How do I match batch payments that I’ve received through payment gateways with their corresponding transactions in Zoho Books?

Let’s assume that you use the payment gateway Authorize.Net and your customers pay you for 5 invoices, amounting to $100 each.

However, once your customers pay for the invoices through Authorize.Net, the amount will be withheld by Authorize.Net for a short period, after which, it will be deposited as a batch payment to your bank account, say Citi bank as $500.

Now, to match the five customer payments to a single deposit:

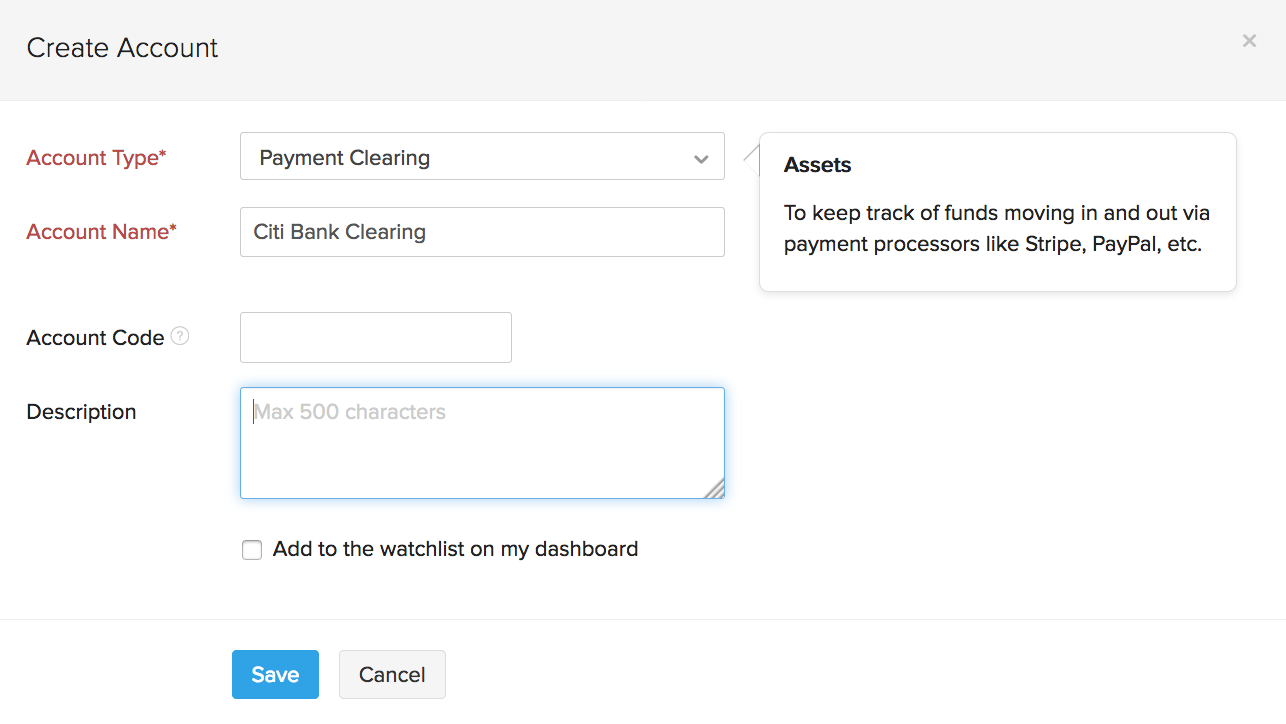

Go to Chart of Accounts from the Accountant module on the left sidebar.

Click + New Account and create a new account with the Account Type as Payment Clearing. You can name this account as “Citi Bank Clearing”.

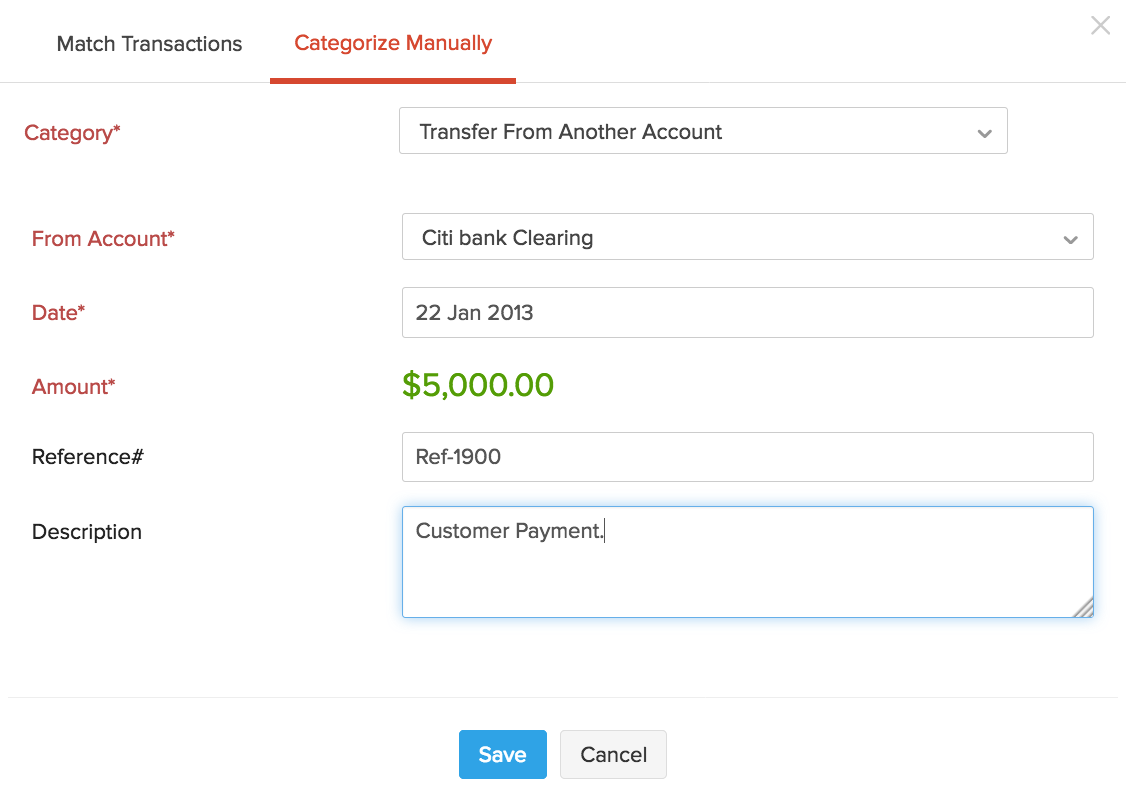

Go to the Banking module from the left sidebar and select the bank (Citi bank) for which you’d like to categorise your transactions.

Choose a deposit transaction and click the Categorize Manually tab.

Select the Category as Transfer From Another Account and choose the corresponding clearing account(Citi Bank Clearing) in the From Account dropdown.

Now, your transaction will be categorised and a credit entry for the amount will automatically be created in the clearing account (Citi Bank Clearing).

This ensures that you do not have to manually create a credit entry in the clearing account. Additionally, you can further simplify this process by creating transaction rules to automatically categorise transactions.

Yes

Yes