- HOME

- Taxes & compliance

- File UAE VAT Returns with Zoho Books: What You Need to Know

File UAE VAT Returns with Zoho Books: What You Need to Know

The VAT regime has had a major impact on business owners and their accounting. This new tax system has been in the works for quite some time, and business owners have had their share of concerns about how they would be affected. Now that it’s here, we can see that it hasn’t just impacted the price of goods and services, but also changed the way that business owners record their sales and accounts. The new requirements laid down by the Federal Tax Authority (FTA) has business owners scrambling to find appropriate accounting software. For some business owners who’ve been using manual accounting up to now, the VAT regime marks the first time they’ve had to use accounting software at all.

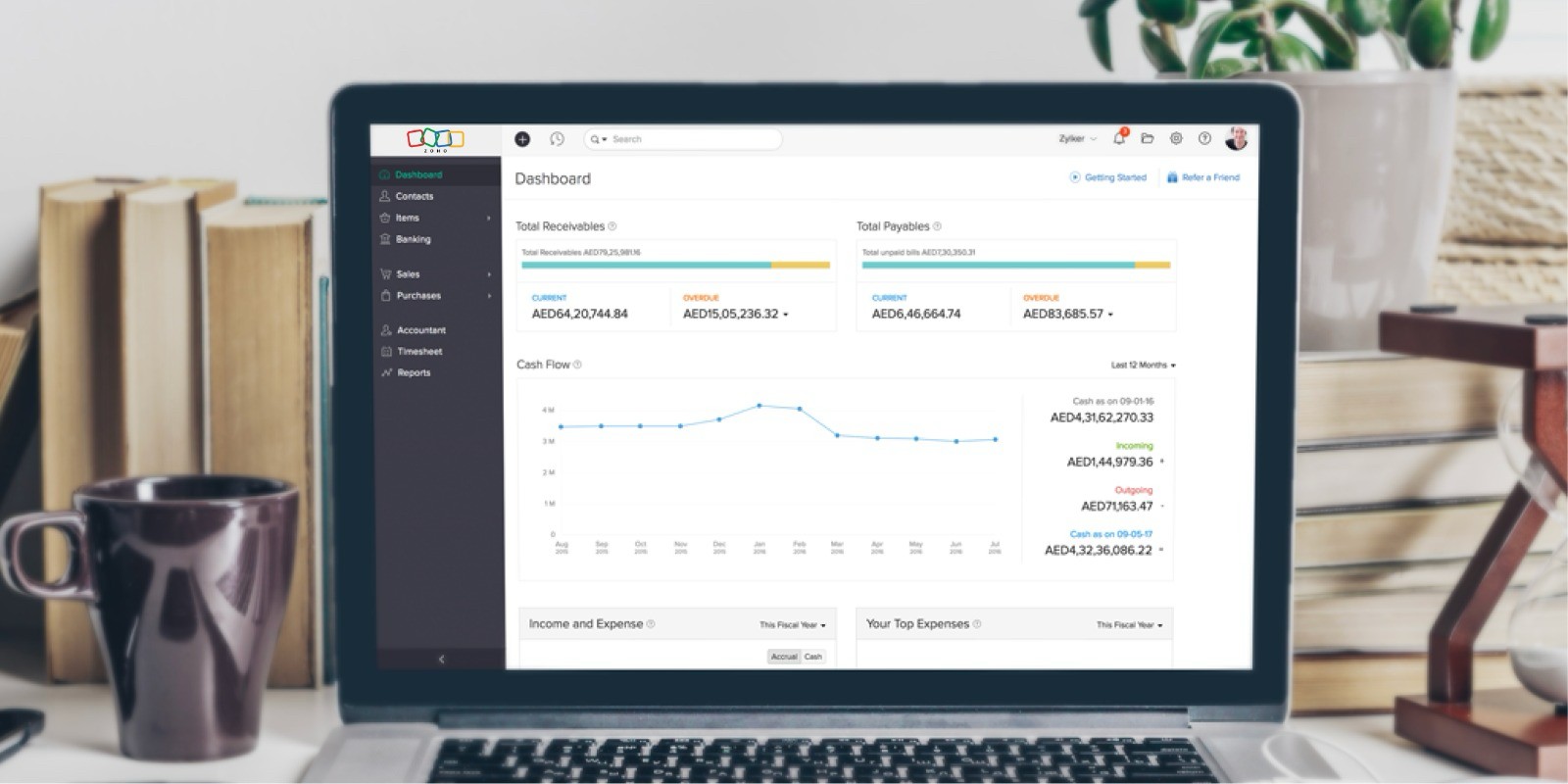

To help business owners manage their finance and stay VAT compliant, we’ve made Zoho Books VAT-ready. With Zoho Books you can complete business transactions, manage your customers and vendors, issue VAT compliant documents, generate reports, and file your tax returns in a few clicks. Zoho Books, an FTA Accredited VAT compliant software, now lets you to file VAT returns with the EmaraTax portal directly.

Let’s take a look at what VAT-ready business owners need to do with their accounting software.

Issue VAT compliant documents

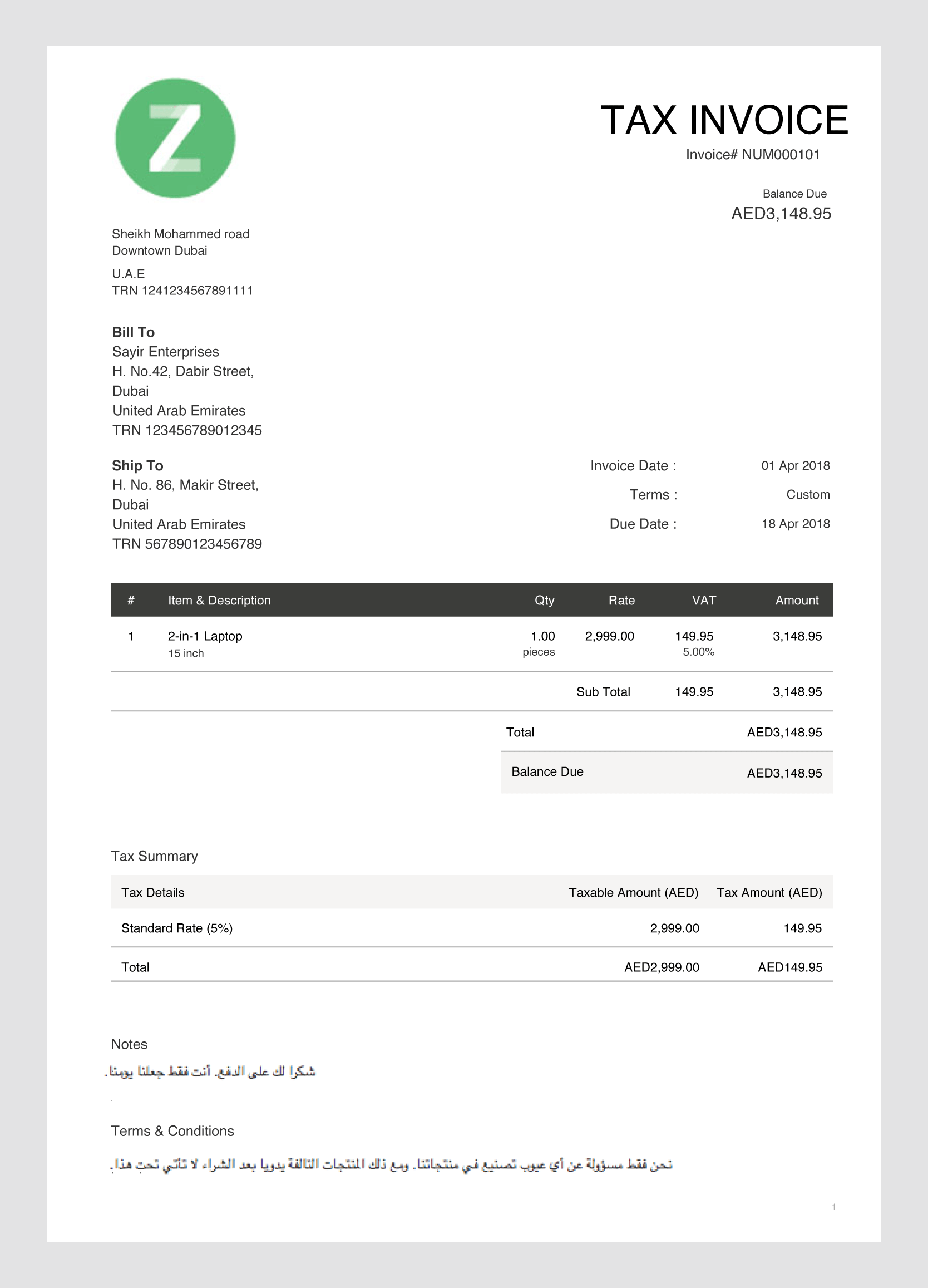

The FTA has established certain rules for transaction documents and the data fields that they should contain. Leaving out important specifications, or generating documents that do not comply with the laws, is likely to attract a heavy penalty from the FTA.

With Zoho Books, you can issue FTA-approved documents like tax invoices, self-billed invoices, bills, and credit and debit notes. Transactions that involve the reverse charge mechanism are explicitly identified on the document.

You can also customize your invoices or use templates to add a dash of your personal touch and ensure brand recognition. Starting with the included templates, you can format your invoices and rearrange data fields to suit your business.

Record the right transaction details

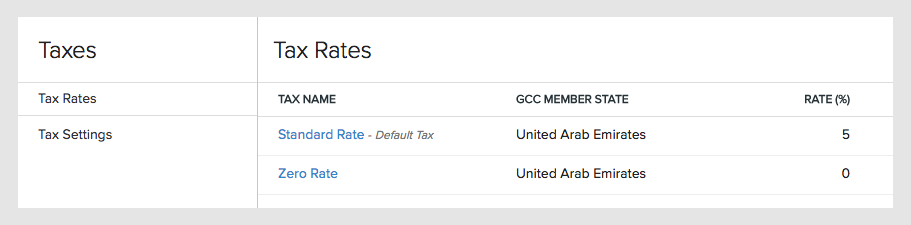

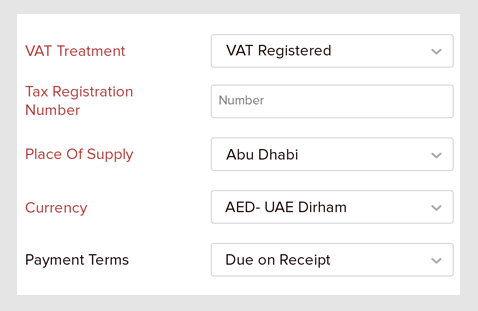

FTA’s new regulations require business owners to record details like the VAT rate and place of supply for each transaction. Keeping the tax laws and the needs of business owners in mind, Zoho Books has been designed to ease the process of recording transactions.

Business owners who handle transactions both inside and outside the UAE can divide their customers and vendors into VAT registered, non-VAT registered and non-GCC entities.

These categories make it easy to record the Place of Supply and select the appropriate VAT rate for each transaction. Special designations for excise goods (like tobacco) and digital services (like animation) help ensure the right VAT rates for each supply.

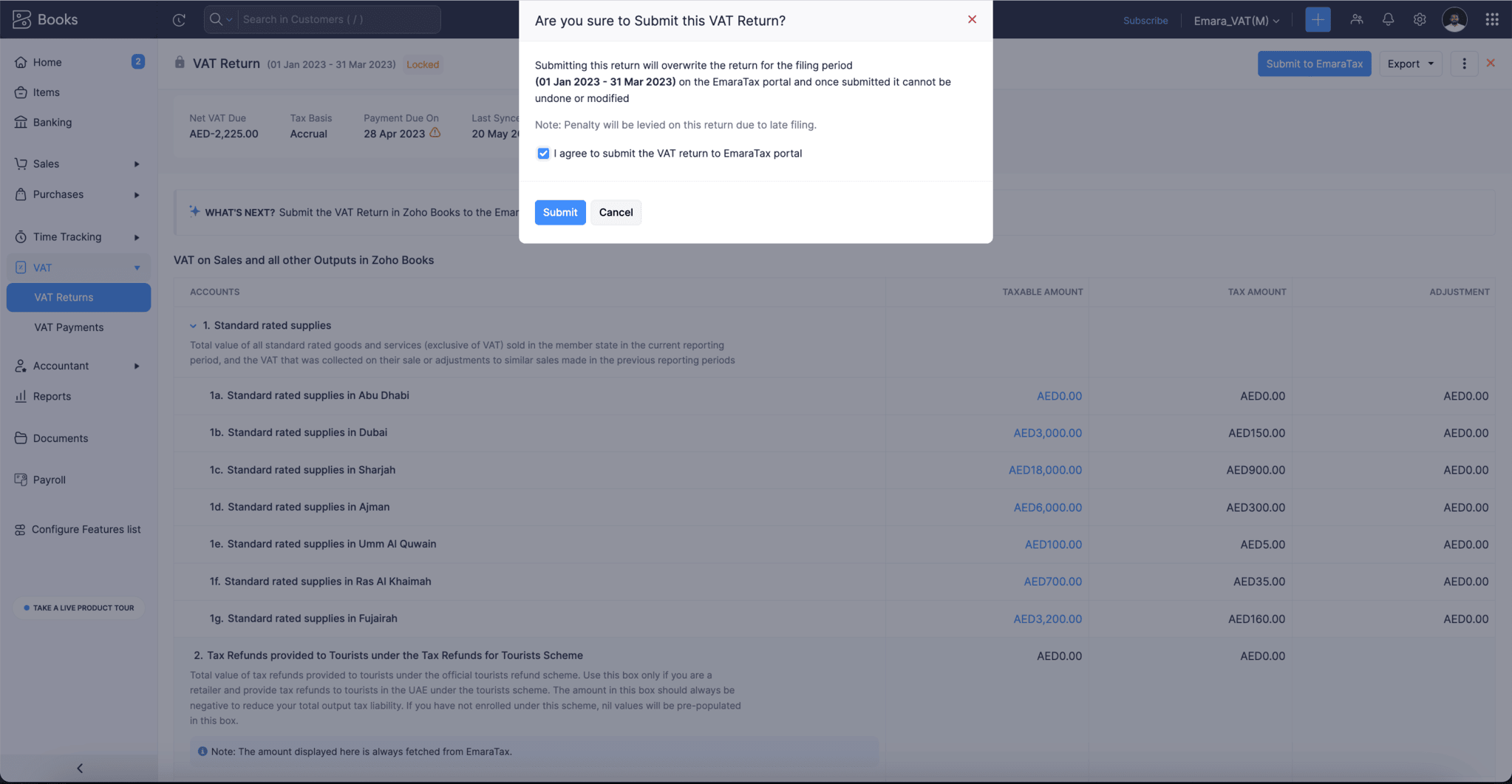

File your VAT returns directly with EmaraTax portal through Zoho Books

Registered business owners in the UAE must file a VAT return each tax period, which can be monthly or quarterly, depending on the business’s annual turnover.

Filing VAT returns for the first time can be a little confusing, and switching between multiple platforms to generate and submit returns may increase the risk of errors.

Zoho Books simplifies financial operations by seamlessly connecting to the EmaraTax portal. This integration lets businesses stay compliant with the VAT regulations while also allowing them to identify and review mismatches, ensuring VAT returns can be filed directly from Zoho Books with ease.

What this update enables you to do:

Connect your Zoho Books organization with the EmaraTax portal, minimizing the need to switch between platforms and tools.

Not only see your VAT Returns generated in Zoho Books, but also fetch your filed reports from the EmaraTax portal.

Include unfiled transactions from the previous period.

Verify, lock, and push VAT201 directly to the FTA EmaraTax portal.

Track VAT payments and VAT reclaim to maintain financial compliance.

Check out our help doc to learn more about the processes involved in filing VAT returns to EmaraTax in the Zoho Books.

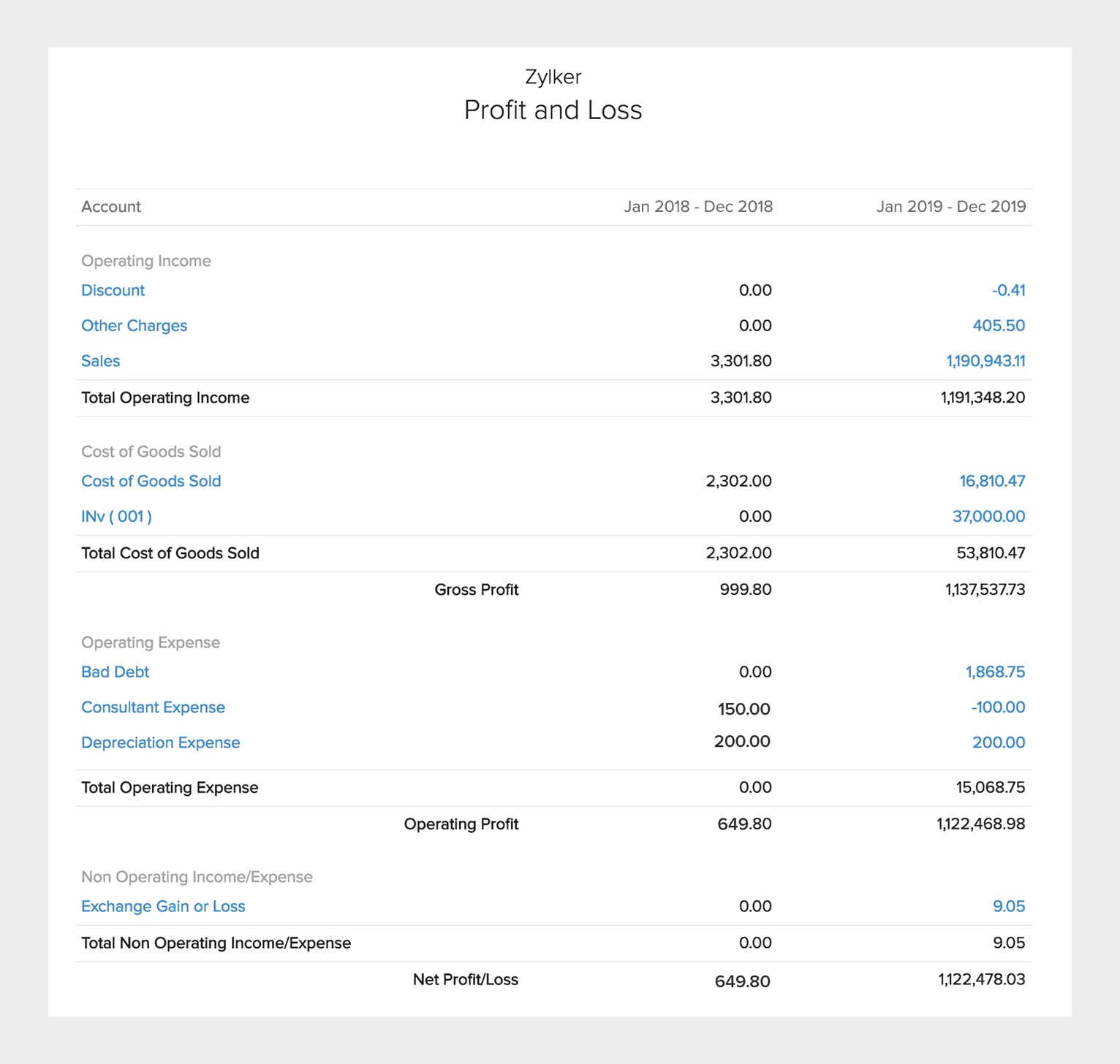

Generate insightful reports to facilitate business decisions

To make important business decisions, business owners should have a clear picture of their business finance. Financial reports provide detailed insights on the financial position of the firm and the cash flow. Right from allocating resources to analyzing the results of strategies, reports play a vital role in the financial aspect of a business. With Zoho Books, you can generate valuable business reports like Balance Sheets, Profit and Loss statements, and Cash Flow statements to stay on top of your business finance.

In case of audits, business owners should provide the FTA Audit File (FAF)- a master file that contains information on all the sales and purchase transactions, suppliers and customers, and transaction level data. Using Zoho Books, you can generate the FAF against every VAT return.

Maintain secure financial data

According to the FTA, every business in the UAE should keep a backup of their financial and accounting records for a period of at least 5 years, irrespective of their VAT registration status.

Business owners can be at ease regarding their data back-up, because at Zoho, we offer our users top-notch data security, which is better than maintaining data on their personal computers or servers. Zoho services are accessed by several million users worldwide; this includes individuals, small and medium businesses and large organizations. To ensure security and data protection, Zoho has an extensive set of rules, policies, practices and technologies. Learn more about Zoho’s Security Practices, Policies and Infrastructure.

Learn about VAT compliant accounting

Zoho Books provides a comprehensive set of VAT help guides for the benefit of taxpayers and auditors. Using these resources, users can learn how to configure their Zoho Books account for easy VAT compliance, gain in-depth understanding of the new requirements, and get ready to file accurate returns.

With Zoho Books, a one stop accounting platform, you are not just streamlining your accounting process, but also ensuring your on top of compliance at all times with the latest FTA e-filing capability.

Sign up today to simplify your VAT filing!