How do I write of a customer’s opening balance?

To write off a customer’s opening balance, you’ll have to:

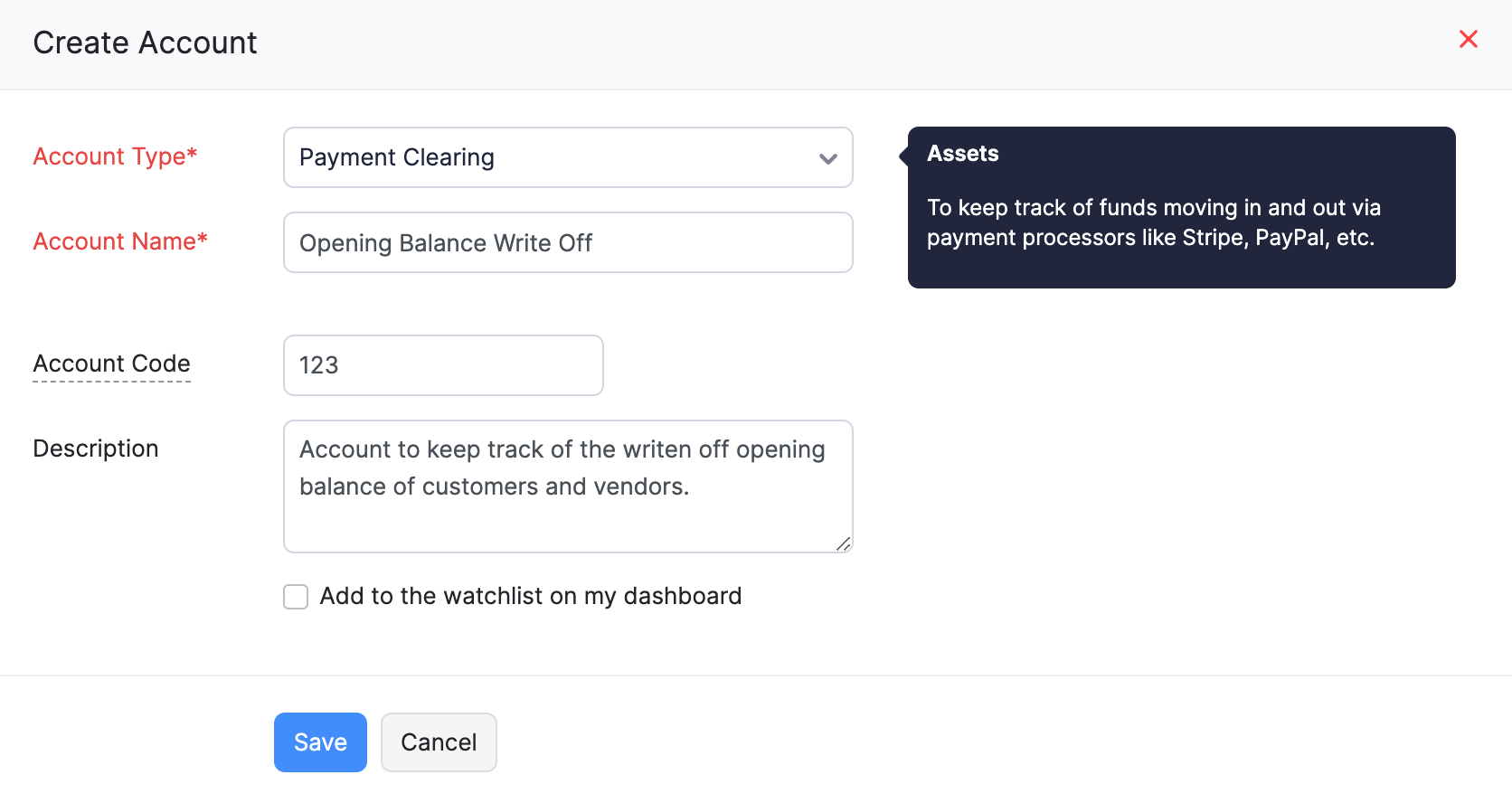

Create an Account

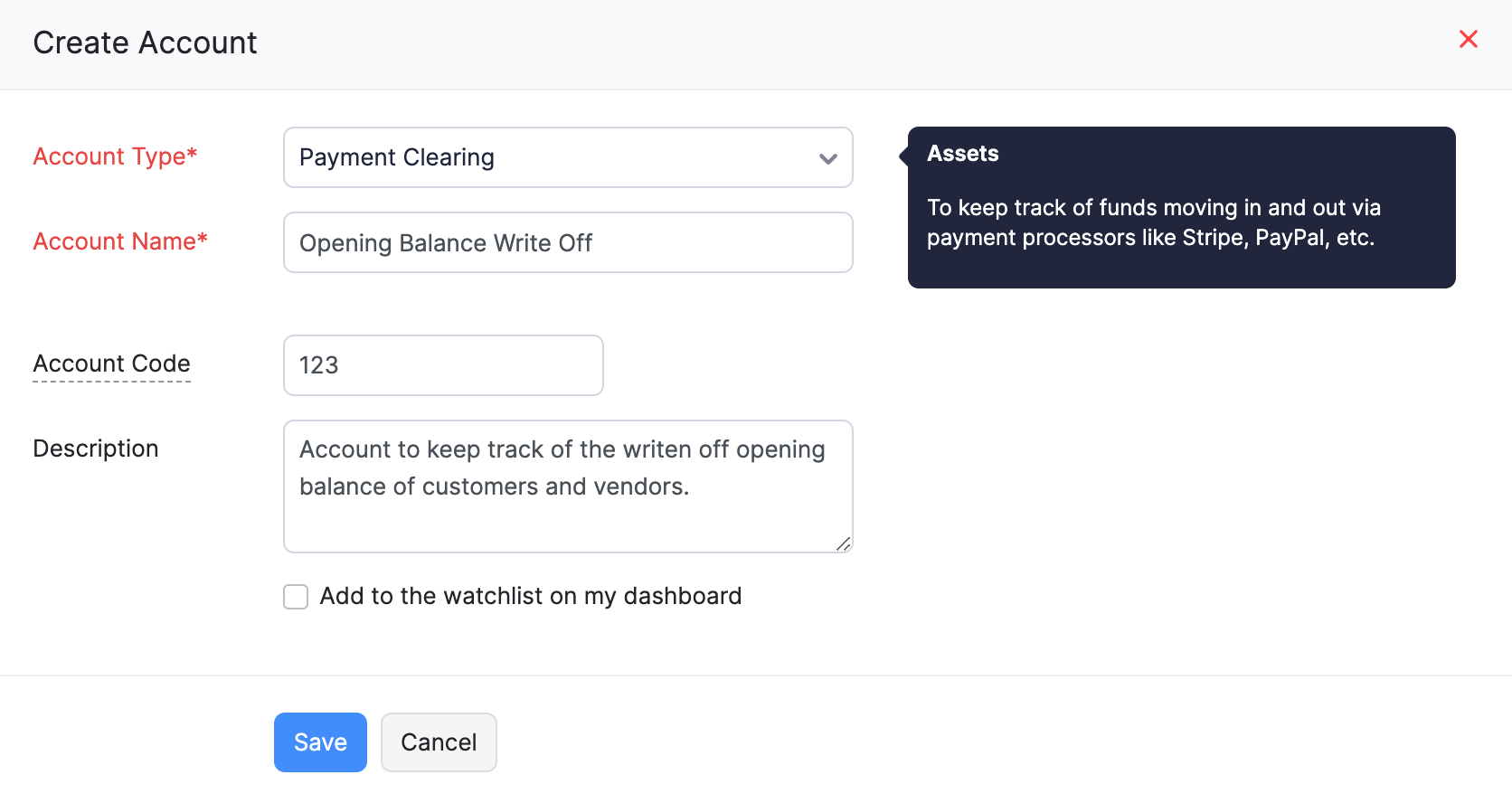

You have to create an account through which you can track the written-off opening balance. Here’s how:

- Go to the Accountant module on the left sidebar and select Chart of Accounts.

- Click + New Account in the top right corner of the page.

- In the Create Account pop-up:

- Enter a suitable Account Name, for example, Opening Balance Write Off.

- Select Payment Clearing as the account type from the Account Type dropdown.

- Enter the Account Code and provide a short Description for the account if required.

- Click Save.

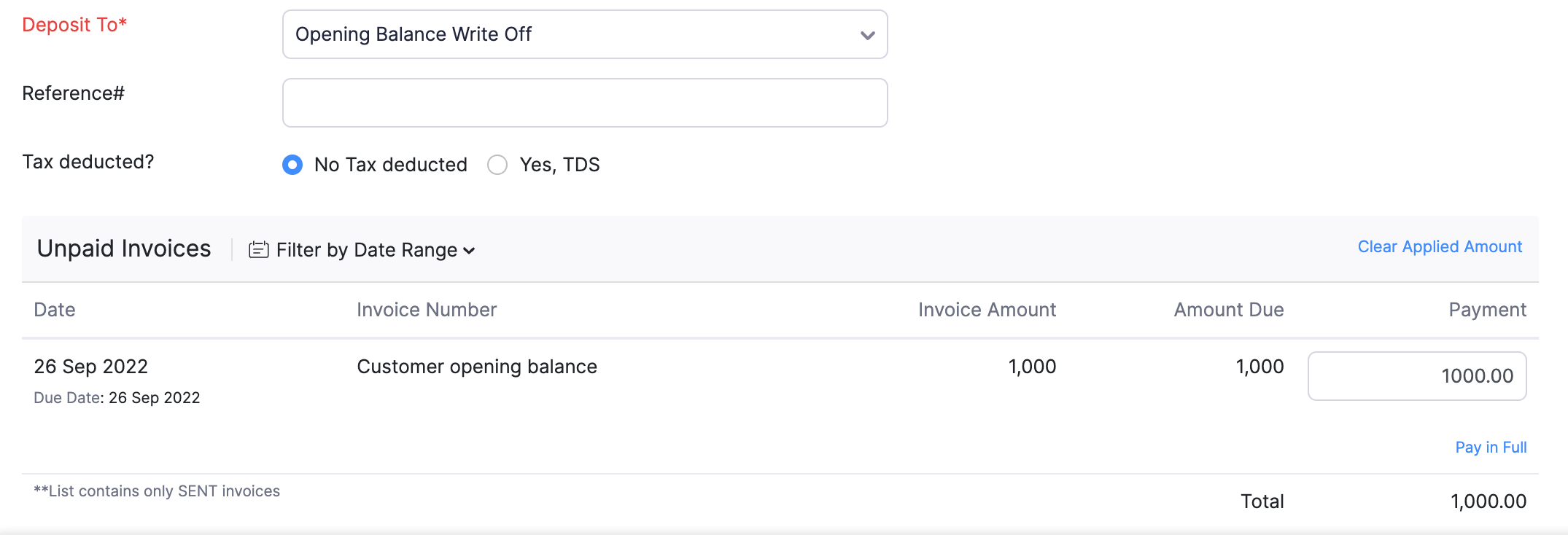

Record Payment for the Opening Balance

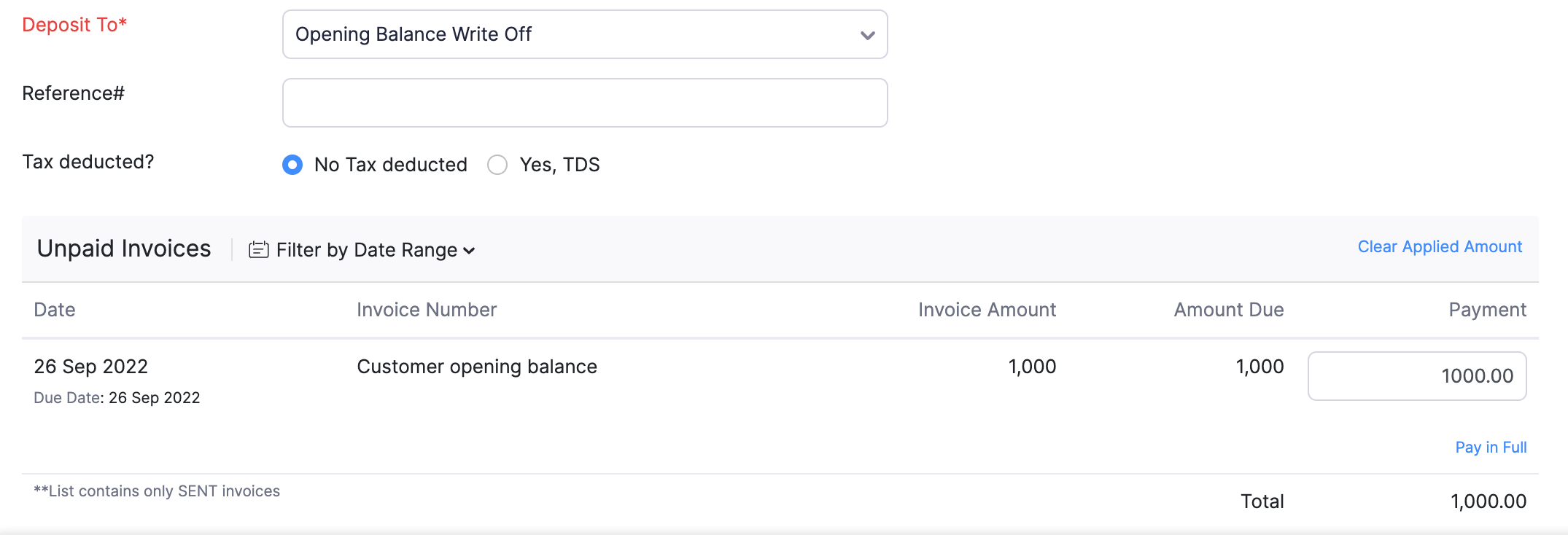

You have to record a payment to offset the customer’s opening balance and account for the noncollectable debt. Here’s how:

- Go to the Sales module on the left sidebar and select Payments Received.

- Click +New in the top right corner of the page.

- On the Record Payment page:

- Select the customer whose opening balance you want to write off from the Customer Name dropdown.

- Select Opening Balance Write Off from the Deposit To dropdown.

- Enter the amount in the Customer opening balance row in the Unpaid Invoices section.

- Enter the other necessary details and click Save.

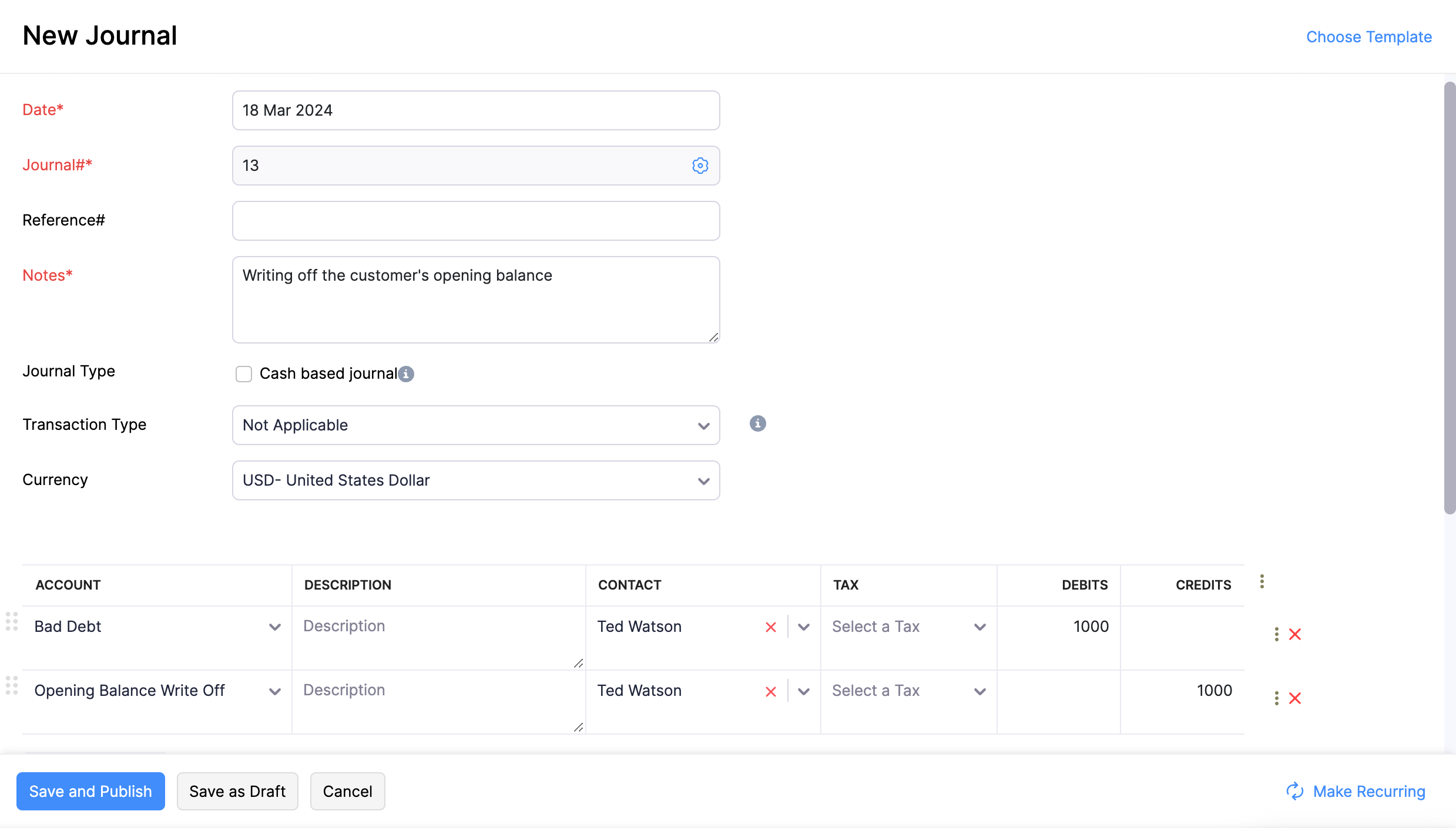

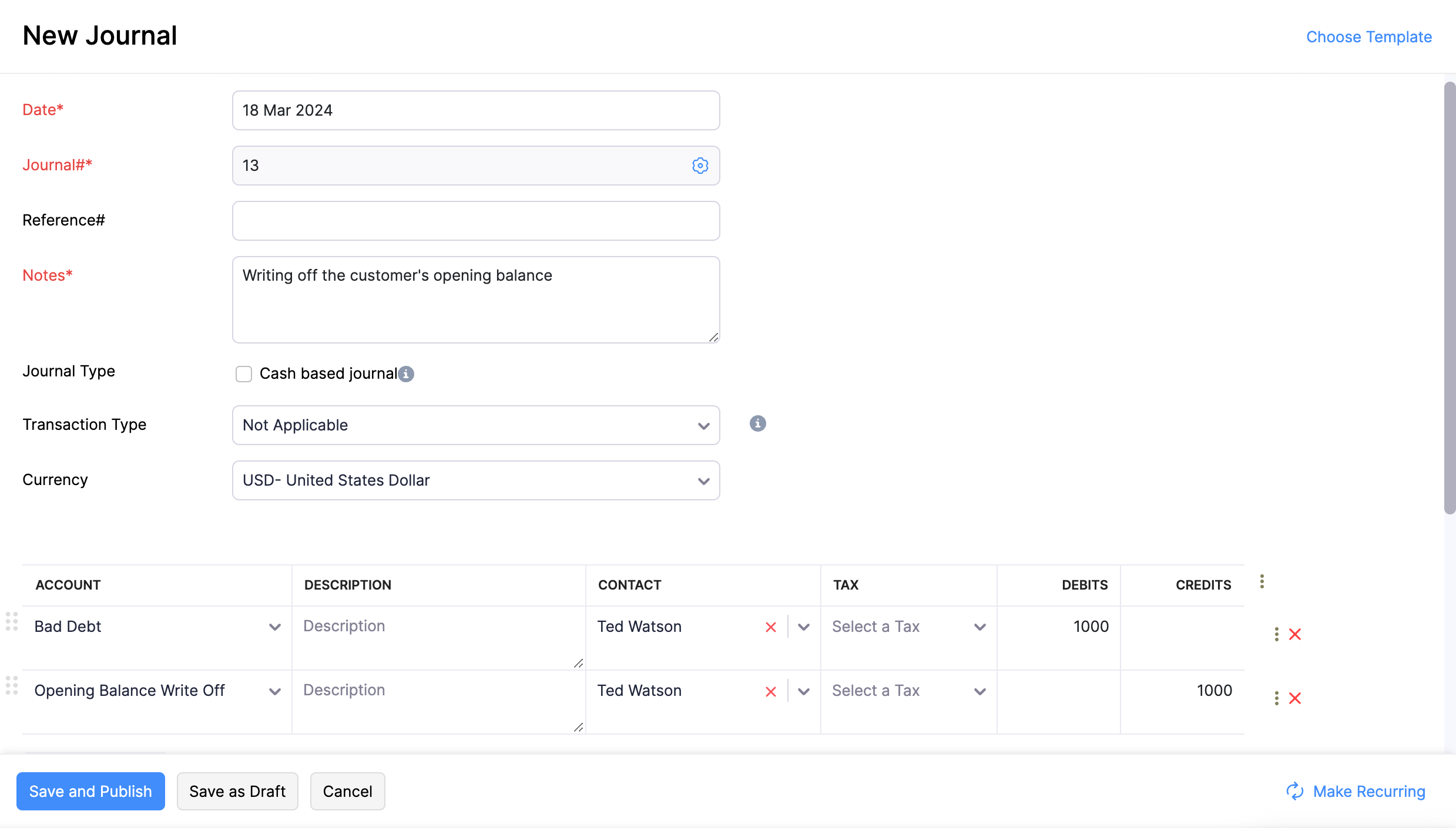

Create a Manual Journal

You have to create a manual journal to pass of the opening balance write off as a bad debt. Here’s how:

- Go to the Accountant module on the left sidebar and choose Manual Journals.

- Click +New Journal in the top right corner of the page.

- On the New Journal page:

- Select the account from which the amount is debited (Opening Balance Write Off) and the account to which the amount is credited (Bad Debt).

- Select the customer with whom you want to associate the journal entry.

- Enter the Debit and Credit amount. Ensure that the debited amount equals the credited amount.

- Click Save and Publish.