Contacts

Contacts are your customers or vendors. You can configure the tax treatment for your contacts in Zoho Books. While adding contacts, you need to select the appropriate VAT treatment for each of them. Learn more about adding contacts.

- Go to Contacts and select + New.

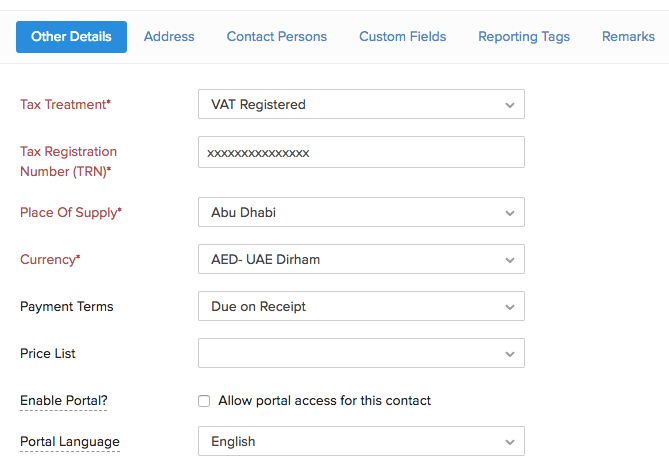

- Enter the VAT details of your customer in the Other Details section.

- In Zoho Books, you can store the following tax information of your contacts:

Tax Treatment

| Tax Treatment | Description |

|---|---|

| VAT Registered | The business is in the UAE and is registered for VAT |

| Non VAT Registered | The business is in the UAE and is not registered for VAT |

| GCC VAT Registered | The business is in any of the GCC member states except the UAE and is registered for VAT |

| GCC Non VAT Registered | The business is in any of the GCC member states except the UAE and is not registered for VAT |

| VAT Registered - Designated Zones | The business is in a Designated Zone in the UAE and is registered for VAT |

| Non VAT Registered - Designated Zones | The business is in a Designated Zone in the UAE and is not registered for VAT |

Tax Registration Number (TRN)

The TRN is a unique 15-digit number assigned to a VAT registered person in the UAE.

It will be displayed on all the transactions once you enter it here.

Place of Supply

The place of supply is where a transaction is considered to have occurred for VAT purposes. Place of supply is determined differently for goods and for services. Learn more about Place of Supply.

For a contact in the UAE, the place of supply can be any one of the following emirates:

- Abu Dhabi

- Ajman

- Dubai

- Fujairah

- Ras al- Khaimah

- Sharjah

- Umm al-Quwain

For a contact in the GCC, the place of supply can be any one of the following member states:

- Bahrain

- Kuwait

- Oman

- Qatar

- Saudi Arabia

- United Arab Emirates

Currency

If the contact is dealing with a currency other than AED, you can select their currency as well.

The tax treatment of your customers will affect your transactions in Zoho Books. Learn more.

Next:

Items >

Yes

Yes