VAT in Transactions

Zoho Books has a wide range of sales and purchase transactions. Each of these transactions are VAT-compliant i.e., different VAT treatments can be applied on items while creating transactions for them.

Sales Transactions

- Quotes

- Sales Orders

- Delivery Challans

- Invoices

- Recurring Invoices

- Credit Notes

Purchase Transactions

- Expenses

- Recurring Expenses

- Purchase Orders

- Bills

- Recurring Bills

- Vendor Credits

- Self-Billed Invoices

Once you have set up the taxes, contacts and items in your Zoho Books account, you can start creating transactions. Transactions in Zoho Books are affected by the:

- Location from where your business is operating (mainland or designated zone)

- Place of supply

- Contact’s tax treatment

If you are a VAT registered person in the mainland, here’s how your transactions will incur VAT:

Sales Transactions in Mainland

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

| Non VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

| GCC VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

| GCC VAT Registered | GCC | Zero Rate |

| GCC Non VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

| GCC Non VAT Registered | GCC | Zero Rate |

| Non GCC | - | Zero Rate |

| VAT Registered - Designated Zones | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

| Non VAT Registered - Designated Zones | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let us understand each of these scenarios in detail:

Case 1

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a VAT-registered customer in the UAE. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 2

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a customer who is in the UAE and is not registered for VAT. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 3

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a customer who is registered for VAT in any one of the GCC member countries other than the UAE. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 4

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC VAT Registered | GCC | Zero Rate |

Let’s say you sell goods or services to a customer who is registered for VAT in any one of the GCC member countries other than the UAE. The supply takes place within the GCC.

In this case, the supply of goods or services is zero-rated.

Case 5

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC Non VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a customer who is in any one of the GCC member countries other than the UAE and is not registered for VAT. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 6

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC Non VAT Registered | GCC | Zero Rate |

Let’s say you sell goods or services to customer who is in any one of the GCC member countries other than the UAE and is not registered for VAT. The supply takes place within the GCC.

In this case, the supply of goods or services is zero-rated.

Case 7

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non GCC | - | Zero Rate |

Let’s say you sell goods or services to a customer who is outside any of the GCC member countries.

In this case, the supply of goods or services is zero-rated.

Case 8

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered - Designated Zones | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a customer who is registered for VAT in a designated zone in the UAE. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 9

| Customer Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non VAT Registered - Designated Zones | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you sell goods or services to a customer who is in a designated zone in the UAE and is not registered for VAT. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Purchase Transactions in Mainland

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope, Domestic Reverse Charge (Standard Rate, Zero Rate) |

| Non VAT Registered | UAE | Out of Scope, Domestic Reverse Charge (Standard Rate, Zero Rate) |

| GCC VAT Registered | UAE | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

| GCC VAT Registered | GCC | GCC VAT/Exempt/Out of Scope |

| GCC Non VAT Registered | UAE | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

| GCC Non VAT Registered | GCC | Out of Scope |

| Non GCC | - | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Only Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

| VAT Registered - Designated Zones | UAE | Goods - Out of Scope Services - Standard Rate, Zero Rate, Exempt, Out of Scope |

| Non VAT Registered - Designated Zones | UAE | Out of Scope, Reverse Charge (Standard Rate, Zero Rate) |

Case 1

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered | UAE | Standard Rate, Zero Rate, Exempt, Out of Scope, Domestic Reverse Charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a VAT-registered vendor in the UAE. The supply takes place within the UAE.

In this case, the supply of goods or services can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Whereas, the domestic reverse charge will be applicable only for the following taxes:

- 5%

- 0%

Case 2

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non VAT Registered | UAE | Out of Scope, Domestic Reverse Charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a vendor who is in the UAE and is not registered for VAT. The supply takes place within the UAE.

In this case, the supply of goods or services is out of the scope of VAT.

Whereas, the domestic reverse charge will be applicable only for the following taxes:

- 5%

- 0%

Case 3

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC VAT Registered | UAE | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a vendor who is registered for VAT in any one of the GCC member countries other than the UAE. The supply takes place within the UAE.

In this case, the supply of goods, goods associated with services / services associated with goods are out of the scope of VAT. Whereas, the reverse charge will be applicable for the following taxes:

- 5%

- 0%

For services, the supply can have any one of the following taxes:

- Exempt

- Reverse Charge along with 5% or 0%

Case 4

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC VAT Registered | GCC | GCC VAT / Exempt / Out of Scope |

Let’s say you buy goods or services from a vendor who is registered for VAT in any one of the GCC member countries other than the UAE. The supply takes place within the GCC.

In this case, the supply of goods or services is exempted from tax. However, if you want to apply tax on the supply, you would need to create a new tax in Zoho Books for the relevant GCC member country and apply it in the appropriate transaction. The transaction could also be out of the scope of VAT.

Case 5

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC Non VAT Registered | UAE | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a vendor who is in any one of the GCC member countries other than the UAE and is not registered for VAT in that particular country. The supply takes place within the UAE.

In this case, the supply of goods, goods associated with services / services associated with goods are out of the scope of VAT. Whereas, the reverse charge will be applicable for the following taxes:

- 5%

- 0%

For services, the supply can have any one of the following taxes:

- Exempt

- Reverse Charge along with 5% or 0%

Case 6

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| GCC Non VAT Registered | GCC | Out of Scope |

Let’s say you buy goods or services from a vendor who is in any one of the GCC member countries other than the UAE and is not registered for VAT in that particular country. The supply takes place within the GCC.

In this case, the supply of goods or services is out of the scope of VAT.

Case 7

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non GCC | - | Goods / Goods & Services - Out of Scope, Reverse Charge (Standard Rate, Zero Rate) Only Services - Exempt, Reverse charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a vendor who is outside any of the GCC member countries.

In this case, the supply of goods, goods associated with services / services associated with goods are out of the scope of VAT. Whereas, the reverse charge will be applicable for the following taxes:

- 5%

- 0%

For services, the supply can have any one of the following taxes:

- Exempt

- Reverse Charge along with 5% or 0%

Case 8

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| VAT Registered - Designated Zones | UAE | Goods - Out of Scope Services - Standard Rate, Zero Rate, Exempt, Out of Scope |

Let’s say you buy goods or services from a VAT-registered vendor in a designated zone in the UAE. The supply takes place within the UAE.

In this case, the supply of goods is out of the scope of VAT. For services, the supply can have any one of the following taxes:

- 5%

- 0%

- Exempt

- Out of the scope of VAT

Case 9

| Vendor Tax Treatment | Place of Supply | Tax Rates |

|---|---|---|

| Non VAT Registered - Designated Zones | UAE | Out of Scope, Reverse Charge (Standard Rate, Zero Rate) |

Let’s say you buy goods or services from a vendor who is in a designated zone in the UAE and is not registered for VAT. The supply takes place within the UAE.

In this case, the supply of goods or services is out of the scope of VAT.

Whereas, the reverse charge will be applicable for the following taxes:

- 5%

- 0%

Taxes in Transactions

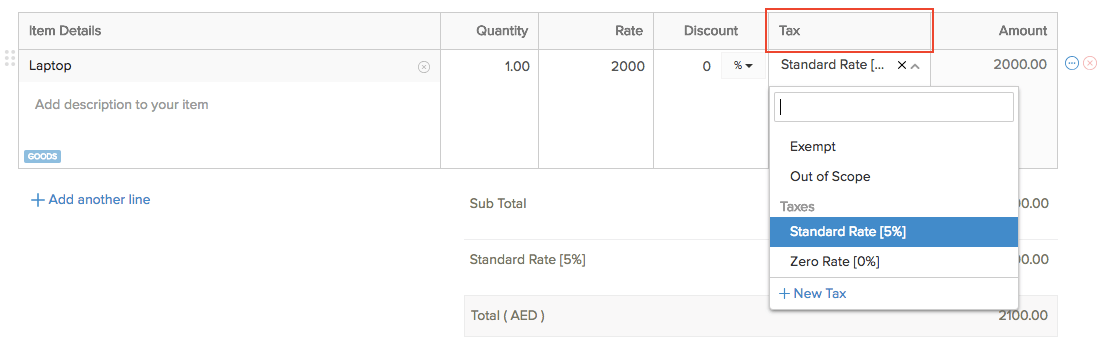

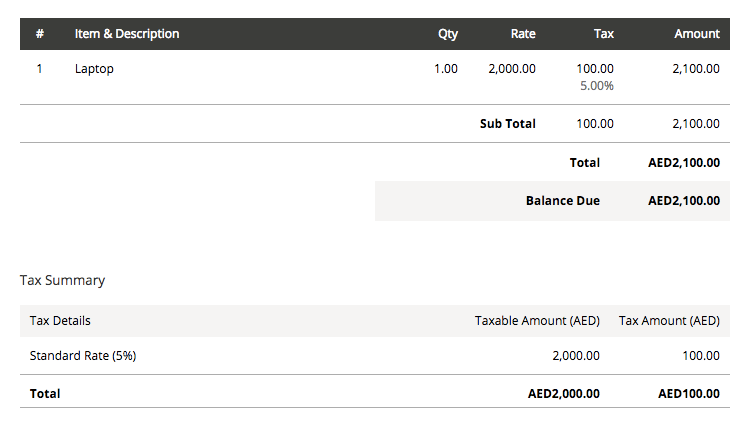

Let’s learn how VAT is applied in different transactions. Take the case of an invoice.

When you select an item to be invoiced, the default tax rate that you have set for the item will be applied to it.

A comprehensive Tax Summary Report will be displayed at the end, which is a requirement by the FTA.

Next:

Designated Zones >

Yes

Yes