- HOME

- HR insights

- Form 940: A comprehensive guide for every employer

Form 940: A comprehensive guide for every employer

- Last Updated : November 18, 2025

- 1.4K Views

- 6 Min Read

Employers bear significant responsibility in managing various payroll taxes, including federal unemployment taxes. The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) programs offer crucial financial support to employers facing job losses among their workforce. Nearly all businesses must fulfill obligations for both FUTA and SUTA taxes on behalf of their employees. If you have employed W-2 workers and made payments throughout the year, you will likely need to file Form 940. A thorough grasp of these forms is vital for business owners to ensure compliance with IRS regulations. Below is a concise overview of Form 940 and its filing requirements.

What is IRS Form 940?

Form 940 is a US tax form used to report the Federal Unemployment Tax Rate (FUTA) with the IRS annually. Employers can use Form 940 to report the total wages paid to employees who are subject to FUTA taxes. Employers have the option to receive a credit against their FUTA tax which is determined by the unemployment taxes they've already paid to their state.

What is the Federal Unemployment Tax Rate (FUTA) tax?

A federal initiative mandating payroll taxes for employers is the Federal Unemployment Tax Act (FUTA). These collected funds are then distributed to state unemployment insurance agencies, facilitating the provision of benefits to employees experiencing job loss. Employers must pay FUTA taxes and report FUTA liability with the IRS using Form 940 under the following specific conditions:

Employers who pay $1,500 or more in a calendar quarter to their employees during the year.

Employers have atleast one employee who worked or provided services for 20 or more weeks.

Some of the exceptions are:

Hired household employees and paid cash wages less than $1,000 in any quarter of the year. (need to pay FUTA taxes if paid $1,000 or more).

Hired farm workers and paid cash wages less than $20,000 or employed less than 10 workers. (need to pay FUTA taxes if paid $20,000 or more (or) employed more than 10 workers).

What are FUTA tax rates?

Understanding FUTA tax rates is crucial for assessing your FUTA tax responsibility. These rates vary annually; for instance, in 2023, the FUTA tax rate was 6% of the initial $7,000 earned by your employee in a tax year. This $7,000 is the FUTA tax wages. The state wages may vary according to the respective states rules and regulations.

Contributing to state unemployment funds can earn you a credit of up to 5.4% of FUTA taxable wages upon filing Form 940. If you qualify for the full 5.4% credit, the FUTA tax rate, post-credit, is 0.6%. According to the IRS, you qualify for the maximum credit if you've completely paid your state unemployment taxes by the Form 940 due date, covering all wages subject to FUTA tax, and if your state is not designated as a credit reduction state.

What is a FUTA credit reduction?

If the state borrowed a loan from the federal government and has not paid it back within the given time, then the state is considered a Credit Reduction State. In this case, the federal government will reduce certain FUTA tax credits to that particular state until they repay it back.

Some of the states with credit reduction are:

California - 0.6%

New York - 0.6%

U.S. Virgin Islands - 3.9%

Employers operating across multiple states and paying wages in a credit reduction state should include Schedule A (Multi-State Employer and Credit Reduction Information) along with Form 940, specifying the credit reduction states in that.

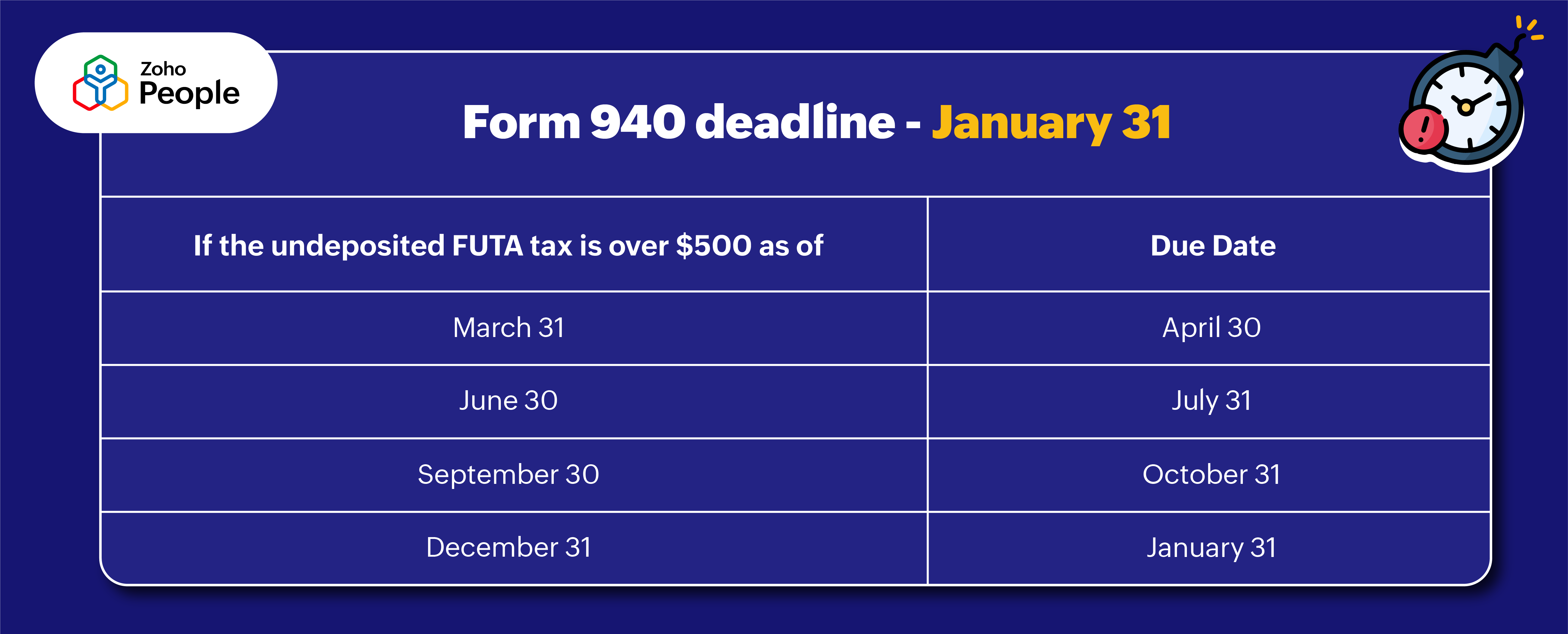

When is the deadline to file Form 940?

The deadline to file Form 940 with the IRS falls on January 31st of every year. If you deposited the Federal Unemployment Tax Rate (FUTA) before the deadline, you will have until February 10th to file (If you have submitted all mandatory FUTA tax deposits by their respective deadlines).

You also need to deposit the FUTA tax liability every quarter. If your FUTA tax liability is less than $500, you can carry it over to the next quarter. However, if your tax liability is $500 or more, you need to deposit it every quarter.

Due dates for FUTA tax liability deposits, if the undeposited FUTA tax is over $500 as of

March 31, then the deadline will be on April 30.

June 30, then the deadline will be on July 31.

September 30, then the deadline will be on October 31.

December 31, then the deadline will be on January 31.

Information required to file Form 940

To file Form 940 with the IRS, employers need the following information:

Business information including EIN (Employer Identification Number), company name, and address

Select return type (Amended, Successor Employer, No Employee Payments, Final Return)

Aggregate payments to all employees

Adjustments for state exclusions (if applicable)

Federal Unemployment Tax Act (FUTA) Tax

Balance due or overpayment

FUTA liability deposits

Authorized person signature

For more information, check out IRS 940 instructions.

Methods to file Form 940 with the IRS and pay FUTA taxes

Employers can report their Form 940 with the IRS using two methods:

Electronic filing method:

The IRS has provided a list of Modernized e-File (MeF) providers who are authorized by the IRS to make electronically file Form 940. Employers can choose their provider from there. The IRS recommends employers file their employment tax returns electronically for safe, secure, and faster processing.

Paper filing method:

If you choose to file Form 940 using the paper filing method, the list of mailing addresses for the respective states is provided by the IRS. Employers can send their 940 to the corresponding mailing address. Please note that the mailing address will vary for each state depending upon their business location and whether it accepts payments.

How to amend Form 940?

Employers can amend Form 940 for the current and prior year. To amend 940 return, employers can choose either electronic filing or paper filing.

Steps to amend Form 940:

Choose Form 940 (either paper filing or e-filing).

Tick "Amend return: in the type of return.

Update the correct amounts.

Enter the reason for amending the returns.

If paper filing, send your amended form to the correct address. If electronic filing, submit it directly to the IRS.

Employers should attach Schedule R if they have amendments for an aggregate Form 940.

Why is it important for every organization to file Form 940?

Legal obligation: It is a legal requirement for employers who meet the criteria to file Form 940. Failing to do so can result in significant penalties and interest charges from the IRS.

Supporting the system: FUTA taxes collected through Form 940 contribute to the unemployment insurance system which helps eligible workers who lost their jobs receive financial assistance.

Responsible business practice: Timely and accurate filing of Form 940 demonstrates your organization's commitment to responsible tax practices. This can be important for maintaining a good reputation and avoiding potential audits.

Tax credits: Some states offer tax credits that can reduce your federal FUTA tax liability. Form 940 allows you to claim these credits, potentially lowering your overall tax burden.

Filing Form 940 is essential for maintaining compliance, supporting the social safety net, and upholding responsible business practices.

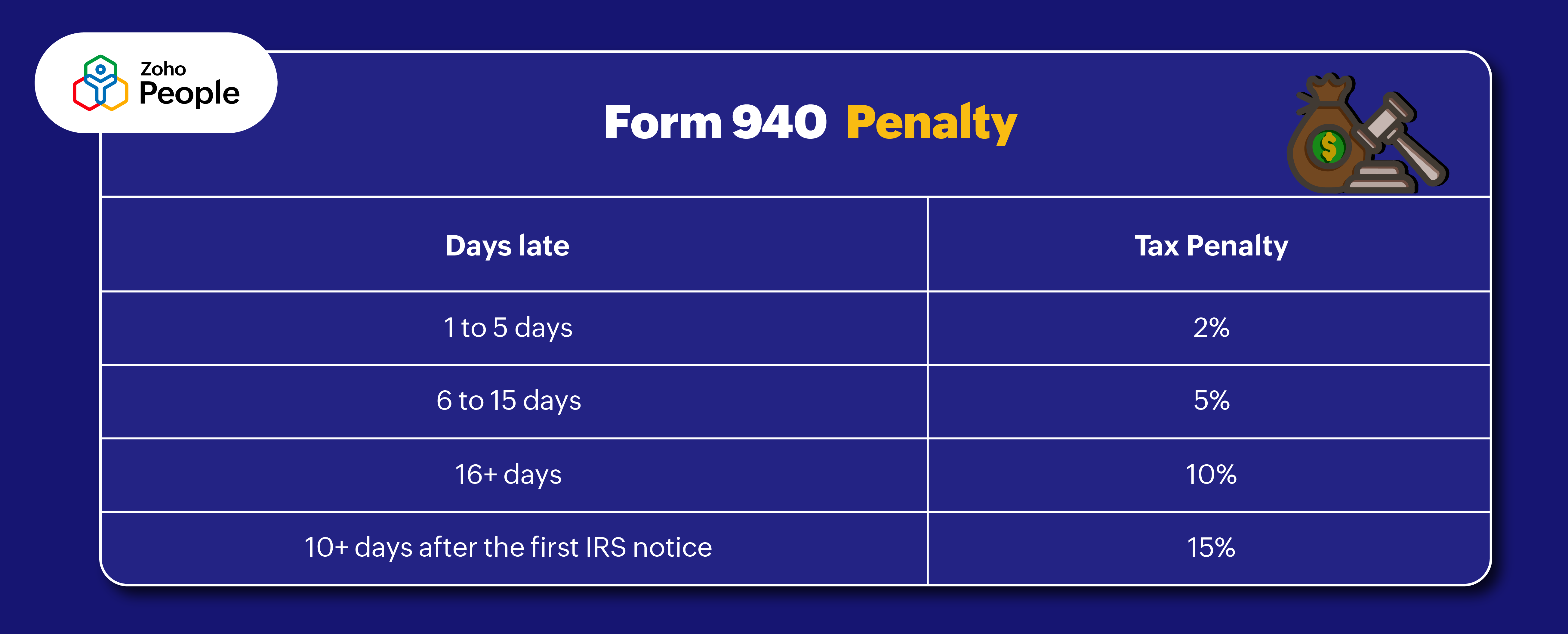

Penalty for not filing Form 940 before the deadline

The amount of penalties for employment tax violations typically varies based on several factors, such as the nature of the violation, the scale of the business, the amount owed, and whether the payment was delayed or not made at all. Additionally, penalties tend to escalate the longer payments remain outstanding.

- If 1 to 5 days late, then the penalty is 2%.

If 6 to 15 days late, then the penalty is 5%.

If 16+ days late, then the penalty is 10%.

If 10+ days late, after the first IRS notice then the penalty is 15%.

Difference between Form 940 & Form 941

Form 940 is used to report the Federal Unemployment Tax Rates (FUTA) whereas Form 941 is used to report the employer's quarterly Federal Insurance Contributions Act (FICA) taxes, which include Social Security and Medicare taxes.

Wrapping up

FUTA hinges on employee wages. The human resources department plays a crucial role in employee classification, accurate wage tracking, and timely reporting, whereas actual filing and tax calculation fall on the finance department's shoulder. It is essential that human resources and finance departments communicate and collaborate for a smooth process and to stay tax complaint with the IRS.