GSTR-2B - An overview

In this guide you will find the following information:

- What is the GSTR-2B?

- Features of GSTR 2B

- What are the benefits of GSTR 2B?

- What is the difference between GSTR 2A and GSTR 2B?

- What are the steps to download GSTR 2B?

- How GSTR 2B will help with ITC filing

What is the GSTR-2B?

GSTR 2B is an auto-drafted document that will act as an Input Tax Credit (ITC) statement for taxpayers. The GST Council states that GSTR 2B will help in cutting down the time taken to file returns, minimise errors, ease reconciliation and simplify compliance.

Starting August 2020, you will need to download this statement on the 12th of every month before filing your ITC claims. For example, GSTR 2B for September 2020 can be viewed and downloaded on 12 October 2020.

The return statement is available to all GST-registered taxpayers. The statement is generated in the GST portal based on the inputs from GSTR 1, GSTR 5 and GSTR 6.

- GSTN has now enabled an option to download GSTR 2B summary as well as detailed report via GST portal.

Features of GSTR 2B

Here are the top features of GSTR 2B:

- The document will tell you whether ITC is available or not under each section and what actions you will need to take in a particular section for GSTR 3B. You can refer to the GSTR 2B advisory for more details.

- You can view or download document-wise details like invoices, credit and debit notes. You can also view the cut-off dates and regulations for generating or using GSTR 2B.

- The summary report will contain information from ICEGATE systems on import of goods from overseas and inward supplies from SEZ units.

- You can view and download the whole ITC summary statement as a PDF or Excel file. You can even download it in sections, if you want only section-wise details.

- You can do text searches on generated records, filter and sort the information you need, and hide or view columns as per your convenience.

Benefits of GSTR 2B

There are benefits to viewing GSTR 2B before filing ITC in GSTR 3B:

- The summary report will help your accounting team get an overview of the ITC for that month.

- The summary report will contain information from ICEGATE systems on import of goods from overseas and inward supplies from SEZ units. This ensures all transactions are considered before ITC is calculated.

- You can see clear information on your ITC and you won’t be required to download it multiple times like GSTR 2A used to require.

- ITC ledger information and invoice details will be uploaded by your supplier in GSTR 1. Since GSTR 2B is static, you will save a lot of time in reconciling transactions. However, reconciliation may be required for October 2019 to June 2020.

What is the difference between GSTR 2A and GSTR 2B?

| Basis | GSTR 2A | GSTR 2B |

|---|---|---|

| Nature of statement | It is dynamic in nature. It changes based on the documents uploaded by the suppliers and vendors. | It is static in nature. The statement is finalised every month and details cannot be changed afterward based on the actions of suppliers or recipients. |

| Inputs from returns | GSTR-1, GSTR-5, GSTR-6, GSTR-7, GSTR-8, ICES | GSTR-1, GSTR-5, GSTR-6, ICES; does not provide TCS or TDS deduction information |

| Utility | It can be difficult to ensure that all the GSTR 2A credits have been included because vendors usually delay their filing process. | It is useful during ITC reconciliation and helps you identify compliant and non-compliant vendors. |

| Availability | Monthly | On the 12th of every month |

| ITC on imports | Details of ITC on imports, from overseas and inward supplies from SEZs, are available from ICES in the GST system. | Contains information on imports from ICES. |

What are the steps to download GSTR 2B?

Navigate to GST portal

Log in to the GST portal using your credentials.

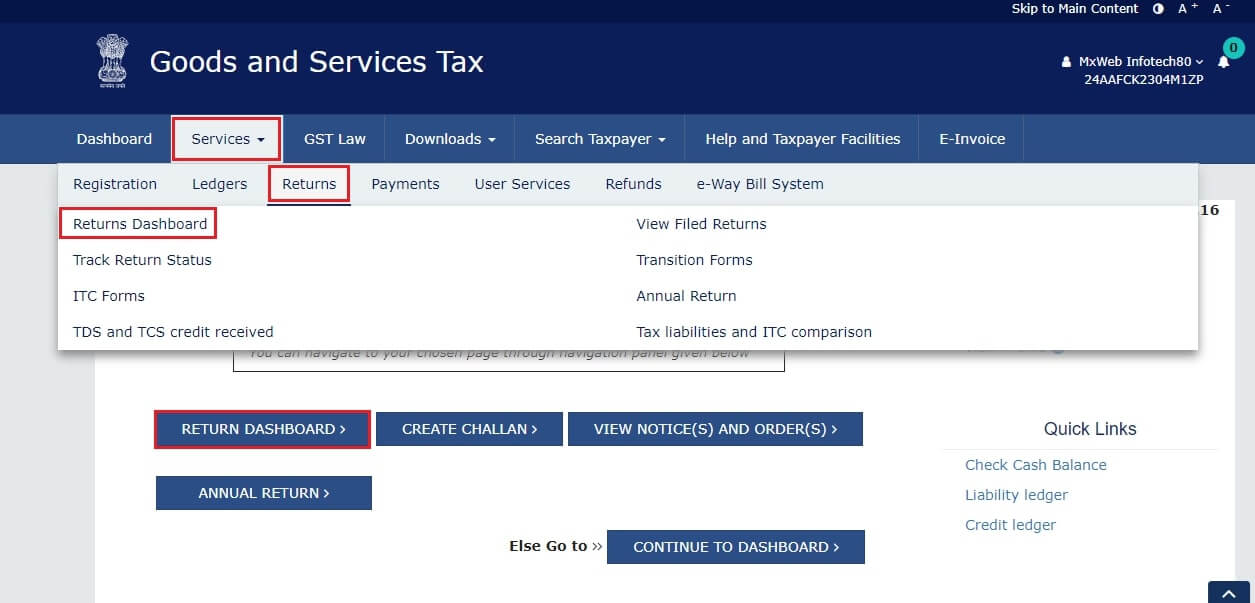

Click on Services > Returns > Returns Dashboard option

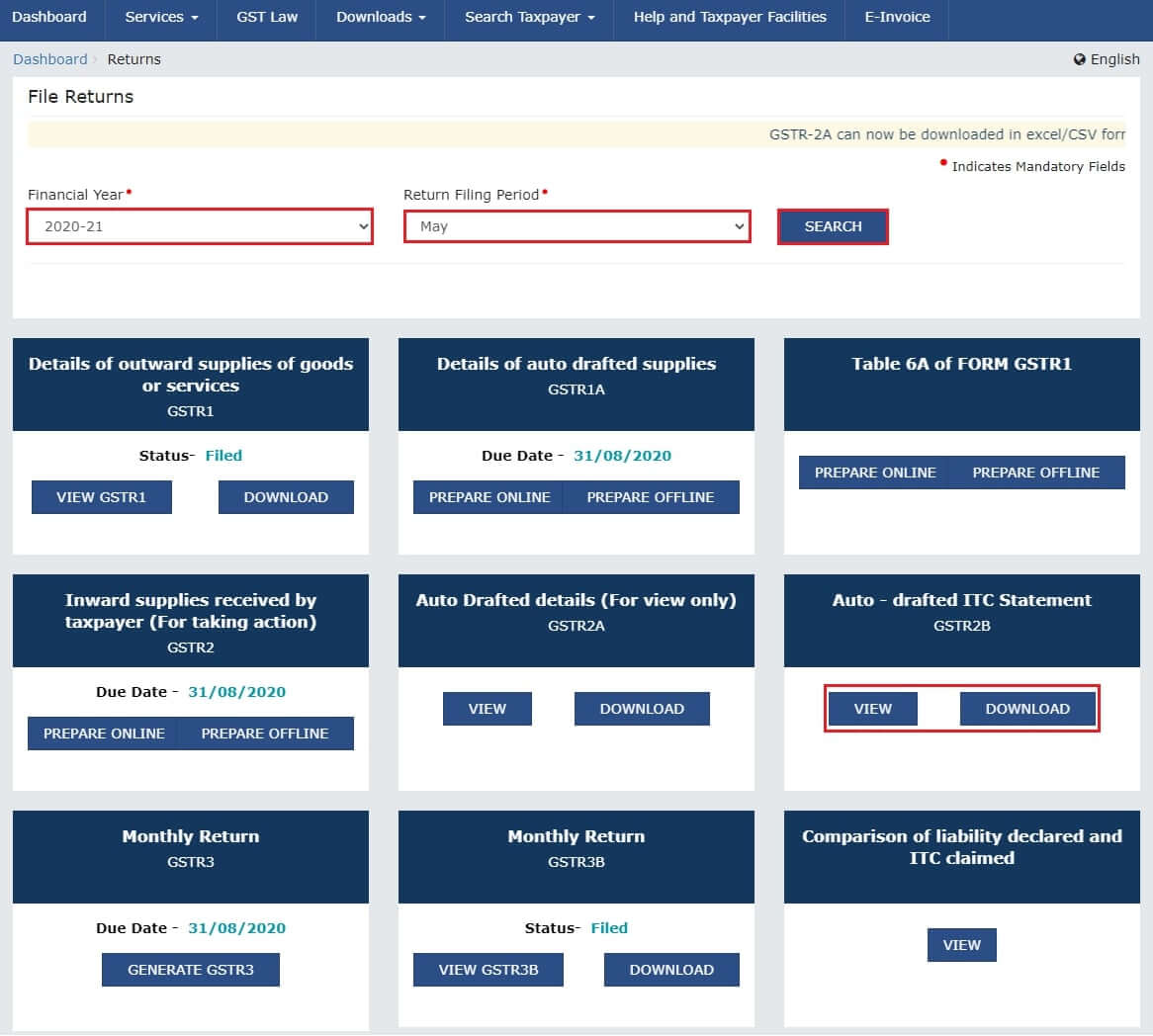

When the returns page appears, use the drop down menu to specify the financial year and return filing period. You can then view or download Form GSTR 2B.

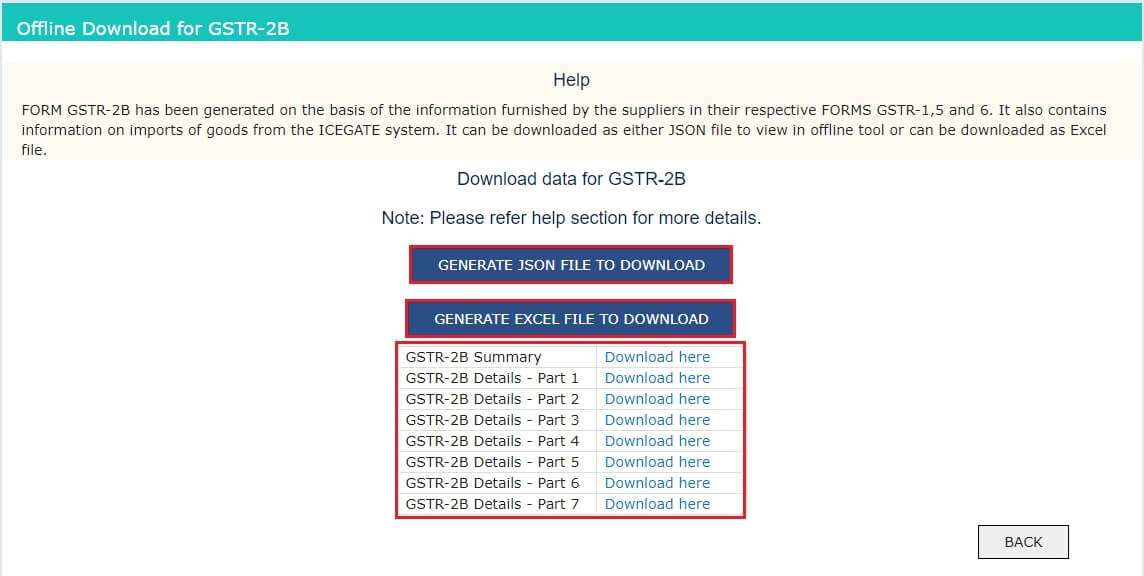

When you click Download, you will see a new page with options to download the form in JSON or Excel format. The Excel file will contain multiple sheets containing details about different parts of the same form.

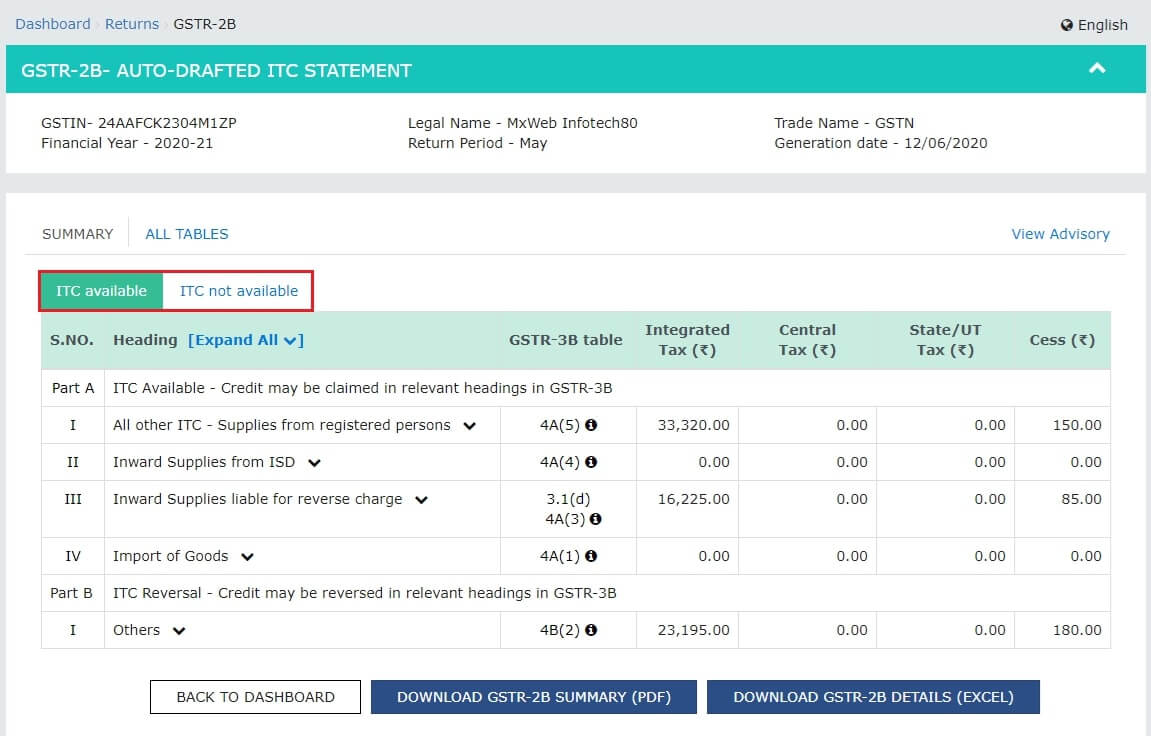

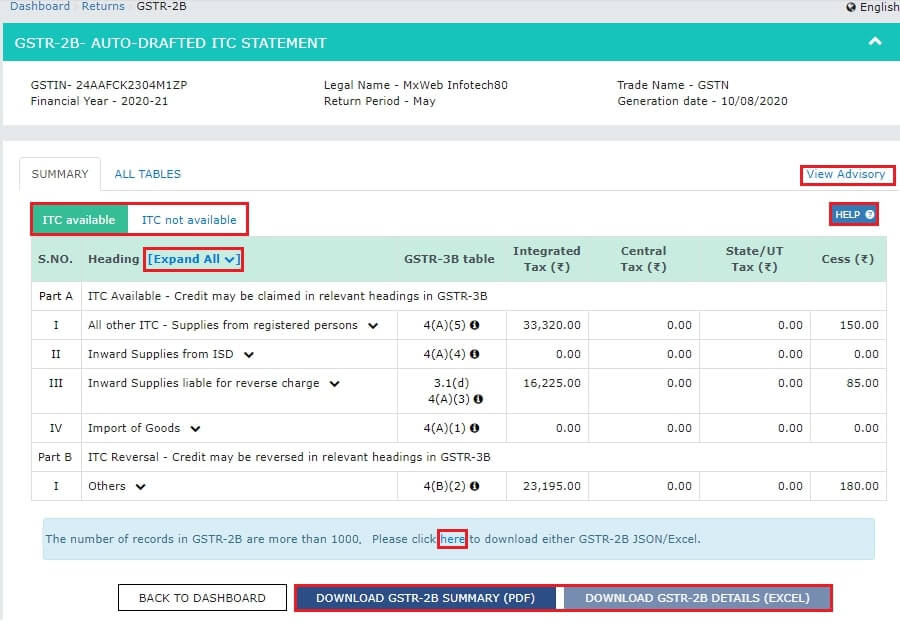

If you click View, you will see the auto-drafted ITC statement (Form GSTR 2B). It consists of two main viewing formats: summary and all tables.

The Summary tab is divided into two parts: ITC available and ITC not available.

ITC available: You will see a summary of inward supply along with applicable ITC that can be claimed in Form GSTR 3B.

ITC not available: You will see a list of inward supplies for which ITC must be reversed or cannot be claimed in Form GSTR 3B. You can click on Download GSTR 2B Summary (PDF) or Download GSTR 2B details (Excel) to view the ITC details in PDF or Excel formats.

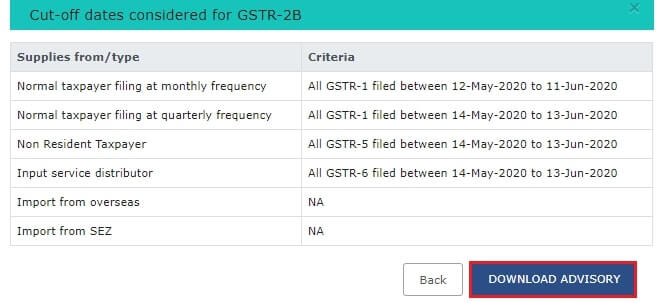

To find the cutoff dates, click View Advisory. You save the PDF for future reference by clicking Download Advisory.

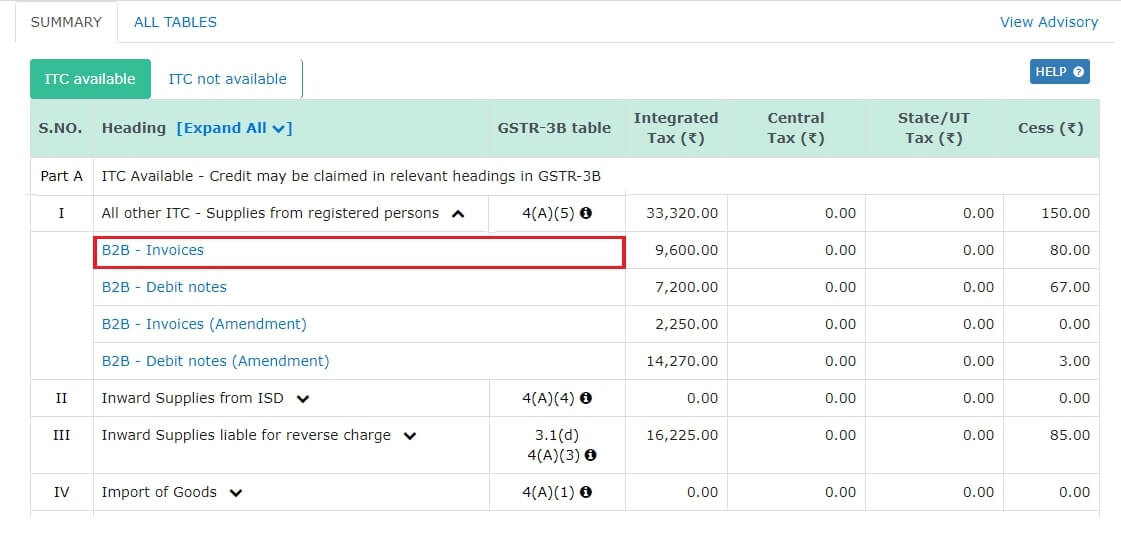

You can expand each field in the summary page by clicking the downward arrow, or click Expand All to view details for all of them.

For example, when you click the downward arrow next to ‘All other ITC- Supplies from registered persons’, you will be able to view invoices, debit notes, and credit notes. You can click on these links to view the list available for taxable inward supplies.

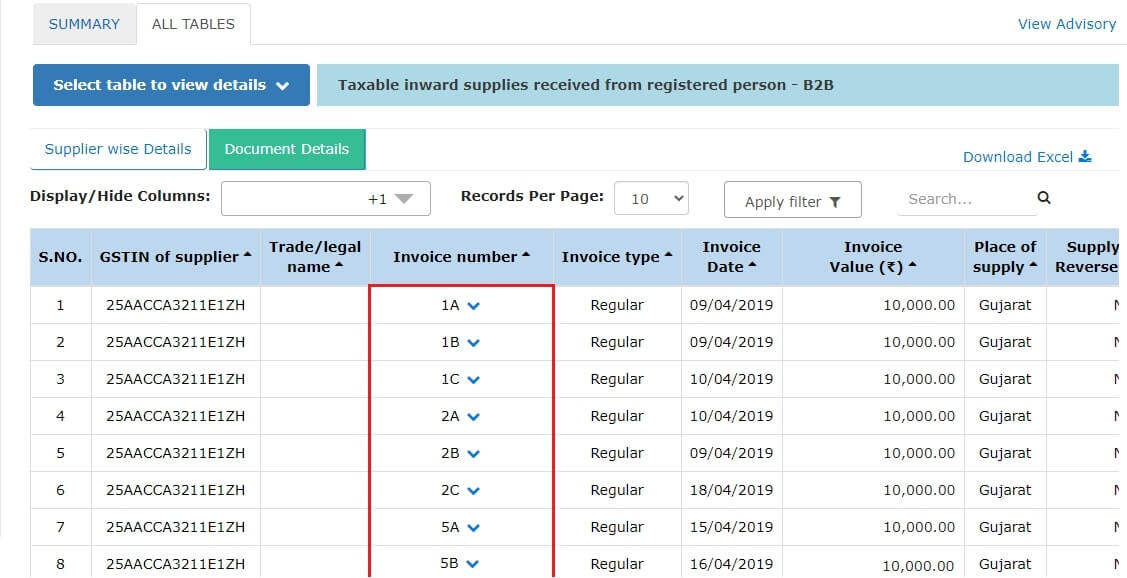

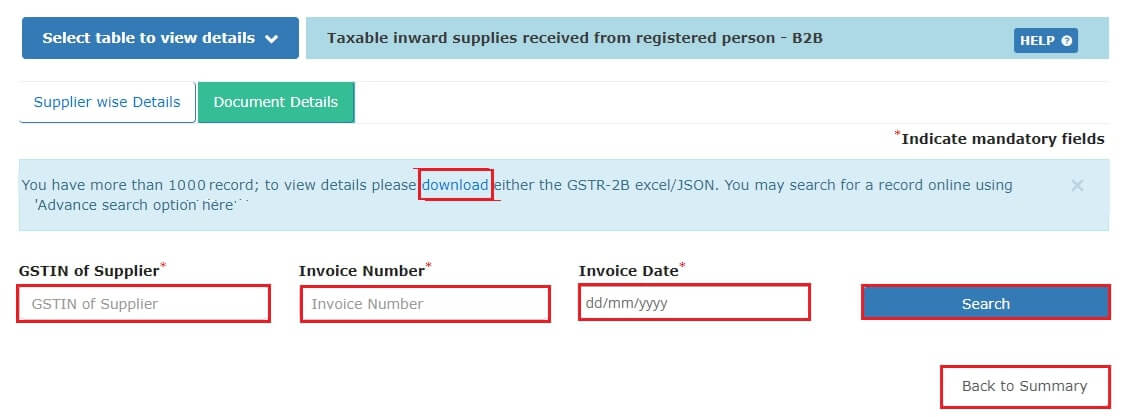

You will then be navigated to Document Details under All Tables, where you can view pre-filtered documents.

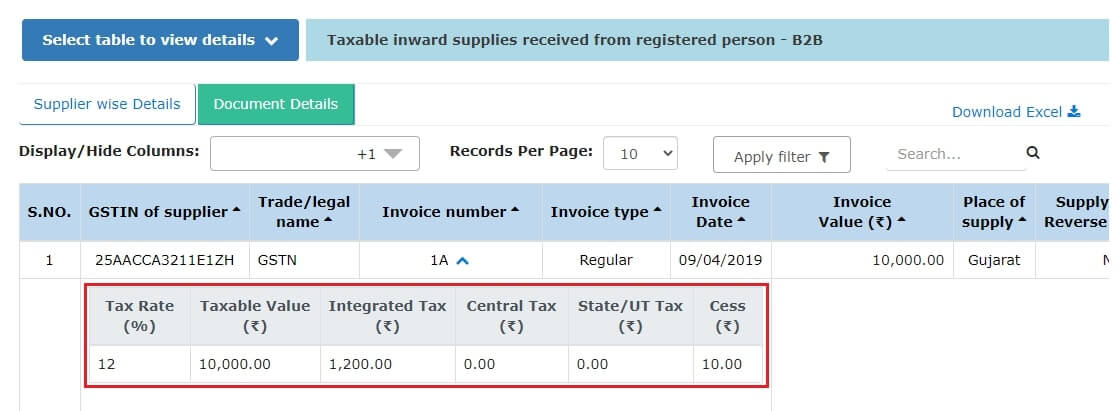

When you click on an Invoice number, you will be able to view the tax details.

Click Back to Summary to go back to the summary page.

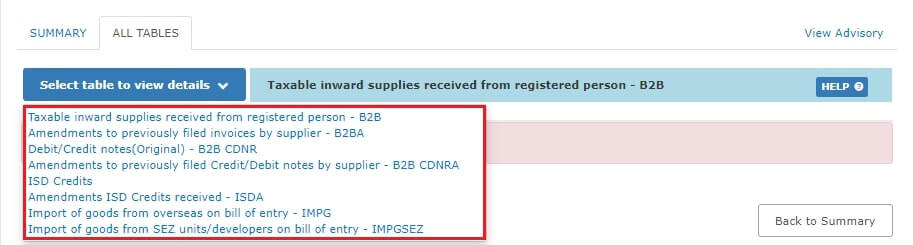

The All Tables tab will allow you to see all the documents related to a particular section of the summary document. Select a table from the dropdown to view the details related to it:

- B2B table of GSTR 2B - Inward supplies from registered persons including supplies attracting reverse charge

- B2BA table of GSTR 2B - Amendments/changes to inward supplies made by registered businesses

- B2B CDNR table of GSTR 2B - Debit notes or credit notes

- B2B CDNRA - Changes or amendments made to the debit or credit notes received from registered persons

- ISD - ITC received from Input Service Distributors (ISD)

- ISDA - Amendments made to ITC received from ISDs

- IMPG - Overseas imports of goods in bill of entry

- IMPGSEZ - Supply coming from SEZ units/developers on a bill of entry

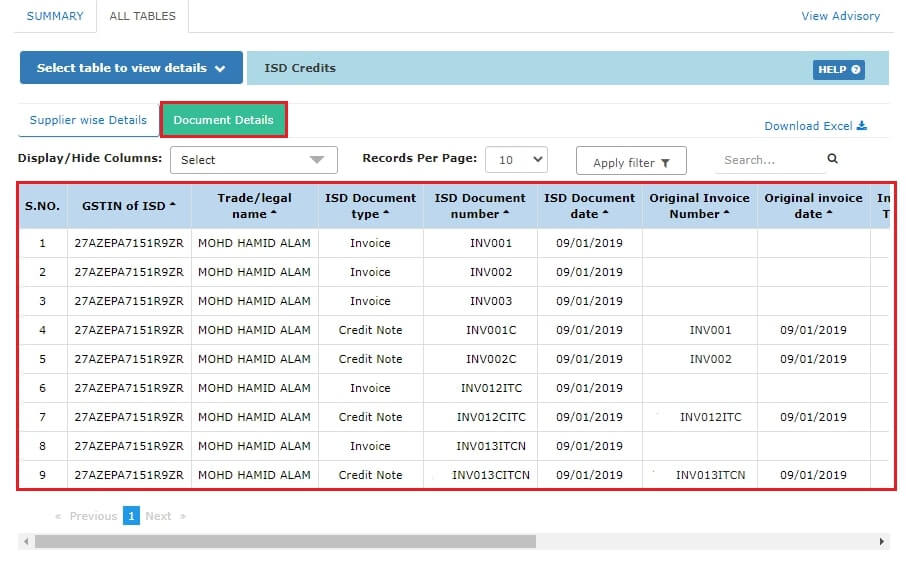

Click on any table to view the Document Details.

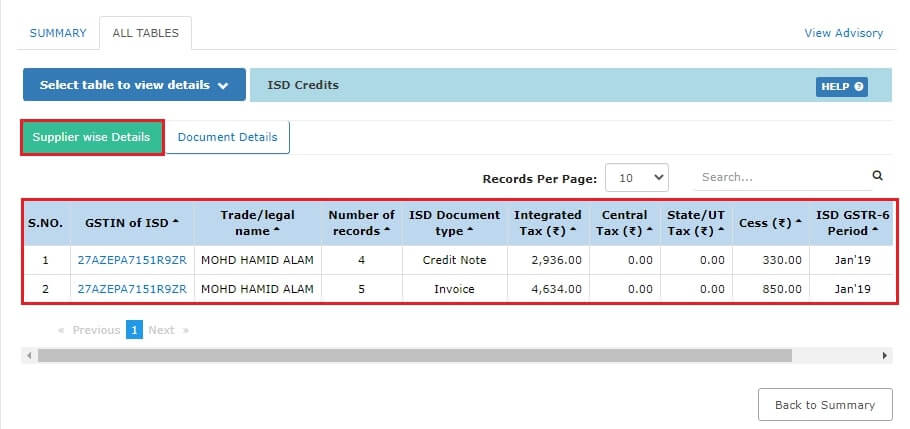

Click Supplier-wise Details to view the documents related to each supplier.

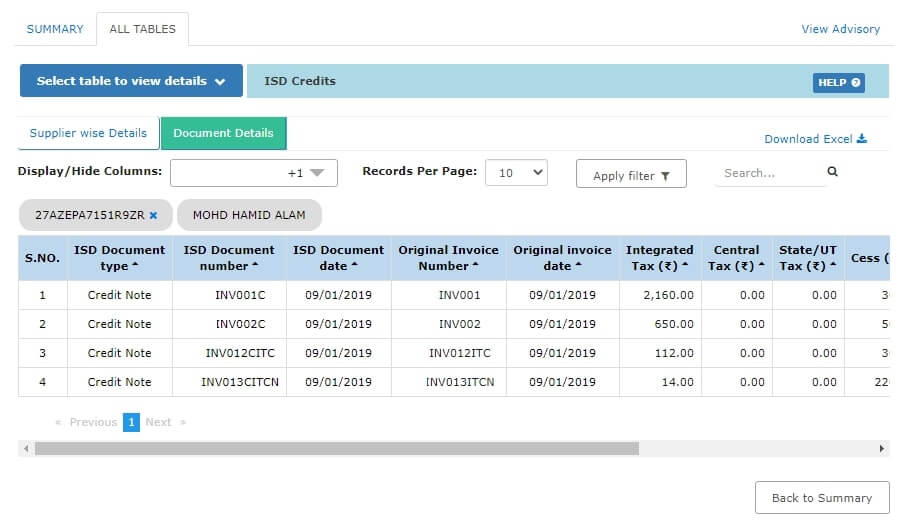

When you click on any GSTIN link, you can use the Document Details tab to view documents received only from that particular supplier.

How GSTR 2B will help with ITC filing

While you will continue to file your returns in Form GSTR 3B, the auto-drafted GSTR 2B statement can be used as a basis for calculating ITC claims. The additional information and the static nature of the return is the key to simplifying the process.

Every document filed under this return will have additional information to indicate whether ITC is available or not. ITC is marked unavailable when the time to avail ITC on an invoice or debit note expires either before 30th September of the following financial year or before the filing date for the annual return (whichever comes earlier). ITC is also not available when the supplier’s GSTIN and the place of supply are in the same state and the recipient is in another state.

The GSTR 2B return will include only those invoices for which the returns have been filed. It will also contain information like filing period and date of filing. During reconciliation, you can easily keep track of invoices for which you have claimed ITC earlier so that a double claim situation can be avoided.