- HOME

- Taxes & compliance

- Detailed guide on VAT refunds in the United Arab Emirates

Detailed guide on VAT refunds in the United Arab Emirates

What is a refund?

When the input tax is greater than the output tax on a VAT return, the taxpayer can request a VAT refund after filing their VAT return.

Timeline for refunds

When a taxpayer submits a claim for refund, the FTA will process and review the application within 20 business days of submission. The taxpayer will be notified regarding the FTA’s decision to accept or reject the claim. If the process exceeds the timeline of 20 days, the FTA will notify the taxpayer regarding the extension of the deadline

VAT refund form

The VAT refund form contains the following fields:

TRN (Tax Registration Number): This field is pre-populated based on the information in the taxpayer’s account in the User Profile tab. It’s advisable to verify if the correct TRN is listed.

Total amount of Excess Refundable Tax (in AED): This field is pre-populated based on the formula, Refunds - Penalties = Excess Refundable Tax. This includes refunds reported in all previously submitted VAT returns, and all administration penalties due except for the late registration penalty.

The amount you wish to have refunded (in AED): The amount you enter must be equal to or less than the amount displayed in the Total amount of Excess Refundable Tax field.

Remaining amount of eligible Excess Refundable Tax: This field is pre-populated with the amount of refundable tax that you can apply for in the future.

Late registration penalty amount (in AED): This field is pre-populated based on the penalties imposed on you and whether you have settled the penalty amount or not:

- If you’re free from penalties, then the field will display Zero (AED).

- If you have been charged a penalty, which you have paid, then the field will display Zero (AED).

- If you have been charged a penalty, but you’re yet to pay the amount at the time of claiming this refund, then the field will display the penalty amount. If the refund amount is negative after deducting the penalty amount, your application will be automatically rejected after submission. If the refund amount is positive after deducting the penalty amount, only the balance will be submitted to the FTA for refund claim purposes.

Authorised Signatory and Declaration: The authorised signatory is pre-populated by the system in both English and Arabic. Make sure you read the declaration thoroughly before ticking Yes to submit the form.

Submitting a refund claim

To submit a refund claim:

- Log in to the FTA’s e-Services portal.

- Go to the VAT tab, then the VAT Refunds tab, and access the form by clicking VAT refund request.

- Complete the form. Some of the fields are pre-populated using the details from your account. Make sure that the details you’ve entered are correct, then submit the form by clicking ’Submit’.

- After you submit the form, you will receive an email from the FTA to notify you of the result of your refund application. Once the claim is approved, the refund will be processed within 5 business days.

- You can verify the refund amount by checking your balance from the My Payment tab under the Transaction History section in the e-Services portal.

Special VAT refund procedure

There are special VAT refund procedures for business visitors, and UAE nationals involved in the construction of new residential buildings.

Business visitors

Eligibility criteria

Foreign business owners can apply for VAT refunds if they satisfy the following eligibility criteria:

- The business should be located in a GCC member state other than the implementing state. The business should be a foreign entity that carries on business operations, but does not have a place of establishment or fixed establishment in the UAE.

- The business owner should not be a taxable person in the UAE.

- The business should be registered in the GCC member state where it’s located.

- The business should be located in a country that provides VAT refunds to UAE entities.

Timeline

The timeline for each refund claim is 12 calendar months. The first refund application should be made at the end of 2018.

VAT refund limit

The minimum amount of each tax claim submitted by business visitors under the Foreign Businesses Scheme is AED 2000.

Procedure

To submit a refund claim:

- Download the form from the FTA website and fill in all the fields in the PDF. Your form will be rejected if it’s filled by hand.

- Print out the form and add your signature and official stamp. Once you’ve filled out the form, scan it and submit the soft copy to specialrefunds@tax.gov.ae.

- Only PDF, JPG, JPEG and PNG file types are accepted and the total size limit is 5 MB. You will be notified via email once you’ve successfully submitted the form.

UAE nationals involved in building new residences

UAE nationals building new residences need not set up an e-Services account to submit a refund claim. They can use the refund form downloaded from the FTA website to claim a refund.

Eligibility criteria

The person claiming the refund must be a UAE national, and they should provide supporting documentation showing their national status, such as a family book or passport.

What is reclaimable?

VAT refunds can be claimed if the expenses meet the following criteria:

Usage of expenses: The expenses should be used on a newly constructed building solely intended to be used for residential purposes by the applicant or their family. You cannot claim refunds for expenses spent on buildings like hotels, guest houses, and hospitals.

Nature of expenses: The expenses should be spent on certain goods and services:

- Services provided by contractors (including builders, architects, and engineers).

- Building materials and goods that are incorporated into the building by the contractor.

Here’s a list of incorporated goods that are eligible for VAT refund:

- Central air conditioning and split units

- Fire alarms and smoke detectors

- Doors, flooring (excluding carpets), window frames and glazing, wiring (when embedded inside the building)

- Sanitary and shower units

- Kitchen sinks, work surfaces, and fitted cupboards

Timeline

You should submit your refund form to the FTA within 6 months after the date of completion of the building. The date of completion is the earlier of:

- When the building becomes occupied

- When the building is certified as completed by the Municipality as mandated by the FTA

Procedure

The FTA has come up with new provisions to help UAE nationals who are building a new residence to apply for VAT refunds using the FTA e-services portal. If you are a new user registering only for the purpose of applying for the New Residence VAT Refund, don’t register as a Taxable Person. Go to services.tax.gov.ae and create an account using the Sign up button in the top right hand corner of the page. Follow the given procedure exactly.

If you are an existing user, you can simply log in to your account and follow the procedure to apply for the New Residence VAT Refund.

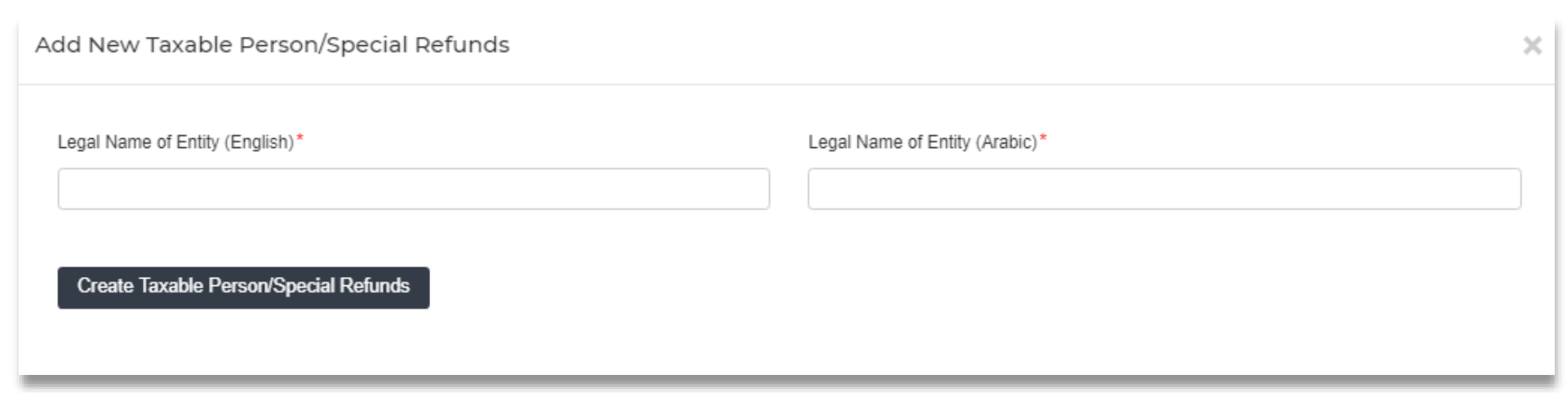

How to create a new taxable person account

- Click the Add New Taxable Person/Special Refunds button within the dashboard.

After entering your legal name as it appears on your Emirates ID in English and Arabic, click the Create New Taxable Person/Special Refunds button. The account will be automatically added without any additional approval process.

Now you can access your account by clicking Access the Taxable Person’s account/Special Refunds button on the home page of the FTA e-services portal.

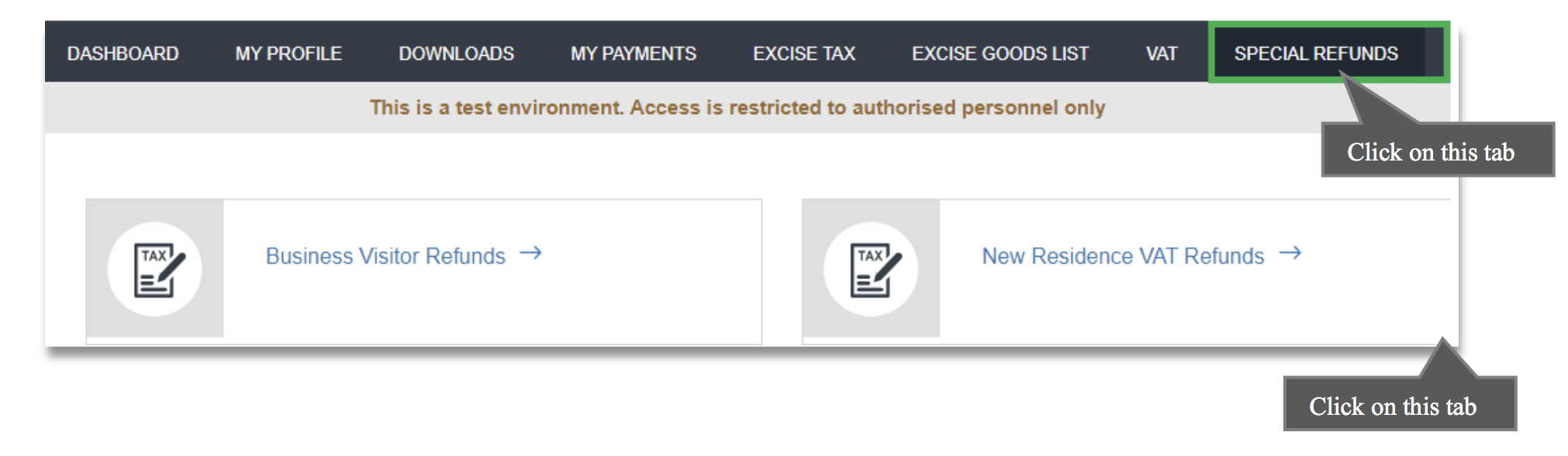

How to apply for the New Residence VAT Refund

- Click on the New Residence VAT Refunds tab from the Special Refunds menu on the Taxable Person dashboard.

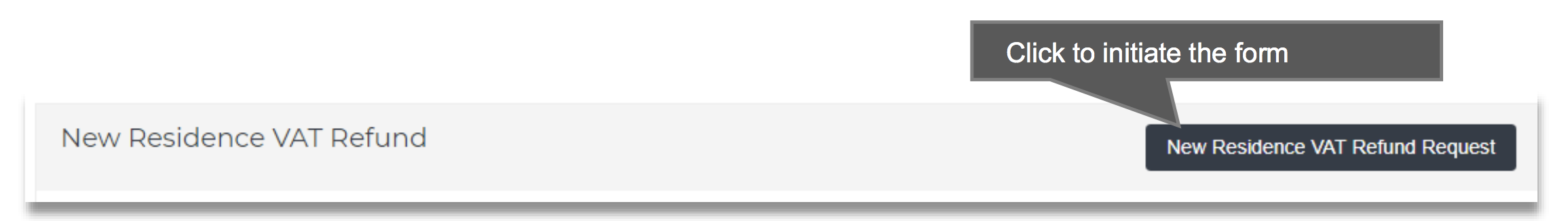

- Then, click New Residence VAT Refund Request to initiate the process.

How to fill and submit the VAT refund request form

Fill in the details requested by the form, upload scanned copies of the following supporting documents, and submit the form. Accepted file types are PDF, JPG, PNG and JPEG. The individual file size should be less than 5MB.

- A copy of your passport, Emirates ID, and family book

- Document to prove that you own the specific plot of land in the UAE

- Documents to support your claim regarding the date of completion of the building

- Documents to support your claim that the building is occupied (such as utility bills)

- A copy of the funder certificate

- A copy of the building permit

- A copy of your bank account confirmation certificate

Below are the details that the VAT refund request form will ask for.

Applicant details

| Field | Description |

|---|---|

| Full Name (in English or Arabic) | This is a mandatory field. The name given here should be the same as on your Emirates ID. |

| Email address | Provide your valid email address. |

| Emirates ID | Enter your valid Emirates ID. |

| Upload Valid Emirates ID | Upload a scanned copy of your valid Emirates ID. The individual file size limit is 2MB. |

| Family Book Number | Enter your family book number. |

| Upload Family book copy | Upload a scanned copy of your Family Book. |

| Are you registered for VAT? | Answer “YES” if you are registered for VAT and a TRN is assigned to you. Answer “NO” if you are not registered for VAT |

| TRN (applicable if registered for VAT) | Enter your assigned TRN number if you have answered “YES” for the previous question. |

| Have you included the housing costs in your return? | You must answer “YES” if you are registered for VAT and the housing costs for which you are seeking refund have been recovered in your tax returns Answer “NO” otherwise. |

Claim details

| Field | Description |

|---|---|

| Funder Name | This is applicable if you have selected either Housing Program Fund or Housing Program and Personal Fund in the Request Fund Type field. Enter the government body or entity which provided you with the housing fund. |

| Upload Funder certificate | Upload the declaration letter provided by the funding body (if you have selected either Housing Program Fund or Housing Program and Personal Fund option in the Request Fund Type field). |

| Date of Property Completion Certificate | Select the date mentioned on the Property Completion Certificate. Note: You must apply for the refund within 6 months of this date of property completion. |

| Upload Property Completion Certificate copy | Upload a copy of the property completion certification. |

| Upload Building Permit copy | Upload a scanned copy of your building permit if the property is in AI Ain or Ras AI Khaimah. |

Applicant contact details

| Field | Description |

|---|---|

| Property Plot number | Enter the property plot number of the newly constructed building for which you are requesting a refund. |

| Building number (if any) | Enter the building number for which you are requesting a refund. |

| Upload Property Site plan | Upload a scanned copy of your property site plan. |

| Street, Area, City, Emirate | Enter the address of the building for which you are claiming a refund. |

Expense Details

| Field | Description |

|---|---|

| Total of the Tax claimed | Enter the total sum of money spent on property construction. This will be the money requested for a refund. |

| Have all the materials purchased been used for the construction of building? | Answer “YES” or “NO”. |

Banking details

In this section, you need to provide your bank details. This bank must be established in the UAE.

Before entering your bank details, check with your bank to find out whether your account can process payments electronically. Since the refund will be processed to your bank account, ensure that you provide accurate bank details.

| Field | Description |

|---|---|

| IBAN | Enter the International Bank Account Number. You can find this information in your bank account or contact your bank for details. |

| Bank Name | Enter your bank name. |

| Bank Name/Location | Enter the name or location of the specific branch of your bank where you have your account. Contact the bank for details. |

| Account Holder’s Name | Enter the correct name of the account holder. This should be the same as the applicant’s name. |

| Account Number | Enter your bank account number. |

| Upload Bank Account confirmation letter/certificate | Upload a copy of a letter/certificate issued and stamped by your bank, including details such as account holder name, bank’s name and IBAN number. |

User comments

| Field | Description |

|---|---|

| Are you planning to apply for a VAT refund for the retention of the same property later? | If you intend to request a VAT refund later, check this box. |

Declaration

| Field | Description |

|---|---|

| I hereby declare I am the owner (a UAE national) and all the information in this form is correct and that the new residence for which the New Residence VAT Refund has been requested will be used exclusively by myself or my family members. I acknowledge that the Federal Tax Authority may claim the refund if it finds that I do not meet the specified conditions. | Check the box next to the declaration to confirm that you agree with the declaration Terms and Conditions. |

It is recommended that you save the form as you complete each field by clicking the Save as draft button at the bottom of the screen, since you will be logged out of the system after 10 minutes of inactivity. Once you have filled in the form fields and uploaded the necessary documents, carefully review the form once again and click the Submit button in the bottom right corner of the screen. Once the form is submitted, the status of your request will change to Pending on the dashboard.

If FTA needs any additional information from you to verify your refund request form, you will be notified about the information required via email.

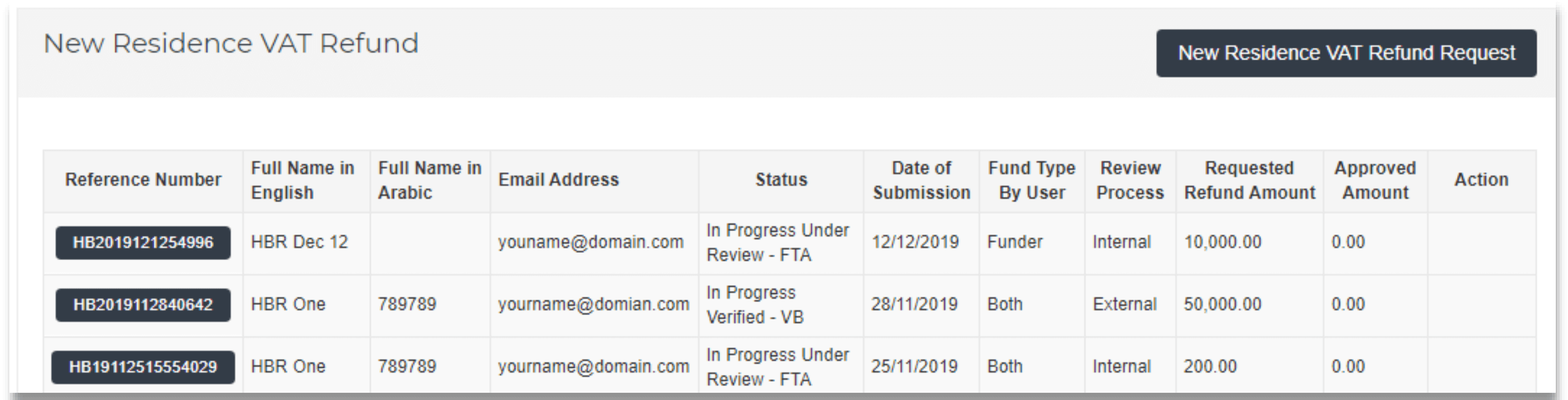

How to check the status of your VAT refund request form

- You can check the progress of your refund request in the Status field on the dashboard.

| From Status | Explanation |

|---|---|

| Drafted | You have not submitted your in-progress refund request form. |

| Pending | The form has been received by the FTA and is pending review. |

| Resubmit | The FTA requires additional information after reviewing the form. |

| In Progress - Under Review FTA | An FTA official is currently reviewing your refund request form. |

| In Progress - Under Review VB | A Verification Body official is currently reviewing your refund request form. |

| In Progress – Verified FTA | An FTA official has reviewed your form and submitted for approval. |

| In Progress – Verified VB | The form has been verified by the Verification Body and submitted back to FTA. |

| Reviewed | FTA has completed the review and your request will be processed shortly. |

| Reject | The refund request has been rejected. |

| Approved | The refund request has been approved and the refund has been processed. |

After successful form submission, you will receive an acknowledgement email from the FTA confirming the receipt of your request.

If FTA requires any additional information, you will be notified via email with a list of details you need to provide. In this case, the refund form will be in Resubmit status. You can edit the form with additional details while it is in this state.

Procedure for form resubmission

- Log in to your account. Your refund request form will be in Resubmit status.

- Click the Edit button to update or add information.

- If needed, you can leave comments for FTA before resubmitting the form. Use the Resubmit Comment field at the bottom of the form.

- Click the Resubmit button. Your updated request form will be sent to the FTA for review.

Verification Body

A Verification Body is an FTA-approved third party that reviews expenditure, invoices, and VAT incurred by applicants to verify their refund claims.

Documents to be submitted to the Verification Body

The following documents should be submitted to the Verification Body:

- The refund form which includes your reference number. This form will be stamped and shared by the FTA.

- The construction plan of your building

- The tax invoices which will be used to claim refunds. You should make sure that these invoices include valid TRNs, VAT amounts, and the name of the applicant/owner. Simplified invoices will not be accepted.

Procedure

Your Verification Body will provide details about how to proceed with the application and what fees they will charge for the review process. You cannot claim VAT refunds for the verification body fees.The verification body will process your request within 15 days and hand over the signed and stamped verification report to the FTA. This report will contain the total VAT amount to be refunded. You will also receive a copy of the report from the verification body.

Processing by the FTA

The refund application will be processed by the FTA within 20 business days, once they receive the verification report from the verification body. The taxpayer will be notified regarding this via e-mail and once the claim is processed and approved, the FTA will make the refund payment within 5 business days.