- HOME

- Expense Management

- What is an expense report?

What is an expense report?

In any organization, employees might incur business expenses that they end up paying for out of their own pockets. This ranges from travel-related expenses and client luncheons to office supplies or tech devices. Because these expenses are incurred on behalf of the firm, employees will request reimbursement for any amount they paid by submitting an expense report.

An expense report contains a categorized and itemized list of expenses that were made on behalf of the organization. This report helps the employer or finance team determine what money was spent, what was purchased, and how much of the expenditure is approved for reimbursement. Having said that, the merits of expense reports are not restricted to reimbursement claims. They also make it easier for businesses to file tax returns, claim tax deductions, and complete audits.

In this guide, you will learn all about expense reports—what they contain, why they are important, and most importantly, how to create them.

What is an expense report?

When an employee requests reimbursement for business expenses they paid for with their own money, these expenses are outlined on a paper or digital document called an expense report. Typically, these expenses are organized by categories, such as office supplies, meals, or mileage. They are also itemized so that multiple entities are listed along with their individual costs. This allows for more detailed auditing during the approval process than only listing the total amount of expenses incurred. Usually, an expense report is also submitted with the corresponding receipts for each itemized purchase.

Expense reports help track business spending and are usually generated on a monthly, quarterly, or yearly basis.

Monthly and quarterly expense reports are essential to track all the purchases a firm has made within that period. These reports are used to check if the spending is within the organization's budget and to identify areas where costs can be cut to maximize profits.

Yearly expense reports are used to deduct expenses on the firm’s tax returns.

Expense reporting process

Once an employee or department has submitted their expense report, their line manager or department head reviews the report for legitimacy and accuracy. Based on this validation, they can either approve the report and forward it to the finance team for reimbursement or reject it in case of a policy violation. After reimbursement, the finance team records the reimbursed amount as a business expense that impacts the accounting profits and taxable profits of the firm. Receipts and records of expense claims are then stored securely for external audits.

At times, employees are provided a certain amount in advance to cover business expenses. In those cases, expense reports are used to tally expenditures made against an advance payment. The finance department would still record the reimbursed amount as a business expense, but there would be no reimbursement and the finance team would simply deduct the total cost incurred from the employee's advance.

Contents of an expense report

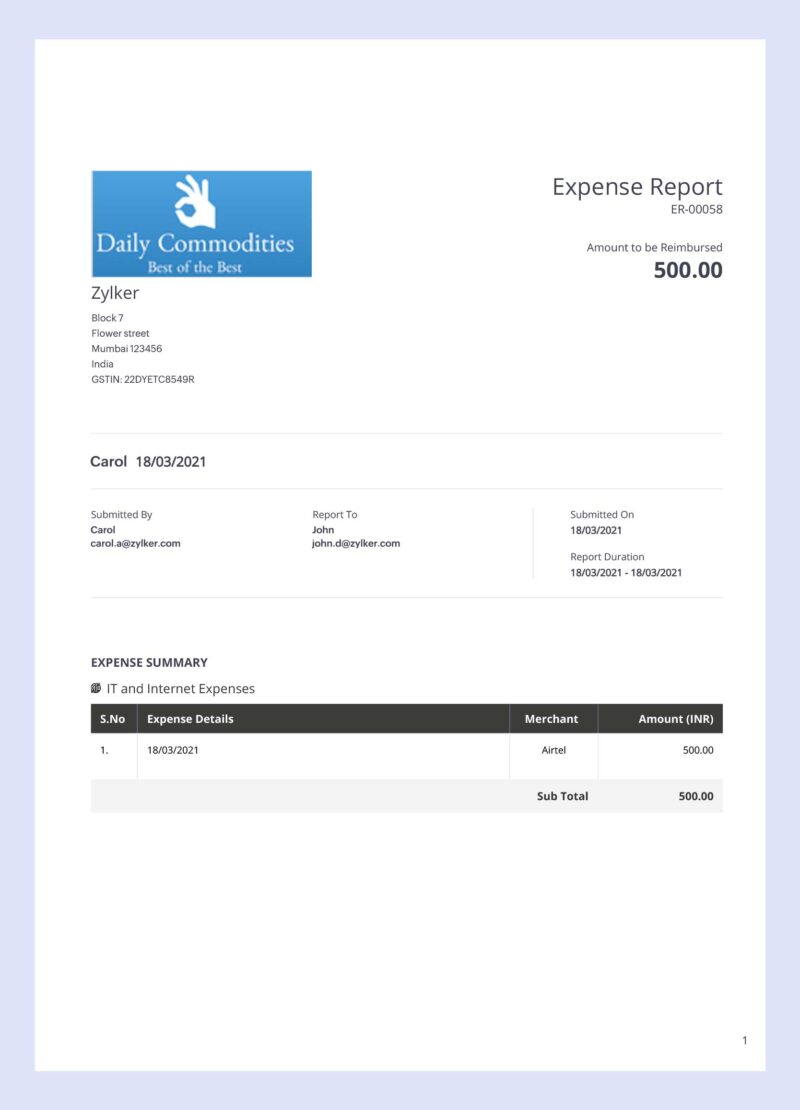

Information about the employee submitting the report (name, department, designation, contact details, etc.)

A date and amount for each expense (correlating to the date and amount on the attached receipt)

Type of expense (meals, mileage, internet, etc.)

The merchant or vendor from whom the item was purchased

The client or project it was purchased for (if applicable)

The account to which the expense is to be charged from your firm’s chart of accounts

Additional descriptions about each expense

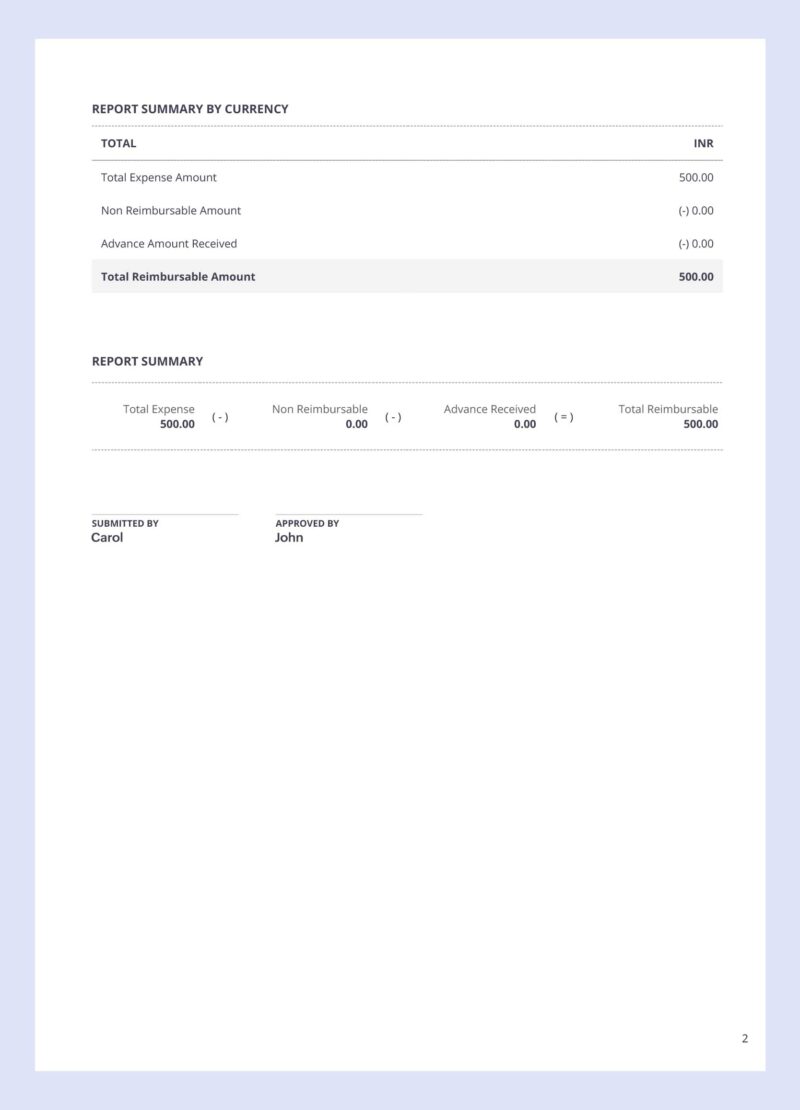

A subtotal for each type of expense and the total cost of the expenses, including tax

A subtraction for prior advances paid to the employee (if applicable)

Why do we need expense reports?

Here are a few benefits of generating expense reports:

Facilitates efficient expense tracking and cost control

Cost control ideally begins with reviewing expense report data. This helps in tracking your firm’s spending over time by giving you a clearer picture of how much money is being spent and what it's being spent on. You can also decipher how much your employees are spending with respect to different expense categories, check which categories are driving the costs up, and strategize on how to reduce or eliminate these costs. Analyzing these reports also helps you identify loopholes in expense policies that lead to increased expenditure and decide which vendors to prioritize and which ones to let go.

Helps with budgeting

Budgets are absolutely key to running a business smoothly. Detailed and accurate expense reports help with structuring a strong and informed financial plan for your organization's future. This allows more appropriate budgets to be allocated for various projects and departments. With consistent expense reporting, you can verify if the different departments or projects are adhering to their budget thresholds in order to keep your business financially secure in the long run.

Makes for accurate reimbursements

If an employee has paid for business expenses out of their pocket, they would want a reimbursement that is accurate and fair. Luckily, you also want to make sure the request is fair so you aren't paying more than you owe. Expense reporting puts a standardized process in place where employees are made aware of what can and can't be expensed, and it also gives organizations a faster way to determine if a claim is legitimate. An itemised expense report with receipts attached acts as solid evidence about when, where, and how any expenses were incurred, and whether they are compliant with your organization's expense policy.

Simplifies tax deductions

Many business expenses incurred by your employees while at work are tax-deductible. However, you cannot claim deductions for expenses unless you have them properly recorded with proof that they were actually incurred. Some business owners use their bank account or corporate card statements as a source to list all their deductible expenses. However it’s important to note that these statements may not reflect all expenses. Expense reports, on the other hand, simplify the entire process of keeping track of deductible expenses and writing them off during tax season. All the finance team has to do is add up all the expenses that can be written off and input them into the appropriate tax forms.

From receipt to reimbursement: The expense reporting process

Most firms choose between spreadsheets, templates, and expense reporting software to generate and track expense reports. In this section, we’ll learn how expense reports are created in two different ways—manually and using expense reporting software.

Manual expense reporting with custom templates

Since creating an expense report from scratch each time is a tedious task, some organizations equip their employees with customizable, ready-made templates to prepare reports in a spreadsheet or PDF format. Here are the steps involved in this type of expense reporting:

The employee documents their name, contact information, designation, the date range covered, and the business purpose of the report.

Next, they establish the right number of rows and columns to report the expenses. Certain firms have mandatory columns and categories to match the columns and expense categories in tax return forms.

Each expense is entered in chronological order with a brief description, where the most recent expense is listed last on the report.

Once all the expenses have been reported, the employee must calculate the subtotals of all the expense categories followed by the grand total. The subtotals help the finance team analyze how much is being spent on each expense category.

Finally, the employee must attach corresponding receipts for all the expenses mentioned above. They can either provide scanned copies of the receipts or photocopies, depending upon whether they are submitting the report digitally or not.

The report is submitted to the line manager or department manager, who will validate the report and check for policy violations or fraudulent claims.

On securing their approval, the report is forwarded to the finance team for reimbursement.

Automated expense reporting

Using expense report templates is a quick way to track expenses for small businesses. However, as your firm expands, it can become too time-consuming. With multiple departments processing several expense reports a day, you will want to switch to an automated expense reporting solution to track and manage these reports more effectively.

With an expense management system, your employees can generate expense reports on the go with just a few clicks. They only need to fill in the mandated fields on the form within the application or capture their receipts digitally. With the latter option, the expense data is extracted from these receipts, and itemized claims are created automatically.

Once this is done, all the expense claims can be grouped into a report and submitted with the tap of a button. Some applications are robust enough to gather unsubmitted expense claims from a date range automatically, group them, and submit them to the designated approver.

As an alternative, your employees can connect their bank account, credit/debit card, or corporate card to the expense reporting software. Statements can then be imported automatically, or card transactions can be fetched directly from the card provider. This makes it easier for your employees to convert these transactions to expense claims.

The line manager or department manager will review the reports submitted to them and check for warnings or notifications regarding policy violations, fraud, or duplicate expenses. Approvers can set up auto-approval for reports with no warnings and auto-reject for reports that don’t meet the criteria.

Upon review, the approved report is forwarded to the finance team so reimbursements can be distributed.

Switching to expense reporting software

Filing expense reports covers the first half of the expense management process. Staying on top of your business expenses also involves maintaining policy compliance, timely reimbursements, successful expense audits, and more. This is where an expense management solution like Zoho Expense can help. It removes the need for manual data entry and paperwork by providing multiple ways to record expenses on the go. Zoho Expense:

Automates report generation and submission

Supports multiple expense policies

Weeds out policy violations and fraudulent expenses

Increases spend visibility with intuitive dashboards and analytical reports

All of these features help save you a great deal of time and money, all while keeping your employees productive and satisfied. Try Zoho Expense for free today to streamline your expense management process.