Back

A customer has paid $200 as down-payment towards the purchase of a new television. How do I record this transaction in Zoho Books?

In Zoho Books, you can create a transaction to record the down payment you received from your customer. There are three methods to do this:

- Create a retainer invoice

- Record a payment received from the customer

- Create a transaction from your bank account

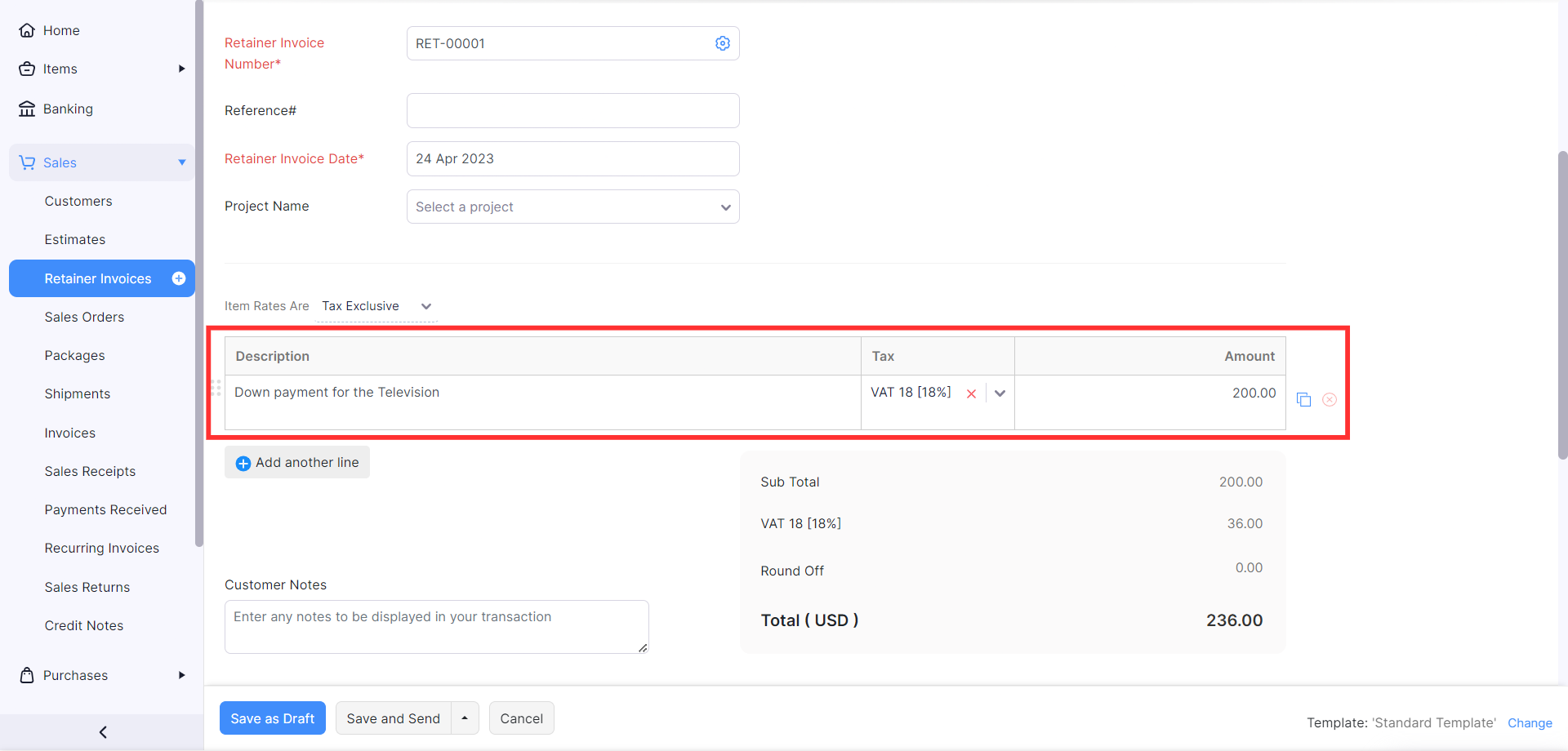

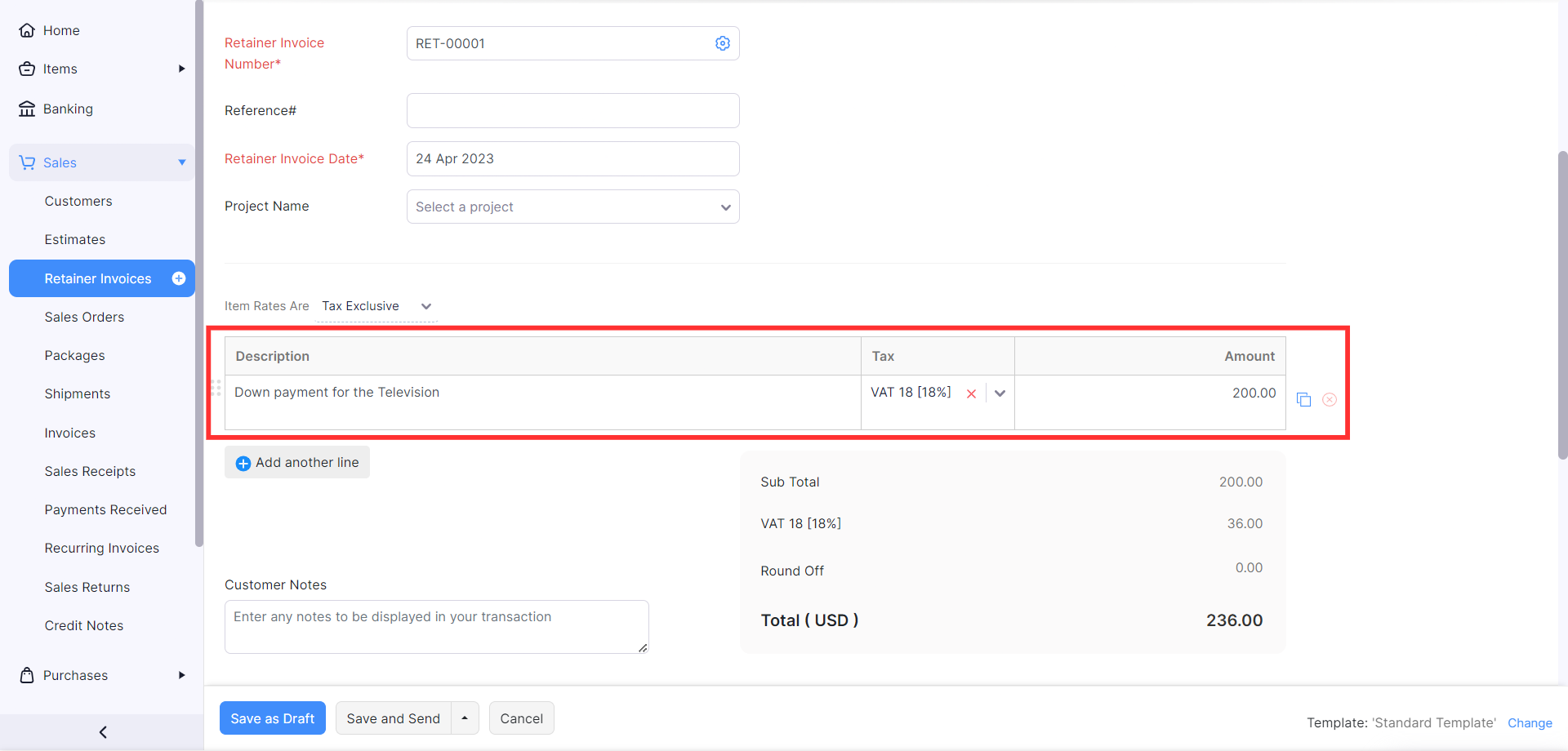

Create a Retainer Invoice

Note: This feature is available in all the editions of Zoho Books except EU.

- Go to the Sales module on the left sidebar and select Retainer Invoices.

- Click + New on the top right corner of the page.

- Select the customer who made the down payment from the Customer Name field.

- In the Item Details section, enter the Description, Tax, and the Amount you received as a down payment.

- Fill in the other necessary details.

- Click Save as Draft or Save and Send.

When you create an invoice for the customer, you will have an option to apply this retainer invoice to the invoice.

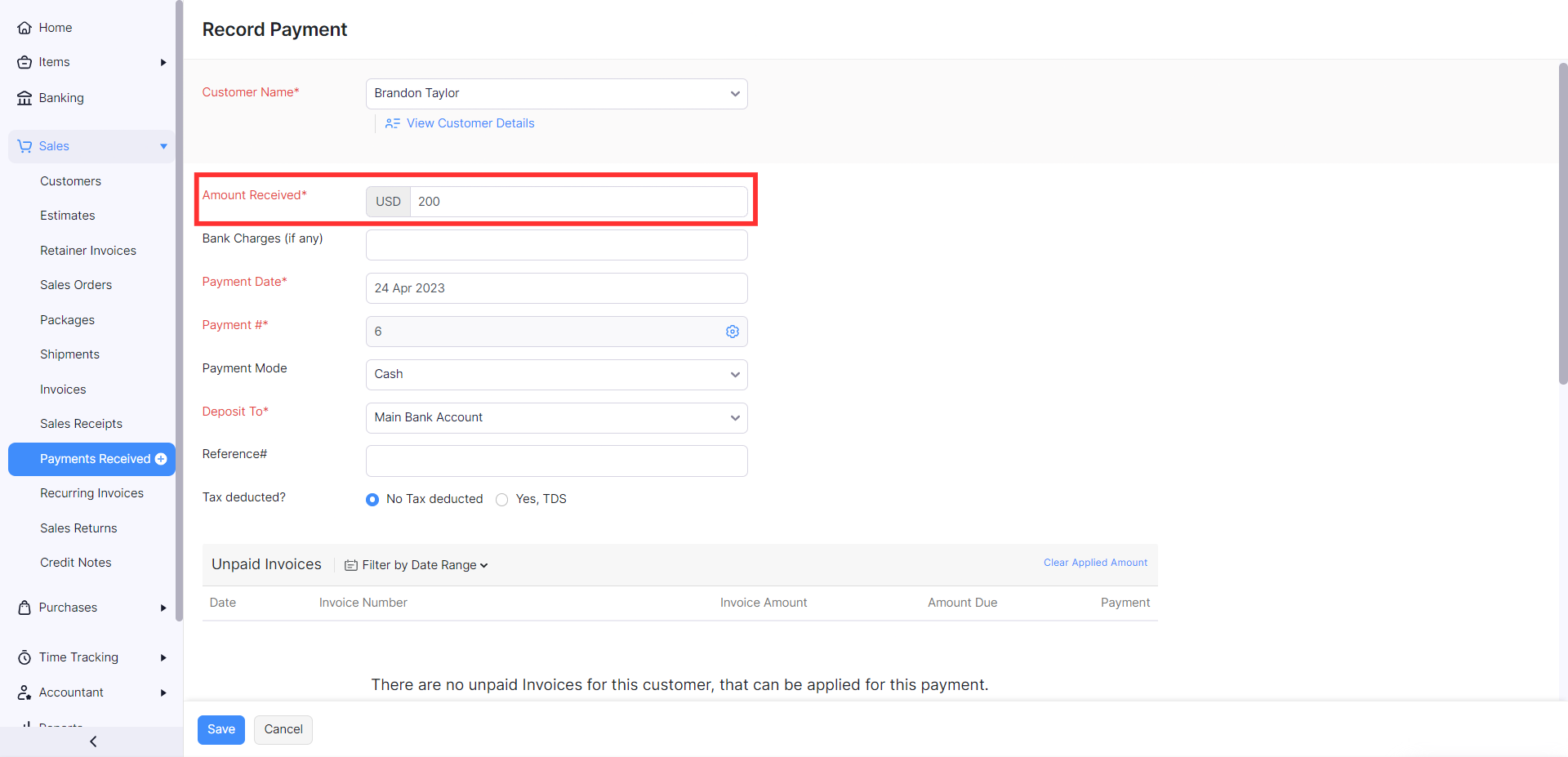

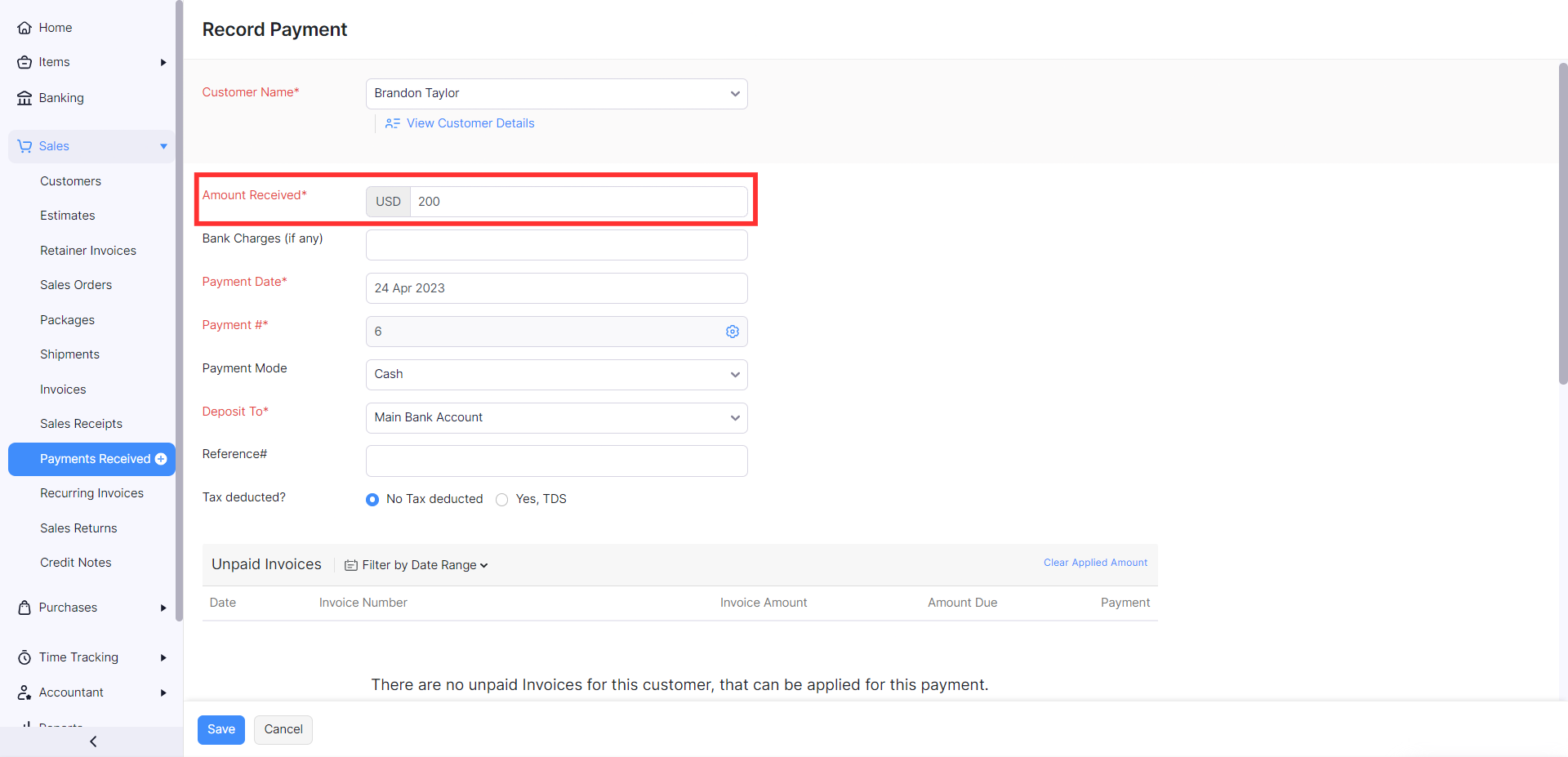

Record a Payment Received From the Customer

- Go to the Sales module on the left sidebar and select Payments Received.

- Click + New on the top right corner of the page.

- Select the customer for whom you’re recording the down payment from the Customer Name field.

- Enter the amount received as a down payment in the Amount Received field.

- Fill in the other necessary details.

- Click Save.

This amount will be saved as unused credits that can be applied to invoices created for this customer.

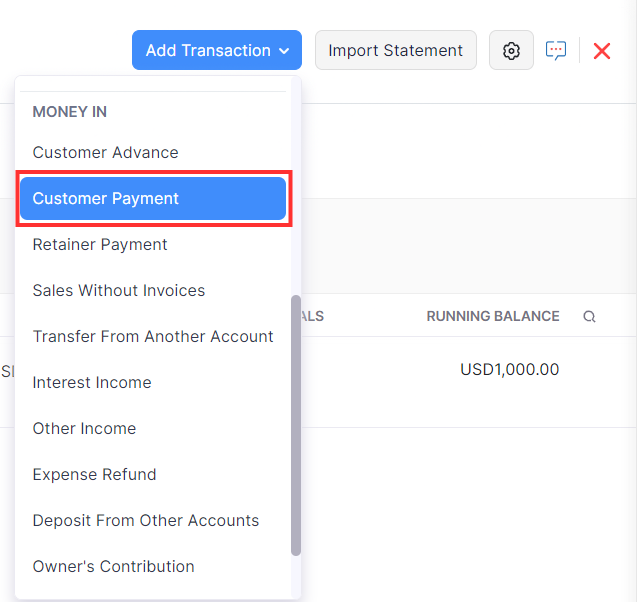

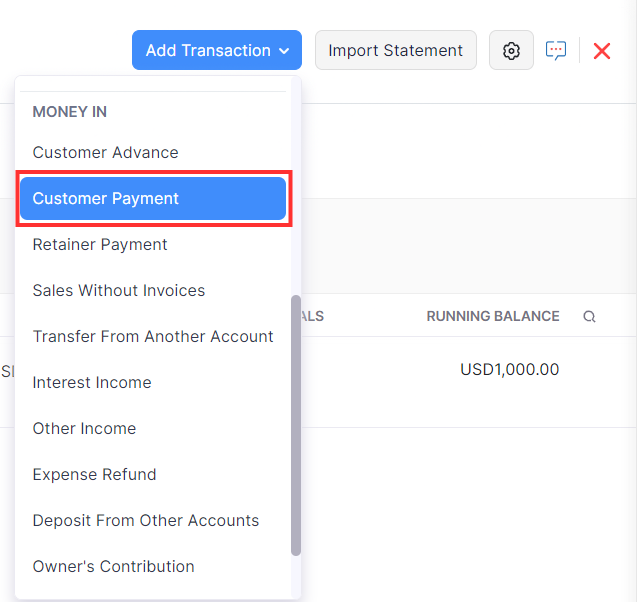

Create a Transaction From Your Bank Account

- Go to the Banking module on the left sidebar.

- Select the bank account in which you want to record the down payment.

- Click Add Transaction on the top right corner of the page and select Customer Payment under Money In.

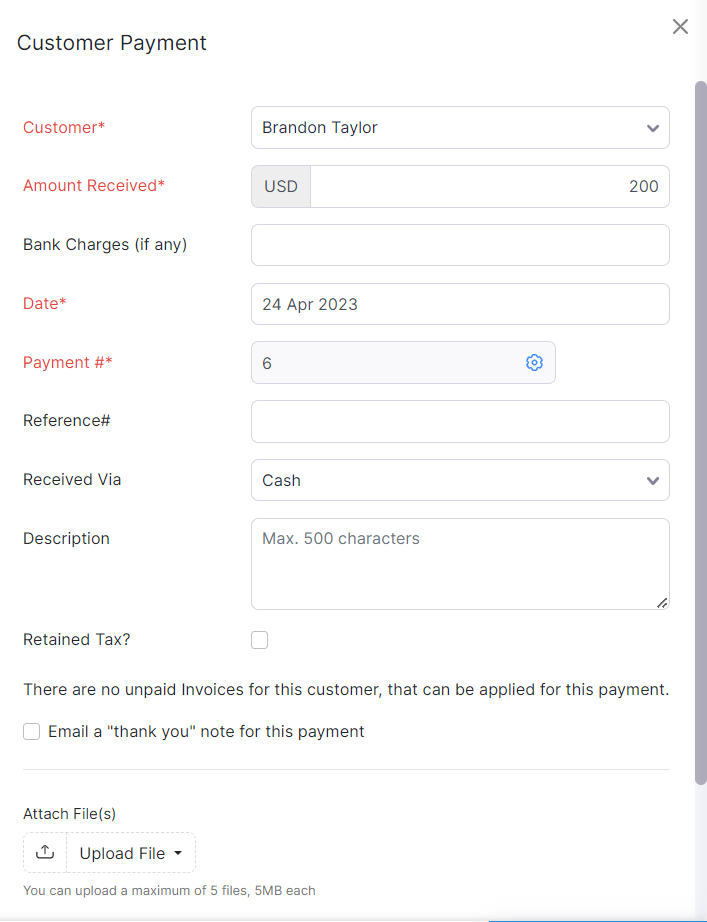

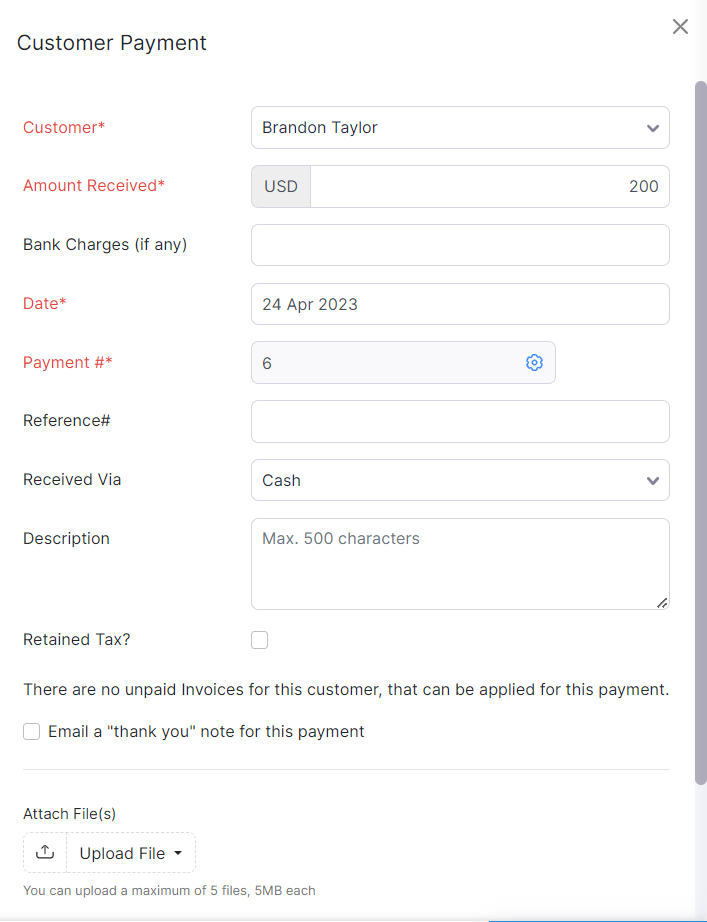

- In the pane that appears, select the customer from whom you received the down payment from the Customer Name field.

- Enter the amount you received as a down payment from the Amount Received field.

- Fill in the other necessary details.

- Scroll down and click Save.

This amount will be saved as unused credits and it can be applied to invoices created for this customer.

Yes

Yes