- HOME

- Taxes & compliance

- Transitional registration guidelines under Oman VAT

Transitional registration guidelines under Oman VAT

Registrations for VAT have already begun in the Sultanate. Now that the country is in the transition stage, the Oman Tax Authority has come up with certain regulations on how businesses can register for VAT.

Registration may be mandatory or voluntary, based on the revenue a business generates. If your taxable supplies and imports exceed the mandatory threshold of OMR 38, 500, then you will need to register. However, you can also opt for voluntary registration, if your taxable supplies and imports exceed voluntary registration threshold of OMR 19,250.

Registrations for VAT in the Sultanate began in February, and the law comes into effect on 16 April 2021. Now that the country is in the transition stage it is important that you get your businesses registered before the effective date of law.

In this guide, you will learn about the eligibility criteria for registration, calculating annual supplies, deadlines for registration and steps to register via the Tax Authority's online portal.

Steps for VAT registration

You can follow the steps below to register your business for VAT in the Sultanate of Oman:

Step 1: Check if you are required to register for VAT in Oman

You are required to register for VAT if:

You have a place of residence in Oman

You are performing business activities in the Sultanate. Business activities include commercial, industrial or any other professional activities.

Your value of supplies is already exceeding the mandatory registration threshold or is likely to exceed it in the future.

Irrespective of your business turnover, if your business is not established in Oman but still provides taxable supplies to other businesses in the Sultanate, then you must also register for VAT.

There are two tests to determine if you are exceeding the mandatory registration threshold.

Backward look: Here you will need to check if your taxable turnover has exceeded the mandatory VAT threshold for the current month plus the previous 11 months.

Forward look: Here you will need to check if your taxable turnover is expected to exceed the mandatory threshold in the current month plus the upcoming 11 months.

Unregistered businesses need to track their revenue and continue to check if any of the two conditions applies. The moment either of the conditions becomes true, then they must register for VAT.

Businesses exempt from VAT

The Sultanate has specified a few kinds of businesses that are exempt from registering for VAT:

1. If you are a taxable person or business selling exempt supplies, even if your revenue exceeds the prescribed threshold, you do not need to register for VAT.

2. If you are a taxable person or business engaged in manufacturing zero-rated supplies, you may request to get exempted from registering for VAT.

Step 2: Determining value of supplies for registration

In order to calculate the value of your supplies, you will need to know the following values:

1. Value of all taxable supplies, excluding the values which fall under capital assets.

2. Value of goods and services that are supplied to a taxable person and subject to the reverse charge mechanism.

3. Value of supplies of goods and services distributed in the intra-GCC region.

Let's look at a scenario to understand how the value of supply can be calculated. Salalah, a television company, had the following transactions in the year 2020.

From the above table, the value of supply will be = 800,000 + 300,000 + 1000 = 1,101,000 OMR.

Step 3: Determining annual supplies

The date of registration mentioned by the Sultanate of Oman was 1 January, 2021 and the law comes to effect only on 16 April, 2021. Calculating the annual value of supply during the periods around the transition to VAT can be confusing, so the government has provided some guidelines.

Calculating annual supplies before the effective date of law

If you are to calculate taxable supplies for the term before 16 April 2021, you will need to determine which of your supplies would be taxable/exempt and then calculate the taxable value, as if the law was in effect at that time.

To calculate your actual annual supplies during the transition, use the total value of supplies made during the 12-month period between 1 November 2019 and 31 October 2020.

To calculate your expected annual supplies during the transition, use the total value of supplies that are expected to be made in the 12-month period between 1 October 2020 and 30 September 2021.

This would help the person calculate when to register their business for VAT. If they are not currently required to register, then they should carry out frequent checks using these rules mentioned to determine if they have crossed the registration threshold after the effective date.

Calculating annual supplies after 1 January 2021

The value of actual annual supplies is the total value of the supplies made in any 12-month period whose end date is the last day of a month (for example, the 12 months ending on 31 January 2022).

The value of expected annual supplies is the total value of the supplies which are expected to be made in any 12-month period that starts at the beginning of a month (for example, the 12 months beginning on 1 June 2021).

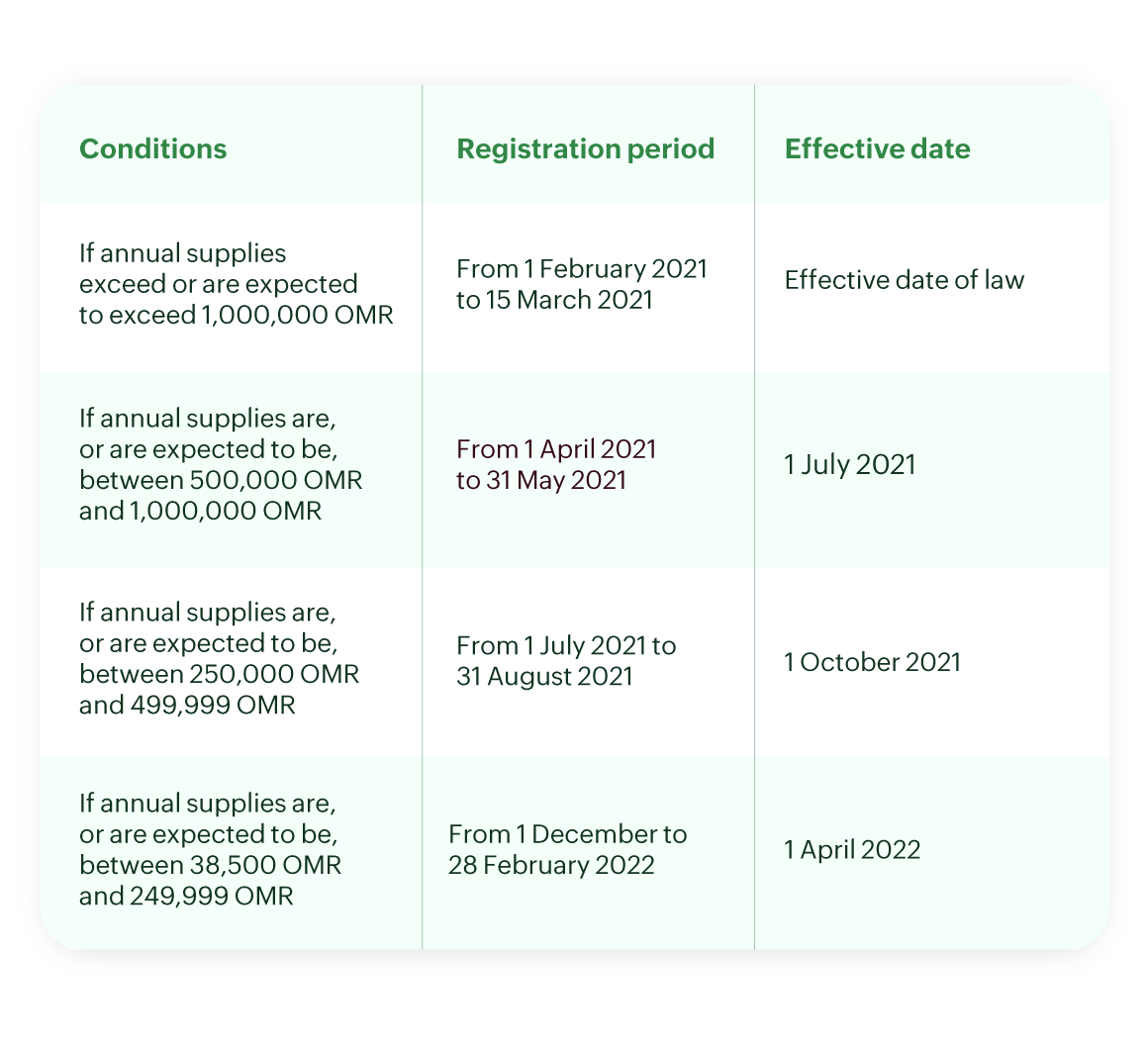

Step 4: Follow the deadlines for mandatory registration

Once you have calculated the value of your annual supplies, you must apply to register with the Tax Authority by the following due dates.

The effective dates mentioned in the above table are the dates from which you must comply with the VAT regulations.

For example, if your company's value of annual supplies is 750,000 OMR, then you must apply for registration between 1 April 2021 to 31 May 2021. You must comply with VAT regulations starting 1 July 2021.

Those voluntarily registering for VAT can apply for registration with the Tax Authority from 1 February 2021.

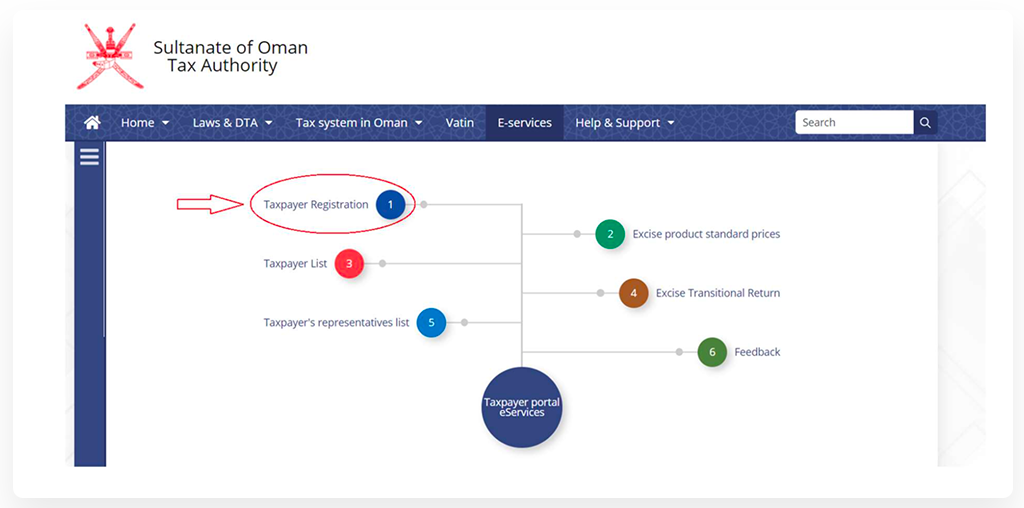

Step 5: Register from the VAT registration portal

You will need to follow the below steps to submit your registration application.

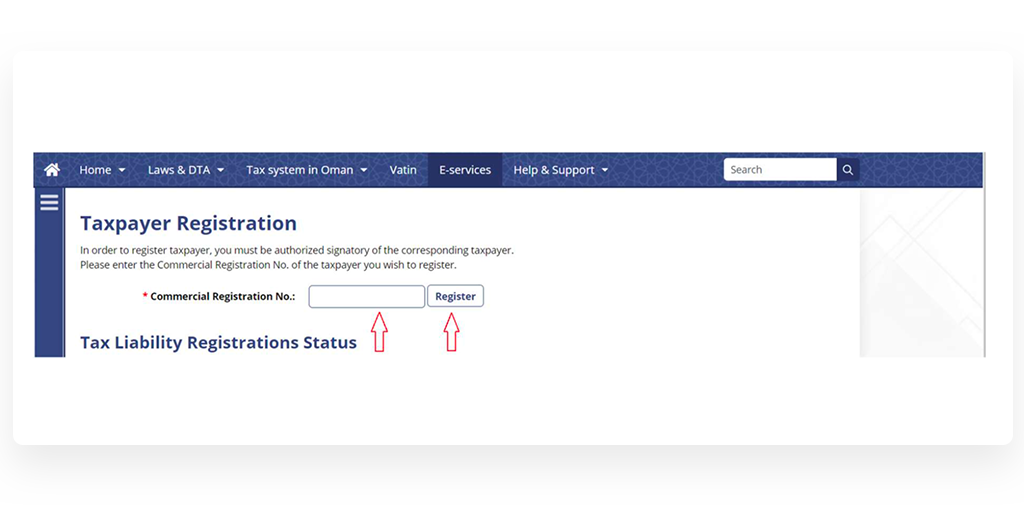

1. Register your business at the Tax Authority's online portal. You will need to obtain a Commercial Registration Number (CRN) to register via the online portal. Taxpayers without a CRN must fill up the form available in the Tax Authority's portal and submit it via mail.

2. In the Commercial Registration field, enter your CRN and click Register.

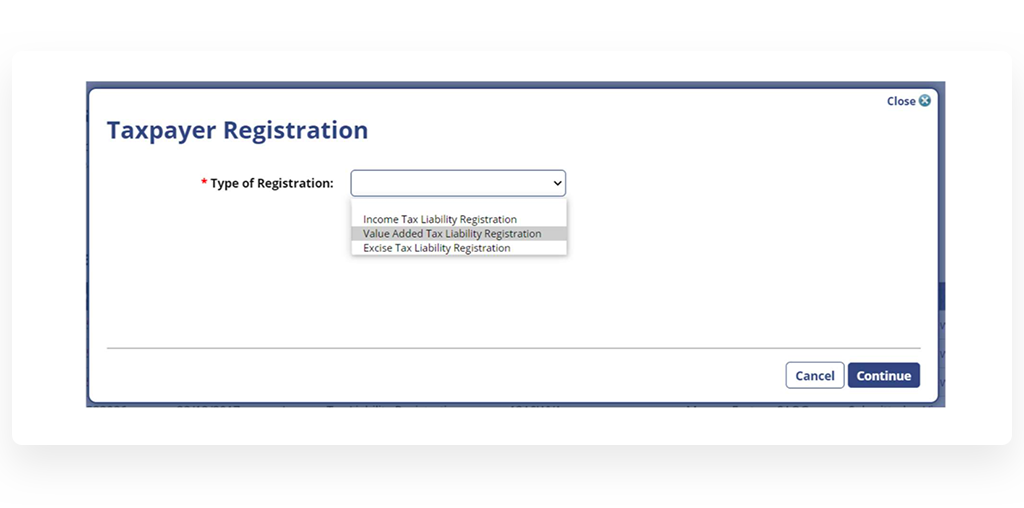

3. In the 'Taxpayer Registration' page, click Type of Registration and select Value Added Tax Liability Registration from the drop-down menu. Click Continue.

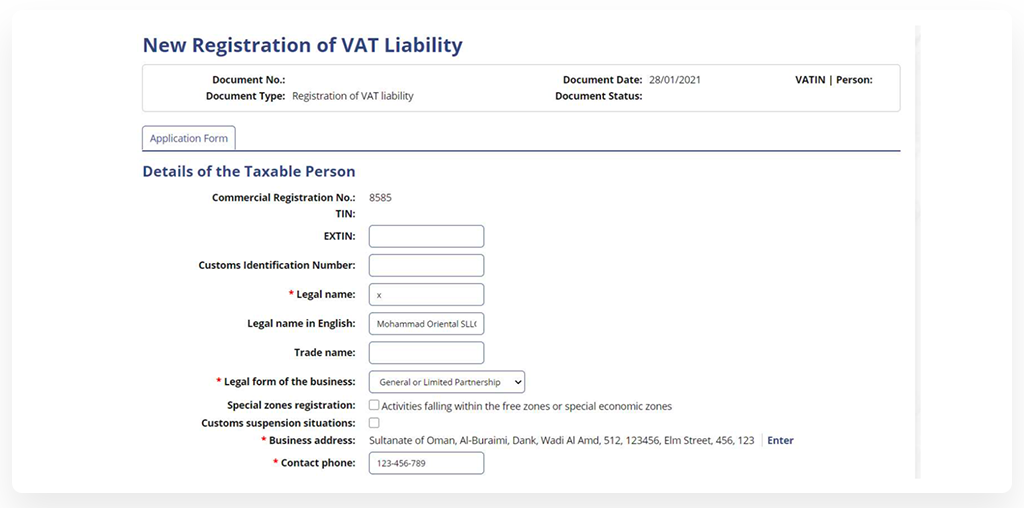

4. Once the previous step is completed successfully, the 'New Registration of VAT Liability' page will be displayed.

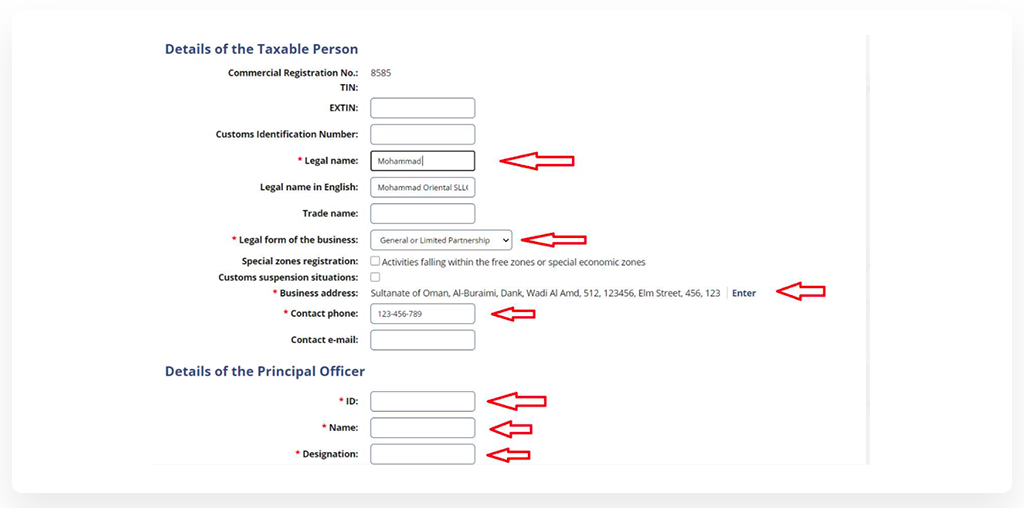

5. Fill in the correct information against each field mentioned in the form.

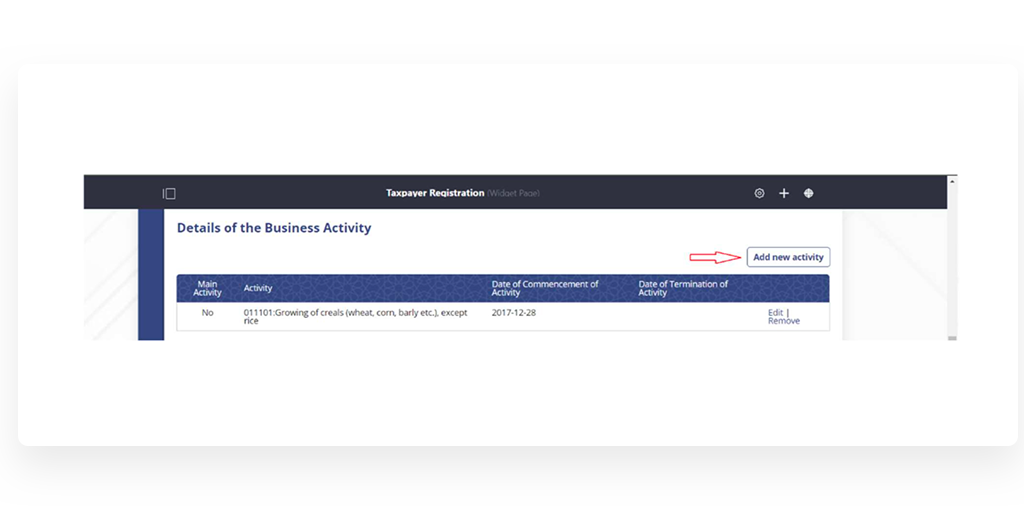

6. Once you have filled out the 'Details of the Taxable Person' section, click Add new activity to add activities to the list.

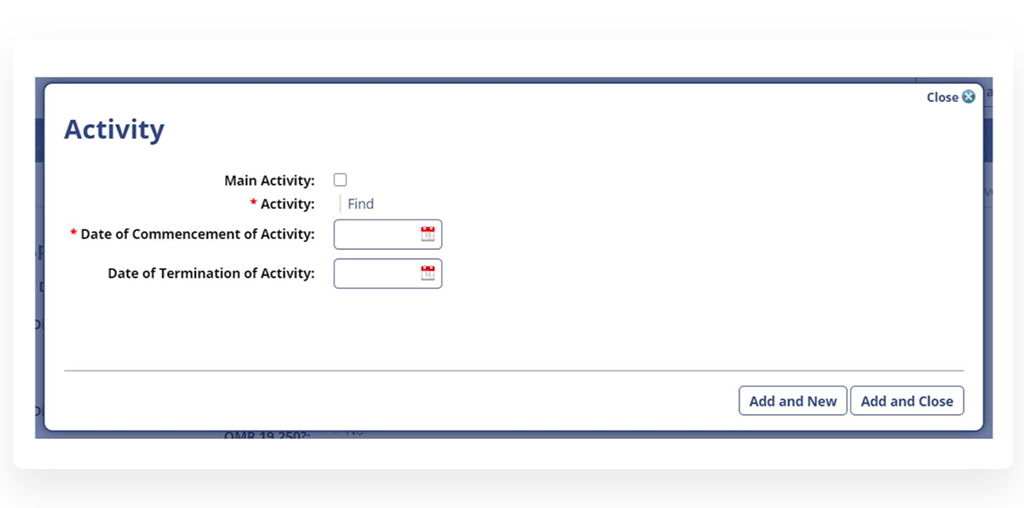

7. In the 'Activity' window, click the Main Activity checkbox and fill out the dates of commencement and termination of that activity. Finally, click Add and Close.

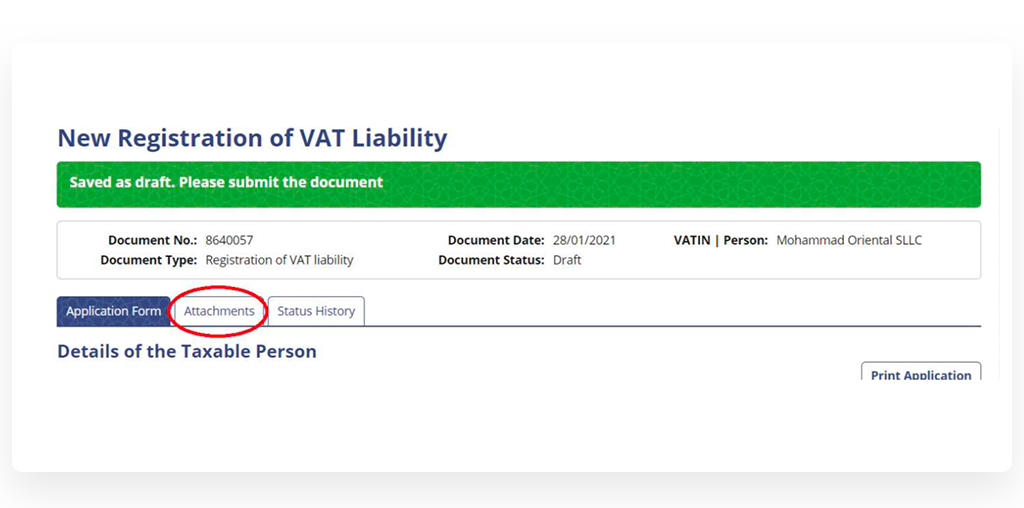

8. In the 'Application for the Tax Registration Number' window, fill out the required fields and click either Save Draft or Submit at the end of the form.

9. You can click Attachments to add any necessary document proofs.

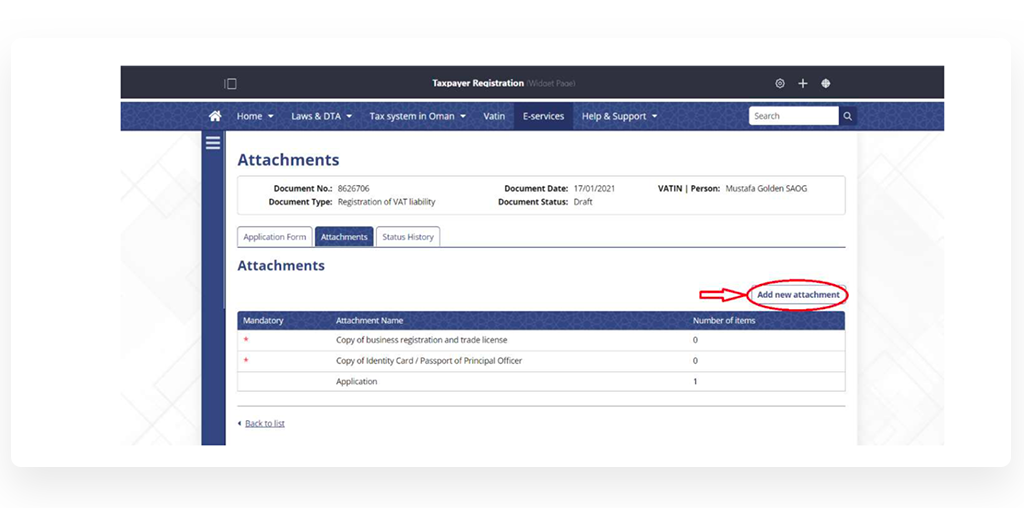

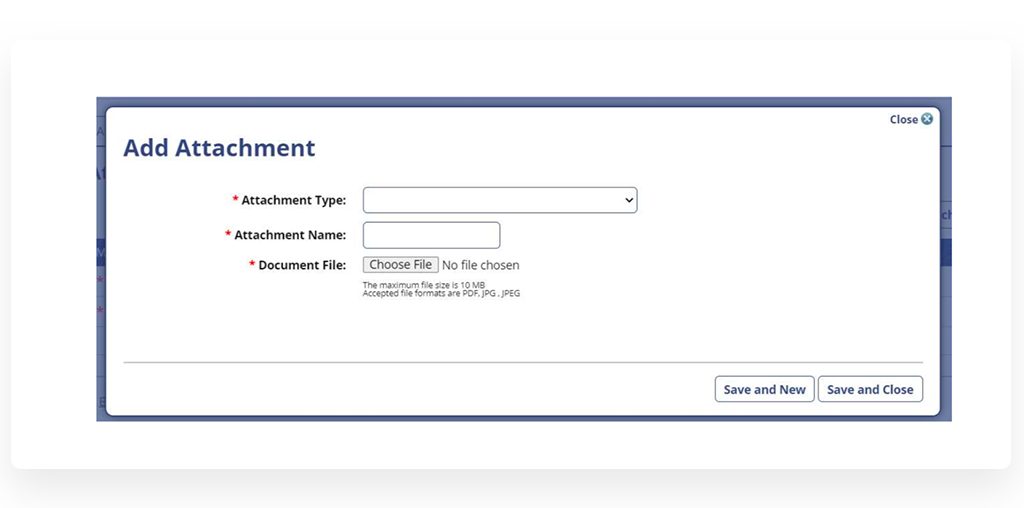

10. Click Add new attachment, fill out the required information and click Save and Close.

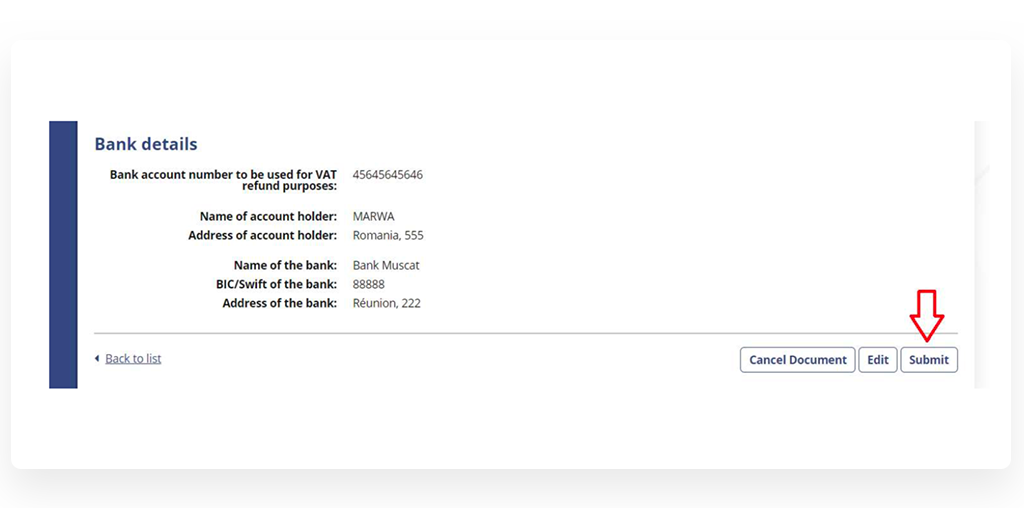

11. You will then need to click the Submit button from the 'Application Form' tab.

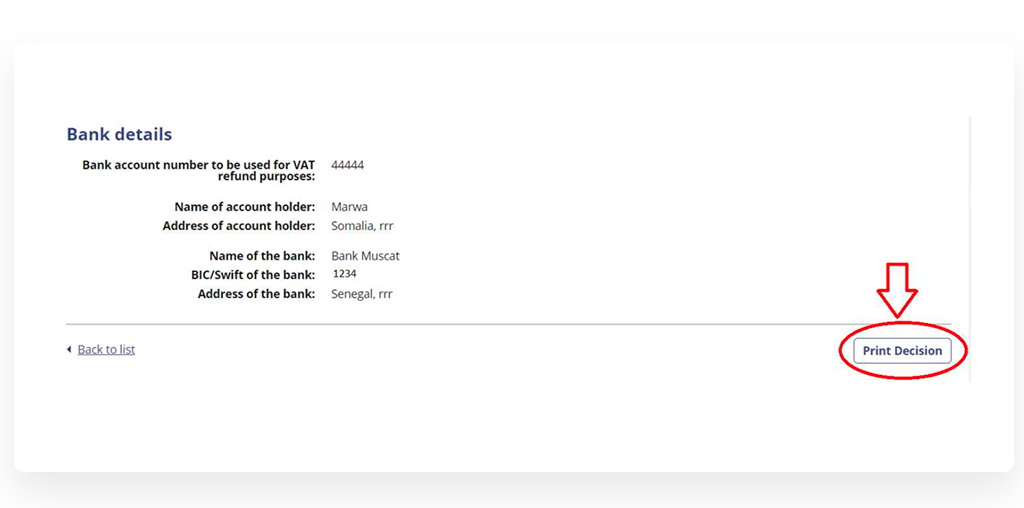

12. Click Print Decision to print the form.

VAT Registration Certificate and VAT Identification Number

Once the Oman Tax Authority reviews your registration application and approves it, you will be issued a VAT registration certificate containing the registration number and other fields such as registration date, tax period, etc. You must display your VAT registration certificate at all of your business locations, including your head office, branch offices, and stores.

Your VAT identification number is a unique number, which will remain consistent for all transactions. The number should be reflected in all reference documents like tax invoices, communications, and any other business documents you produce.