The process of GST registration involves filling and submitting an online application in order to obtain an unique GST Identification Number (GSTIN).

This section will cover the following topics:

Before diving into the process involved in GST registration, let’s take a look at the eligibility criteria for GST registration.

Eligibility

Businesses with an aggregate turnover exceeding Rs. 20 lakhs must mandatorily register and pay for GST. Threshold limit is based on the yearly aggregate turnover of a business.

Aggregate turnover is the sum of all taxable, non-taxable, and exempt supplies. It also includes export of goods and services (if any).

Apart from the above mentioned criteria, there are a few cases where GST registration is mandatory. They are:

- Businesses involving inter-state supply of goods and services

- Casual taxable person

- Non-resident taxable person

- People who supply goods and services on behalf of a taxable person

- An online business that offers services under the aggregator model. For example, businesses supplying online information and database access or retrieval services from a place outside India to a non-registered person in India.

- Input service distributors

- Business owners who were registered under the pre-GST law

- Business owners paying tax under the reverse charge mechanism

- E-commerce operators who collect tax at source

Required Documents

While registering for GST, please make sure that you have soft copies of the documents mentioned below:

Private Limited Company/Public Company

Documents related to the business

- PAN card

- Registration Certificate of the firm

- Memorandum of Association (MOA) /Articles of Association (AOA)

- Copy of Bank Statement

- Declaration to comply with the provisions

- A copy of Board Resolution

Documents related to directors

- PAN and ID proof of directors

Documents related to the office

- Copy of electricity/landline/water bill

- NOC (no objection certificate) issued by the business owner

- Rent agreement (if the business premises are rented)

Limited Liability Partnership

Documents related to the business

- PAN card

- Registration Certificate of the LLP

- LLP Partnership Agreement

- Copy of Bank Statement of the LLP

- Declaration to comply with the provisions

- A copy of Board Resolution

Documents related to the business partners

- PAN and ID proof of the business partners

Documents related to the office

- Copy of electricity bill/landline/water bill

- NOC (no objection certificate) issued by the business owner

- Rent agreement (if the business premises are rented)

Normal Partnerships

Documents related to the business

- PAN card

- Partnership Deed

- Copy of Bank Statement

- Declaration to comply with the provisions

Documents related to the business partners

- PAN and ID proof of partners

Documents related to the office

- Copy of electricity bill/landline/water bill

- NOC (no objection certificate) issued by the business owner

- Rent agreement (if the business premises are rented)

Sole proprietorship/Individual ownership

Documents related to the business

- PAN card and ID proof of the individual

- Copy of Cancelled cheque or bank statement

- Declaration to comply with the provisions

Documents related to the office

- Copy of electricity/landline/water bill

- NOC (no objection certificate) issued by the business owner

- Rent agreement (if the business premises are rented)

Registration process for existing tax payers

If you’re an existing tax payer, you will receive a provisional username and password from the tax authority under whom you are registered. You can also reach out to the tax department to obtain the provisional username and password.

You will have to use these credentials to log into the GST portal and submit the necessary forms for obtaining GST registration. To start with the registration process,

- Log on to www.gst.gov.in

- Click New user login and enter your provisional username and password.

- Click Login

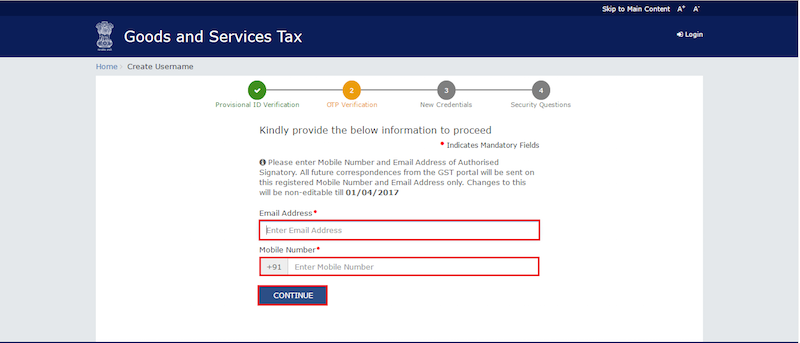

- In the screen that follows, you will be prompted to enter your email address and mobile number.

- A One Time password (OTP) will be sent to your registered email address and mobile number. (The one you receive in your email and the one you receive on your mobile number are different). Enter both the OTPs to complete the verification.

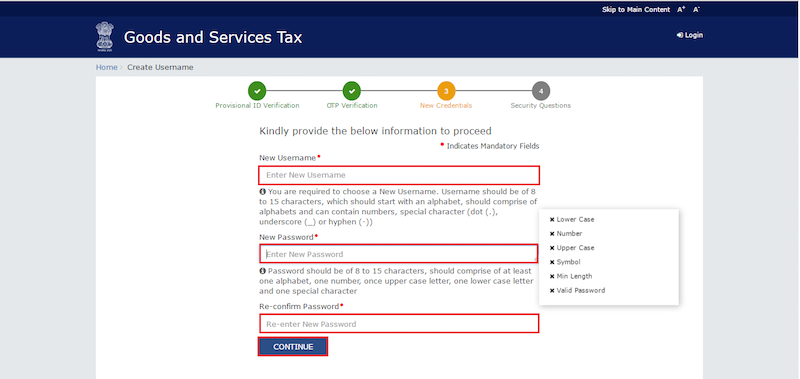

- Once the process is done, you will be taken to the screen where you will be asked to select a new username and password for your GST portal.

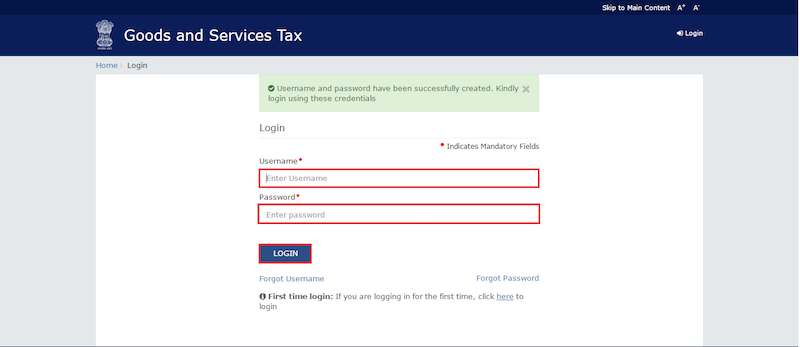

- Enter the username and password of your choice and click Submit. You will get a success message informing about the update of your new username and password. You will then be redirected to the login screen where you will again have to login using your new username and password.

The next step is to register for GST and receive a provisional GST number.

As soon as you log in, you will see the dashboard of the GST portal.

In the dashboard, click Provisional enrolment option present on the top left corner.

Under provisional enrolment, you will have seven sections which you will have to fill before submitting your application. They are:

- Business details

- Details about proprietor and partner

- Authorized signatory

- Principal place of business

- Additional place of business

- Goods and services

- Bank accounts

Under each section you will be asked to fill a form and upload the relevant document(s). For example, while filling the Business Details section, you will be asked to upload the proof of constitution of business i.e. proof for registering your business. Similarly, you will be asked for an address proof for your business while filling the Principal Place of Business section. So, keep a digital copy of all your necessary documents ready before filling up the applications. This will save you a lot of time.

After filling up all the seven sections, you will have to verify your details using Digital Signature Certificate (DSC) or E-signature. Enrolment for GST is not complete without the E-signature.

Upon digitally signing the application, you will receive an acknowledgement email in your registered email address.

If all the submitted documents are correct, the application would be processed within 3 working days and a provisional registration certificate will be issued to you. The provisional certificate is valid for 6 months and can be used until you receive the GSTIN.

Registration process for new applicants

GST registration for new applicants is open from June 25, 2017 and will stay open for the next three months.

To apply for a new GSTIN, please follow the steps mentioned below:

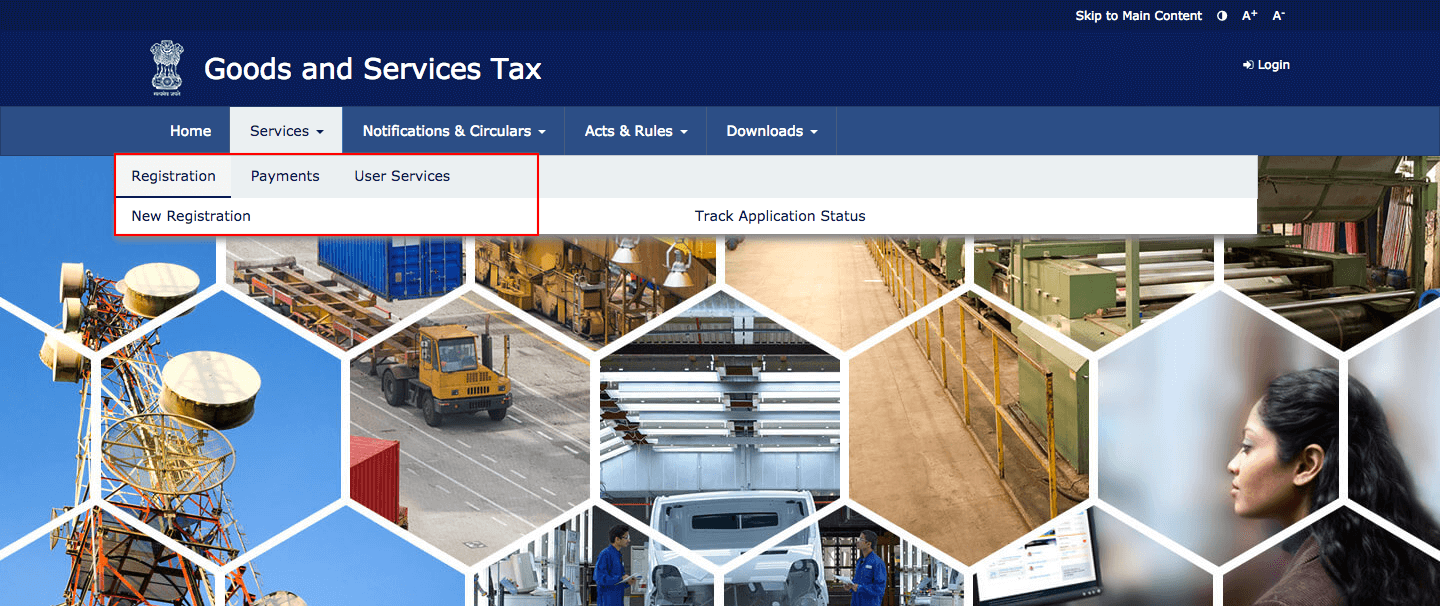

- Go to www.gst.gov.in

- Click the Services dropdown from the homepage, and navigate to Registration > New Registration

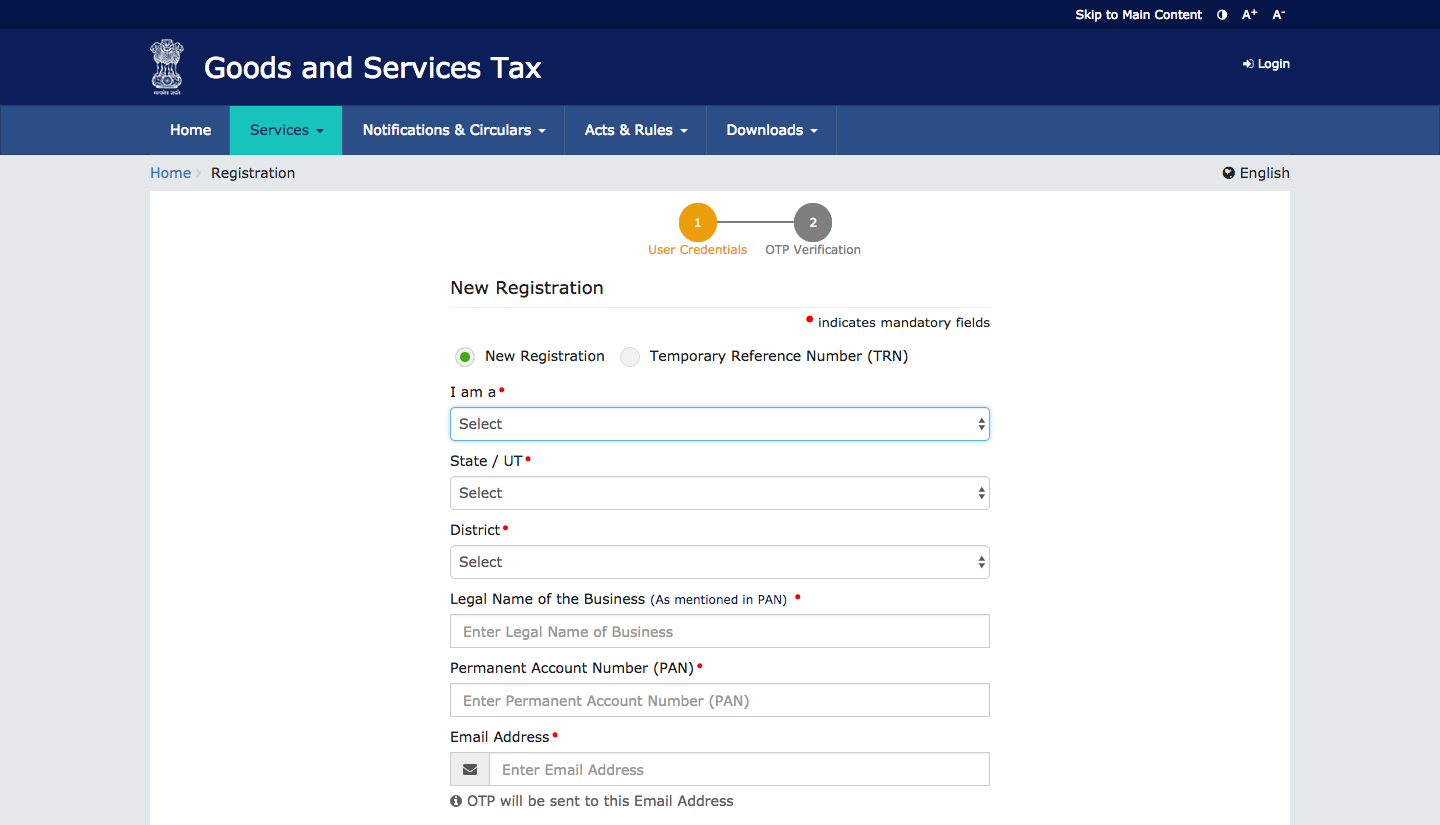

- Select the New Registration option, in the screen that follows.

- Fill the details of the form and an OTP will be sent to your email address and mobile number. Please note that OTPs sent to your email address and mobile number are different.

- Enter the OTPs and click Proceed.

- You will be taken inside the portal where you will be asked to fill other details such as your company name, authorized signatory, PAN information etc.

- You will also be asked to upload digital copies of your PAN and company registration document, etc.

- Once you complete the form, you will be sent a success message and reference number to your email address and mobile number.

- A provisional GSTIN will be sent to you in a couple of weeks.

GSTIN (GST Identification Number)

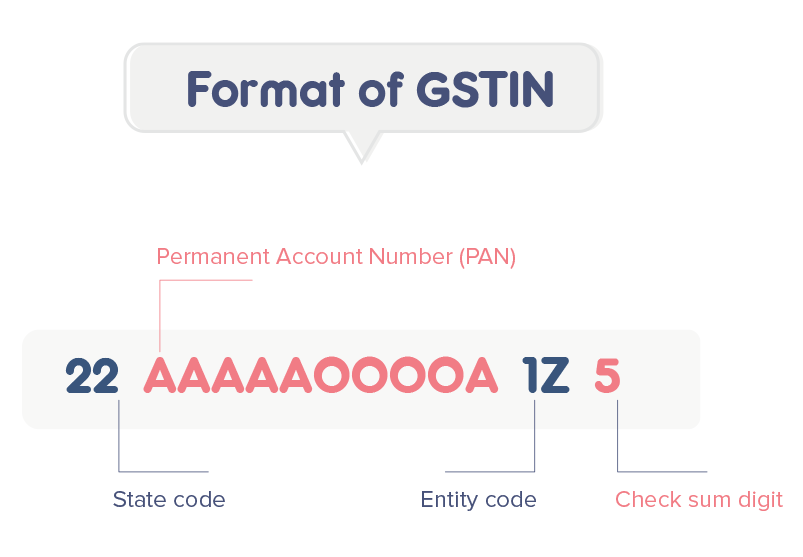

GSTIN is a 15-digit identification number issued by the tax department upon successful processing of your application.

Decoding the GSTIN will give us the following information:

- The first two digits represent the state code.

- The next ten digits represent the PAN number of the business owner.

- The next two digits represent the entity code of the PAN holder in a state.

- The fifteenth digit is the checksum digit.

Checking the status of your Application

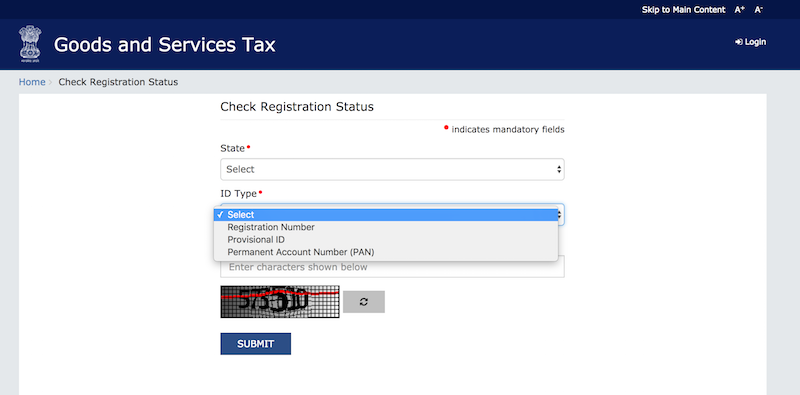

You can track the status of your GST application by following the steps mentioned below:

- Log on to www.gst.gov.in** and scroll down to the bottom of the page.

- Under Important Links, click Check Registration Status

- In the screen that follows, you can check the status of your application by entering either your registration number, provisional ID, or your PAN number.