- HOME

- Billing basics

- What is Annual Recurring Revenue (ARR) | Definition, Formula & Calculation | Zoho Billing

What is Annual Recurring Revenue (ARR) | Definition, Formula & Calculation | Zoho Billing

Subscription fees are the primary revenue stream of any subscription business. For that reason, accurately measuring that revenue plays a crucial role in understanding the financial health of your business and making informed investment decisions. Having a metric that tracks the year-over-year revenue flow is crucial for long-term planning and creating a realistic road map for the company's growth. This is where annual recurring revenue (ARR) comes in.

Here's a look at what ARR is, why a subscription business needs to track this metric, and how to calculate it, including detailed examples.

What is Annual Recurring Revenue (ARR)?

Annual recurring revenue is a critical metric that predicts the annual revenue a company is expected to generate from its customers. To be more specific, it is the annualized version of monthly recurring revenue (MRR), standardizing recurring revenue over a single calendar year.

The ARR calculation encompasses revenue from subscription charges, recurring revenue from add-ons or upgrades, and accounts for losses due to downgrades or canceled subscriptions. It also considers the impact of coupons, discounts, and promotional offers provided to the customers.

However, ARR excludes one-time fees, taxes, credit adjustments, and other non-recurring charges such as training and setup fees.

ARR vs MRR

ARR and MRR are both metrics used to measure the expected recurring revenue generated by the organization. Their difference lies in their time frame and specific uses.

Monthly recurring revenue (MRR) represents the revenue a company anticipates generating from its customers in a given month. It is useful for tracking short-term financial health and growth trends on a monthly basis while helping outline the immediate impact of customer churn, acquisitions, and expansions.

On the other hand, annual recurring revenue (ARR) is the forecasted revenue the company expects to generate over an entire year. It provides a long-term view of an organization's financial growth and stability. It is useful for understanding the impact of recurring revenue streams, investor reporting, and strategic planning.

In summary, both MRR and ARR are essential for understanding an organization's recurring revenue. They serve different purposes and provide different insights, making both vital for organizations.

Why is tracking ARR important for SaaS and subscription businesses?

Annual recurring revenue (ARR) provides a yearly snapshot of your company's performance by accounting for recurring sales, renewals, upgrades, downgrades, and churn. This metric is crucial for assessing business scalability, stability, customer retention, and profitability. An accurate ARR calculation is vital for any SaaS or subscription-based business; without it, you risk misjudging your company's financial health and misleading your teams and investors.

Here's a deeper dive into the topic to understand the benefits of tracking your organization's ARR.

Monitor financial health

A year-over-year analysis using ARR gives you the big picture of your business's financial health. ARR measures the performance of the business in different areas such as new sales, renewal rate, and upgrades, highlighting where revenue is growing and declining. With these insights, you can move forward on product planning, operational planning, and resource allocation.

Forecast revenue

ARR predicts the bottom line of the business, so you can cross-reference it against your acquisition targets and pricing strategies to project where your business will be in the future. This provides a way to forecast your future cash flow and chart the business's growth trajectory in advance. Moreover, with ARR forecast, any negative variation can serve as a red flag to show you where to act.

Attract investors

Since ARR reflects the stability and profitability of a subscription business, potential investors use it to evaluate how powerful your product is. With ARR, you can analyze the business's performance across the years and against its competitors. Without ARR, it’s easy to misjudge the actual trajectory of the business and give the wrong impression to stakeholders and potential investors.

How to calculate Annual Recurring Revenue (ARR)?

Calculating ARR is simple but depends on your billing cycle.

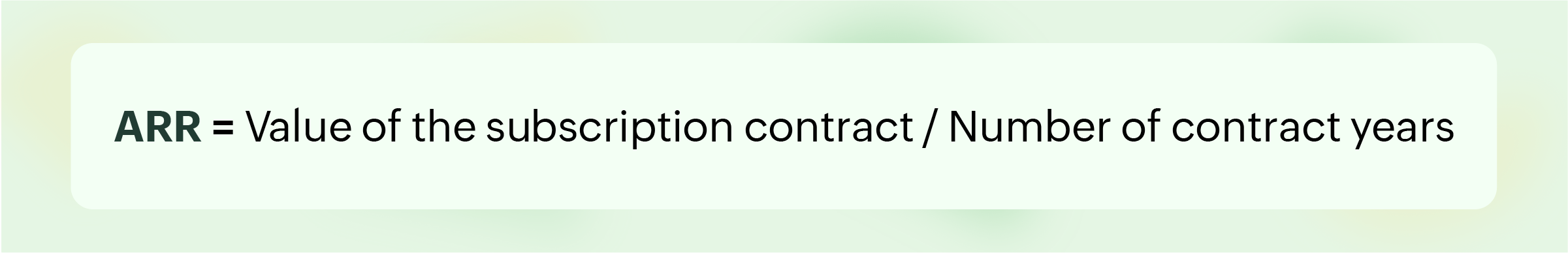

ARR Formula for Yearly Billing

If you bill customers on a yearly basis, your ARR can be calculated by dividing the contract value of the subscription by the length of the contract in years.

For instance, if a subscriber signs up for a six-year subscription for $18,000, the ARR for each calendar year would be:

$18,000 / 6 = $3,000

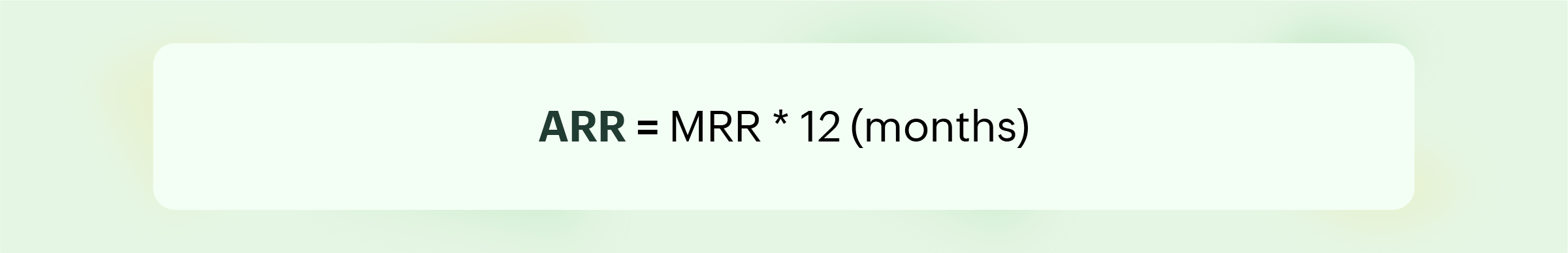

ARR Formula for Monthly Billing

If customers are billed monthly, then the ARR can be calculated by dividing the contract value of the subscription by the length of the contract in months. ARR can also be calculated using the MRR (which is the revenue generated per month) with the following formula.

For instance, if a customer subscribes to a product for $300 per month, the ARR would be:

$3,00 * 12 = $3600

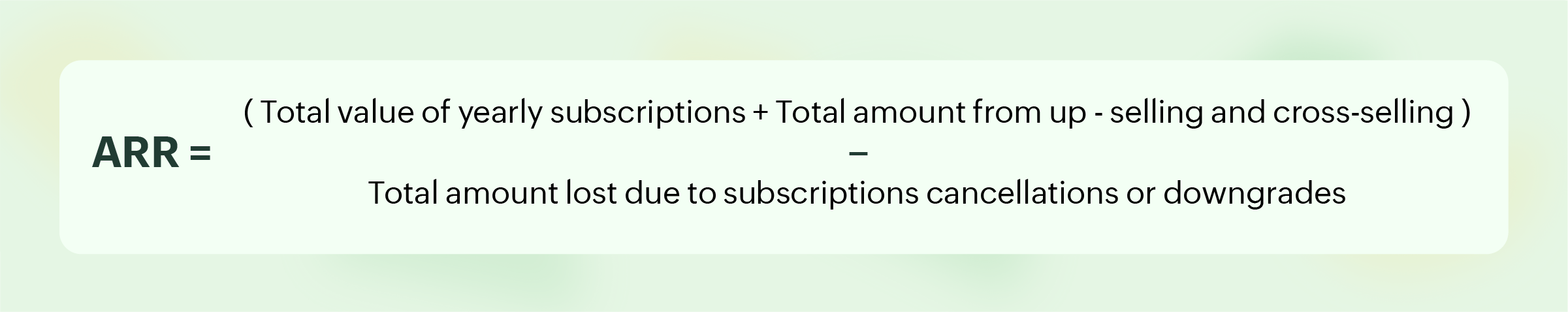

Factoring in fluctuations

During volatile sales cycles and seasons, a business's lifetime value and churn rate will fluctuate, which in turn impacts its ARR. Factors like add-on purchases, subscription upgrades, downgrades, and cancellations also affect the ARR calculations. So taking these values into account, the complete ARR formula will be:

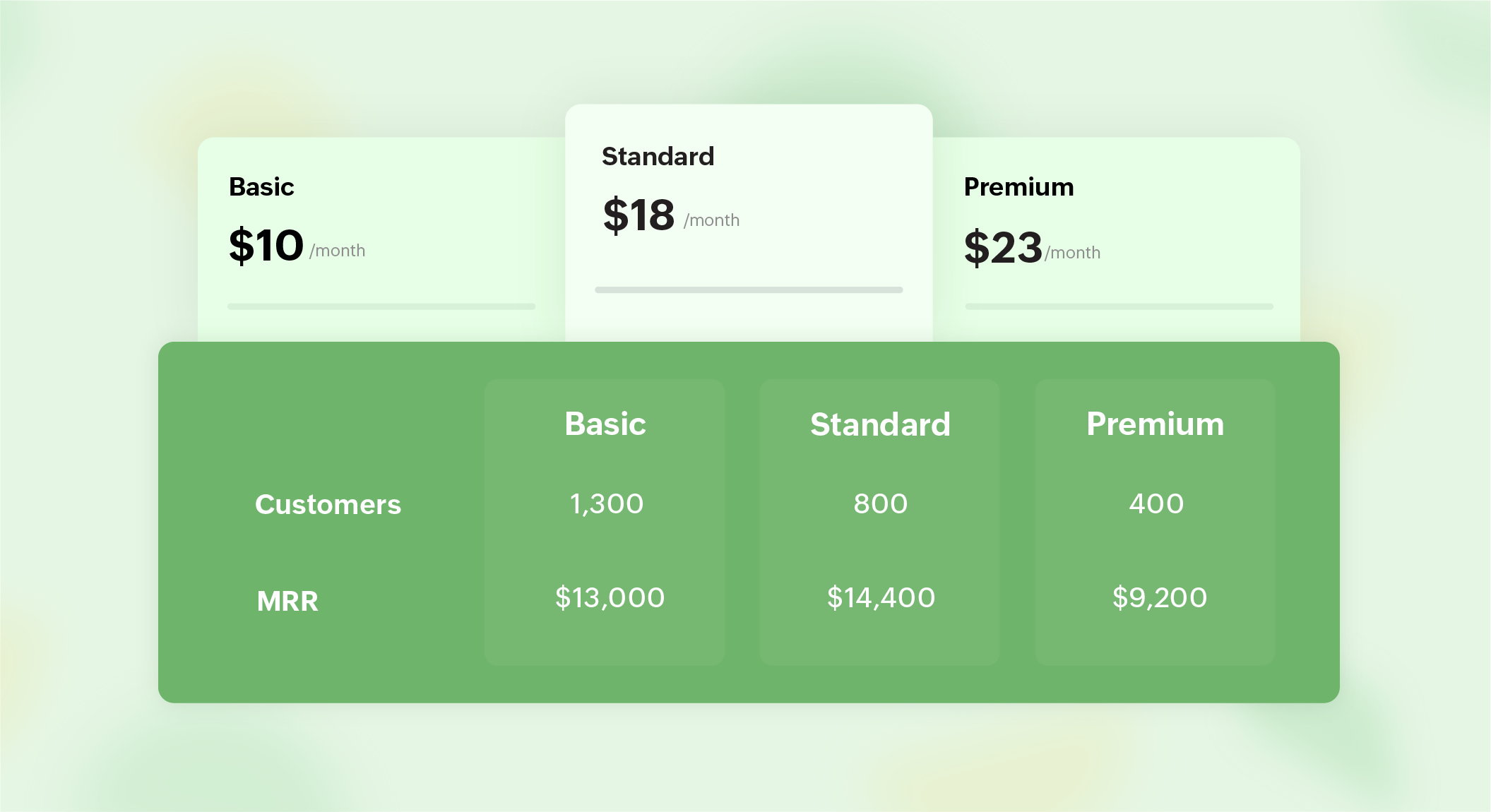

Let's assume a digital media platform has a total of 2,500 customers spread across three different plan tiers as shown below:

Total MRR = 36,600

Total ARR: 36,600 * 12 = 439,200

During the beginning of the year, they onboard 30 more customers:

- 15 customers purchase their basic plan

- 10 customers choose their standard plan

- 5 customers choose their premium plan

ARR after the purchases:

- 1,315 customers * Basic $10 = $13,150/month

- 810 customers * Standard $18 = $14,580/month

- 405 customers * Premium $23 = $9,315/month

Total MRR: $37,045

ARR: 37,045 * 12 = $444,540

Now, say after 3 months, 6 customers upgrade from the Basic Plan to the Premium Plan:

Total amount gained = Difference between plan amounts * Number of customers that upgraded * Months left in the year

Therefore, the total amount gained from the upgrades is:

$13 * 6 * 9 = $702

After 6 months, 3 customers downgraded from the Premium to the Standard Plan:

Total amount lost = Difference between plan amounts * Number of customers that downgraded * Months left in the year

Therefore, the total amount lost due to downgrading is:

$5 * 3 * 6 = $90

Finally, assume these customers remain in their chosen plan without further upgrades or downgrades for the rest of the year.

ARR calculation after factoring in fluctuations is:

$444,540 + $702 - $90 = $4,345,152

Factors to consider in ARR calculation

Include these factors:

Discounts

When you provide discounts, don't include the full price of the subscription in the ARR calculation, because the customers are only going to pay the discounted price. For instance, if you offer a $1,000 yearly subscription with a special discount of 50% in the first year, calculate your ARR using a subscription value of $500 per year, not $1,000. Once the customer starts paying the full price, the actual subscription charge can be used in the calculation.

Late payments, not delinquent charges

Delayed payments are inevitable and can significantly impact your company's KPIs and forecasting abilities. While some businesses mistakenly include uncollected payments in their ARR calculations, this practice can lead to misleading results. Failed payments should not be counted in total revenue until they are actually received.

To track revenue accurately, group late payments separately to understand the financial impact of payment declines or failures. Only include payments in ARR after they are collected. For example, if a customer misses a $100 subscription fee in March and pays it in April, add it to April's revenue, not March's.

Additionally, late payment fees should not be included in recurring revenue calculations, as they are one-time charges.

Exclude these factors:

Trials

Although most SaaS businesses offer a free trial period, some subscription businesses offer a paid trial instead. This typically carries a small fee compared to the regular subscription cost, allowing customers to ease into the idea of paying for the service before subscribing to an actual plan.

For instance, imagine you run a gym, an acclaimed fitness membership platform that offers Silver ($50), Gold ($100), and Platinum ($200) programs. You offer a 30-day paid trial for $30 to the prospects to check which setup will be convenient for them.

This trial amount is not recurring revenue but a one-off fee, so if you include it in your ARR calculations, you will see a minor increase in ARR but higher churn later. Instead, include their full subscription charges in your ARR calculation only after the prospect gets converted to a paying customer.

Setup fees

Setup fees are one-time charges that do not recur on an annual basis. Including them in ARR would inflate the recurring revenue, giving a distorted view of the company's predictable income. Thus, excluding setup fees ensures the ARR accurately reflects the sustainable, ongoing revenue from subscriptions.

Non-recurring add-ons

Non-recurring add-ons, like one-time purchases or occasional upgrades, do not contribute to the regular, predictable income stream. Including these in ARR would misrepresent the stability and consistency of the revenue. Excluding non-recurring add-ons keeps ARR focused on the reliable revenue generated from ongoing subscriptions.

ARR: Summary and implications

Annual recurring revenue (ARR) is a key subscription metric that offers insights into your business's overall health. Since ARR isn't a static metric, it shows how your decisions have impacted the business's performance over the years. By tracking revenue fluctuations with the help of ARR, you can strategize product development and refine sales and marketing plans as you move forward. Overall, ARR is a good indicator of your business's ability to grow, making it simpler to gauge the company's continued success and stay one step ahead.

Revitalize your ARR metrics with Zoho Billing

Zoho Billing is a unique end-to-end billing software that combines one-time invoicing with advanced subscription capabilities. Its enhanced reporting capabilities track metrics like ARR to help you make insightful budget evaluations and forecast revenue.

Take the first step to maximize your ARR by scheduling a demo of Zoho Billing, an end-to-end billing software for growing businesses.

Our objective is to simplify complex billing scenarios, unlock limitless monetization possibilities, and take customer experience to new heights.

Most Frequently Asked Questions

1. How is ARPU different from ARR?

Average revenue per user (ARPU), is the average revenue a customer generates over a specific period of time, which could be both monthly or yearly, while ARR takes not one subscription but an organization's entire active subscription base into consideration and predicts the recurring revenue they expect to generate in a year.

2. How does ARR differ from CLV?

ARR is the annualized revenue generated from customers while CLV (customer lifetime value) is the total revenue the organization can expect to generate from a customer throughout their subscription lifetime.

3. What are some common ways to increase ARR?

There are multiple ways an organization can increase its ARR. Some of the most common ways are: acquiring new customers, reducing churn rates, up-selling, expanding to new markets, and much more.