- HOME

- Accounting Principles

- What is an audit and what are the types?

What is an audit and what are the types?

Coined from the Latin word ‘audire,’ the term audit refers to the process of examining and evaluating your business’s financial statements. During an audit, an auditor checks if the business’s financial statements are up to date and devoid of any errors. A clean record reflects that your business is in good health, especially when the financial transactions match the exact position of your business.

In this guide, we’ll take a look at the importance of financial audits, their types, and how they works.

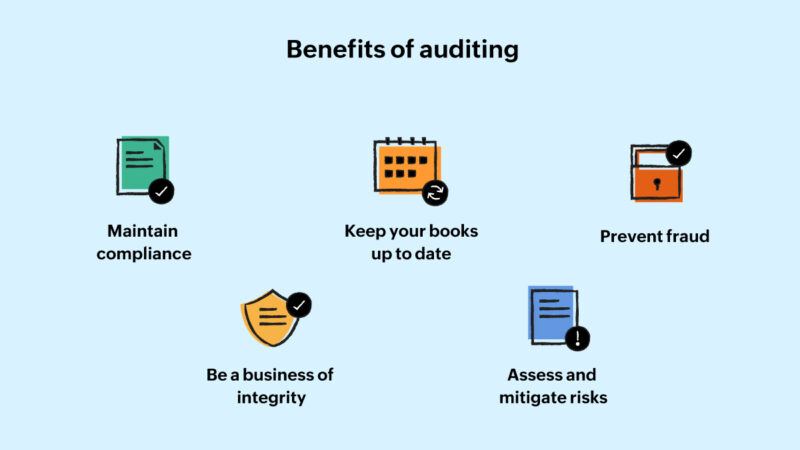

Importance of auditing

Auditing ensures the integrity and compliance of your accounts with Generally Accepted Accounting Principles (GAAP). Performing frequent internal and external audits helps in maintaining the credibility of your finances. Unfortunately, many business owners only realize the true value in auditing only after having to face the consequences of error-prone data.

An auditor’s job is to ensure that your bookkeeping activities are on point and to determine if your financial statements are in sync with the real financial position of the business. A well-audited, up-to-date business grabs a place in the good books of the shareholders who want to invest in your company.

However, if an auditor finds out that the financials have been tampered with, your business could face legal punishment. In such situations, businesses often dissolve because of the ruptured reputation in the eyes of customers and stakeholders. To avoid this, you must plan for regular internal audits so that accounting professionals or auditors can detect fraudulent activities or roadblocks to compliance before they affect the business’s reputation.

Types of audits

There are three main types of audits: Internal, External, and Government audits

Internal audits

An internal audit is useful for evaluating your business’s accounting processes. It ensures that your business is in compliance with the relevant rules and regulations, and enables you to produce timely reports of your financial data. An internal audit is usually carried out by an accountant or an auditor who is a part of your business.

The main goal of this audit is to check the effectiveness of your financial operations, understand the risk factors involved, and come up with viable solutions to exercise better financial management.

Internal audits are conducted on a weekly, monthly, or annual basis. Conducting regular internal audits helps you indicate the pain points in your business operations, prevent potential fraud, and rectify errors before they are reflected during external audits.

Internal audit process

1. Even before you plan to conduct an internal audit, it is necessary that your management comes up with an internal audit plan in collaboration with the auditor. You will need to fix the time within which the audit can be conducted and finalize what steps and procedures will be followed. It is also good practice to keep your employees informed about the audit so that they can get important documents ready even before the audit begins.

2. During the internal audit, the designated auditor will look through the financial documents, take notes, and have conversations with several employees to test their understanding of your business’s objectives, safety standards, and rules and regulations for compliance.

3. Once the auditor has finished the investigation, management will be informed about the results. The auditor will convey the strengths and the pain points in your processes and advise your team on how to implement fixes.

4. Once the discussion with management is over, the auditor will prepare the auditor’s report, which summarizes the investigation and has a final list of expectations that need to be amended by management. Once all the amendments are made to the relevant documents, the audit is officially closed.

External audits

The main aim of an external audit is to validate your business’s financial statements. The result of an external audit provides assurance to third parties that your finances are secure and accurate. Most businesses consider it beneficial to perform external audits because the auditor’s report, in this case, is an asset for that business. Unlike internal audits, external audits are perceived to be much more reliable.

Since the external audits are conducted by independent, third-party accountants or accounting firms, the review process and reports presented are unbiased. The glitches found in the finances for rectification do not affect work relationships. Thus, all stakeholders involved in the business can make informed decisions based on the audited documents.

External audits are conducted once every financial year.

External audit process

1. It is important to prepare your team well in advance before beginning an external audit. Usually, each department will be assigned an audit manager, who will be in close contact with the auditor or the auditing firm’s personnel. Each time there are any questions or concerns, the auditor must know who to reach out to. The audit manager must ensure that all relevant documents are ready for quick reference for the auditor.

2. Once you have appointed an external auditor or an accounting firm to conduct the audit, the auditor will thoroughly collect, interpret, and assess your financial and accounting records to understand your business activities. Some of their key responsibilities include proper planning and execution of audit trail procedures, examining finances, and investigating business risks, if any.

3. The auditor may even recreate your financial statements to check if standard accounting principles were followed while preparing them. They may also look at the other competitors in the field to check if your progress is realistic or look for irregularities in your reporting.

4. Once the audit is over, they are likely to hand over a report and give their objective opinion about your business. Their opinions and input are necessary for rating a company’s performance, which acts as an assurance factor for business owners.

Government audits

Tax audits are conducted by government organizations to ensure that all the financial records submitted by a business for returns are tax compliant. There is no specific time or date on which it is conducted. It is mostly conducted randomly or called for in situations of non-compliance or fraud.

Government audit process

1. The key task here is to keep everything organized at all times because you’ll never know for which transaction you might get called for. So keep your bills, receipts, agreement documents, and more organized month by month and year by year. This will help you answer all the questions raised by a government agent.

2. During the audit, the agent and the taxpayer will have conversations where the taxpayer will need to answer the agent’s question with suitable document proof. Once the investigation comes to an end, there are three probable outcomes.

* The taxpayer will AGREE to make the relevant changes pointed out by the IRS agent.

* The taxpayer will NOT AGREE to make the changes and will instead go for an appeal in court.

* The two parties come to the conclusion that everything has been reviewed and no changes need to be made.

Takeaways

The outcome of an audit is crucial for your business. The auditing of your financial records may either spell success or create additional work for you, based on the transparency of your records. But it’s a process worth going through as it provides assurance to stakeholders that your business is true and fair. To nail any audit process, the key task is to keep your business financials up to date. With smart accounting software, you can keep your accounts updated, generate financial reports in no time, and more. Zoho Books is just one solution that can help you achieve these tasks while staying compliant with the recent tax norms across the globe.