Bring trusted payroll expertise to your business

Payroll software designed for India, the US, Canada and now extended to teams all across the GCC.

Thousands of organizations run payroll for their teams with Zoho Payroll.

Trusted by 50+ industry verticals to cater to their unique payroll requirements.

**Data derived from editions we support across the globe.

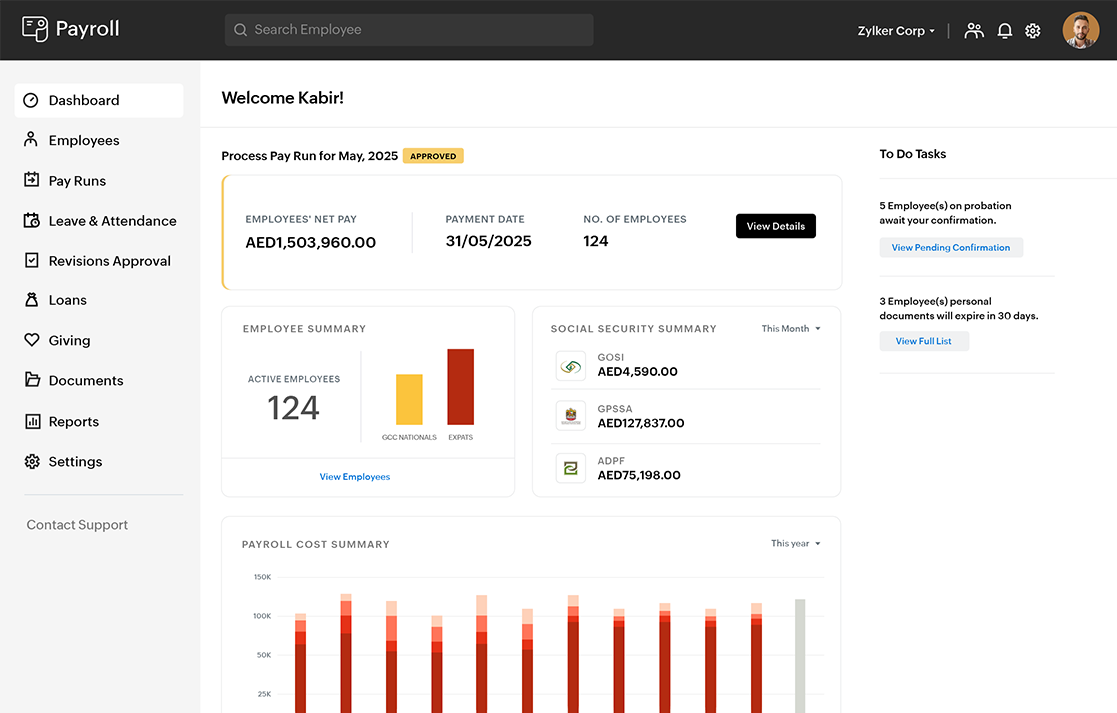

Effortless payroll

One software for your end-to-end payroll operations

Handle multi-country payroll

Manage payroll for all six GCC countries using Zoho Payroll's six editions separately, each tailored to a region but all within one platform.

Faster setup for six regions

Each edition works the same way with a similar interface, so onboarding and configuring payroll becomes quick and predictable without any need to relearn it each time.

Automate your payroll tasks

From salary calculations to salary payments, automate repetitive tasks and keep every pay run accurate and on time.

Customize payroll to match your business

Add unique salary components, assign custom users and roles, and run payroll exactly the way your operations demand for each country.

Get actionable payroll reports

Each GCC edition comes with comprehensive payroll reports covering payroll summary, costs, benefits, and contributions, helping you get full details about your workforce.

Reward your team with benefits

Cover all key employee benefits including housing, transport, air travel allowances, and end-of-service payouts for every GCC country.

Streamlined operations

Integrated payroll, leave, and attendance

Zoho Payroll comes with built-in leave, attendance, and holiday management for every GCC region, allowing you to customize leave policies, manage approvals, and monitor attendance effortlessly from a single platform.

SIMPLIFIED COMPLIANCE

Country-specific compliance for every GCC country

Stay compliant with local regulations and requirements across all GCC countries.

Social security

Handle social security for GCC nationals including SPF, GRSIA, GOSI, GPSSA, SIO, PIFSS, and ADPF to ensure accurate, timely pension contributions for nationals.

Gratuity

Recognize long-serving expatriates by ensuring accurate and timely calculation of their end-of-service benefits all across GCC.

Wage Protection System (WPS)

Generate WPS-compliant SIF files for the UAE and wage files for other GCC countries automatically, ensuring accurate and timely salary processing.

Overtime

Calculate all types of overtime across GCC regions automatically, applying varying rates by region and type to ensure fair and timely payments.

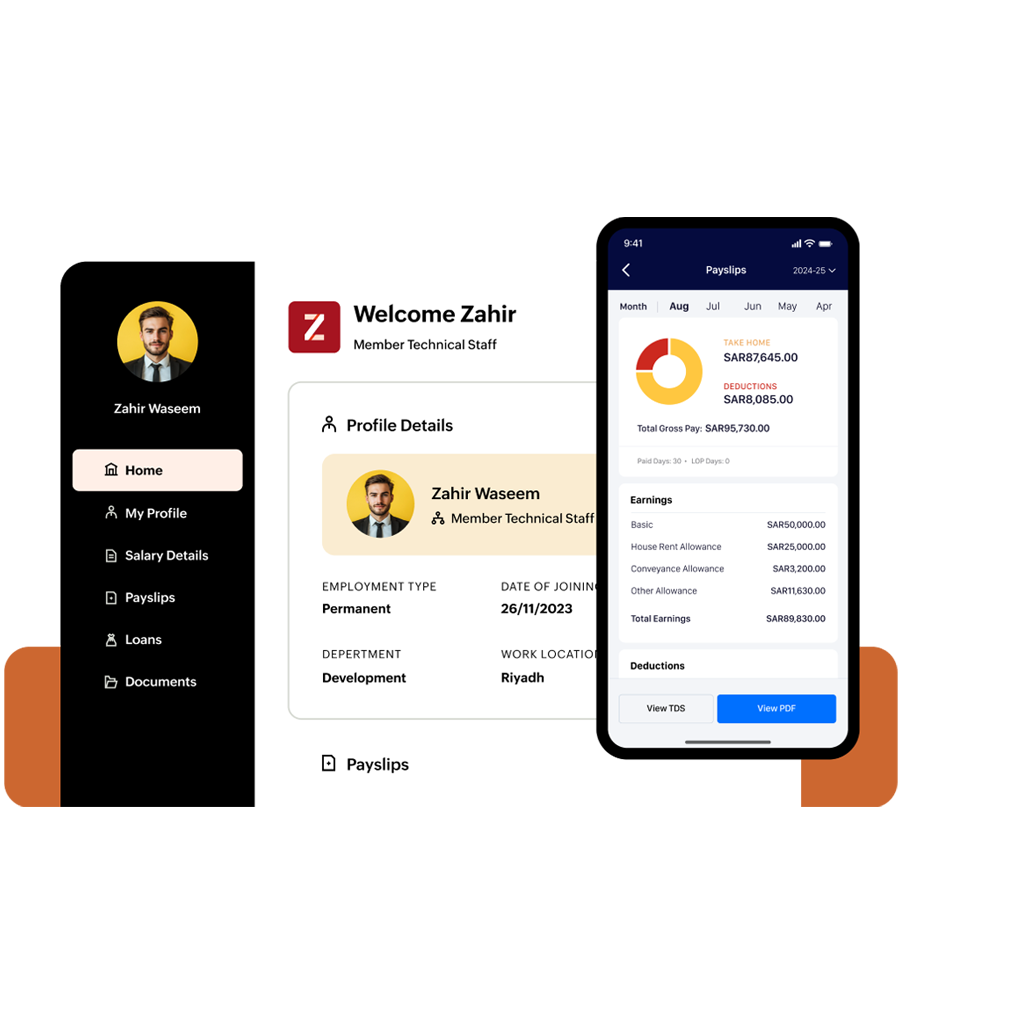

Employee self-service tool

Offer a user-friendly payroll experience for your team

Integration

Bring multiple core systems under one roof

Integrate payroll, HR, accounting, and expense management within one unified ecosystem.

Effortless payroll accounting

Connect to Zoho Books and set journal entries to post automatically to your ledger.

Pay salaries & reimbursements together

Handle payroll and reimbursements simultaneously, ensuring employees are paid on time with zero hassle.

Unify HR with payroll

Sync employee records, leave information, and work locations from Zoho People to Zoho Payroll to simplify payroll processing and final settlements.

Advanced Features

Powerful features built in to work for every team

Create custom earnings formulas

Define personalized formulas for salary components to align with your organization's payroll rules.

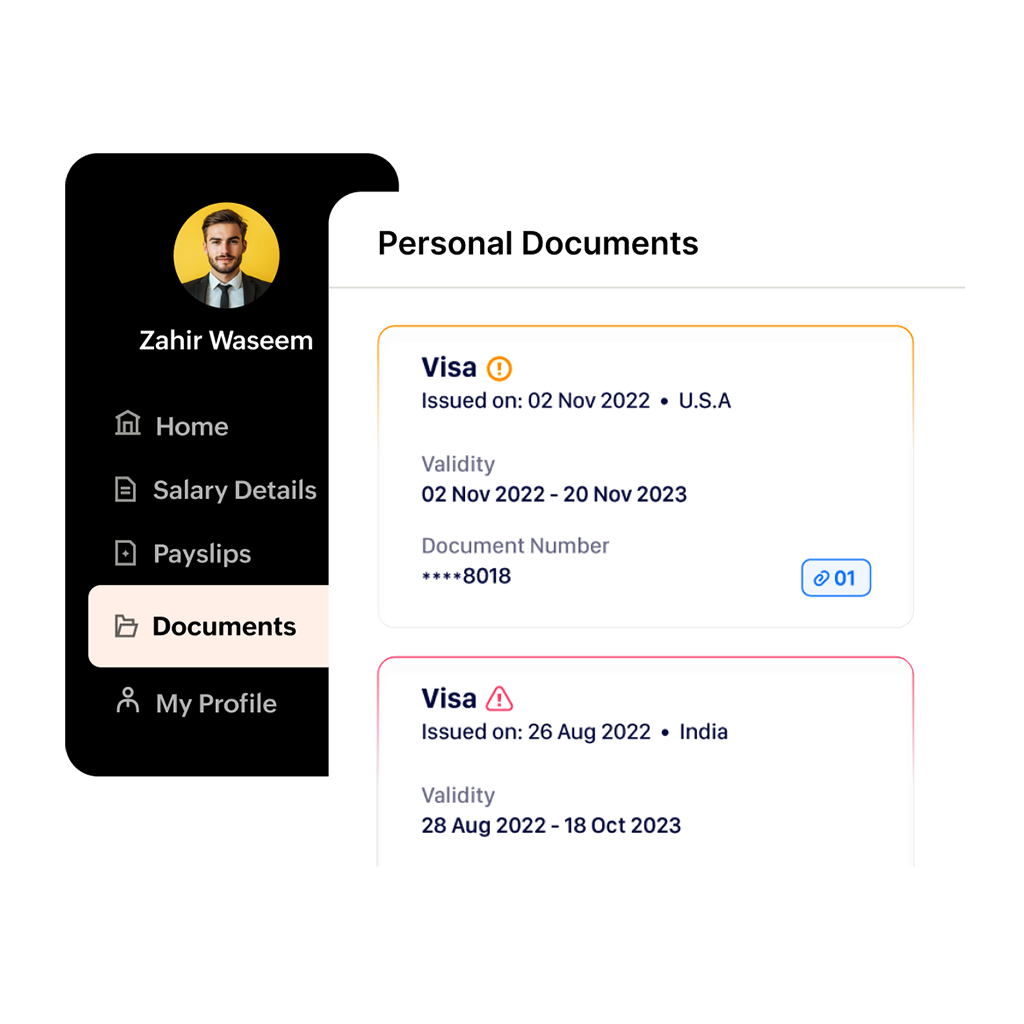

Automate document expiry notifications

Stay ahead with timely alerts for work visas, ID proofs, certifications, and licenses, ensuring uninterrupted compliance.

Make off-cycle payments

Send salaries to employees anytime to accommodate urgent changes, new hires, one-time payments or any exceptional cases.

Region-specific payroll scheduling

Adapt payroll schedules for every GCC region, ensuring salaries are processed on time and in line with labour regulations.

Run payroll tasks on schedule

Automate recurring bonuses, overtime, and allowances to ensure accurate payments every cycle.

Tailor payroll functions for GCC

Set up custom payroll rules, allowances, and deductions to match the specific requirements of each GCC country.