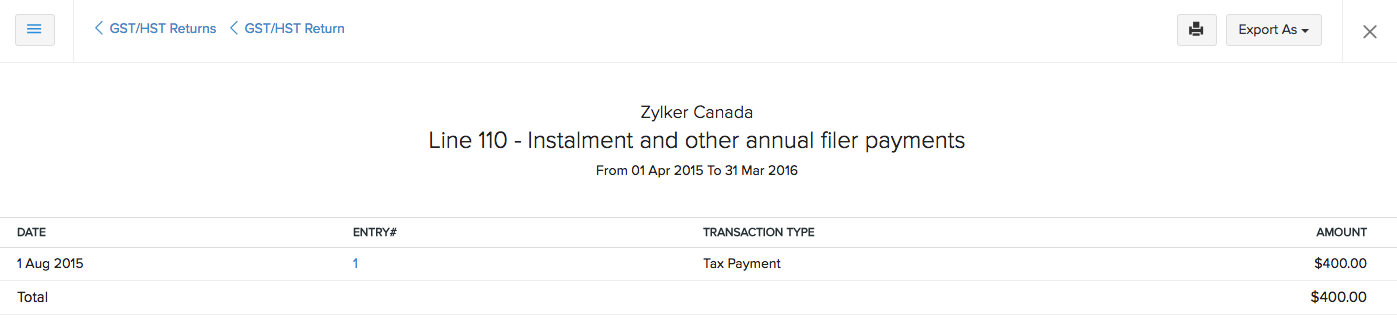

- Scroll down to Line 110 of the report and click on the amount to view the Instalment and other annual filer payments report.

You can also record an instalment payment from the Accountant module of Zoho Books.

- Open the Accountant module and navigate to Tax Payments.

- Click on

, available on the top-right and record the payment.

, available on the top-right and record the payment.

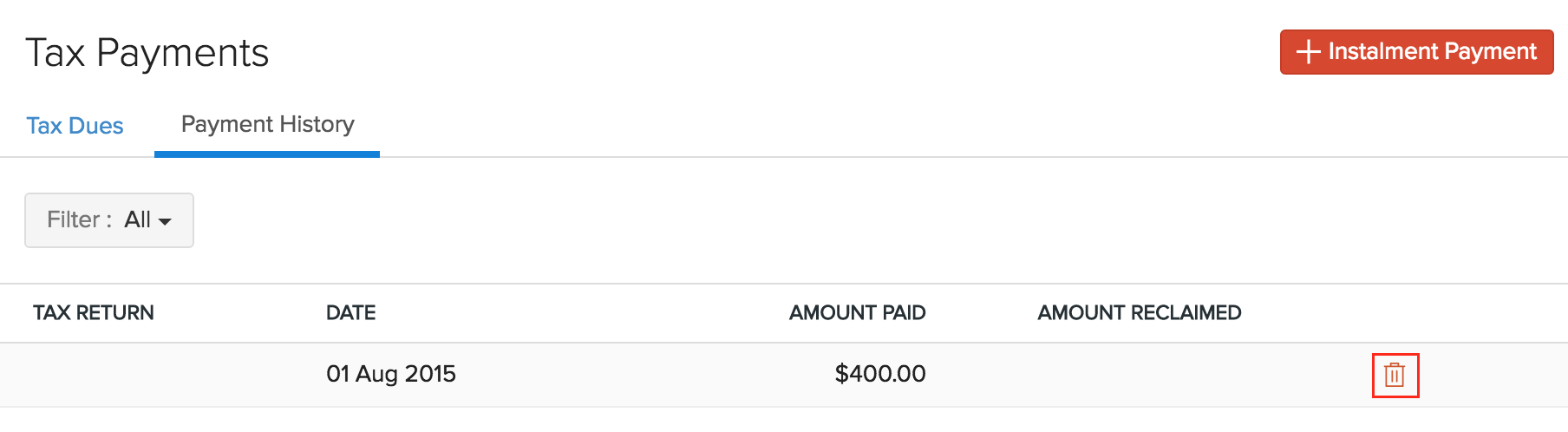

To delete an instalment payment, click on the Payments History tab under Tax Payments, hover your cursor over the entry, and click on the Trash icon, as shown in image below:

Adjustments in GST/HST Returns

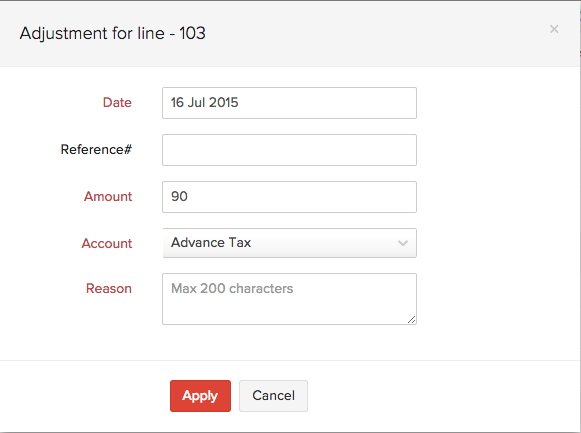

The GST/HST returns allows you to record adjustments in the corresponding lines of your tax report. You can record adjustments by clicking on Adjust against a line and filling out the fields in the pop-up as shown in the image below,

- Date: Select the date on which the adjustment was recorded. By default, the current date will be selected.

- Reference #: Enter the reference number, if applicable.

- Amount: Enter the amount for the adjustment.

- Account: Select an account under which this adjustment has to be recorded.

- Reason: Enter the reason for recording the adjustment.

Finally click on Apply to finish recording the adjustment.

Note: All adjustments made here will be listed under Accountant -> Tax Adjustments section. You may also delete the adjustments by clicking on the Trash icon.

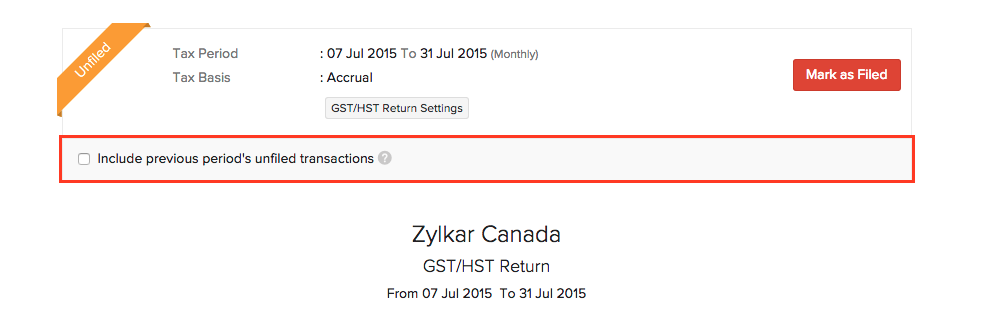

Including previous transactions

There might be a case wherein you want to record a transaction in Zoho Books for the previous GST/HST return but the GST/HST return for that period has already been filed. In this case, you can record the transaction for the previous date and file it with the current GST/HST return filing.

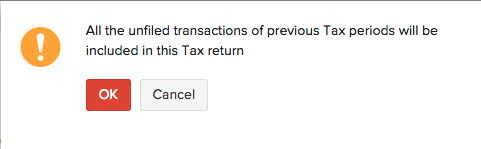

If you have not filed your GST/HST return yet, you will have the option of including transactions from the previous period in your new return. To do so, click on the checkbox against “Include previous period’s unfiled transactions” and hit OK in the pop-up that follows to confirm your selection.

Your new GST/HST report will now include your previous transactions beginning from the date selected while setting up GST/HST Return.

Note: You can generate returns based on your organization’s accounting period(Financial Year). For example, if your organization’s accounting period starts in April and you choose to generate a return on a Quarterly Basis from the month of July, the report will be generated for the next quarter(July-September).

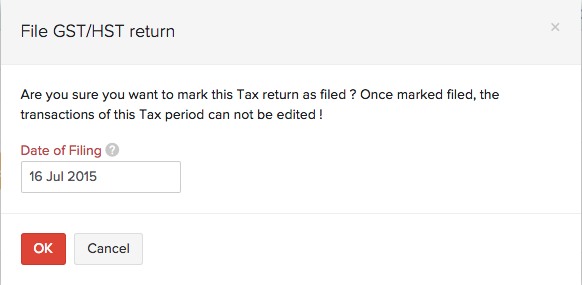

Mark GST/HST Return as Filed

After filing your tax returns with the tax agency using the reference from the GST/HST Return reports in Zoho Books, mark your GST/HST return as filed. Currently we do not have the provision to file your GST/HST returns directly to the Canadian Revenue Agency, but you can always mark them with the date on which you filed them at your tax agency.

Once you select the Mark as Filed option to record GST/HST return under filed status, you will be asked to select the date on which the GST/HST return was filed with the tax agency.

P.S: GST/HST return cannot be recorded as filed before reporting period ends. Once you mark your GST/HST return as Filed, you will not be allowed to edit any transactions that were recorded in that period.

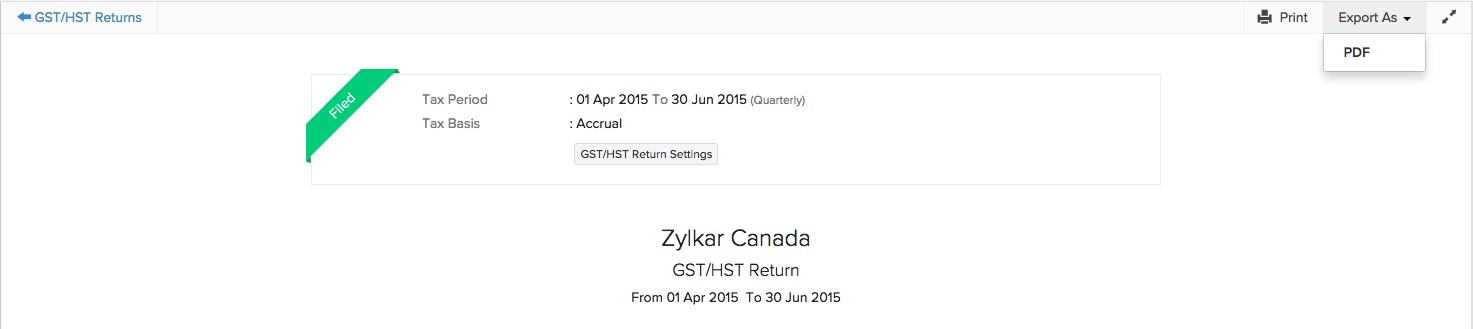

Printing and Exporting a Return

You also have the option to print a return by clicking on the Print button. If you wish to export the tax return as a PDF file, click on Export As and select PDF.

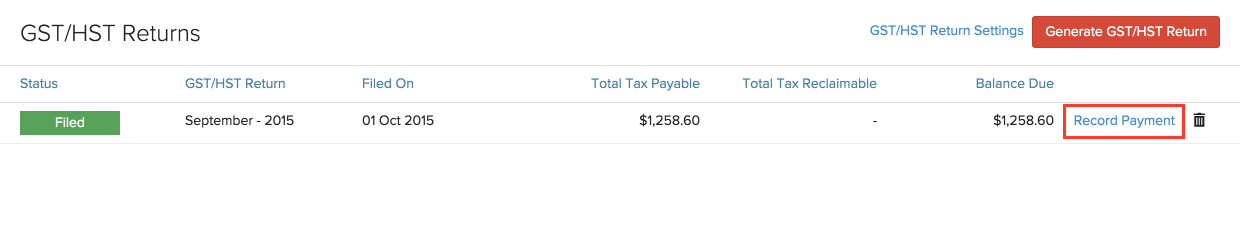

Recording Tax Payments

Once you mark your return as Filed, you can record the payment for it using any one of the following steps,

- Click on Record Payments/Claim against the Tax Return that has been filed. You can also split up the amount and record multiple payments towards Tax Payments which may or may not include Tax claim.

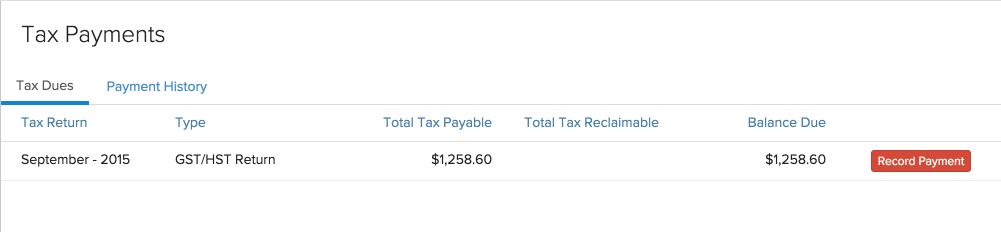

- Navigate to Accountant -> Tax Payments -> Tax Dues. Click on Record Payment for the corresponding return.

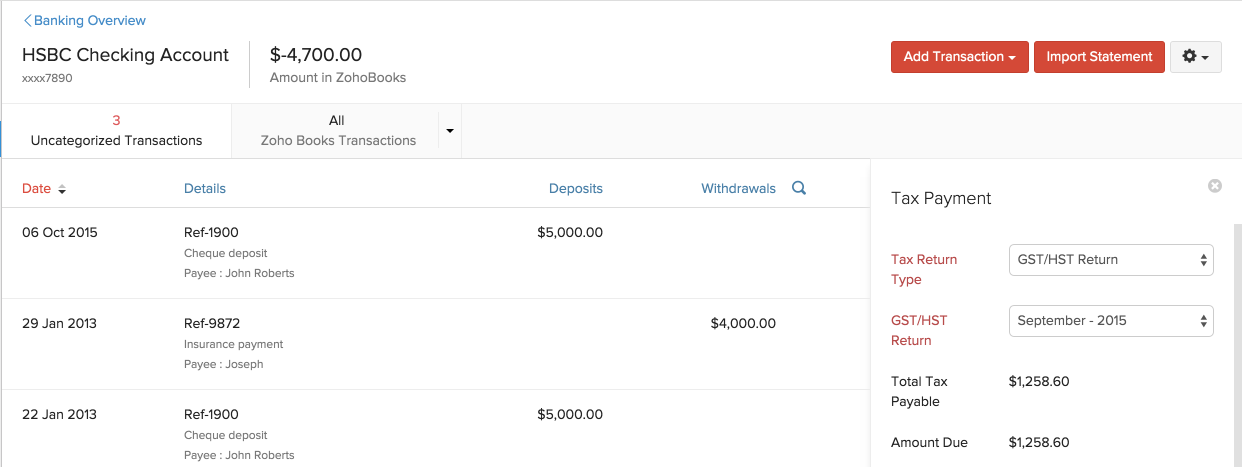

- Navigate to Banking and click on a bank account. Click on Add Transaction and select Tax Payment, if you are paying your taxes or Tax Claim, if you wish to claim a refund for taxes paid, from the drop-down. You may also categorize transactions manually by marking the said transaction as a Tax Payment/Tax Claim.

Fill in the fields that appear on the right hand side and click Save.

Note: Please note that a bank account with its base currency in CAD is mandatory to record Tax Payments/Claims. Also, we only support a bank account as Paid Through account at the moment.

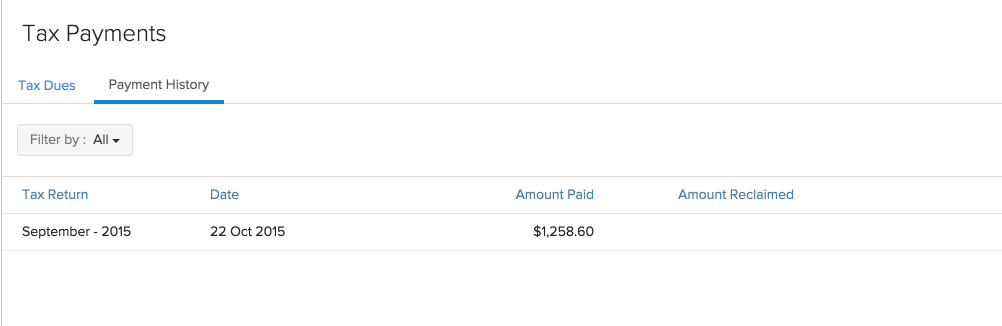

Payment History

You can view, update and delete payments made in the payment history for the returns filed by heading to Accountant -> Tax Payments -> Payment History.

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!