Back

Can I record a transaction to reclaim VAT while creating a mileage expense in Zoho Books?

Yes, you can reclaim VAT on mileage expenses. Please note, however, that HMRC says that VAT can be reclaimed only on the fuel part of the mileage expense.

The fuel rates are calculated as per HMRC’s Advisory Fuel Rates.

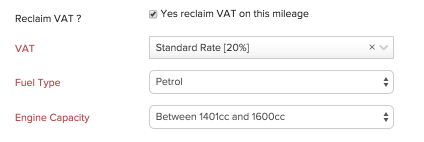

While creating a mileage expense, make sure the checkbox against Reclaim VAT? is selected.

Once you select the checkbox, three additional fields will appear,

- VAT: Select the VAT rate that is applicable for this expense.

- Fuel Type: Select whether the vehicle runs on Petrol, LPG or Diesel.

- Engine Capacity: Select the vehicle’s Cubic Capacity(cc) from the drop-down.

The Fuel Type and Engine Capacity are asked so that Zoho Books can calculate the cost of fuel for the distance you’ve traveled in a vehicle.

The VAT that is applicable on the purchase of fuel is then calculated using these rates.

Yes

Yes