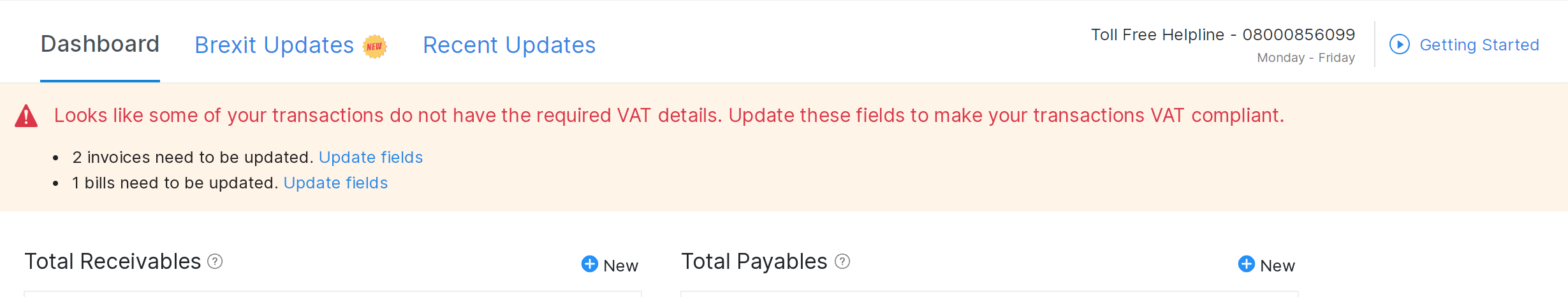

I’m seeing a list of invalid transactions on my dashboard. What should I do?

Invalid transactions are those that have data that is inconsistent with the latest VAT and Brexit guidelines. You can check and update these transactions with the correct information.

To update the invalid transactions, go to the listed transactions, and update the proper information by following the specified help texts.

Yes

Yes