Finance Free Apps

Billing

Accounting

Expense

Inventory

Payroll

- SPREAD THE WORD

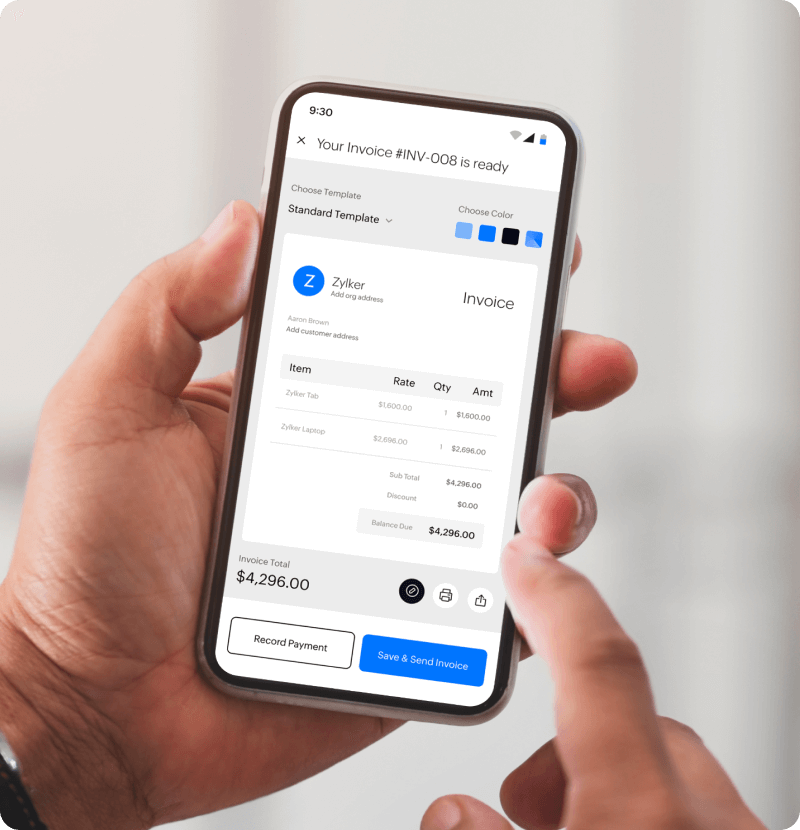

Create professional yet personalized invoices online using Zoho Invoice's free invoice generator tool. Just add all the information to the invoice and download or print it to send it to your customers.

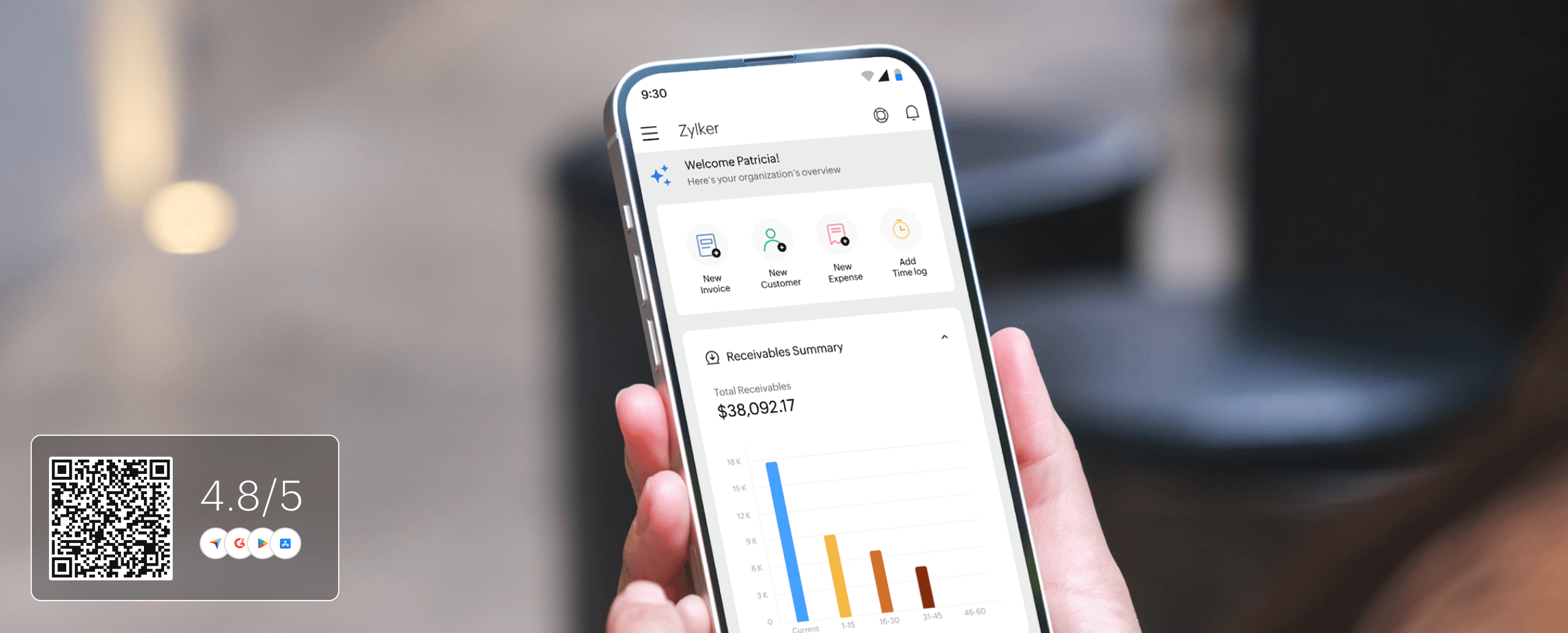

Creating invoices is a hassle. So is chasing payments, tracking expenses, and doing taxes. Zoho Invoice makes all that boring stuff easy. Send invoices and quotes, track time, monitor expenses, and much more for free.

Creating professional invoices with a free invoice generator is now easy. Follow these steps to create an invoice that aligns with your brand identity.

Select the color theme and invoice format (Standard, Spreadsheet, or Compact) in which you wish to display your invoice. Once done, upload your business logo so your invoices reflect your brand's image.

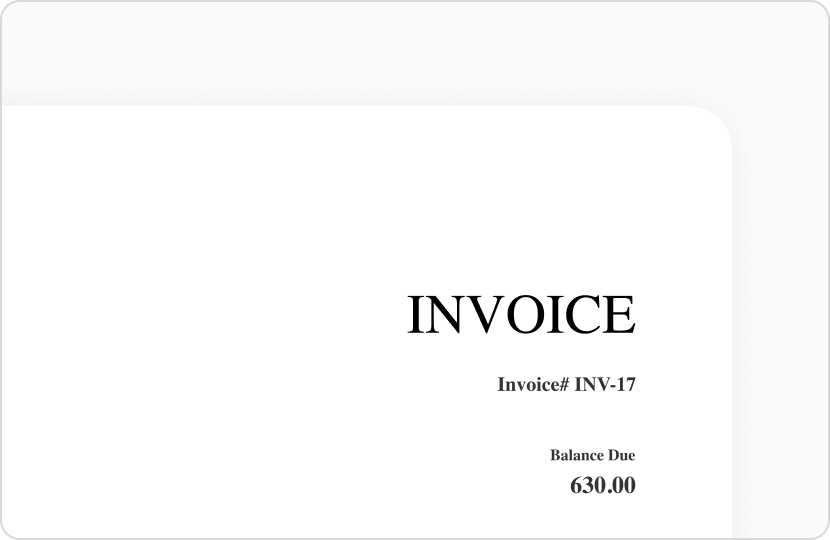

Fill out the essential details like your business name, business address, customer contact information, invoice number, invoice date, and the payment due date.

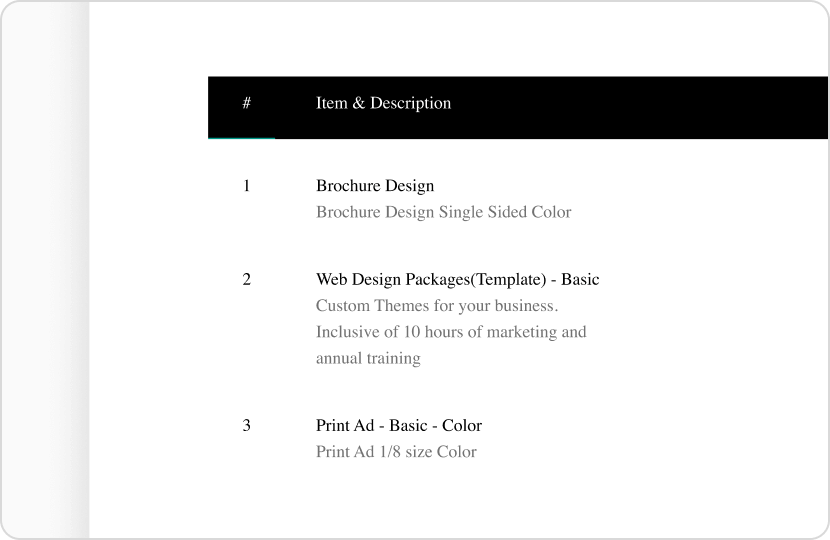

Enter the details of the sale items in the Item description table, and the invoice generator will automatically calculate the rates as you input the item quantities. You can also provide additional notes and terms and conditions in the Notes and Terms and Conditions section.

After entering all the necessary details, click Download/Print to download or print the document, or click Save Online to save and access the invoice later from anywhere using Zoho Invoice.

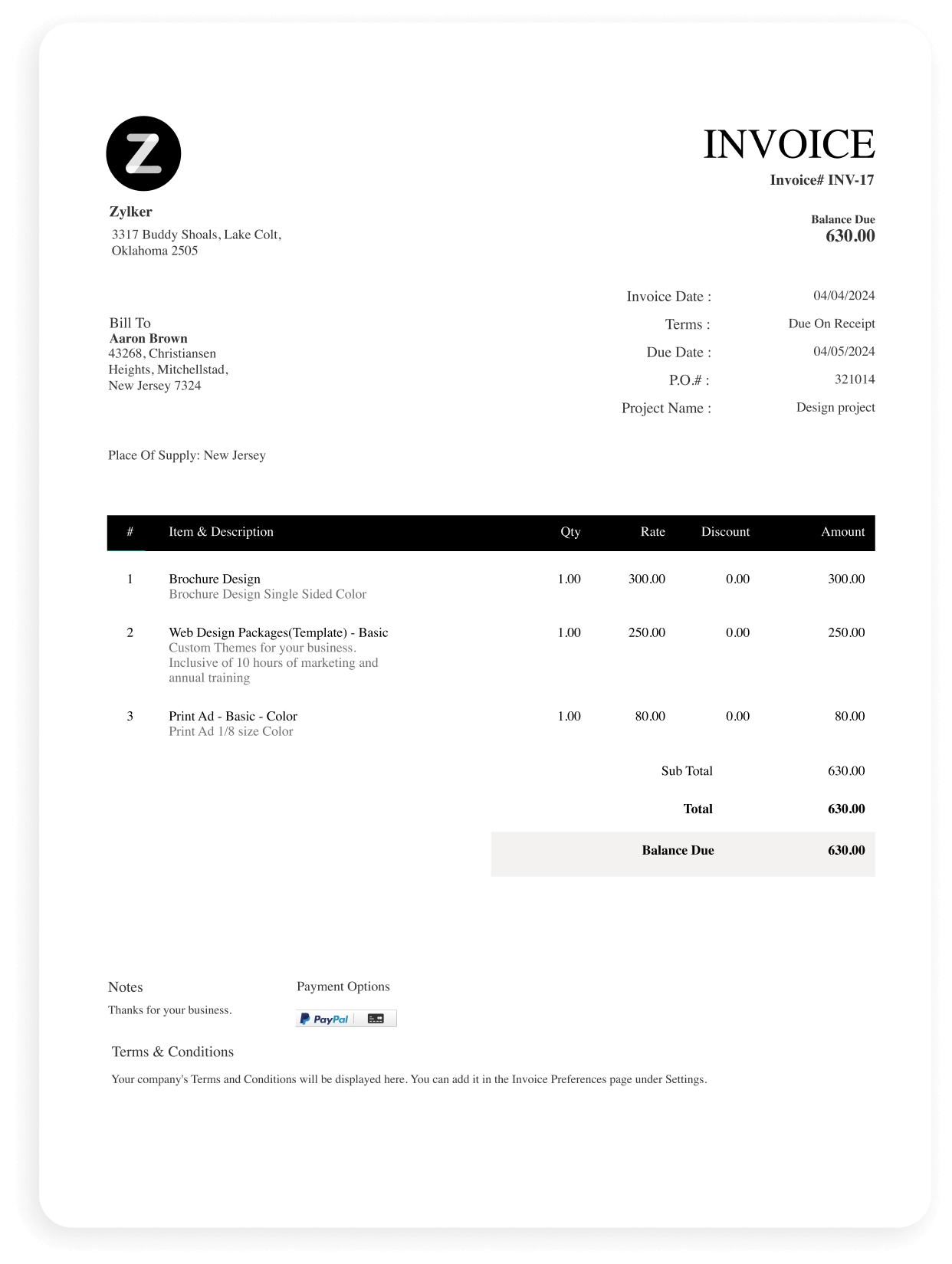

A usual business invoice contains the following components:

The business's logo, name, and address; and the customer's contact information.

The invoice number, invoice date, and the due date

The item names, descriptions, quantities, and rates.

The subtotal, taxes, and total amount that needs to be paid.

The notes and terms and conditions section.

The business's logo, name, and address; and the customer's contact information.

The invoice number, invoice date, and the due date

The item names, descriptions, quantities, and rates.

The subtotal, taxes, and total amount that needs to be paid.

The notes and terms and conditions section.

A business logo is a unique symbol that represents an organization. Adding a business logo to your invoices not only reinforces your brand's identity among your customers but also projects your business as a legitimate one.

Businesses might send out huge volumes of invoices. In such cases, tracking each invoice becomes a tedious task. This is where an invoice number comes in handy. An Invoice number is a sequential number that uniquely identifies each invoice. Sequentially numbering each invoice helps businesses track a specific transaction.

This is the name that your organization goes by. Having your business name and address on your invoice not only makes it easy for your customers to communicate with you but also reassures them that they are dealing with a credible business.

A product description is a compelling marketing copy that showcases all the information of the product. This may include details like the product's size, dimensions, color, and other information. Describing the product in your invoices gives your customers a clear idea of what they are buying.

The invoice date is the date in which an invoice is issued. Apart from this, an invoice also contains the payment due date, which is the date by which a customer should pay the invoice.

Terms and conditions are a set of rules that both the buyer and seller should abide by. These rules might define the payment terms, late fees, or explain the return and refund policies for goods or services.