UK VAT MOSS

Notes: Post Brexit (i.e. from 1 January 2021), the tax treatment for all countries outside the UK will be considered as Overseas. Therefore, UK VAT MOSS will not be applicable when digital services are provided for businesses that are located outside the UK. Instead, you can register for the Non-Union VAT MOSS scheme in an EU member state or register for VAT in each EU member state where you supply digital services to consumers.

HMRC’s VAT MOSS (Mini One Stop Shop) scheme is for businesses which supply Digital Services from UK to Consumers (Private individuals or non-business entities) in the European Union(EU). VAT will be levied according to the consumer’s location.

Digital Services

Broadcasting, telecommunications and e-services fall under the digital services category. Examples of e-services are app downloads, video on demand, gaming, e-invoice, anti-virus software etc.

Why VAT MOSS?

If your business from UK sells digital services to consumers in an EU country, VAT will be levied in accordance with the EU member country. Your business needs to be registered for VAT with every EU member state where the digital services are being sold which is a pretty tenous process.

By registering for the UK VAT MOSS Scheme, your business can skip the process of registering with every EU member state where you supply digital services to consumers.

Once the business registers with the UK VAT MOSS scheme a single MOSS VAT Return and a VAT Payment should be submitted to HMRC every quarter. HMRC will take care of forwarding the return and tax payments to the tax authorities of the EU member states.

Conditions for VAT MOSS to be applicable?

VAT MOSS is applicable for digital services which are completely automated or electronically supplied over the internet with minimal/no human intervention.

These are the condition for VAT MOSS to be applicable:

- Supply digital services electronically.

- Digital services provided should be charged.

- Sell services only to Non-Business consumers in other EU member states.

- Sell services on your own website or platform (not using a third party platform / marketplace).

Who are not affected?

Communicating by email and sending attachments, using the internet to facilitate trade does not constitute e-services. Services that use the internet and does not come under the scheme:

- If order and processing are done electronically and goods are supplied physically. Also includes physical invoice, newspapers or journals.

- Consultants and Lawyers who advise their clients over email.

- Online ticket booking services for entertainment events, hotels or to hire transport.

- Online classroom courses, educational or professional courses delivered over the internet.

- Physical repair services for computer equipment made offline.

- Services for advertising on newspapers, posters and on television.

Enabling VAT MOSS

To enable VAT MOSS in Zoho invoice:

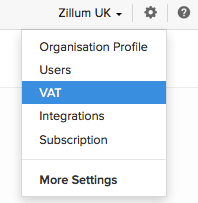

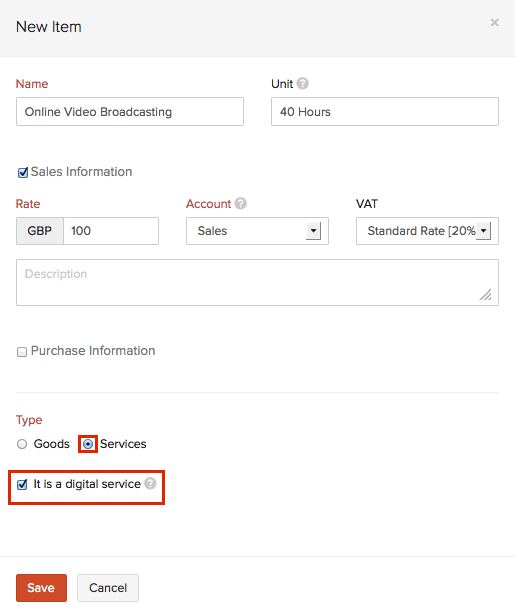

- Navigate to Settings > VAT.

- It is mandatory to enable International Trade to enable VAT MOSS.

- Check the Enable trade with contacts outside United Kingdom box.

- Now check the Registered for VAT MOSS box to enable VAT MOSS in Zoho invoice.

Adding a Member State VAT Rate

To add a VAT rate for a EU country where you sell digital services,

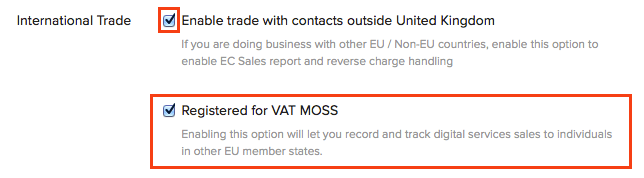

- Navigate to Settings > VAT.

- Select the VAT Rates tab.

- Click on + New VAT.

- In the new VAT rate form,

- Enter the VAT Name, i.e: Austrian VAT or Belgium Reduced VAT.

- The VAT Rate(%) for the EU member country.

- Select the country from the EU Member State drop down provided.

- Click Save.

Creating a Digital Service as an Item

To create a digital service in Zoho invoice:

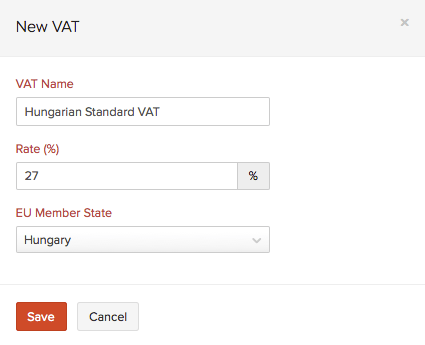

- Navigate to the Items tab and select + New Item.

- Enter details of the digital service you provide in the item creation form.

- When selecting the product type, select Services.

- Now, check the Is it s a digital service box, this will save the item as a digital service.

Insight: If you select a UK VAT rate for the digital service item while creating, it will be applied only on sales inside UK.

VAT MOSS in Sales Transactions

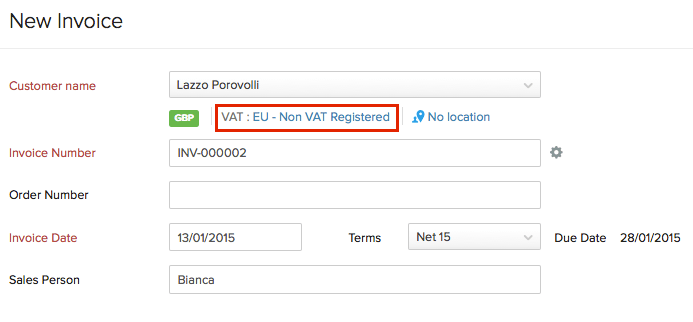

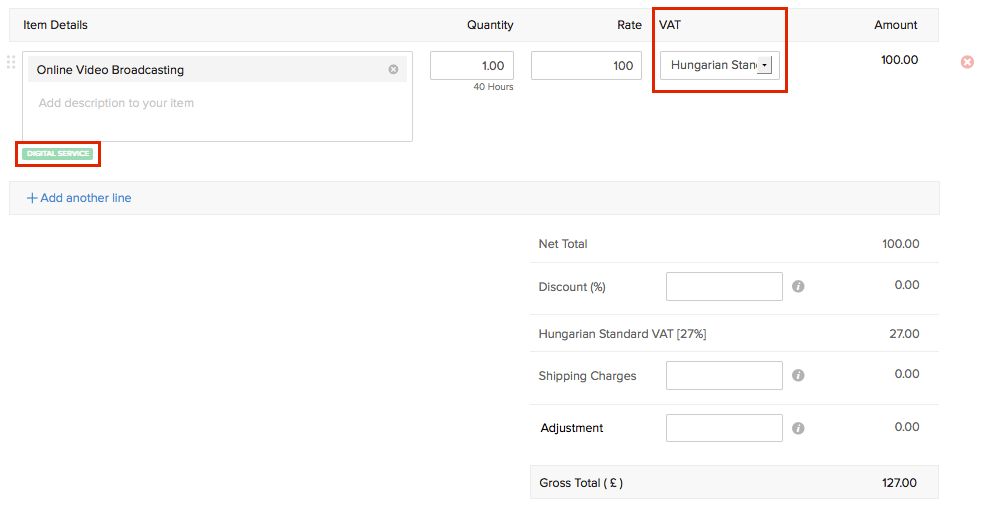

VAT MOSS is applicable only on the sales of a digital service to a EU-Non VAT Registered customer. When creating a sales transaction i.e: Estimate, Invoice, Sales Order etc, make sure that,

- Customer’s VAT treatment is EU-Non VAT Registered.

- The item added is a Digital Service.

- The VAT rate for the EU member country to which you sell the service should be selected.

- After completing other relevant information, you can send the invoice to your customer.

- Once the sales transaction is sent, the tax information will be recorded in the MOSS report.

Insight:

- You cannot record sales of digital services for different countries in a single sales transaction (Invoice, Estimate, Sales Order etc.). Each country should have a separate sales transaction.

- VAT rate of other member countries cannot be used for VAT Treatments other than EU-Non VAT Registered & item type as Digital Service.

- Any number of Digital Service items can be added in a single sales transaction for the same country.

Pro Tip: While processing the sale of cross-border digital services, it is important to know the place of supply so as to apply the correct VAT rate. To ease the process of obtaining this information, you can presume your customers’ place of residence based on any accompanying evidence and apply the VAT applicable in that country.

While Zoho Invoice does not have the option to enter the evidence information directly, we recommend that you use Custom Fields to store this information for your reference while creating invoices.