Taxes and Forms

The taxes you withhold from your employees’ paychecks need to be deposited to the concerned tax authorities based on your deposit schedule.

Further, you need to file your quarterly and yearly forms. Zoho Payroll helps you keep track of all the taxes and forms in one place.

You will be notified when a tax needs to be paid and when a form needs to be filed so you stay compliant at all times.

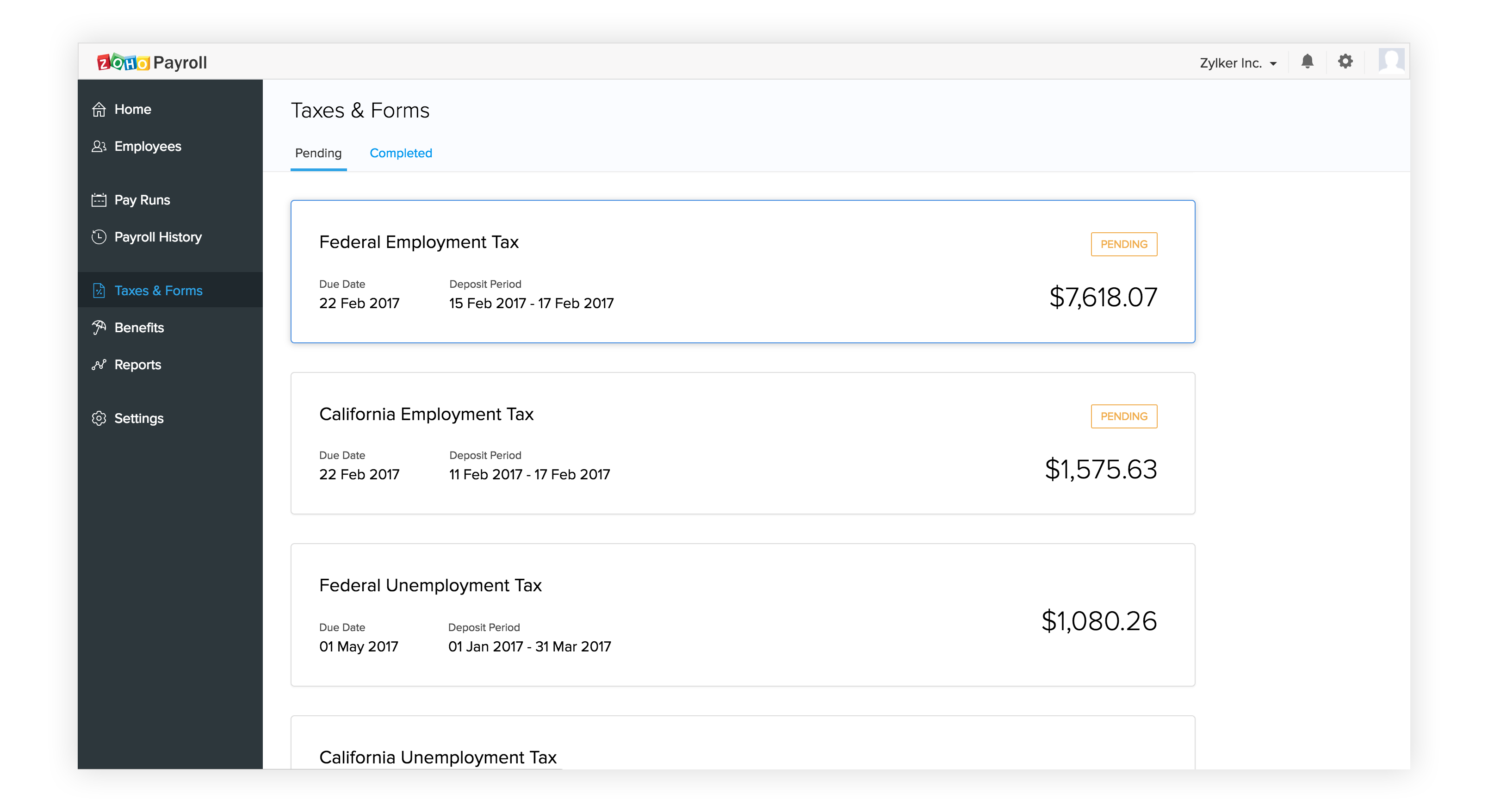

The Taxes and Forms houses all your upcoming and completed tax payments and form filings.

You will find the tax name, deposit period, amount to be paid, and the due date for each tax, with the most urgent ones being listed at the top.

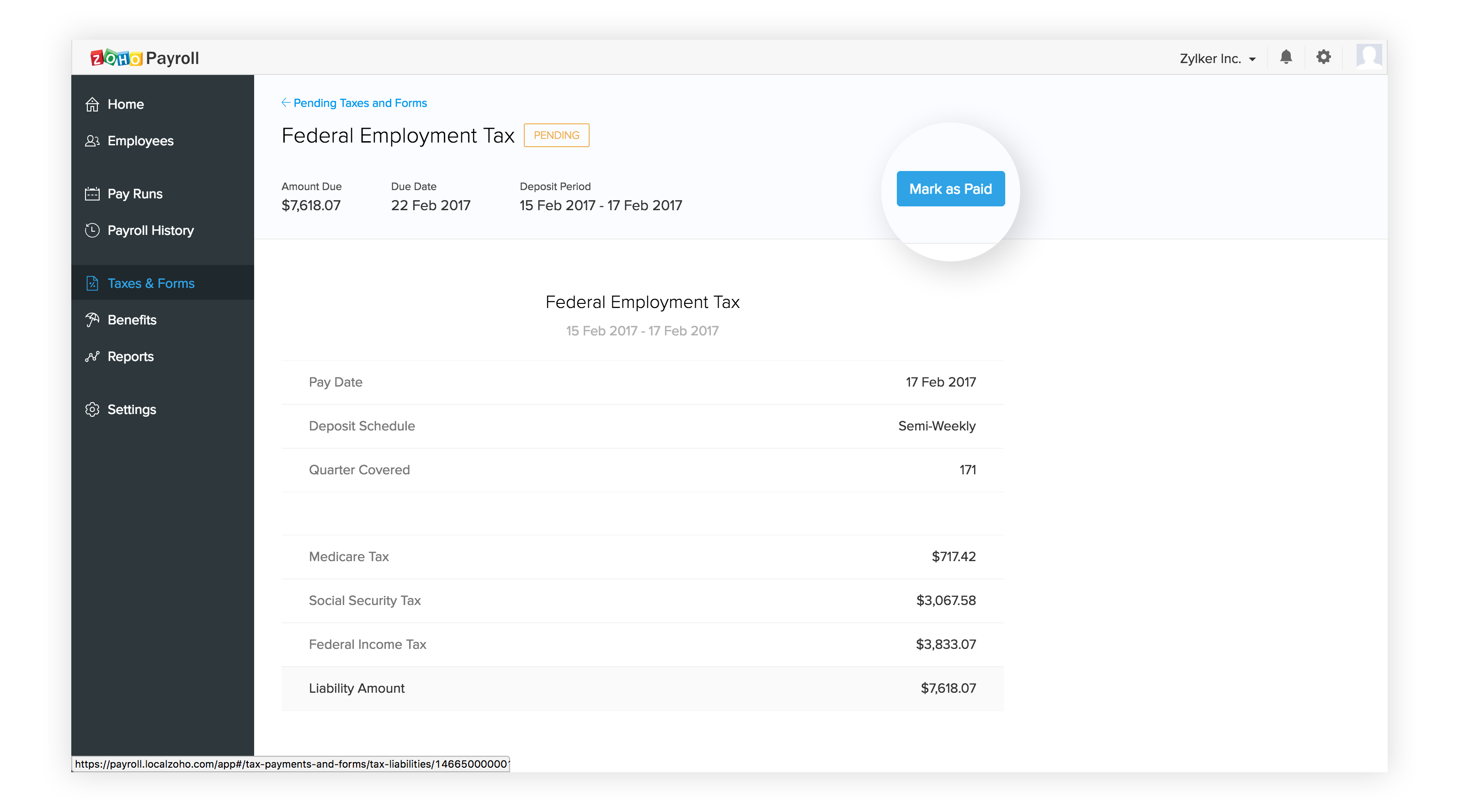

Clicking a tax will give you more details about that specific deposit.

You will find the following details:

| Field | Description |

|---|---|

| Pay Date | The last pay date in the deposit period. |

| Deposit Schedule | The deposit schedule for that specific tax. |

| Quarter Covered | This is the quarter for which the deposit is made. It’s entered in the format YYQ. For example, the second quarter of 2017 is written as 171. |

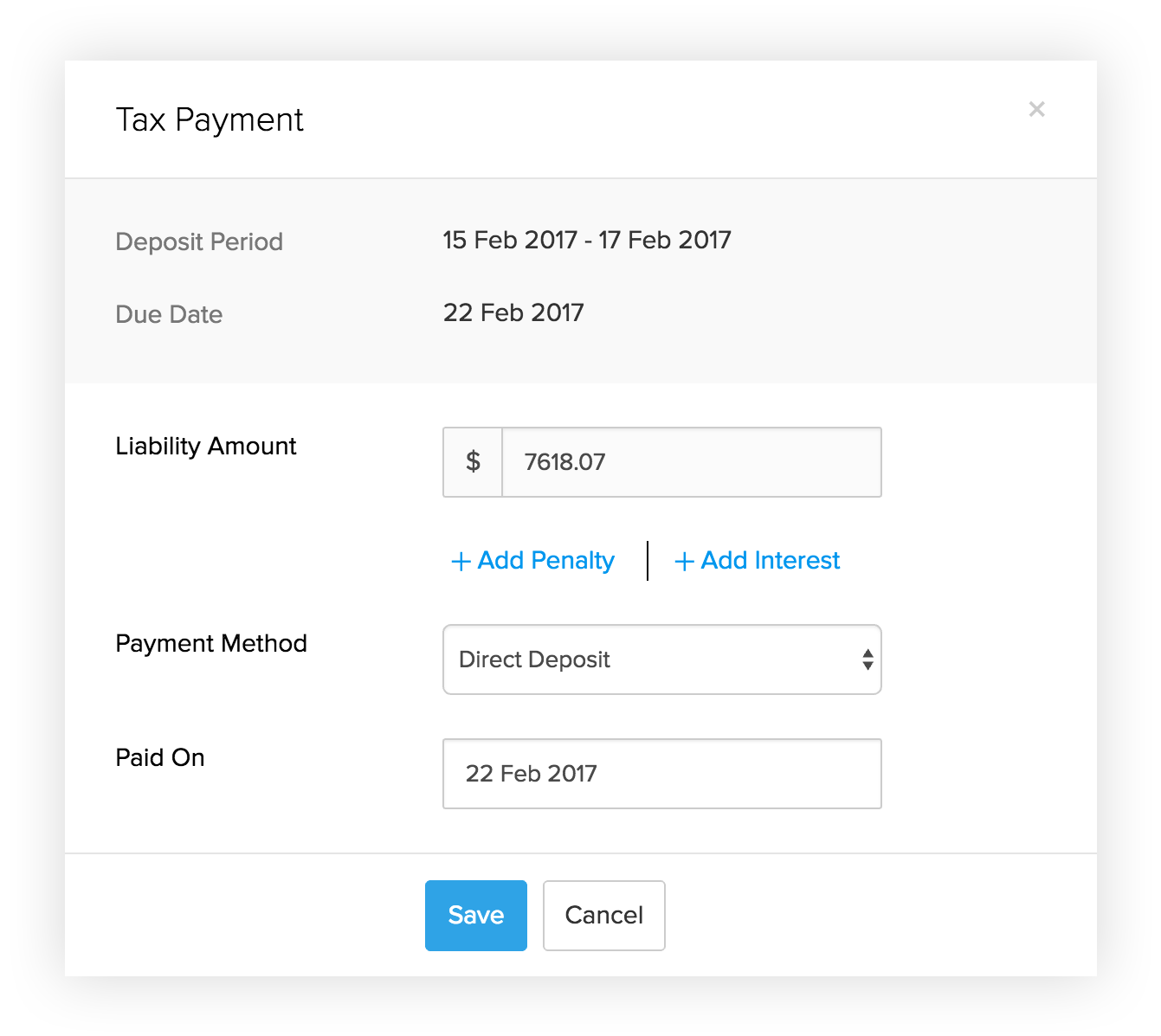

Record Tax Payment

Once you have deposited the tax amount, you can record the payment on Zoho Payroll.

To record tax payment:

-

Click the Mark as Paid button.

-

Select a payment method and the date on which the deposit was made.

Insight: You can also add if there was any penalty or interest that you paid, even though we sincerely believe that you won’t incur any.

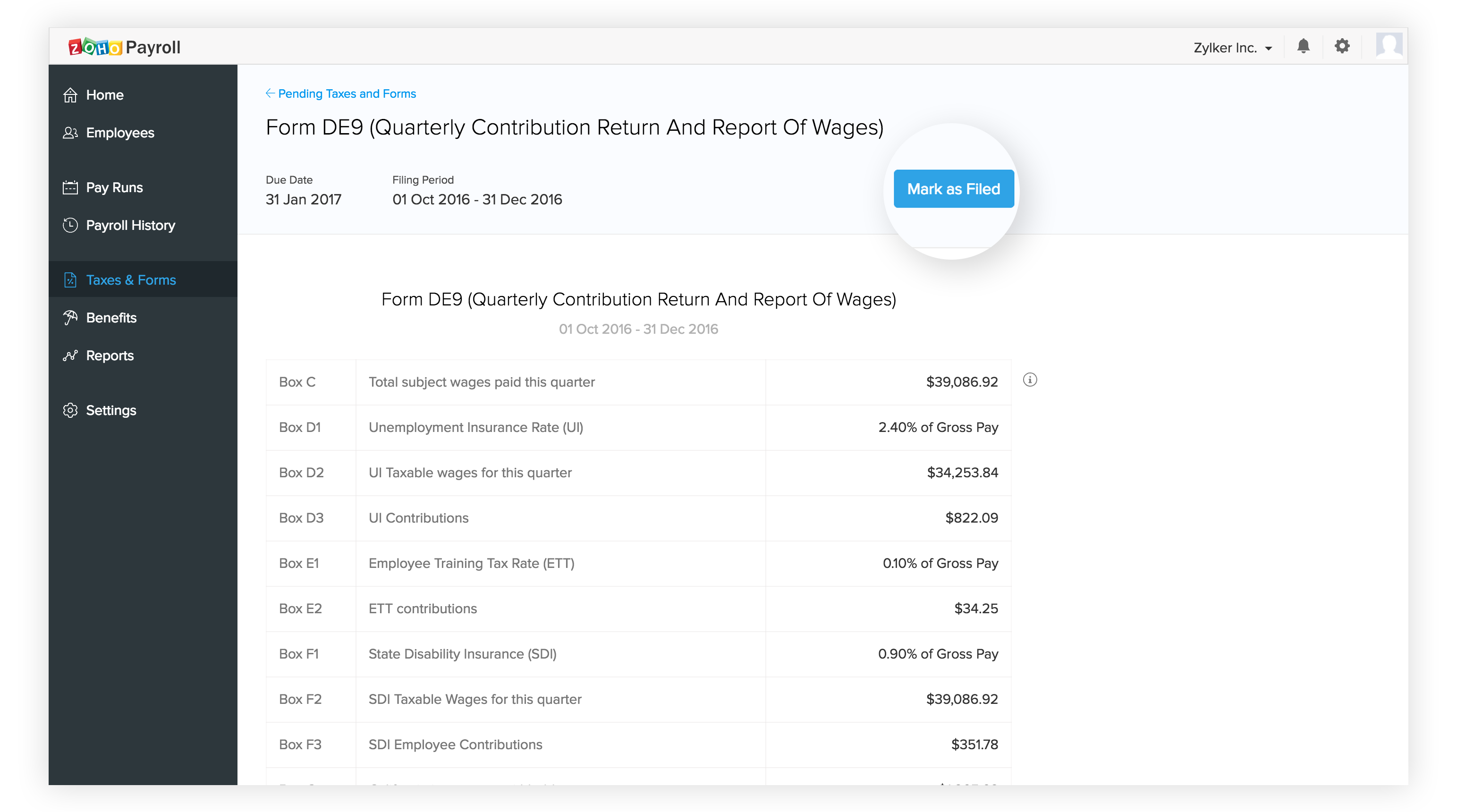

Marking Forms as Filed

In the case of a form, you’ll find a table that tells you what needs to be entered in which line of the form. You can use this as a reference while filling out the form.

To mark a form as filed:

- Once you have filed the form, click the Mark as filed button to record it.

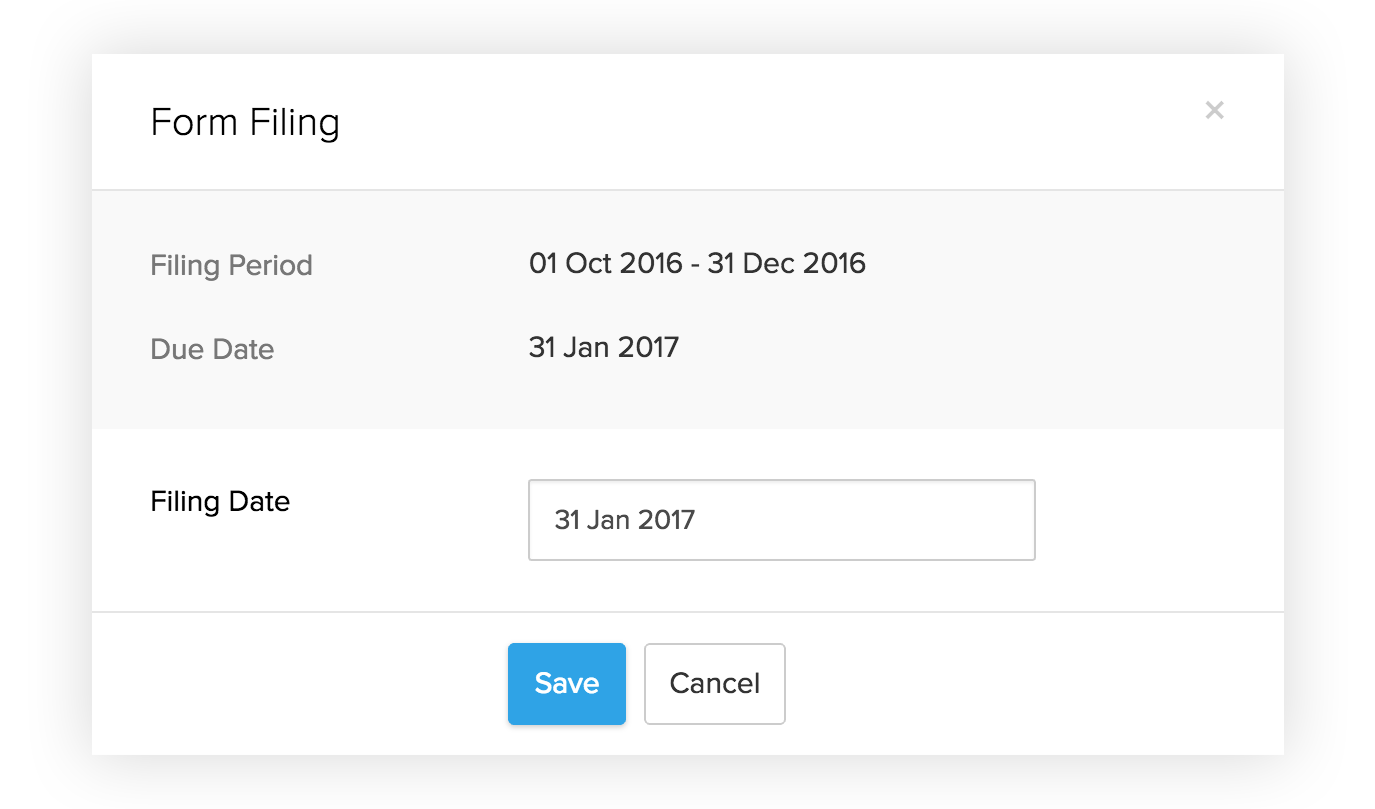

- In the pop-up that follows, enter the Filing Date and click Save. This will now be moved to the Completed tab.

Note: Zoho Payroll does not file your forms currently. We’re working towards it.