Integrate Zoho Expense With WAY2VAT

VAT is a value-added tax that is applied on a product or a service at all stages, starting from production to the point of its sale. If your employee incurs expenses with VAT applied to it, in your country or another country on behalf of your business, you can reclaim the VAT applied to those expenses and WAY2VAT helps you do just that.

WAY2VAT is an application that analyzes if VAT is recoverable from your employees’ domestic and foreign expenses such as meals, accommodation, fuel, etc. and makes the process of reclaiming VAT simple and effortless. To reclaim VAT, you can simply integrate Zoho Expense with WAY2VAT and all the reimbursed expense records will be auto-synced at regular intervals for analysis.

How does the integration work

Once you enable the integration, all the expenses and the expense receipts that are associated with reimbursed reports will be automatically synced to WAY2VAT on the first day of every month. WAY2VAT will analyze if the expenses are eligible for VAT reclaim, and help you receive the maximum refund based on the VAT rules.

Prerequisite: A Zoho Expense organisation and a WAY2VAT account.

Enable Integration From WAY2VAT

- Sign in to your WAY2VAT application.

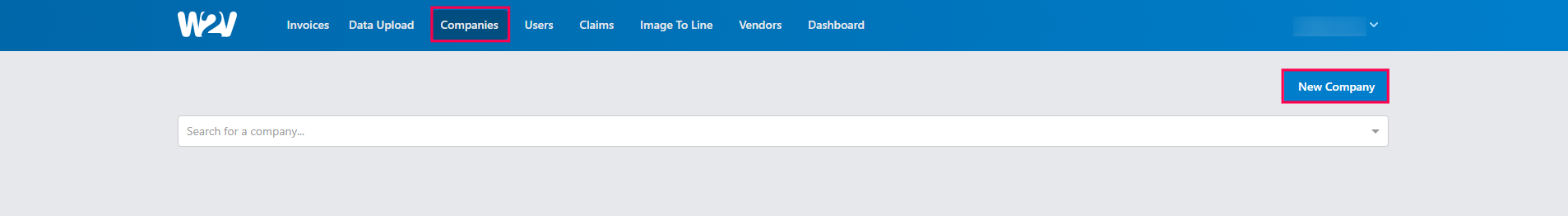

- Go to Companies on the top bar.

- Select the company with which you’d like to integrate Zoho Expense. If you do not want to integrate with an existing company, you can create a new company by clicking New Company.

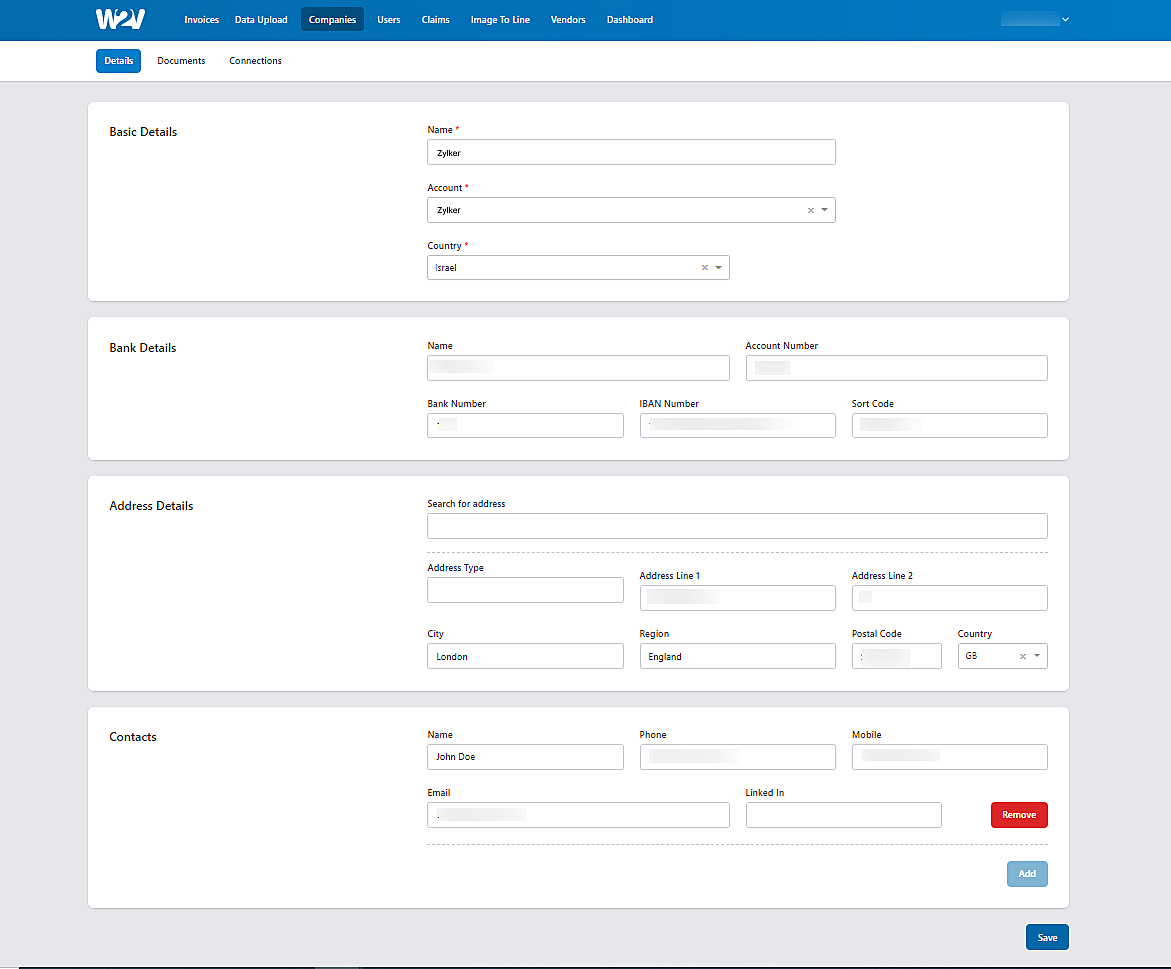

- Enter the details of the new company and click Add.

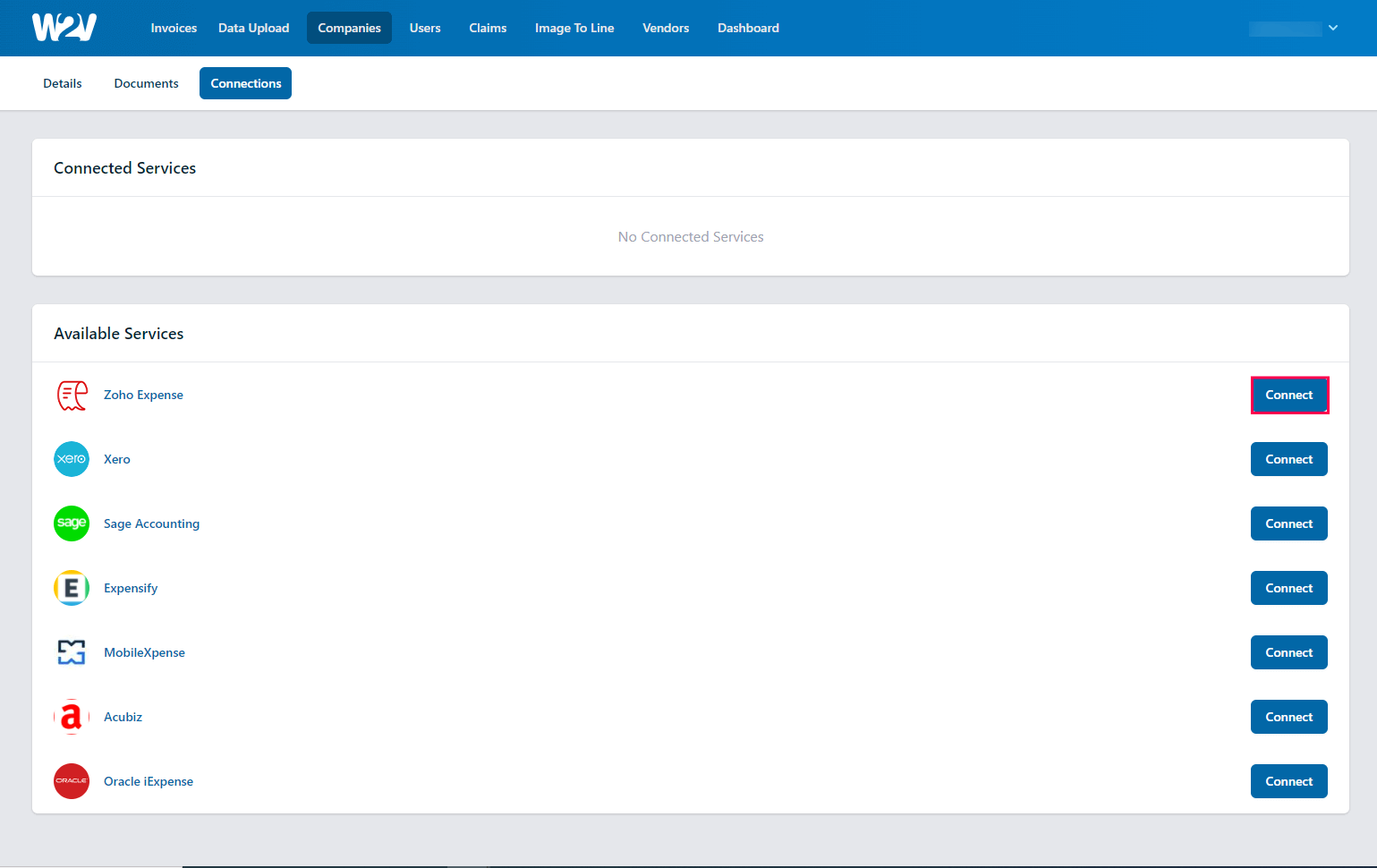

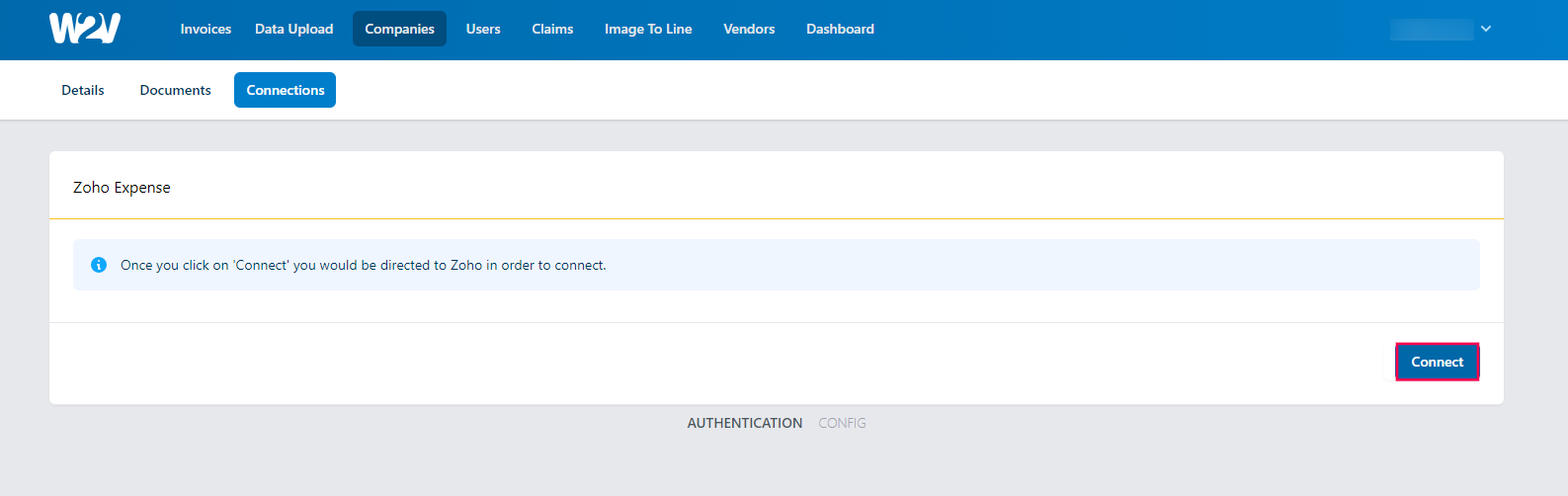

- Navigate to the Connections tab.

- Under Available Services, click Connect at the right corner of Zoho Expense.

- Click Connect again and you will be redirected to Zoho.

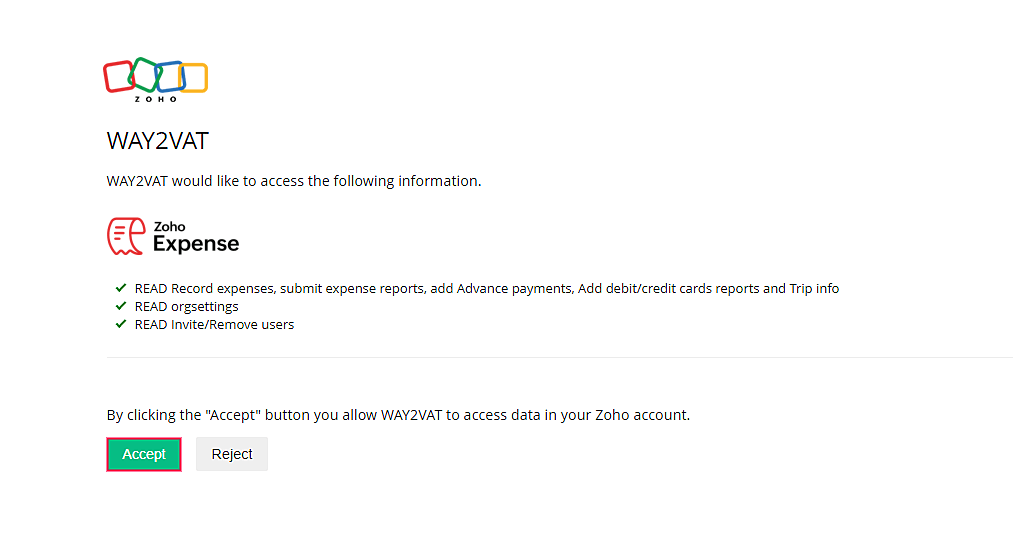

- Enter your Zoho Expense credentials and click Accept to authorise WAY2VAT to access your expenses.

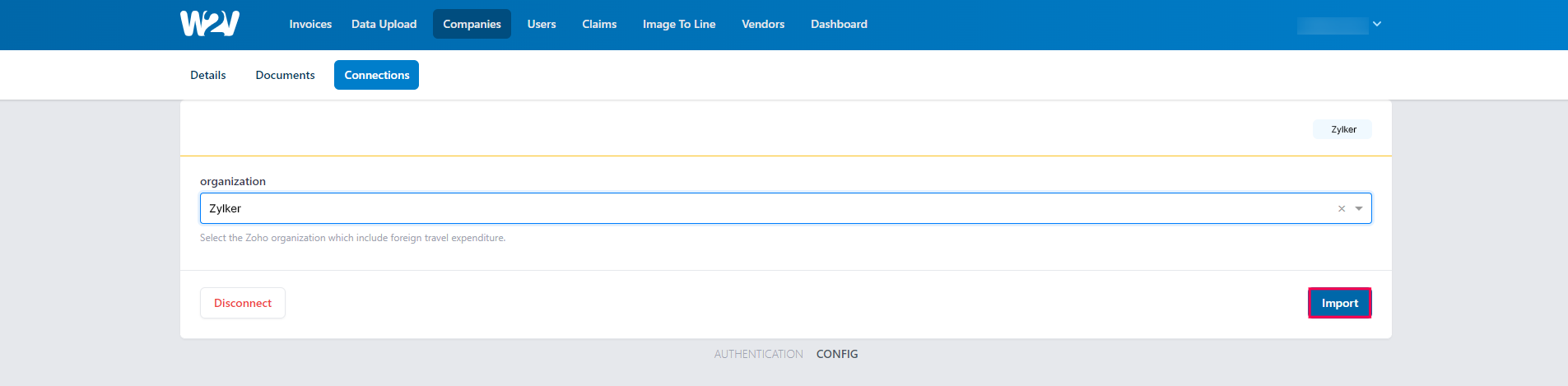

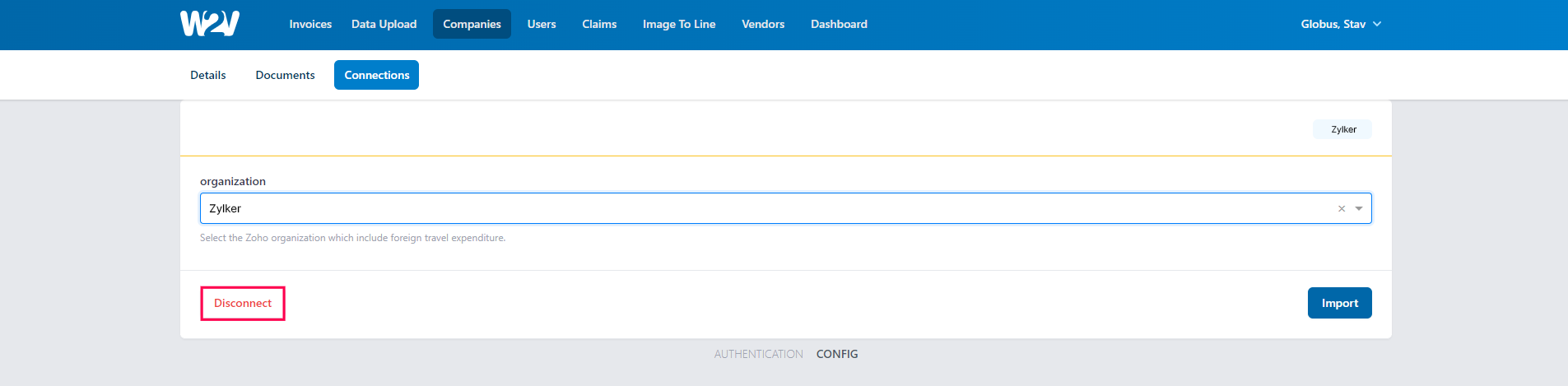

- In the page that opens, select the organisation that you want to connect with WAY2VAT and click Import to sync the data to WAY2VAT.

Once this is done, reimbursed expenses and receipts of the past two years will be synced to WAY2VAT. After this initial data sync, as the reports get reimbursed in Zoho Expense, the expenses in the reports will be automatically synced to WAY2VAT on the first of every month.

Disconnect the Integration

If you disconnect the integration, the reimbursed expenses will stop being synced with WAY2VAT. To disconnect the integration:

- Sign in to your WAY2VAT application.

- Go to Companies on the top bar.

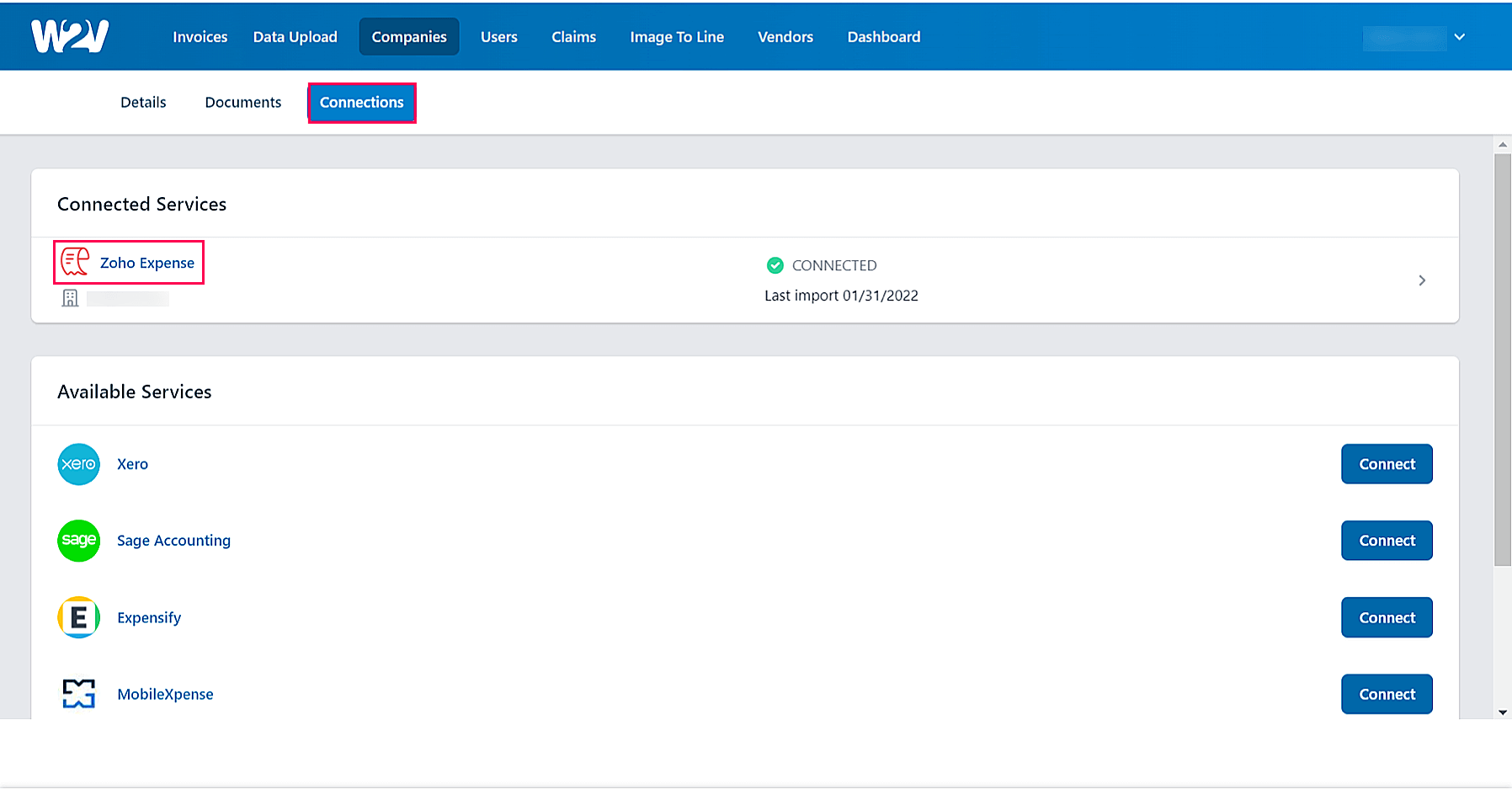

- Navigate to the Connections tab and click Zoho Expense under Connected Services.

- Click Disconnect.

- The integration will be disconnected. You can connect it later when required.

Yes

Yes