I’m based out of Northern Ireland. What should I do when trading goods with the EU?

When you are trading goods between Northern Ireland and the EU, NI protocol will be applicable to those transactions. In Zoho Books, you will have to enable the NI protocol in VAT settings to use EU VAT Registered [NI Protocol] as the VAT Treatment for transactions and contacts. Here’s how:

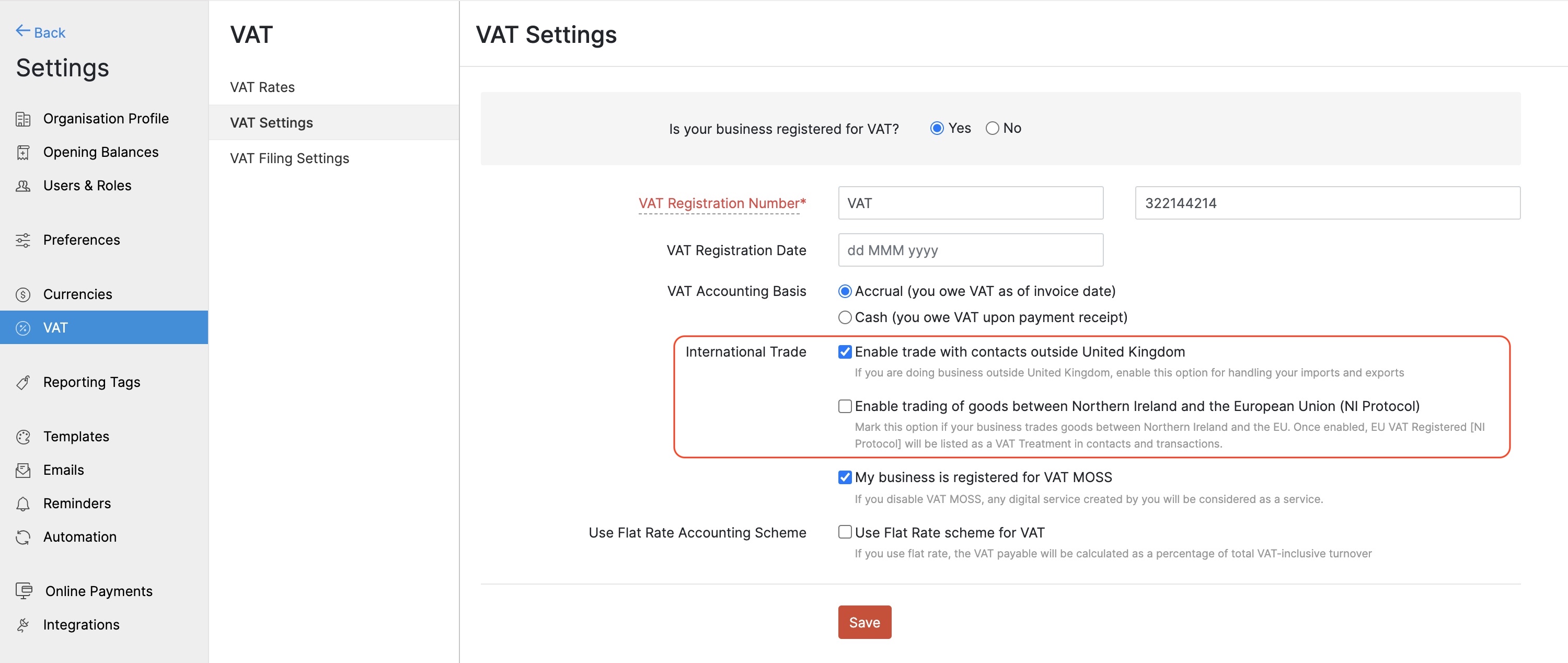

- Go to Settings > VAT Settings.

- Check the Enable trade with contacts outside the United Kingdom option.

- Check the Enable trading of goods between Northern Ireland and the European Union (NI Protocol) option.

- Click S****ave.

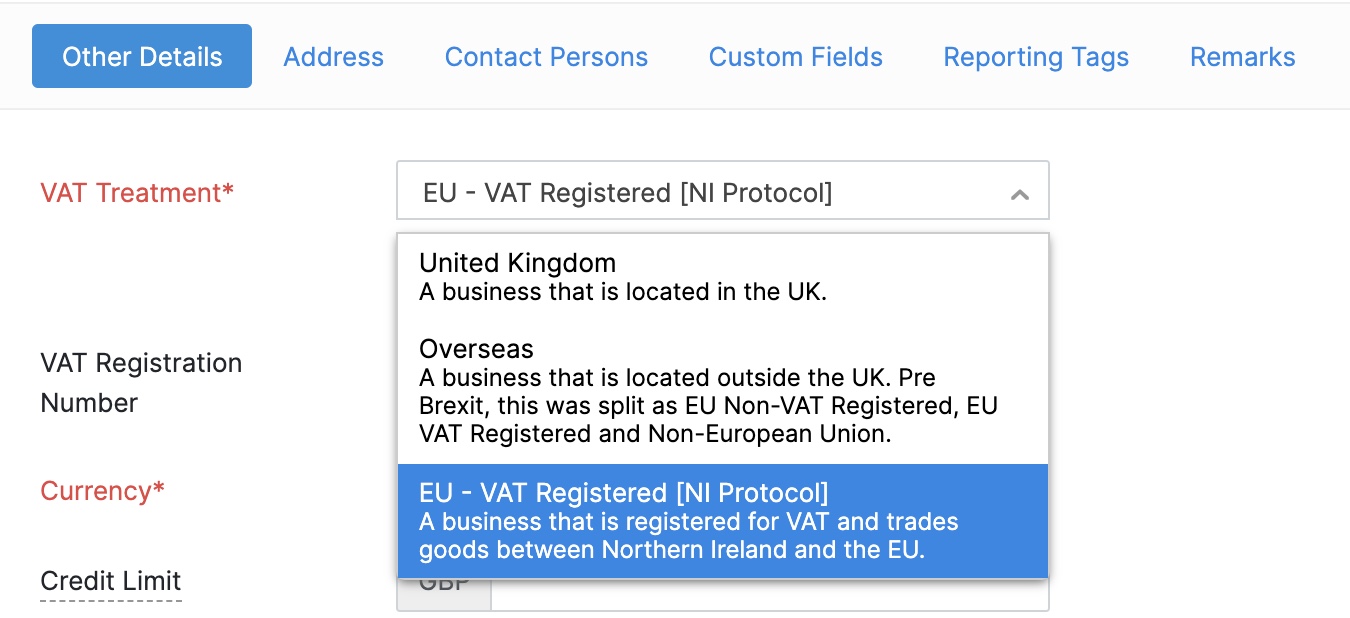

Once you have enabled the settings, the EU VAT Registered [NI Protocol] treatment will be displayed under the VAT Treatment field in contacts and in transactions for trading goods between Northern Ireland and the EU.

Also, by default, the VAT Registration Number will be updated to XI in transactions that have their VAT Treatment as EU - VAT Registered [NI Protocol].

Yes

Yes