Set up Taxes

If you haven’t set up your VAT information while setting up your organization, here’s how you can do it:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Settings.

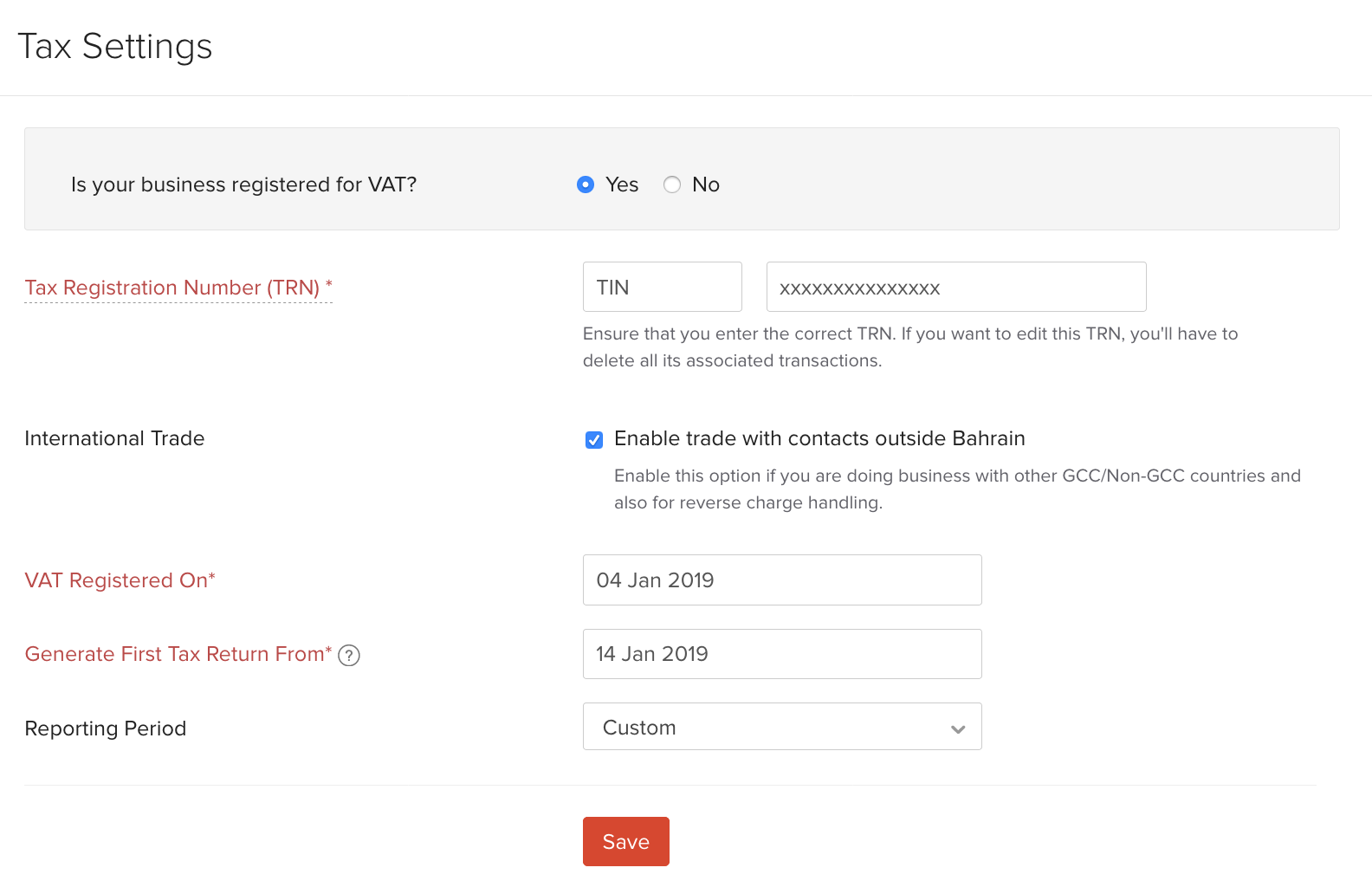

| Fields | Description |

|---|---|

| TRN | Enter the Tax Registration Number provided to you by the NBT. |

| International Trade | If you do business outside Bahrain, mark the Enable trade with contacts outside Bahrain box. This will enable handling of reverse charges. |

| VAT Registered On | Enter the date on which you registered for VAT. You cannot apply VAT on transactions created before this date in Zoho Books. |

| Generate First Tax Return From | Select the date from which you want your tax returns to be generated in Zoho Books. Any transactions created before this date will not be included in your VAT returns. |

| Reporting Period | Set the appropriate start and end date before generating your VAT reports. |

After you set up your tax information, the different tax rates that will be available while creating transactions are:

Standard Rate [5%]

Most transactions that occur in Bahrain fall under this tax rate, unless they belong to a zero-rated or tax-exempt category.

Zero Rate [0%]

A tax rate of 0% can be applied on certain goods and services such as basic food items and education. Learn more about VAT rates in Bahrain.

Exempt

VAT cannot applied be applied on goods or services that are considered to be tax exempt. This tax rate can be selected while creating new transactions.

Out of Scope

If the supply of any of your items does not fall under the scope of VAT, then you can select this option while creating transactions for them.

Next:

Contacts >

Yes

Yes