Corporate Tax in UAE

Corporate Tax is a direct tax imposed by the Ministry of Finance on all UAE businesses with net profits exceeding AED 375,000. This document will guide you through the process of generating your Corporate Tax returns and recording the corresponding payment in Zoho Books.

Note: This feature is available only for certain plans of Zoho Books. Visit the pricing page to check if it’s available in your current plan.

Prerequisite: Before configuring Corporate Tax in Zoho Books, you need to register your business for Corporate Tax in the EmaraTax portal.

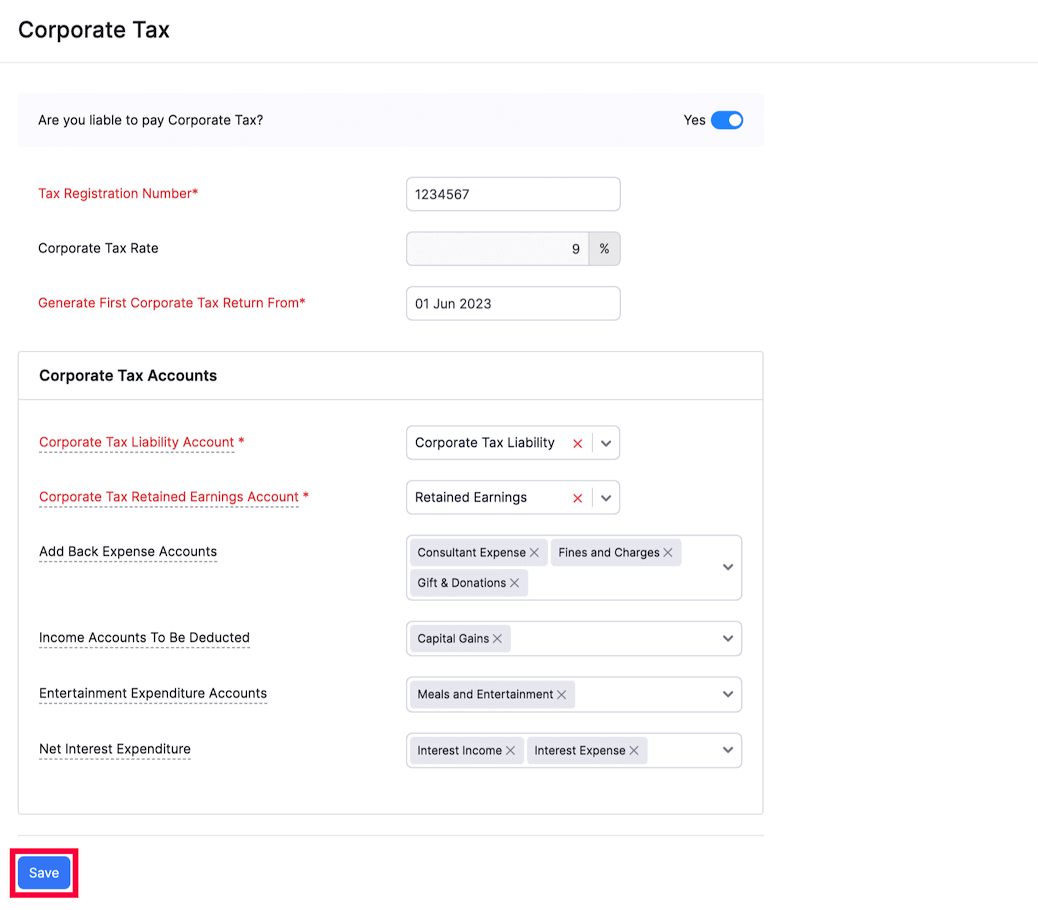

Set Up Corporate Tax

To set up Corporate Tax for your organization in Zoho Books:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Corporate Tax.

- Slide the toggle next to Are your liable to Corporate Tax? to Yes.

- Enter the Tax Registration Number issued by the Ministry of Finance during your registration process in the EmaraTax portal.

- Select the date in the Generate First Corporate Tax Return From field.

- In the Corporate Tax Accounts section, select the accounts you want to use for calculating corporate tax in your organization.

- Click Save.

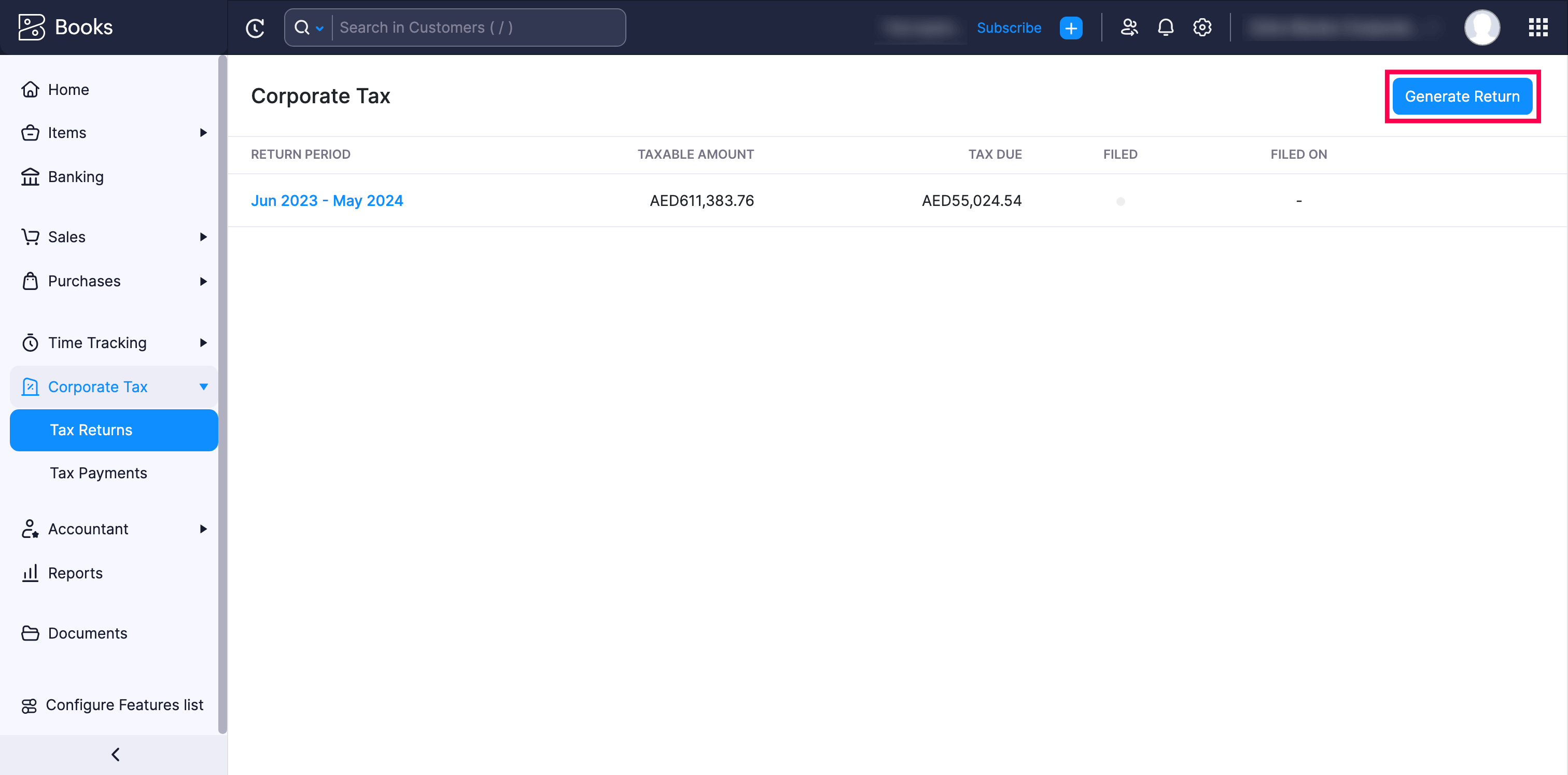

Generate Corporate Tax Returns

Once you have configured your Corporate Tax settings, you can generate your tax returns from the Corporate Tax module. Here’s how:

- Go to the Tax Returns module under Corporate Tax on the left sidebar.

- Click the Generate Return button on the top right corner of the page.

- The tax return for the current fiscal year will be generated.

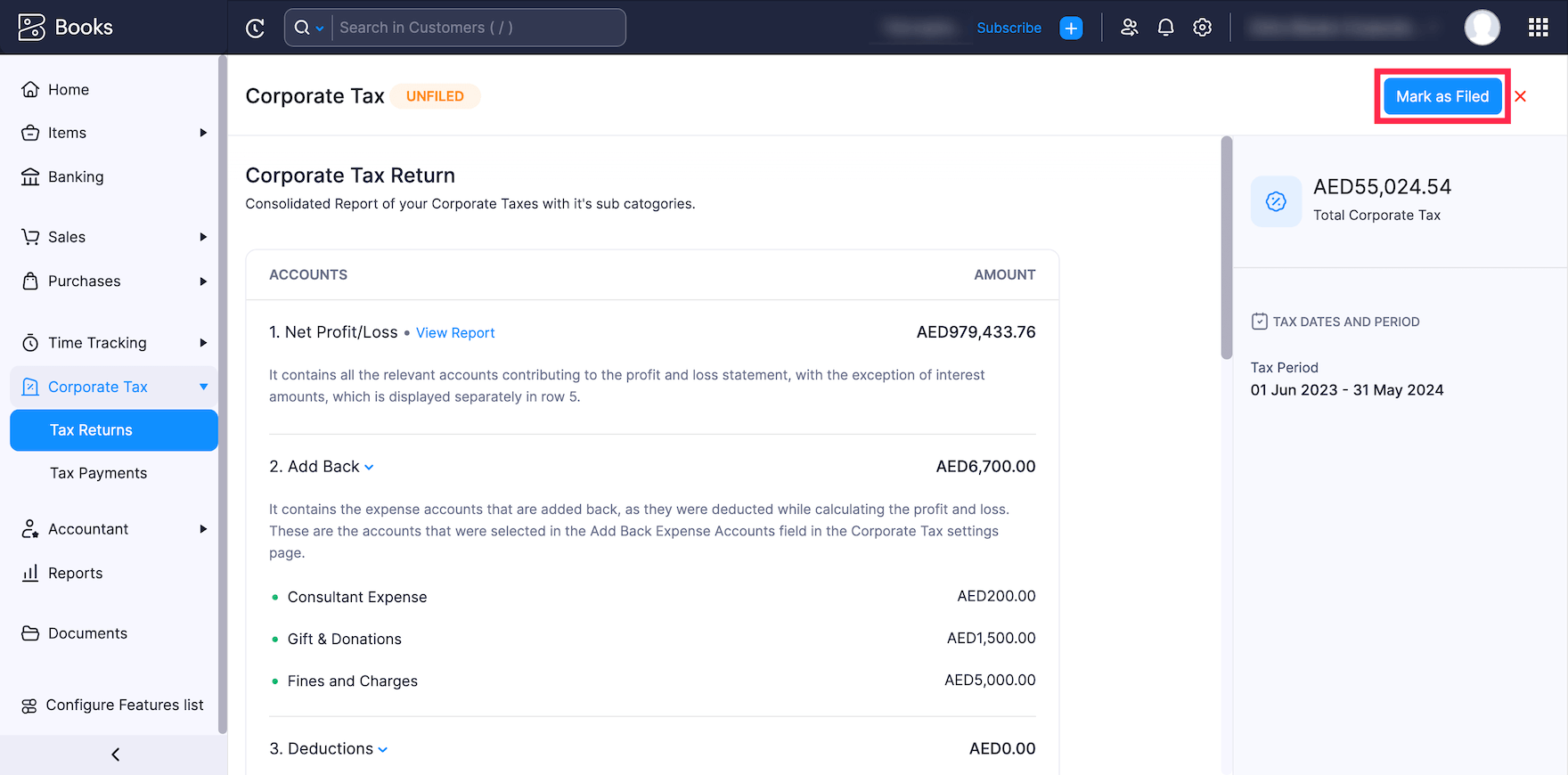

- Next, select the tax return to verify the taxable amount calculated for all the accounts selected in the Corporate Tax Settings page.

- Click Mark as Filed on the top right corner of the report after filing the tax return to the government.

Note: Ensure that you file your corporate tax return within 9 months of the fiscal year-end date. Once you mark the tax return as filed in Zoho Books, you will be able to generate a new tax return.

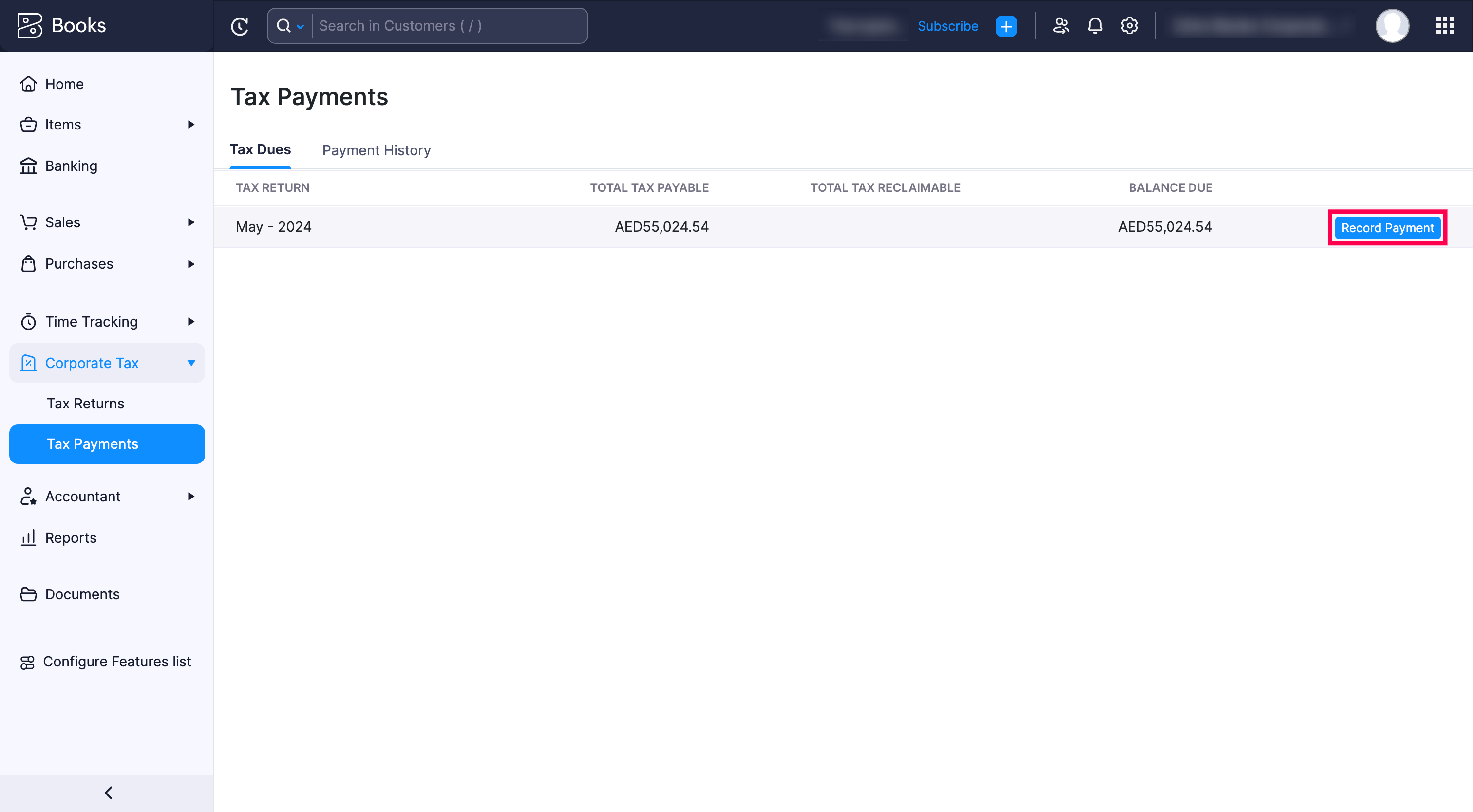

Record Corporate Tax Payments

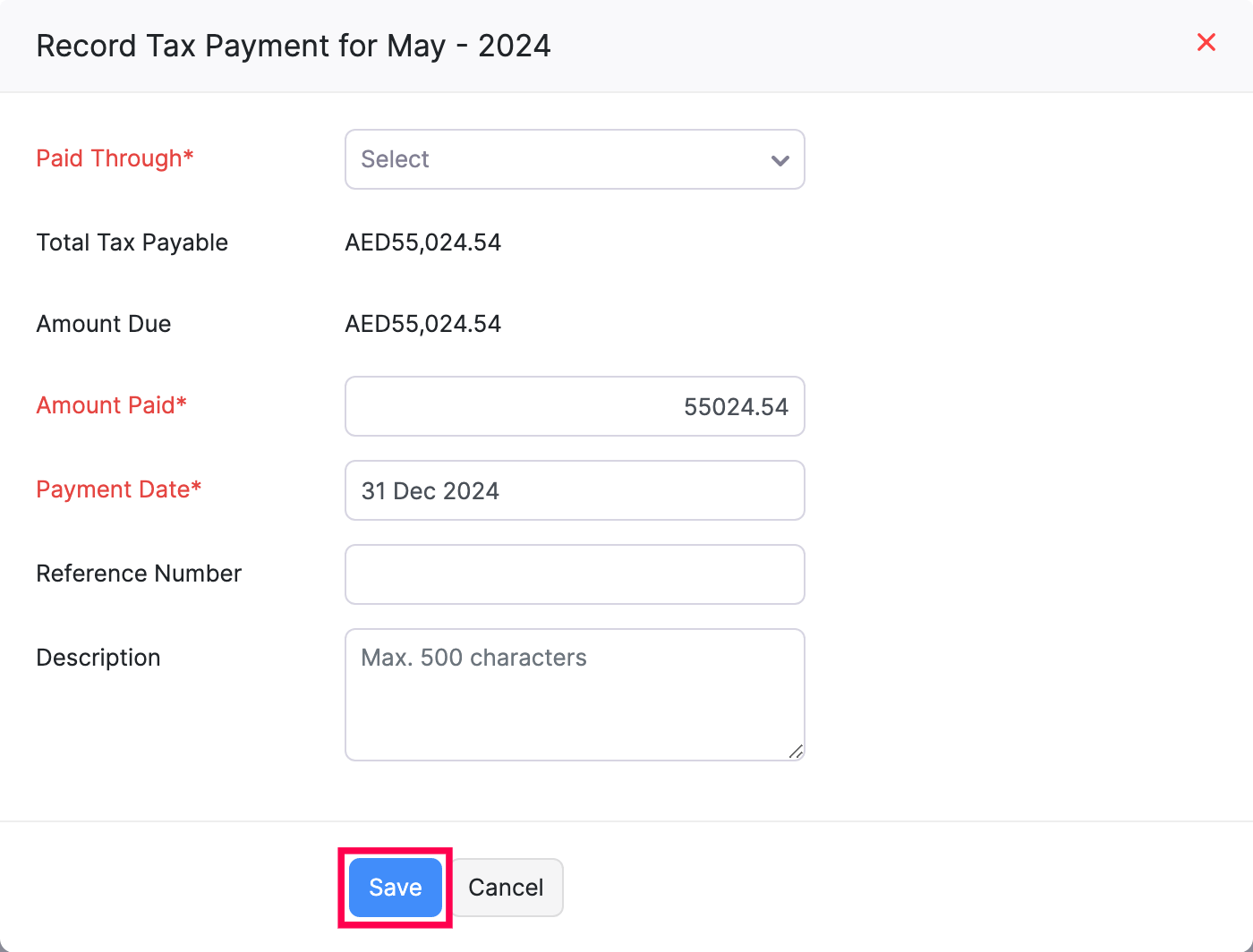

Once you have paid the tax amount to the government, you can record the payment in Zoho Books. Here’s how:

- Go to the Tax Payments module under Corporate Tax on the left sidebar.

- Hover the cursor over the tax return you want to record a payment for and click Record Payment.

- In the popup that follows, select the account that you Paid Through.

- Adjust the amount you want to record in the Amount Paid field.

Protip: To record partial payments for your tax returns, enter the specific amount in the Amount Paid field.

- Select the Payment Date.

- Enter the Reference Number and a Description (optional).

- Click Save.

The payment for the selected tax return will be recorded.

The payment for the selected tax return will be recorded.

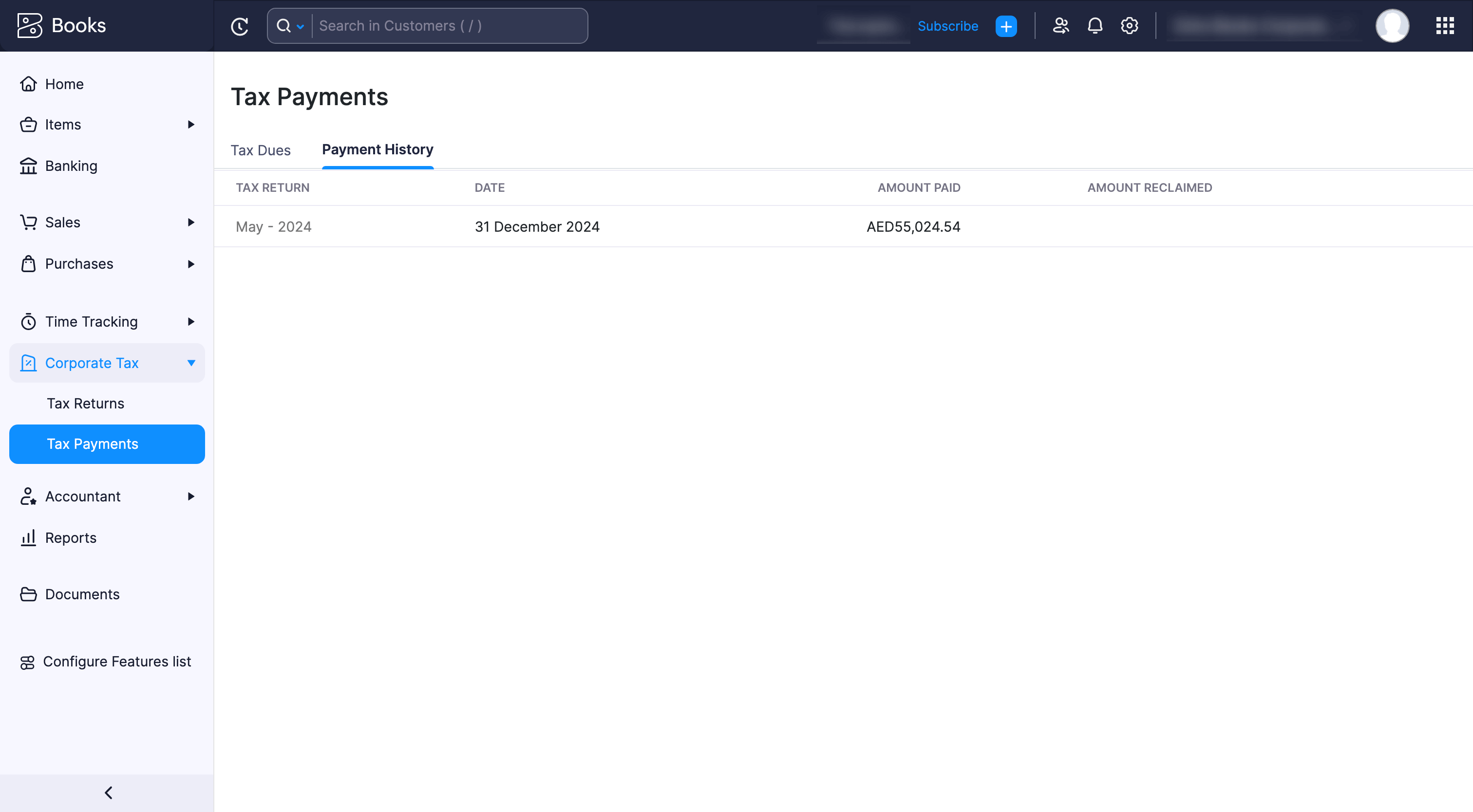

Payment History

Once you have recorded the tax payments, you can easily access and review them in the Payments History section. Here’s how:

- Go to the Tax Returns module under Corporate Tax on the left sidebar.

- Select the Payment History tab in the top of the page.

You will be able to view all the tax payments here.

You will be able to view all the tax payments here.

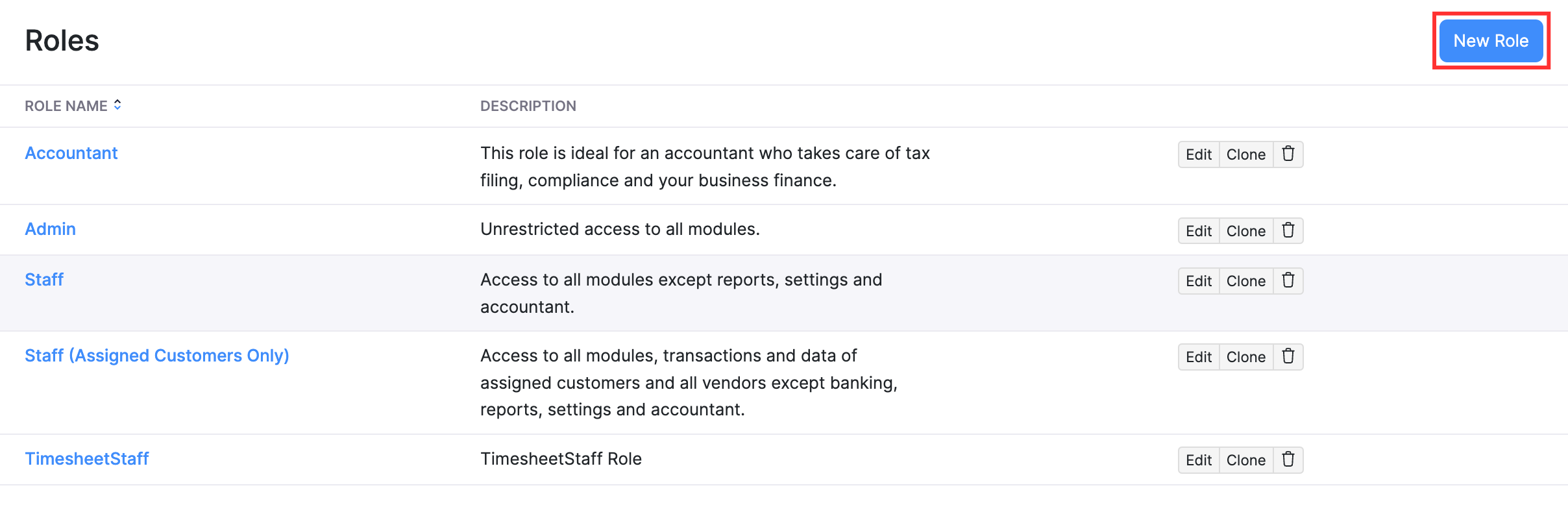

Configure Access Permissions

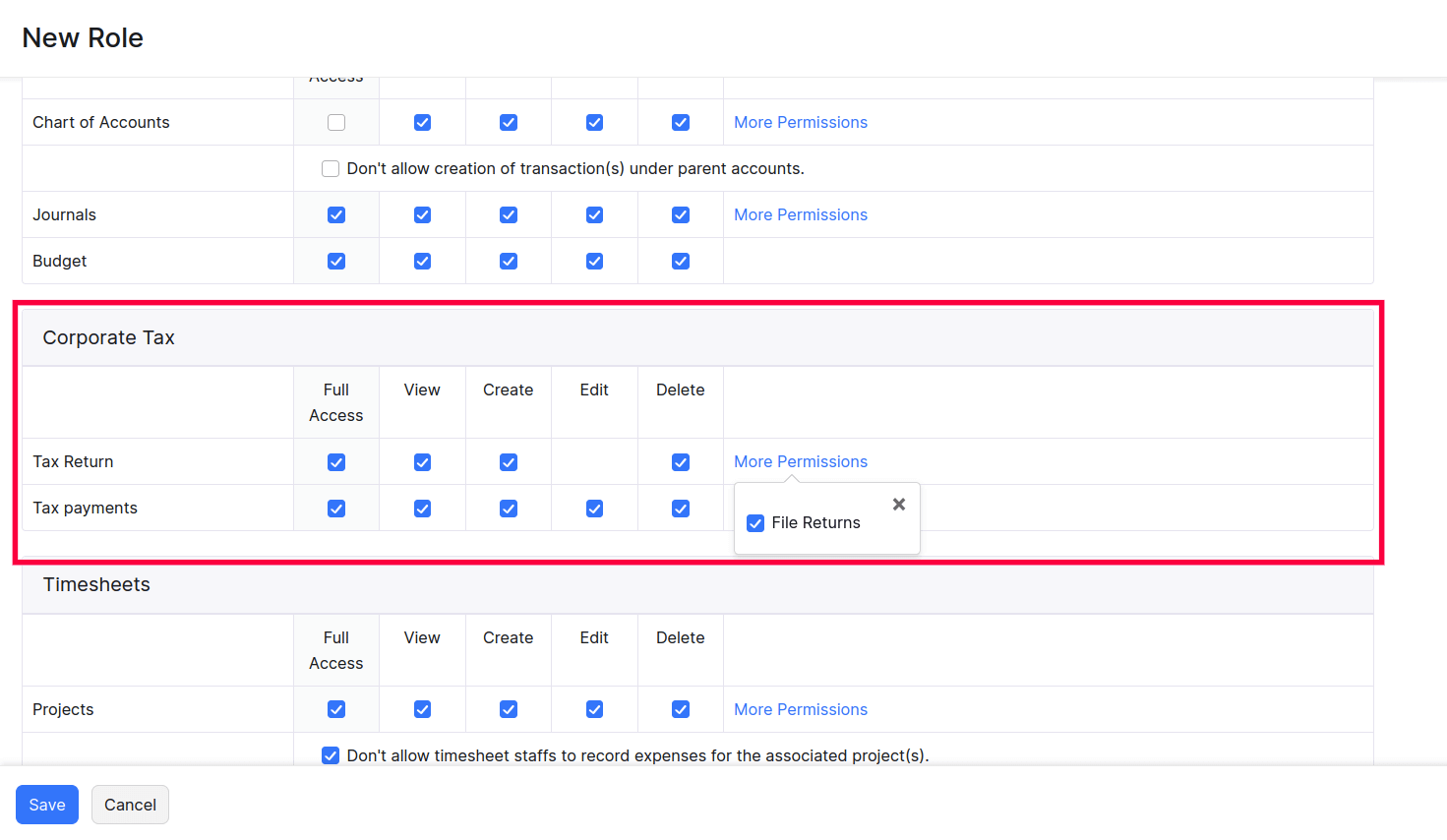

If you are the admin of your organization, you can give other users permission to perform actions related to tax returns and tax payments in the Corporate Tax module. Here’s how:

- Go to Settings on the top right corner of the page.

- Select Roles under Users & Roles.

- Create a new role or edit an existing role that you had already created.

- In the New Role or Edit Role page, go to the Corporate Tax section, and check the boxes for Tax Returns and Tax Payments to provide the necessary permissions.

- Click Save.

The users will now be able to create, file, delete, and perform other actions related to tax payments and tax returns in the Corporate Tax module.

Yes

Yes