Taxes

Your business’ financials are affected by regulatory taxes and each organization has different country specific taxes to adhere to. You may have added Taxes in the Quick Setup section. You can edit or add further Taxes through the Settings section.

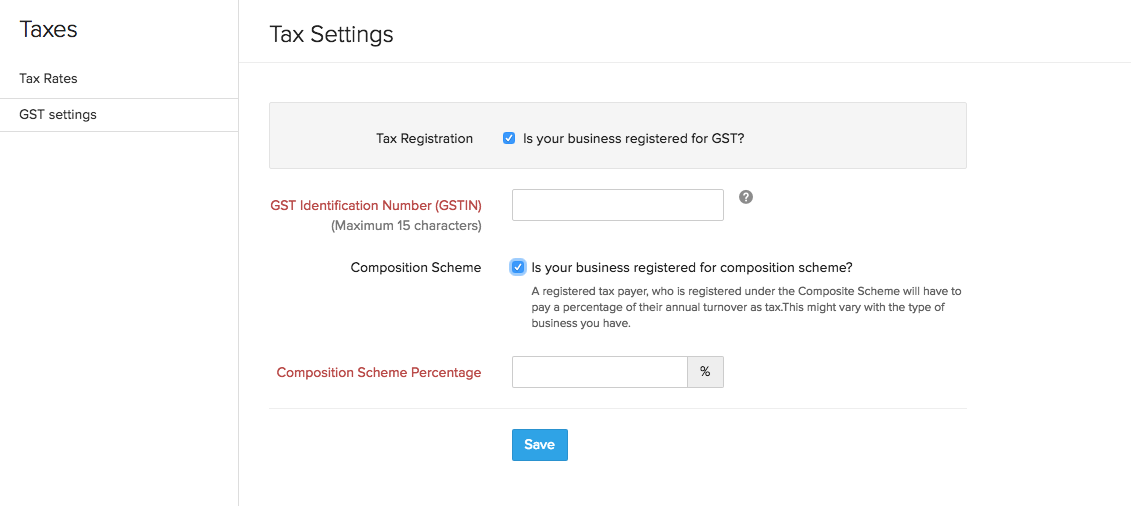

GST Settings

If you are a GST registered business you can make your organization GST-Ready as well by enabling GST.

To enable the GST settings,

- Navigate to Gear icon > Taxes and select GST settings.

- In the following screen, you can enable the GST features for your organisation using the checkbox Is your business registered for GST?

- On enabling it, you will be asked to enter your GSTIN.

- If you’re business is registered for composition scheme you can choose to enable that as well using the other checkbox and you will be asked to enter the composition scheme.

- Once you’ve configured your GST settings, click Save.

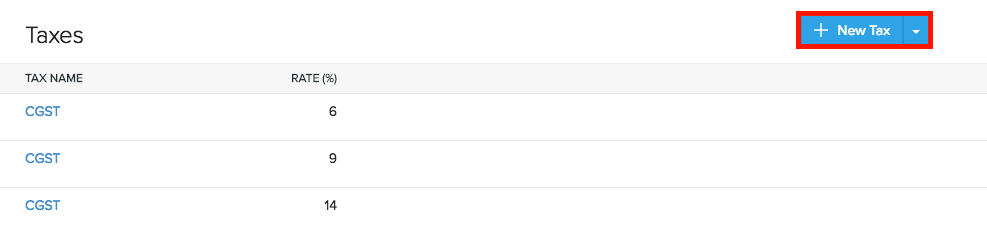

Adding New Taxes

To create or add a new Tax, follow steps as below:

- Click on the Gear icon > Taxes > Tax Rates.

- Next, click the + New Tax button at the top-right corner.

- In the popup that appears, enter the Tax Name, Rate (%) and the Tax Type.

- Once done, click Save.

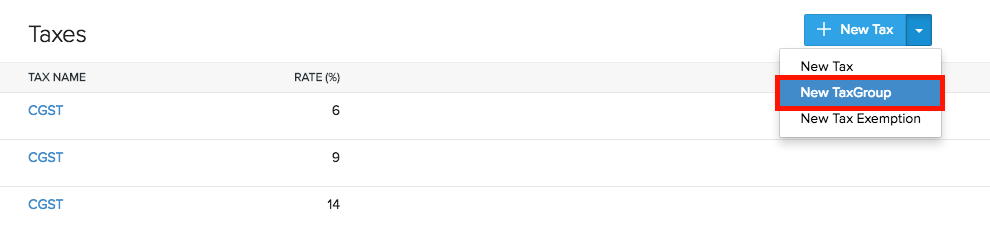

Adding a New Tax Group

To create a Tax Group follow steps as below:

- Click on the Gear icon > Taxes > Tax Rates.

- Click on the + New Tax dropdown button option present on the top right corner and select New TaxGroup.

- In the popup that appears, enter the Tax Group name and select the taxes to be clubbed together using the check boxes.

- Click Save to create the new tax group.

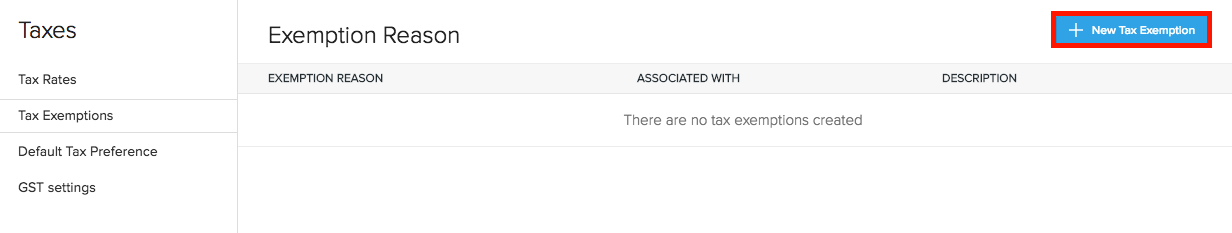

Adding a Tax Exemption

There might be situations where you are exempt from paying taxes because of the item or the customer to whom you are selling the product. In those cases, you can make the customer or plan non-taxable by entering the tax exemption reason.

To create a tax exemption,

- Click on the Gear icon > Taxes > Tax Exemptions.

- Click the + New Tax Exemption button at the top-right corner.

- In the popup that appears, enter the Tax Exemption name, Description and Type.

- Click Save.

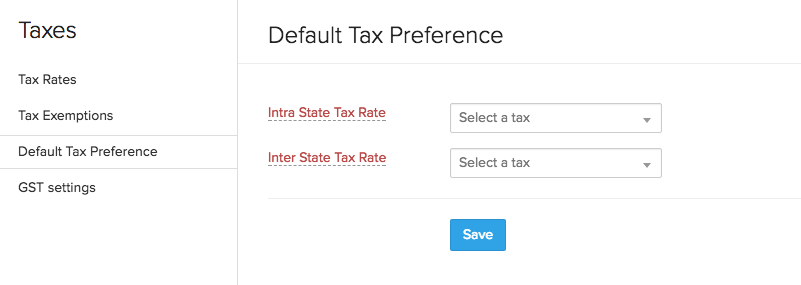

Default Tax Preferences

The Intra State tax and Inter State tax, you enter here will be automatically used to apply tax for the customer when they subscribe to your plan.

- Intra State Tax will be used when you sell goods/service for someone within the same state, as your home state.

- Inter State Tax will be used when you sell goods/service for someone in another state, outside your home state.

Yes

Yes Thank you for your feedback!

Thank you for your feedback!