Basic Functions in Payments Received

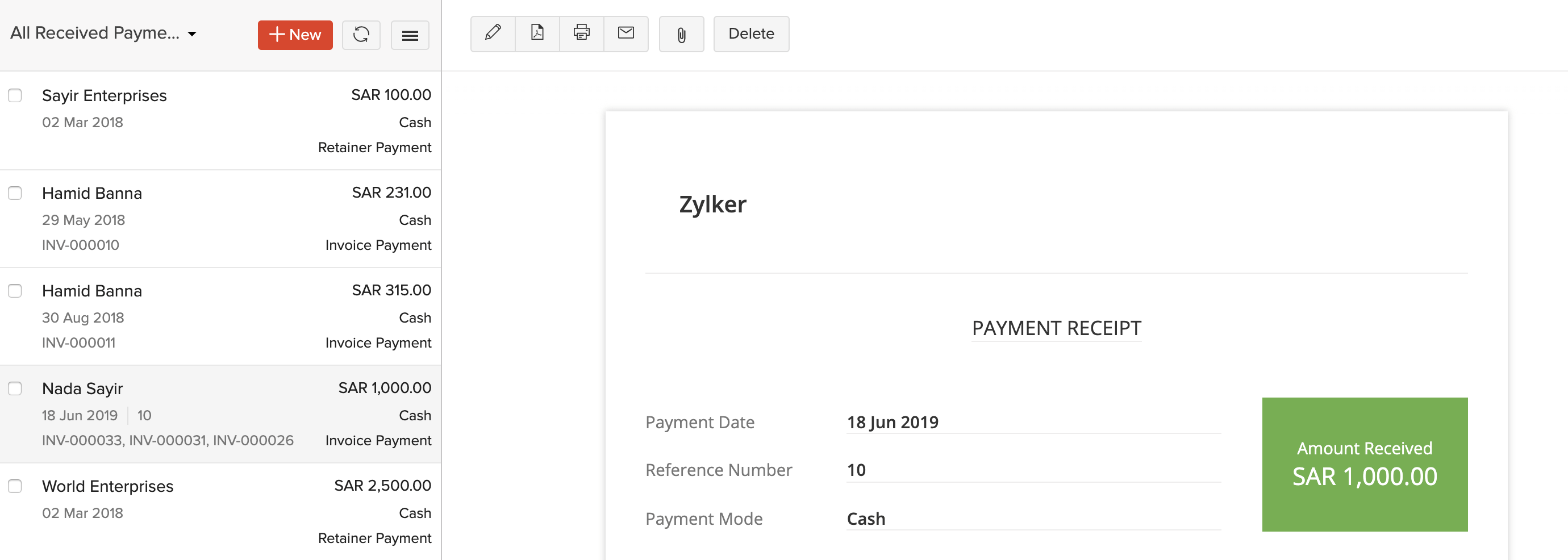

In the Payments Received module, you can find the following types of payments:

- Invoice Payments: Payments recorded for customers’ invoices.

- Retainer Payments: Payments recorded for retainer invoices (advance payments).

Any payment that you receive from a customer can be recorded and applied across their various outstanding invoices.

View Payments Received

If you have already recorded payments from your customers, you can view them in the Payments Received module. Here’s how:

- Go to Sales > Payments Received.

- Select the desired payment.

Record Payments Received

When recording payments, you might come across the following cases:

Record and Split Payment

You can manually record payments from customers, and choose to apply it on their outstanding invoices. The payment amount can be split among a customer’s outstanding invoices either in full or in part. Let’s understand this better with a scenario.

Scenario: Patricia receives a payment of SAR 500 from her customer Nada, who has 2 outstanding invoices whose values are SAR 300 and SAR 450, respectively. Patricia can split the payment of SAR 500 into SAR 300 for the first invoice (full amount) and SAR 200 for the second invoice (partial amount). So, the second invoice will still have a balance of SAR 250 to be paid.

Over Payments

The total amount you receive from any customer can be applied across their various outstanding invoices. If you’ve not applied the whole amount, you can save the balance amount as an over or excess payment. Let’s understand this better with the help of a scenario.

Scenario: Patricia receives a payment of SAR 1000 from her customer Nada. She records a payment and splits only SAR 898 of that amount to apply it on different outstanding invoices of Nada. Now, she still has SAR 102 remaining (SAR 1000 - SAR 898). She can record this as an excess payment.

Pro Tip: Payments which have over/excess payments will have different values for the Amount and the Unused Amount in the Payments Received page.

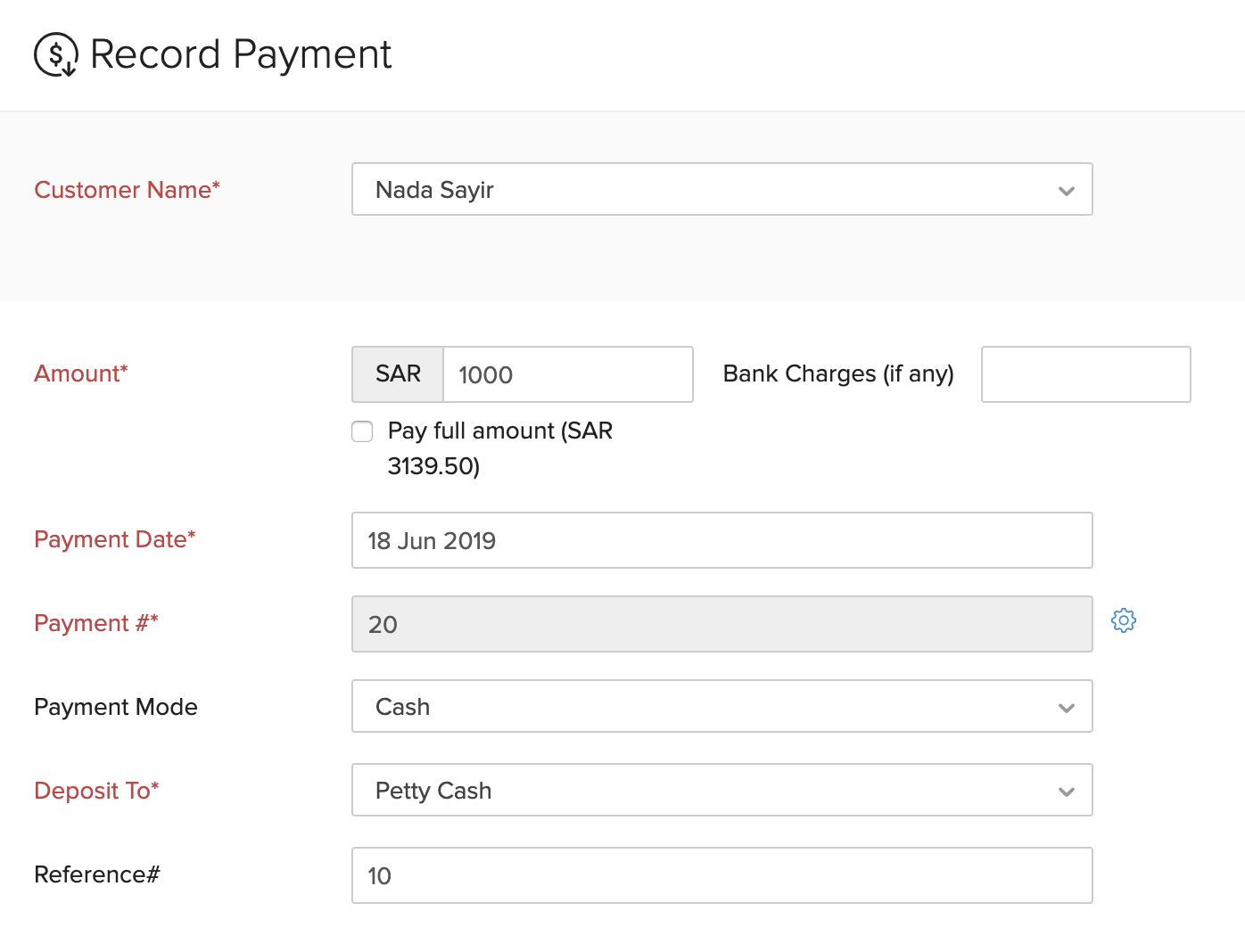

To record payment for a customer:

- Go to Sales > Payments Received.

- Click the + New button in the top right corner of the page.

- Fill in details in the Record Payment page.

| Fields | Description |

|---|---|

| Customer Name | Select the customer from whom you are receiving the payment. |

| Amount | Enter the total payment received from the customer. Check the box Pay full amount to record the full outstanding payment for the customer. |

| Deposit To | Choose the account to which the payment gets deposited to. |

| Tax Deducted | If the customer has deducted tax, mark this box and choose the account which tracks the tax. |

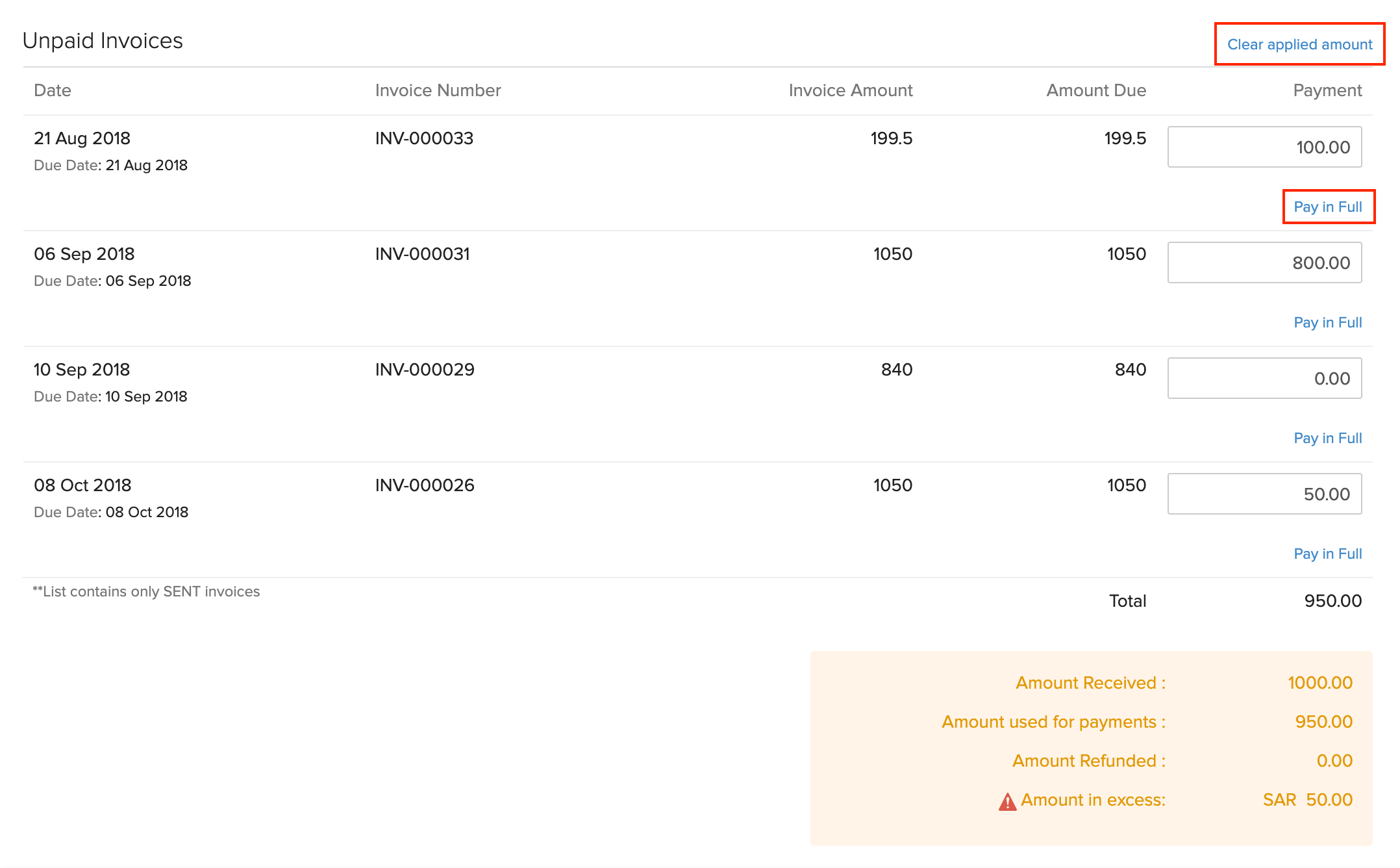

- Split the payment received from the customer (entered in the Amount field) among each of their outstanding invoices. In this page, you can find two options:

- Clear applied amount: Click this to clear all the applied amounts in the page.

- Pay in Full: Click this to enter the entire Amount Due as payment for the invoice.

Insight: You can view the amount used for payments and the available balance (amount in excess) from the Total section.

| Fields | Description |

|---|---|

| Amount Received | Total amount received from the customer. |

| Amount used for payments | Amount applied on the invoices. |

| Amount in excess | Any excess payment by the customer, i.e. the amount that is not applied on the invoices. |

- Add notes and attach files for the payment. You can also send a thank you note to the customer for the payment.

- Click Save at the bottom of the page.

Note:

If you have any amount in excess, i.e. you haven’t applied the whole amount on the invoice(s), you can choose to save it as an over payment for the customer.

Refund Payments

If you have recorded an advance from a customer, you can choose to refund that amount in full or in part. Here’s how:

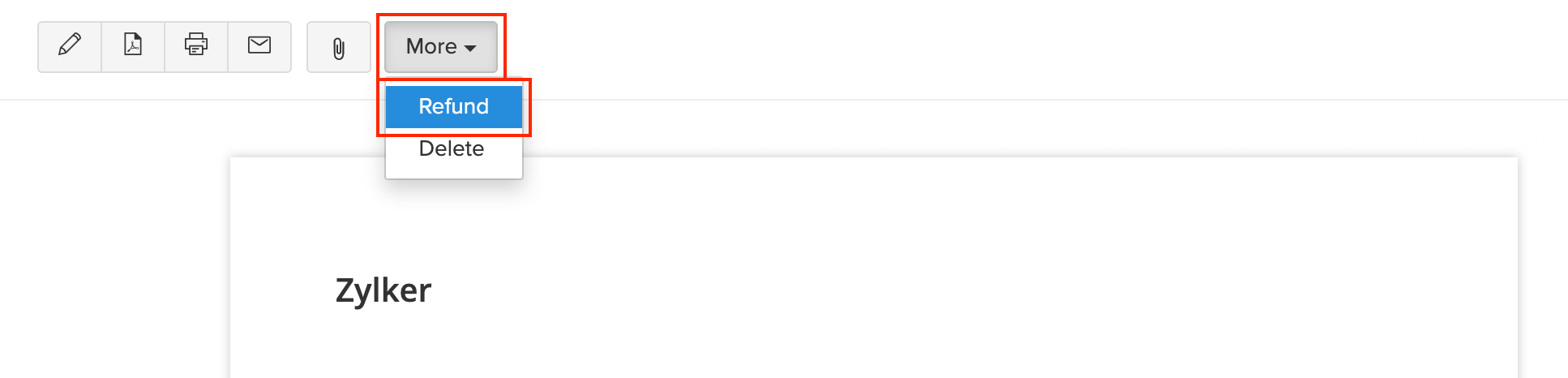

- Go to Sales > Payments Received.

- Select the payment for which you have recorded an over payment.

- Click More > Refund.

- Enter the Amount to refund. You can refund the amount in full or in part.

- Click Save.

Import Payments Received

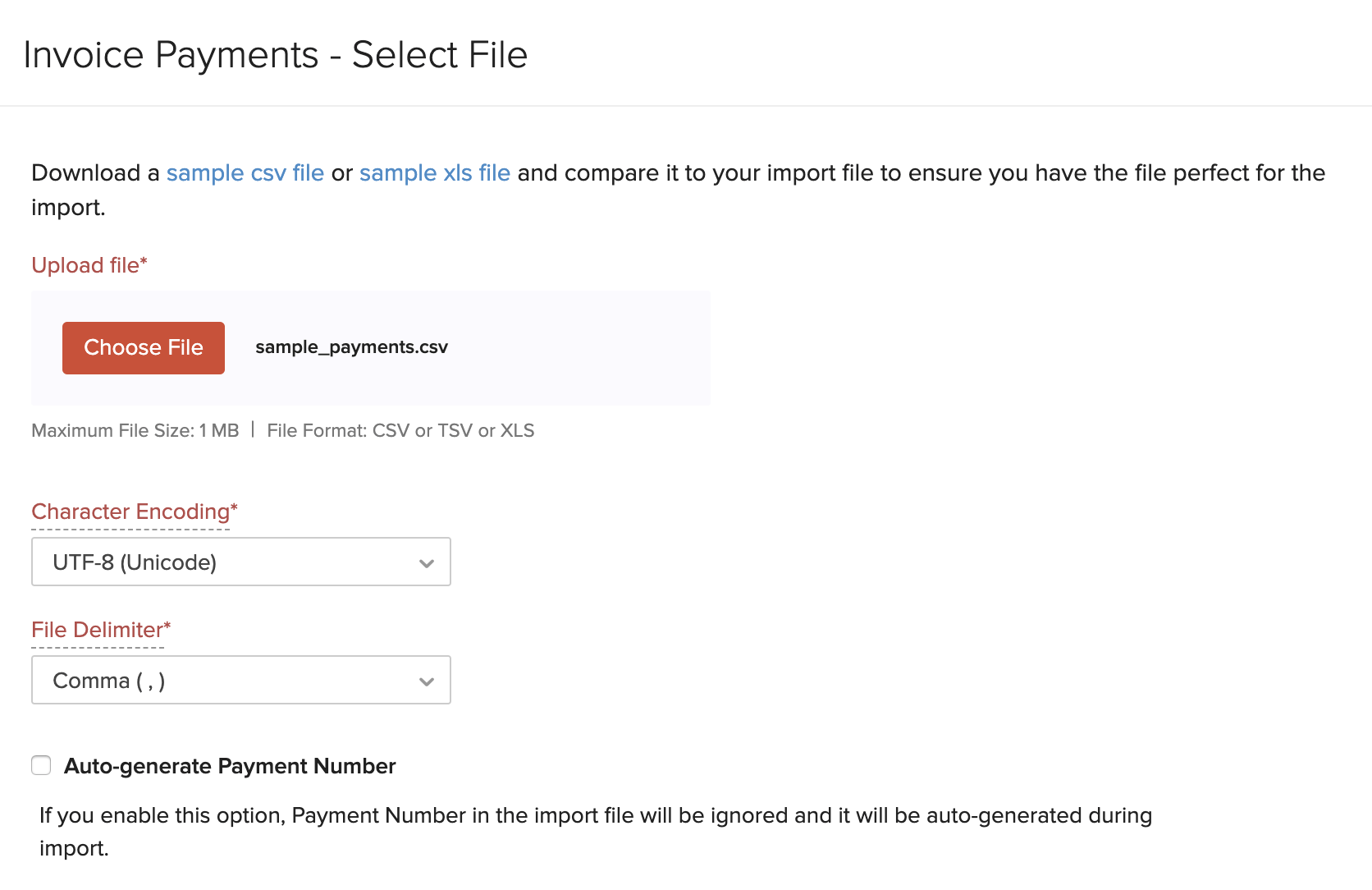

If you already have a list of all the Invoice Payments or Retainer Payments of your customers, you can import them into Zoho Books in the CSV, TSV or XLS format.

To know the format of the import, i.e. the columns and data to be included in the import file, you can download the sample import file which we’ll be looking at in the steps below.

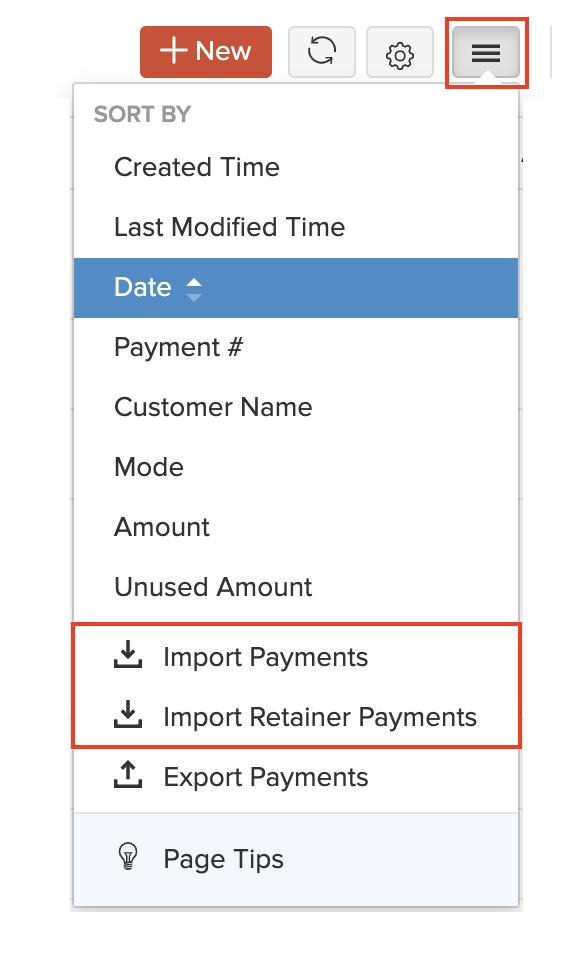

- Go to Sales > Payments Received.

- Click the More icon in the top right corner of the page.

- Select Import Payments or Import Retainer Payments.

- Click the Choose File button under Upload file. You can download the sample CSV or XLS file for your reference by clicking sample csv file or sample xls file.

Insight: The file size cannot be more than 1 MB.

- Choose the Character Encoding and File Delimiter for your file.

Insight: Character Encoding is used to pair numbers with characters. By default, the Unicode Transformation Format (UTF-8) encoding is used which supports a wide range of characters that go beyond 8 bits.

Insight: The Field Delimiter is used to separate two values in a row. While importing payments received, the default file delimiter is comma (,).

- Click Next.

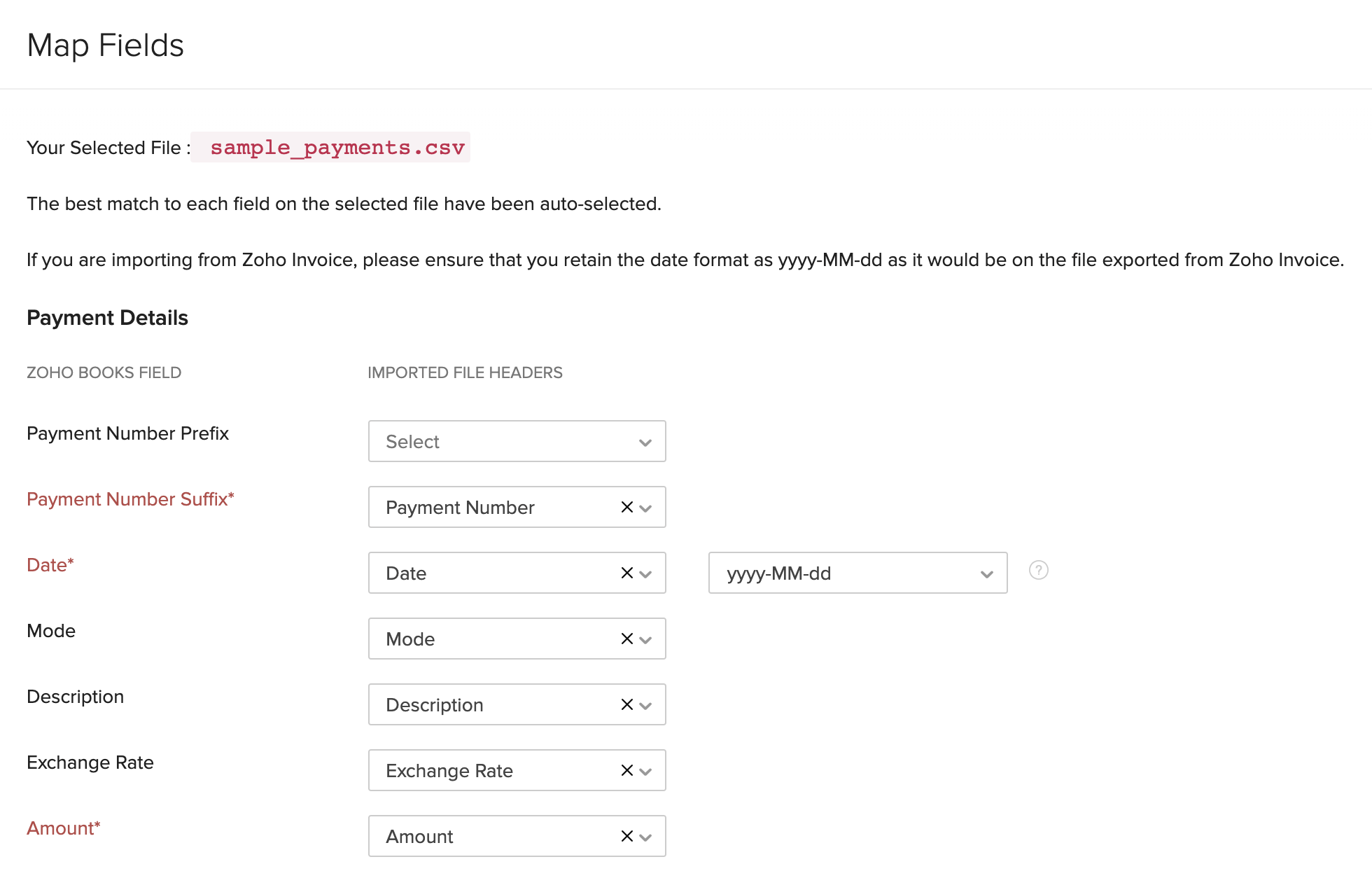

- Ensure that all the fields are mapped correctly in the Map Fields page.

- Mark the box Save these selections for use during future imports if you want to use the similar import format for the next time.

- Click Next.

- In the Preview window, click Import.

Next >

Functions in Payments Received

Related

Yes

Yes