Zoho Expense - Sage Accounting Integration

If you have been importing employee expenses into Sage Accounting manually every time you close your accounting books, this integration will automate it for you. With the Zoho Expense - Sage Accounting Integration, all your expenses will be exported to Sage Accounting regularly and you can get them accounted on time, every year.

Note: This integration is available only in the UK edition of Zoho Expense.

Benefits

-

Auto-export of expenses: With this integration, no manual intervention is required to export your employee expenses for accounting. All the expenses from Zoho Expense will be exported to Sage Accounting automatically.

-

Prompt accounting: All the expenses will be exported to Sage Accounting based on the frequency you’ve set and they will be ready, right on time for closing your books.

How It Works

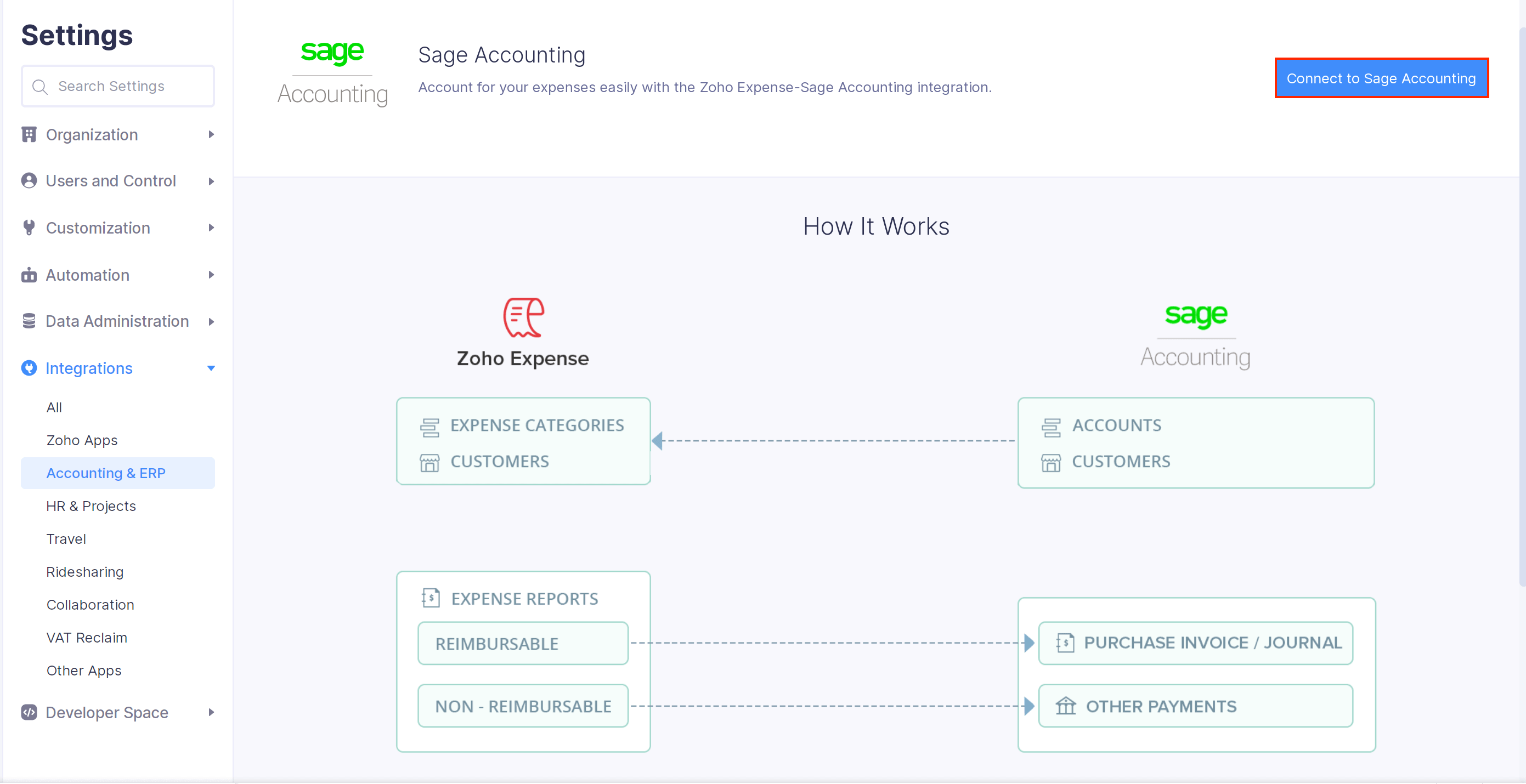

Once you integrate Zoho Expense and Sage Accounting, all the accounts and customers in Sage Accounting are imported as categories and customers respectively. The reimbursable expenses are exported as purchase invoices or journals and the non-reimbursable expenses are exported as other payments to Sage Accounting automatically.

Connect to Sage Accounting

In the first step towards setting up the integration, you will have to connect with Sage Accounting by signing in to it.

Prerequisite:

Ensure that the organisations in both Sage Accounting and Zoho Expense have the same base currency.

To connect:

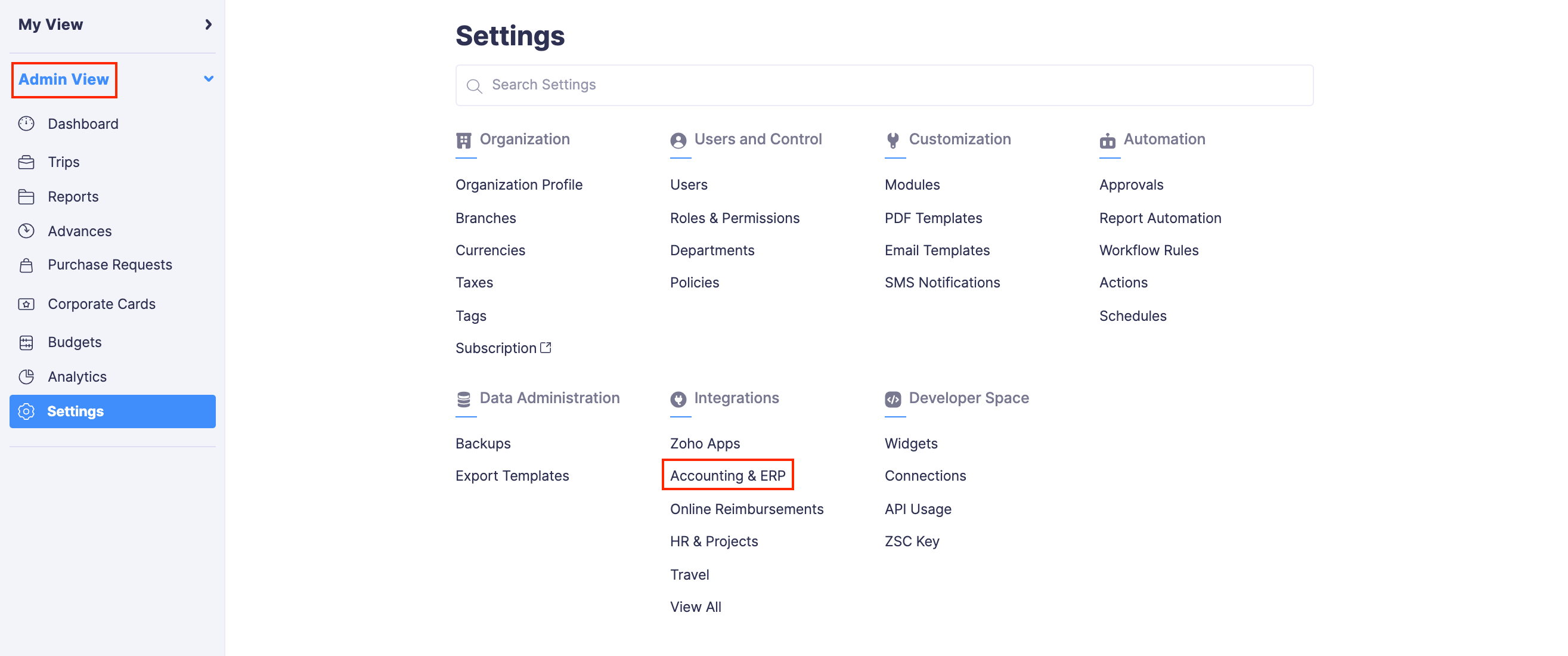

- Click Admin View.

- Click the Gear icon at the top right corner.

OR

Go to Settings on the left sidebar. - Click Accounting & ERP under Integrations.

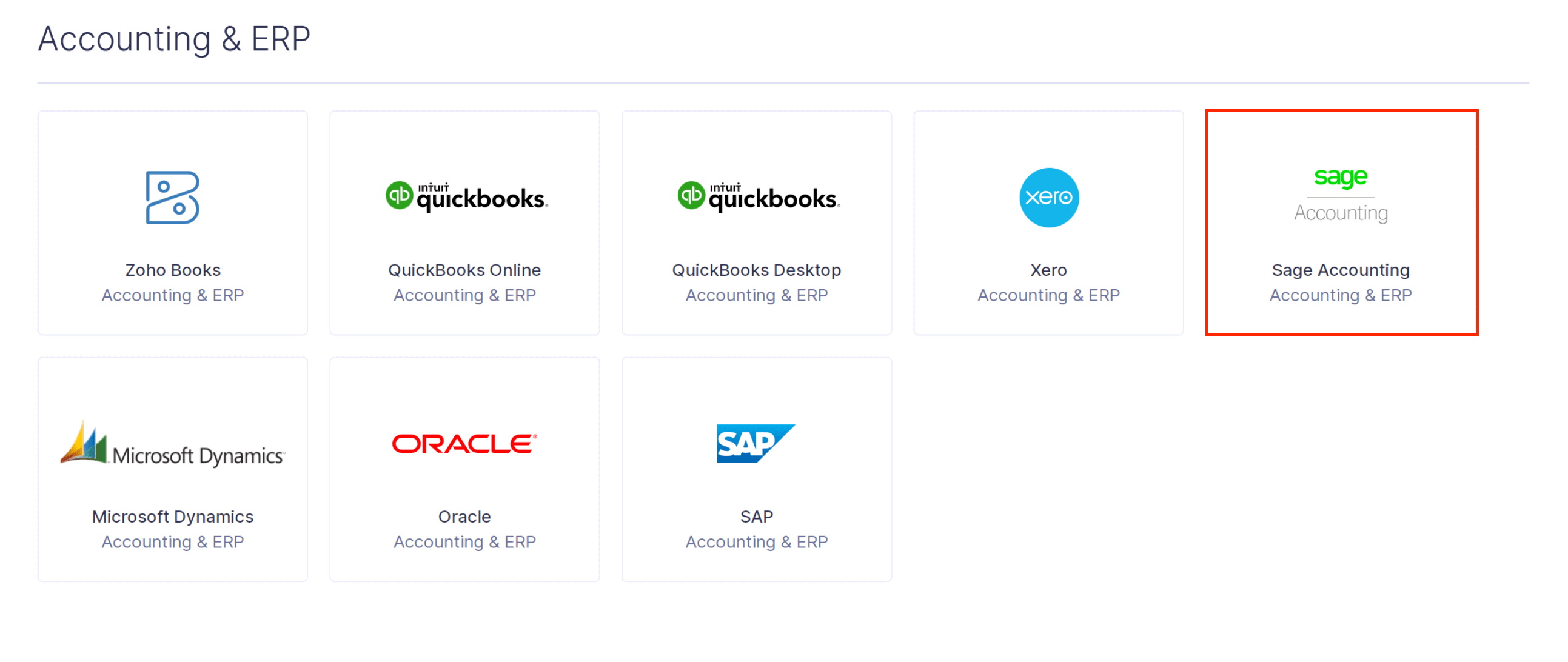

- Click Sage Accounting.

- Click the Connect to Sage Accounting button.

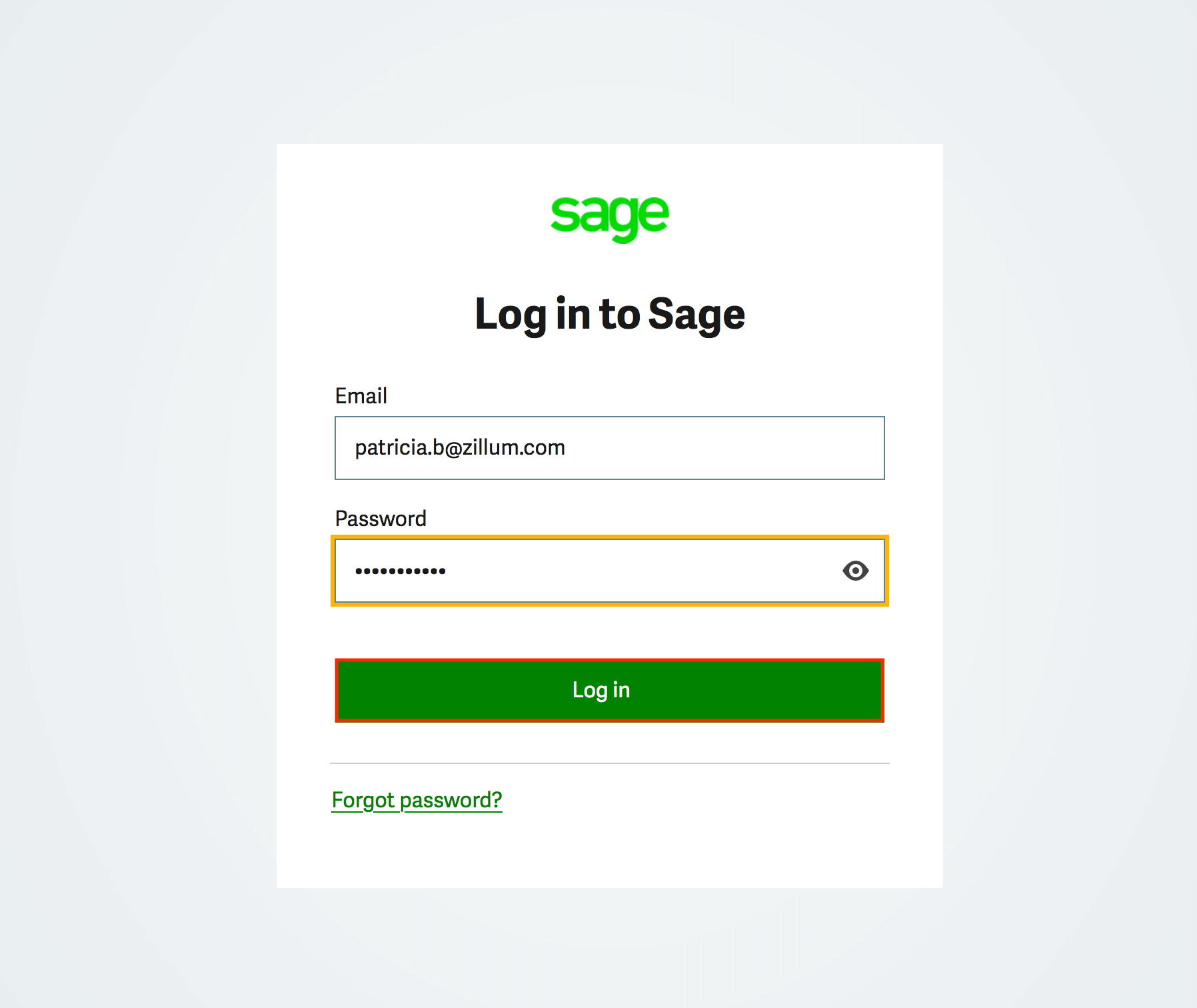

- By doing so, you will be redirected to Sage Accounting’s login page.

- Enter your credentials and log in.

- Select the organisation that you want to connect with Zoho Expense.

- Click the Allow access button to complete the authorization.

Once this is done, you will be redirected back to Zoho Expense to configure the integration.

Note: You cannot connect multiple Sage Accounting organisations to your Zoho Expense organisation and vice versa.

Configure the Integration

You can configure how data must be imported from Sage Accounting into Zoho Expense and how it must be exported to Sage Accounting from Zoho Expense. Also, you can map Zoho Expense’s fields with Sage Accounting’s fields so that when you export data from Zoho Expense, the data will be exported under the mapped fields to Sage Accounting.

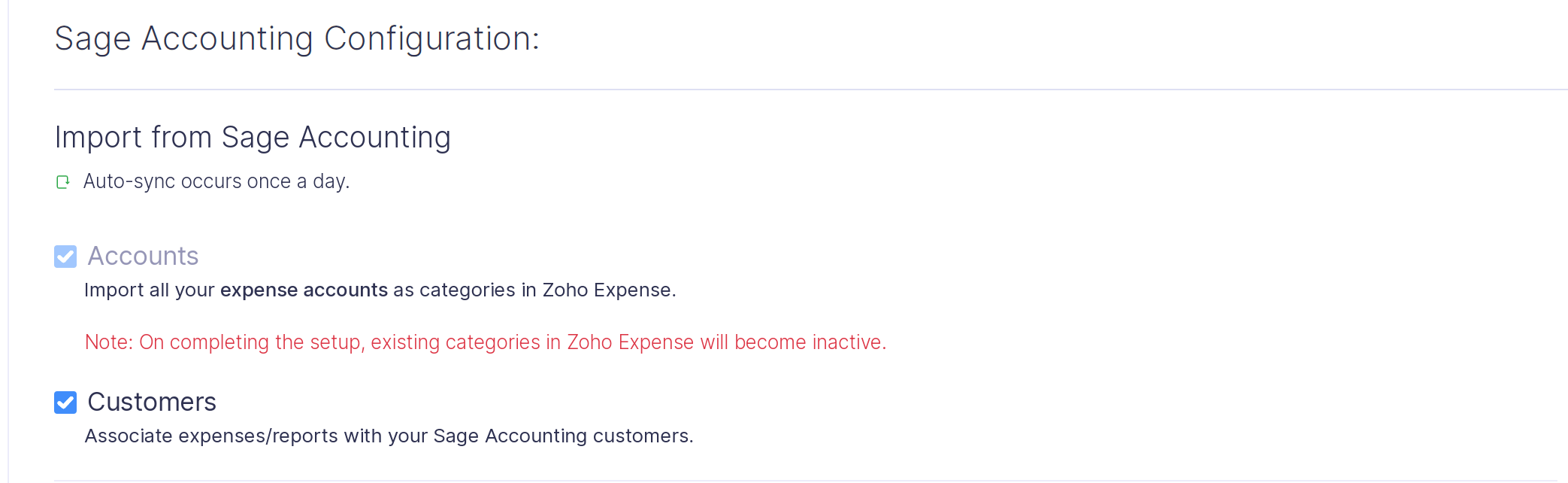

Import from Sage Accounting

Before you can export expenses from Zoho Expense to Sage Accounting, the accounts and customers in Sage Accounting must be fetched into Zoho Expense.

Accounts: The accounts in Sage Accounting can be imported as categories into Zoho Expense. As a result, the existing categories in Zoho Expense will become inactive.

Pro Tip: After the sync, you will not be able to export the expenses that are associated with the activated categories in Zoho Expense. If you want the categories that were made inactive in Zoho Expense after the sync, create the same categories in Sage Accounting and sync the data instantly.

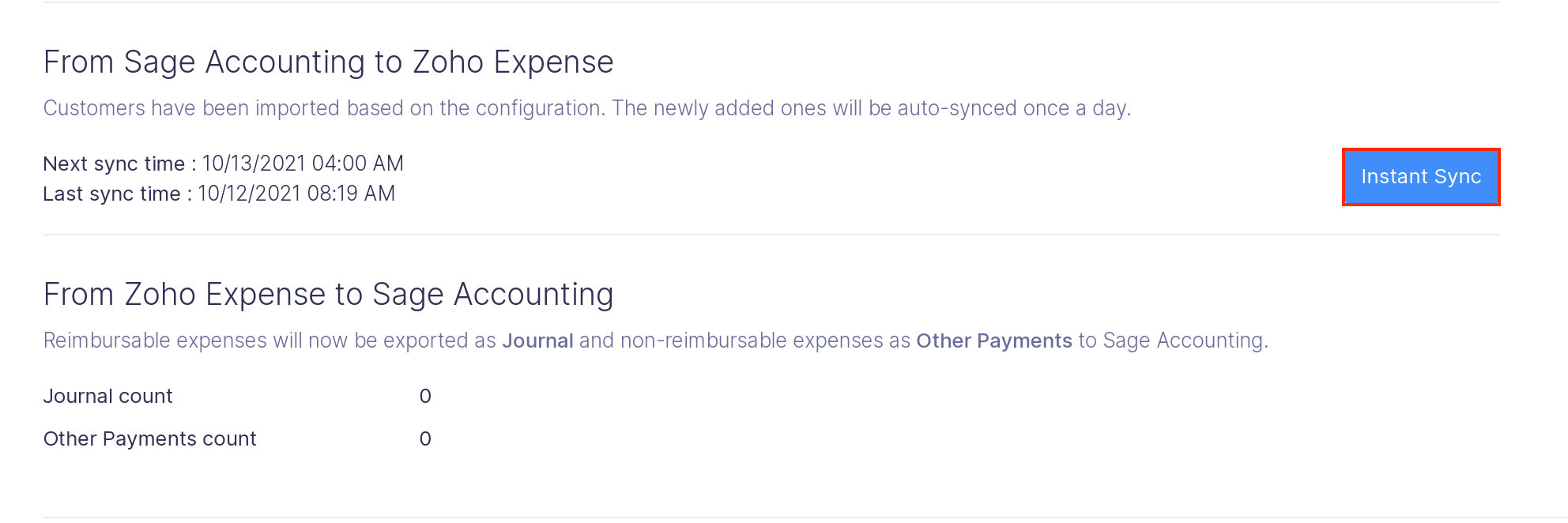

Customers: All your customers from Sage Accounting can be imported into Zoho Expense. These imported customers can be associated with your expenses in Zoho Expense. Any new addition to the list of customers or accounts in your Sage Accounting account will be automatically reflected in Zoho Expense, during the auto-sync that occurs once a day. If you want to view the changes immediately, you can do so by clicking the Instant Sync button.

Export to Sage Accounting

Once you’ve imported the accounts and the customers, you can now set up the auto-export of reimbursable and non-reimbursable expenses from Zoho Expense to Sage Accounting.

Exporting Reimbursable Expenses

You can choose how you would like to export your expenses to Sage Accounting. Reimbursable expenses can be exported as:

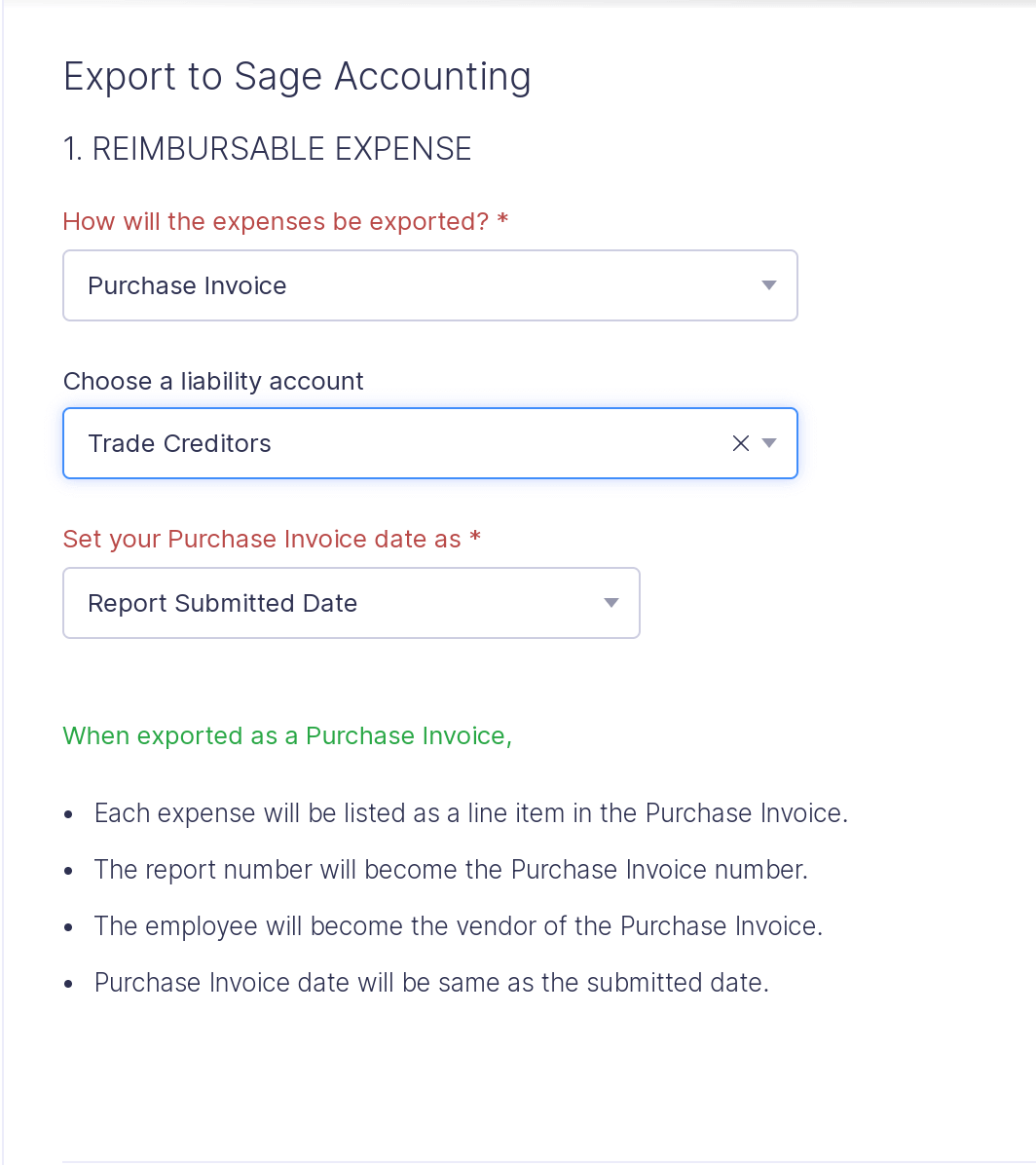

Purchase Invoice

-

When an expense report is exported, a purchase invoice will be created in Sage Accounting wherein each of your reimbursable expenses will be listed as a line item. All the expense details such as the merchant, amount, description, customer, etc., will be mentioned in the line.

-

The purchase invoice number will be the same as the report number.

-

Select a liability account from the dropdown using which you will track the amount to be paid to an employee. The employee would be the vendor of the purchase invoice.

-

Configure the purchase invoice date as any one of the following:

- Expense Date: The date on which the last expense was incurred.

- Report Approval Date: The date on which the report was approved.

- Report Submitted Date: The date on which the report was submitted.

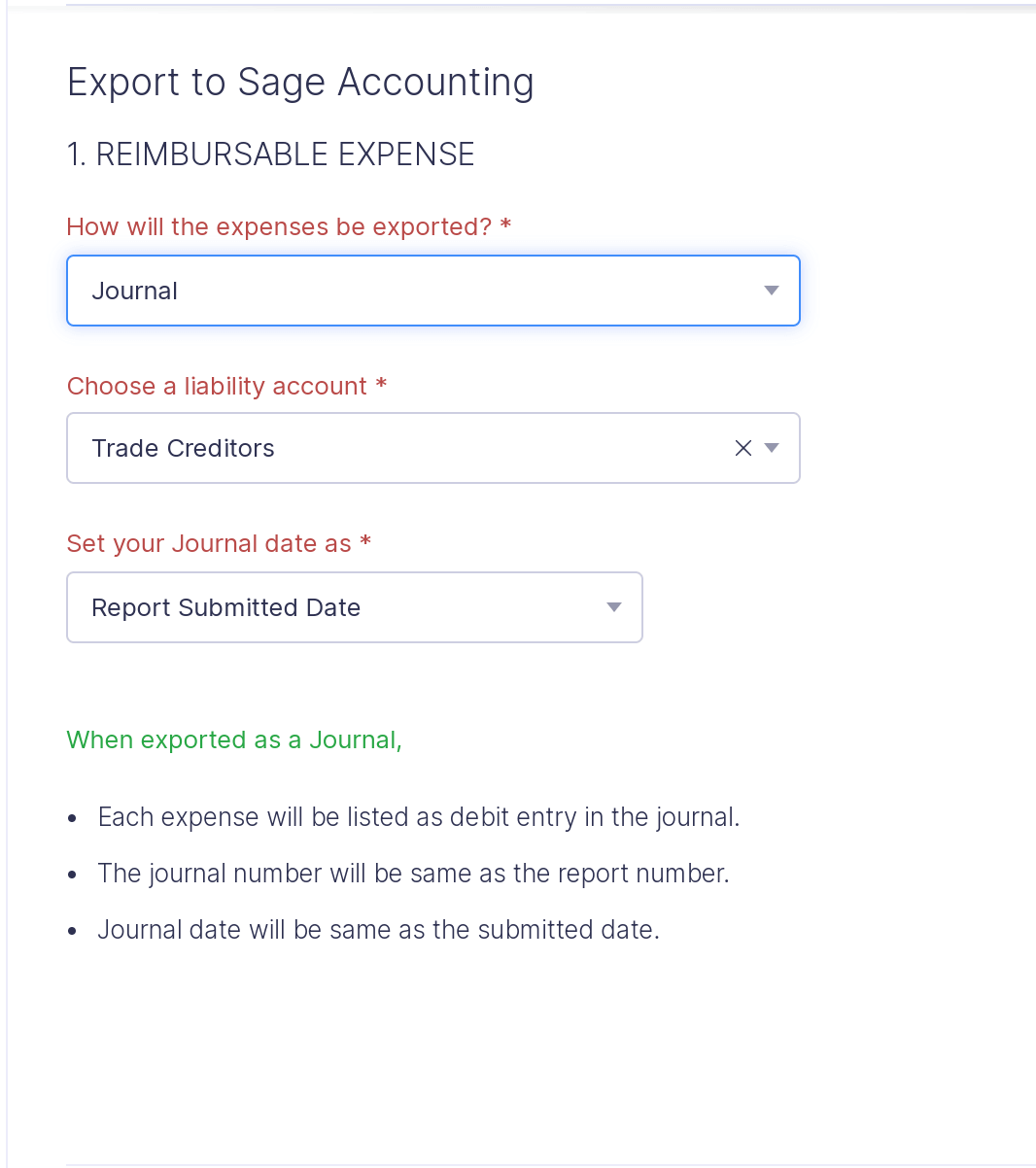

Journal

- Each expense will be entered as a debit transaction in the journal along with the employee name associated with that expense.

- The journal number will be the same as the report number.

- Configure the journal date as any one of the following: Expense Date: The date on which the last expense was incurred. Report Approval Date: The date on which the report was approved. Report Submitted Date: The date on which the report was submitted.

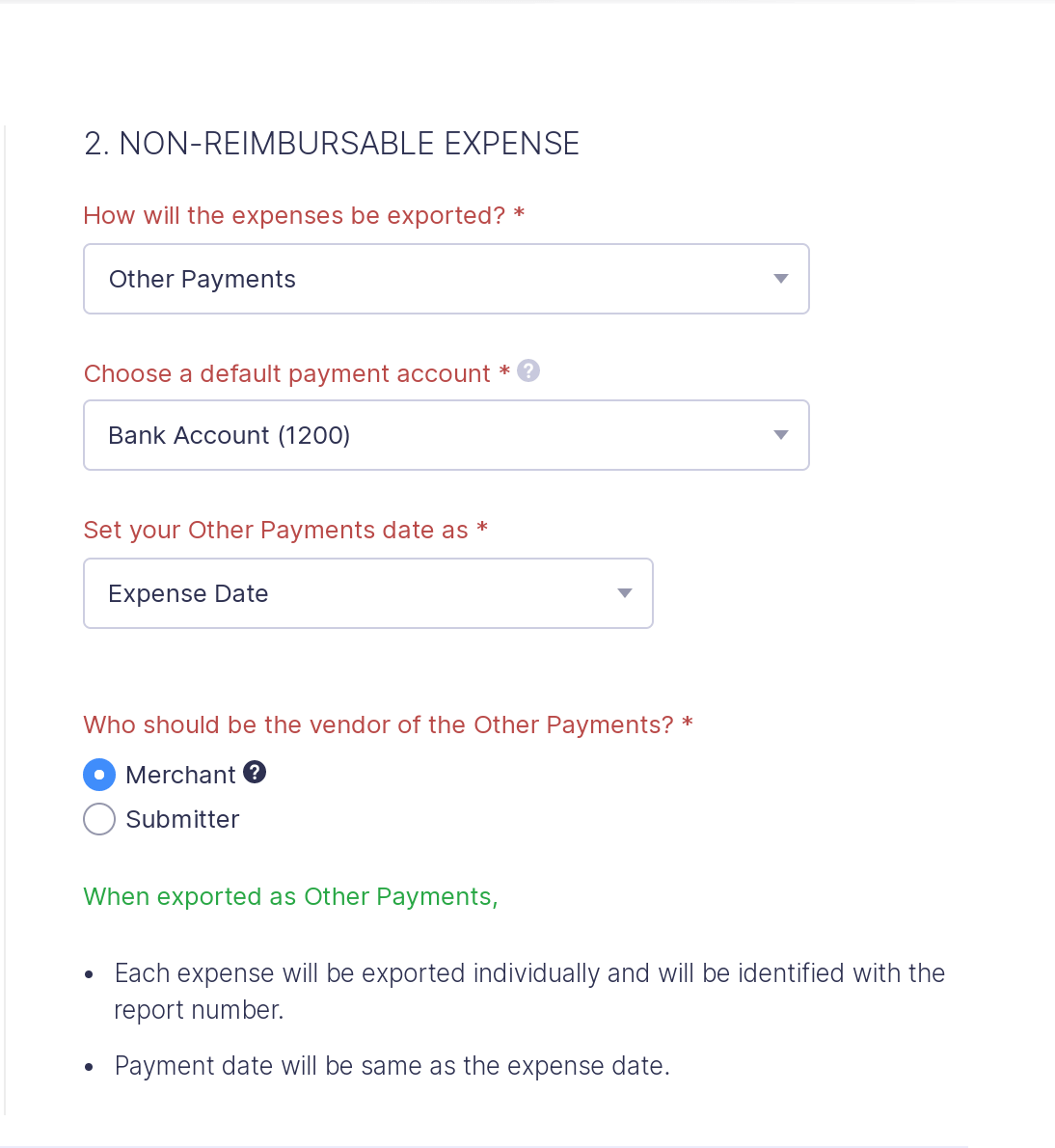

Exporting Non-reimbursable Expenses

The non-reimbursable expenses in Zoho Expense will be exported to Sage Accounting as other payments. In the Choose a default payment account dropdown, the credit card accounts and bank accounts will be listed for choosing the payment account of non-reimbursable expenses.

You can set the other payment’s date as any one of the following:

- Expense Date

- Report Approval Date

- Report Submitted Date

Select whether the Merchant or the Submitter should be the vendor of other payments.

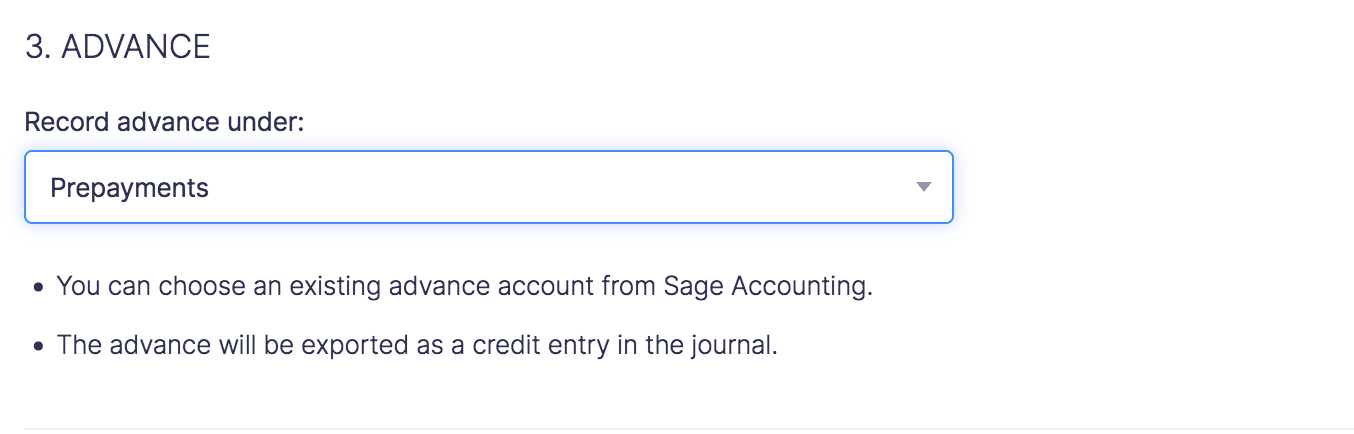

Advance

The advances in Zoho Expense will be exported to Sage Accounting as purchase credit notes. In the Record advance under dropdown, you can choose an existing advance payment account from Sage Accounting.

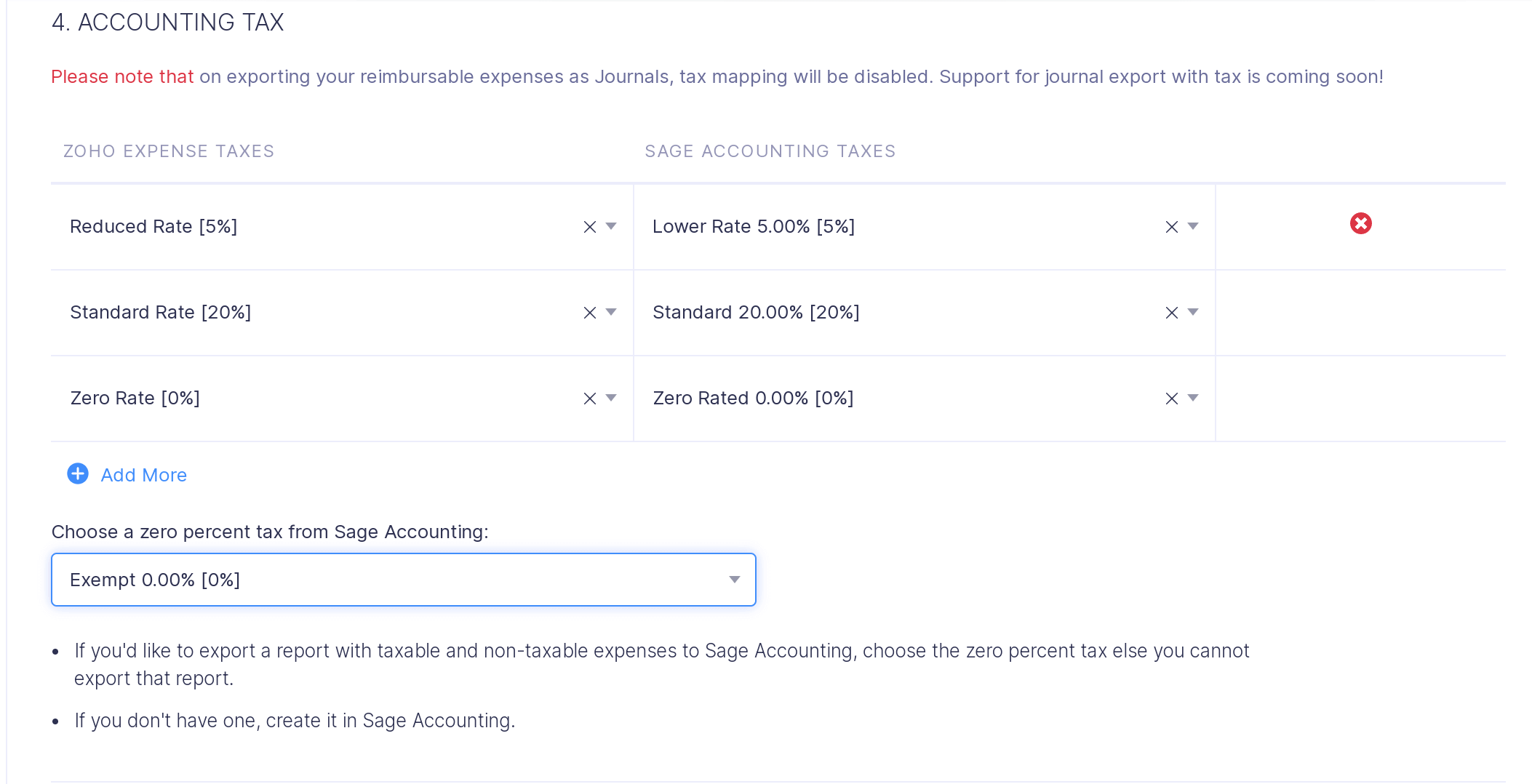

Mapping Taxes

The taxes that have been created in Zoho Expense can be mapped with the corresponding taxes in Sage Accounting. To map the taxes:

- Navigate to the Accounting Tax section.

- Select a tax from the dropdown under the Zoho Expense Taxes.

- Select a corresponding tax in Sage Accounting under the Sage Accounting Taxes dropdown.

- Once this is done, when expenses with taxes are exported from Zoho Expense, the corresponding tax in Sage Accounting will be automatically applied.

- If you’d like to export a report with taxable and non-taxable expenses from Zoho Expense, you must choose a zero percent tax from Sage Accounting. When exported as a purchase invoice, the taxable expenses in that report will be calculated based on the taxes mapped in Zoho Expense. Whereas, tax mapping is not possible for non-taxable expenses. In that case, the zero percent tax that you choose here will be applied to the corresponding non-taxable expenses exported from Zoho Expense.

- To choose a zero percent tax:

Select a tax from the dropdown under the Choose a zero percent tax from Sage.

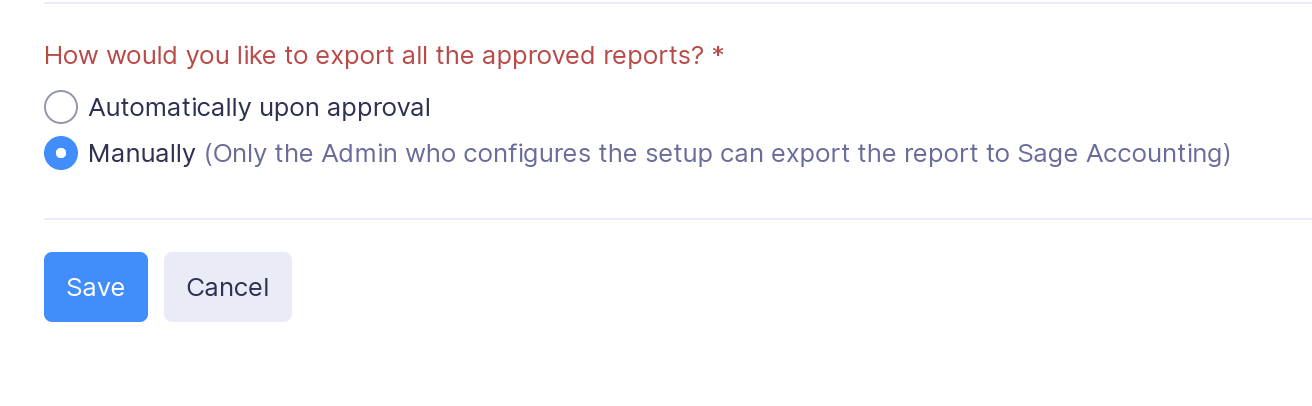

Configure Export of Reports

Once the report is approved, it is ready to be exported to your Sage Accounting account. It will be automatically exported to Sage Accounting upon approval or manually exported by the admin who initiates the integration with Sage Accounting.

After you’ve chosen the data you would like to import, export, and map, click Save. The data that you’ve chosen to import, export, and map will be auto-synced once a day. You can also do instant sync by clicking the Instant Sync button in the Sage Accounting integration page.

Now, you’re all set to enjoy the Zoho Expense – Sage Accounting integration.

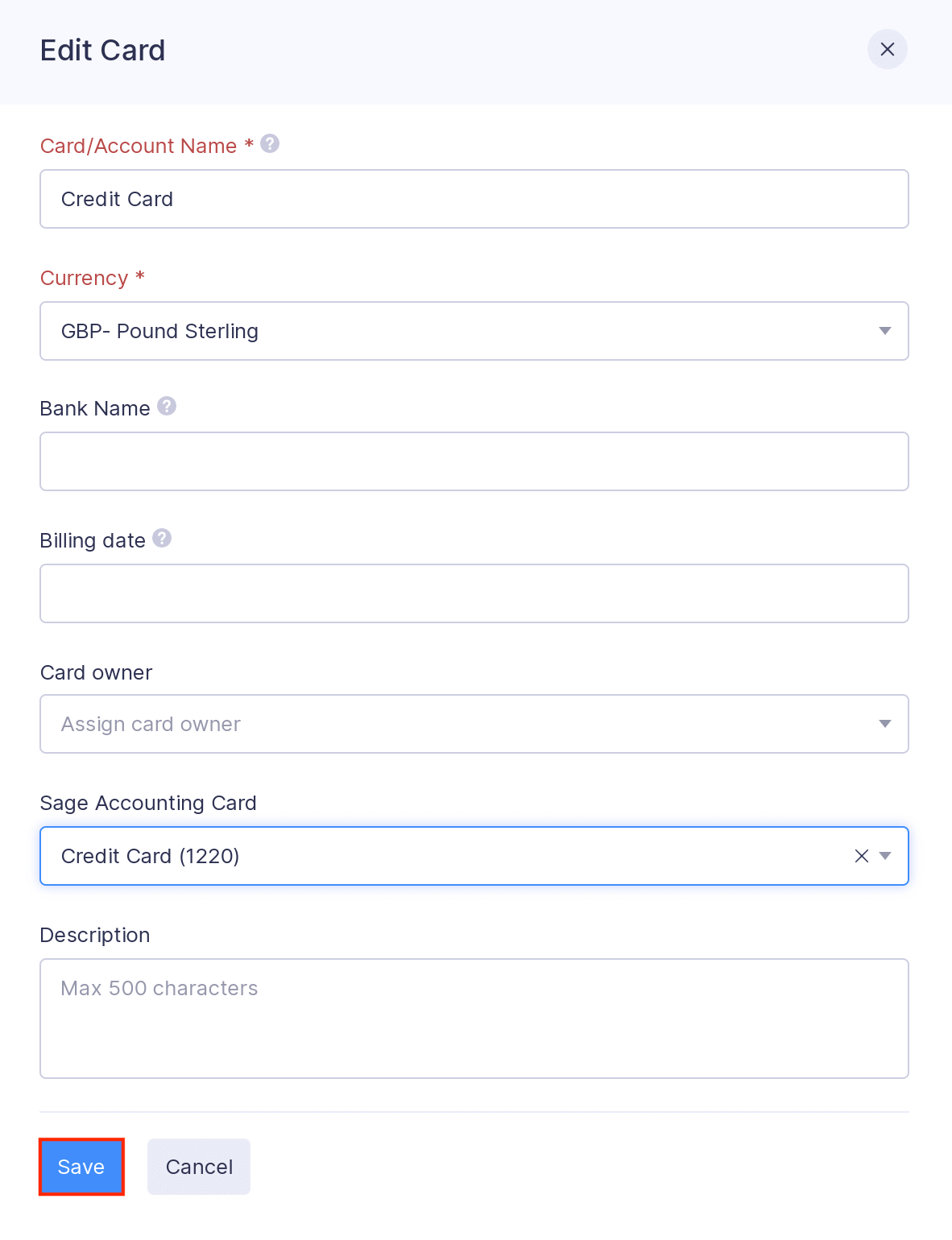

Map Card Feeds

Sometimes, you might want to export card feeds recorded in Zoho Expense to Sage Accounting for accounting or other purposes. You can export your card feeds in Zoho Expense to Sage Accounting by mapping a card in Zoho Expense with a card in Sage Accounting. To do this:

- Click Admin View.

- Go to Corporate Cards on the left sidebar.

- Select the card.

- Click the More icon on the top right corner.

- Select Edit.

- Select a card or a bank account from the Sage Accounting Card dropdown.

- Click Save. Once this is done, every time you export a report with card expenses, they will be recorded under the mapped card in Sage Accounting.

Note: You can view the exported transactions under the associated card’s feed in Sage Accounting.

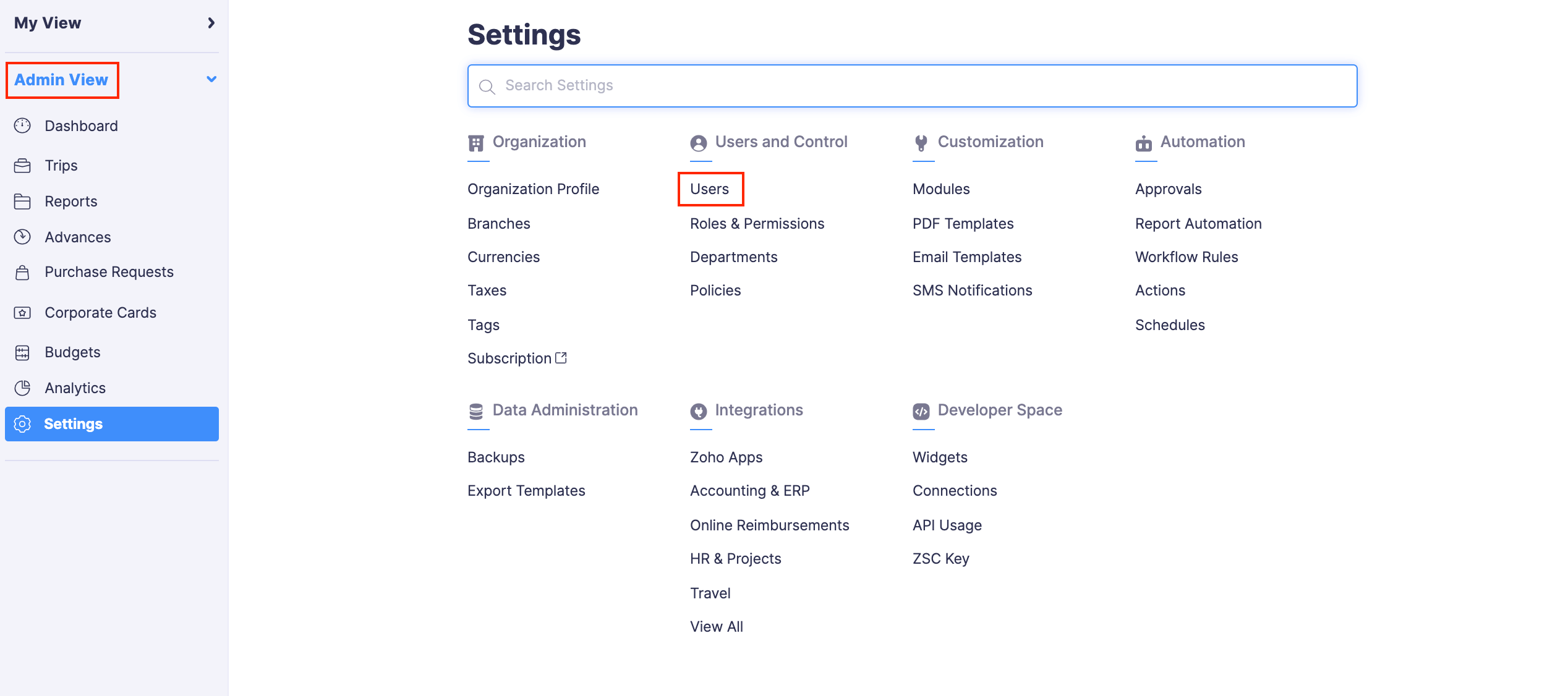

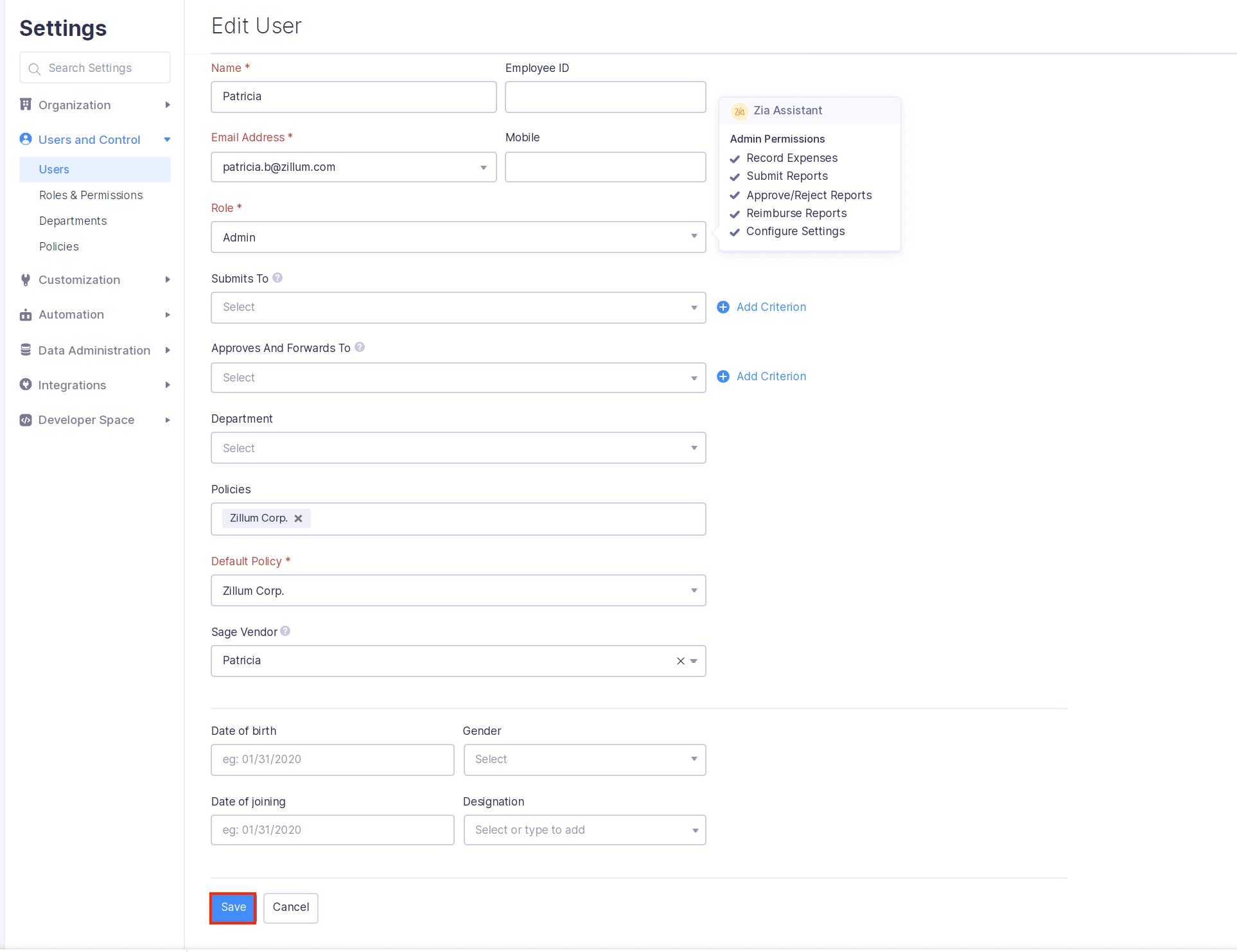

Map Users and Vendors

When you export reimbursable expenses from Zoho Expense, they will be exported as purchase invoices to Sage Accounting and the vendor of the bill will be the user who had created that expense. Hence, to fetch the vendors for creating purchase invoices in Sage Accounting, you will have to map the users in Zoho Expense with the vendors in Sage Accounting. To map the users:

- Click Admin View.

- Go to Settings on the left sidebar.

- Go to Users under Users and Control.

- Hover over the user you want to map with the Sage Accounting vendor and click the More icon at the right side of the user.

- Click Edit.

- Select a vendor from the Sage Accounting Vendor dropdown.

- Click Save.

- Once this is done, whenever a reimbursable expense is exported, the mapped Sage Accounting vendor will be the vendor of the purchase invoice.

Pro Tip: If you haven’t mapped the user with the corresponding Sage Accounting vendor while exporting reimbursable expenses, a new vendor will be created in Sage Accounting and this vendor will be automatically mapped with the user in Zoho Expense.

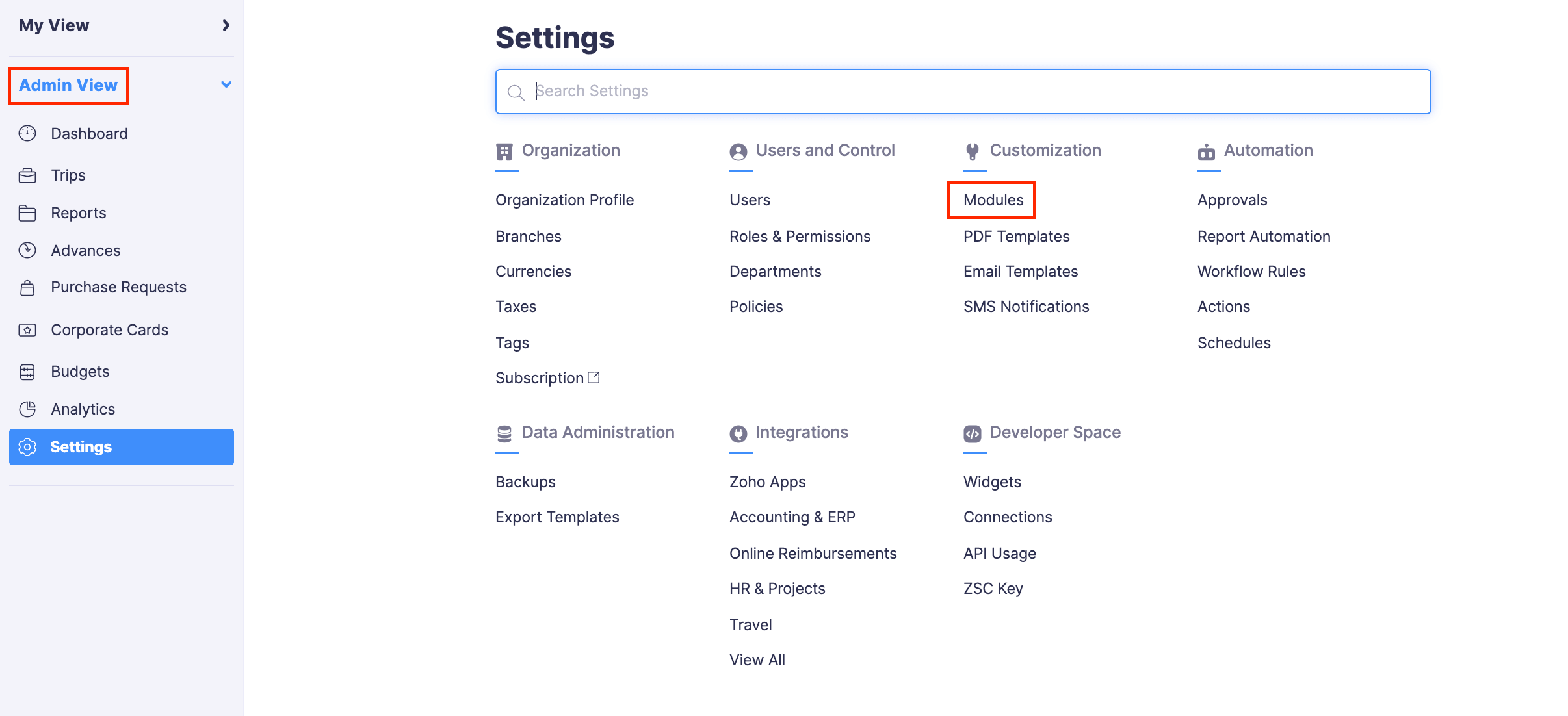

Map Merchants and Vendors

When you export non-reimbursable expenses from Zoho Expense, they will be exported as other payments to Sage Accounting. If you have configured merchants to be the payee of other payments, you can map the merchants in Zoho Expense with the vendors in Sage Accounting. To map the merchants:

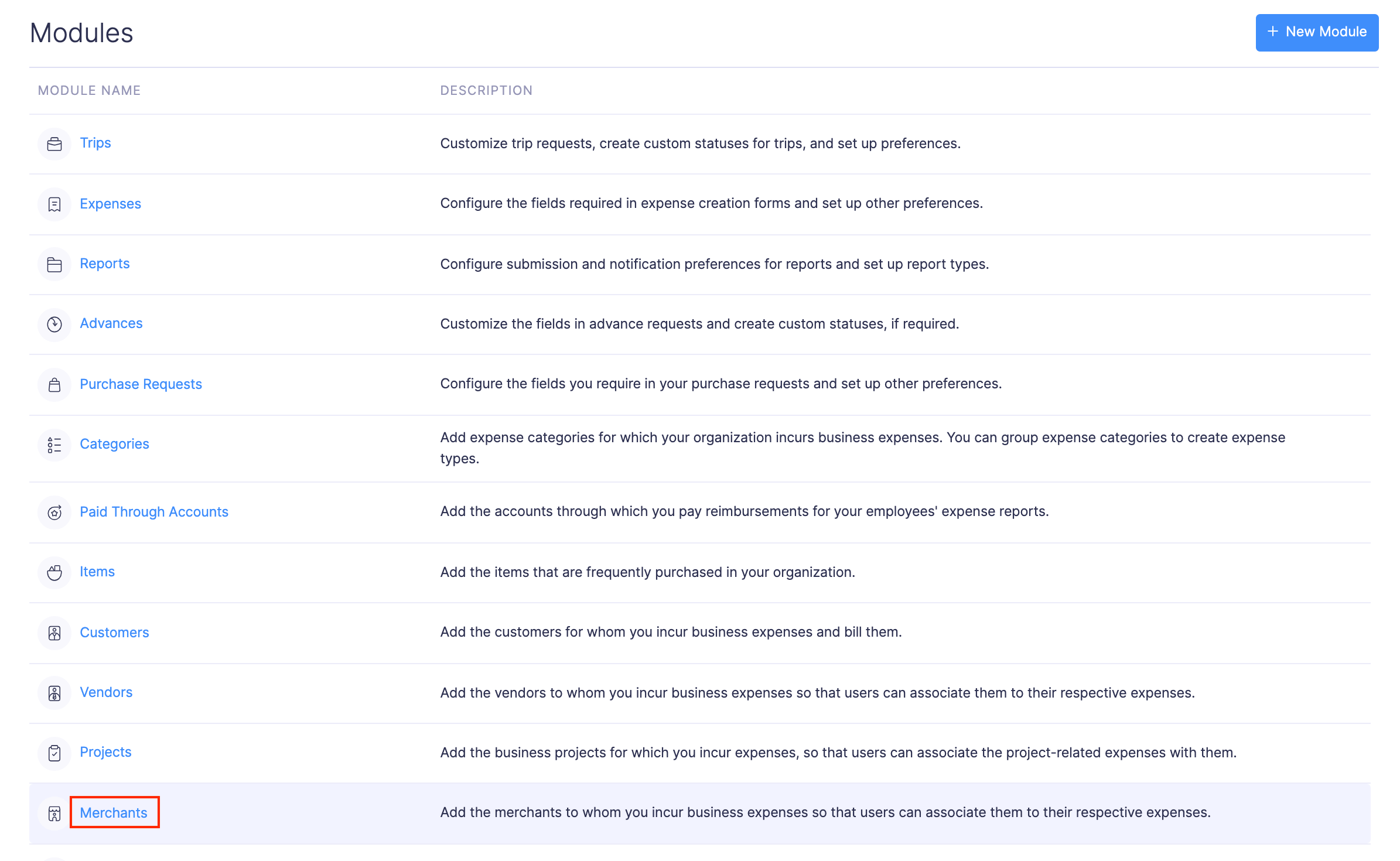

- Click Admin View.

- Go to Settings on the left sidebar.

- Go to Modules under Customization.

- Click Merchants.

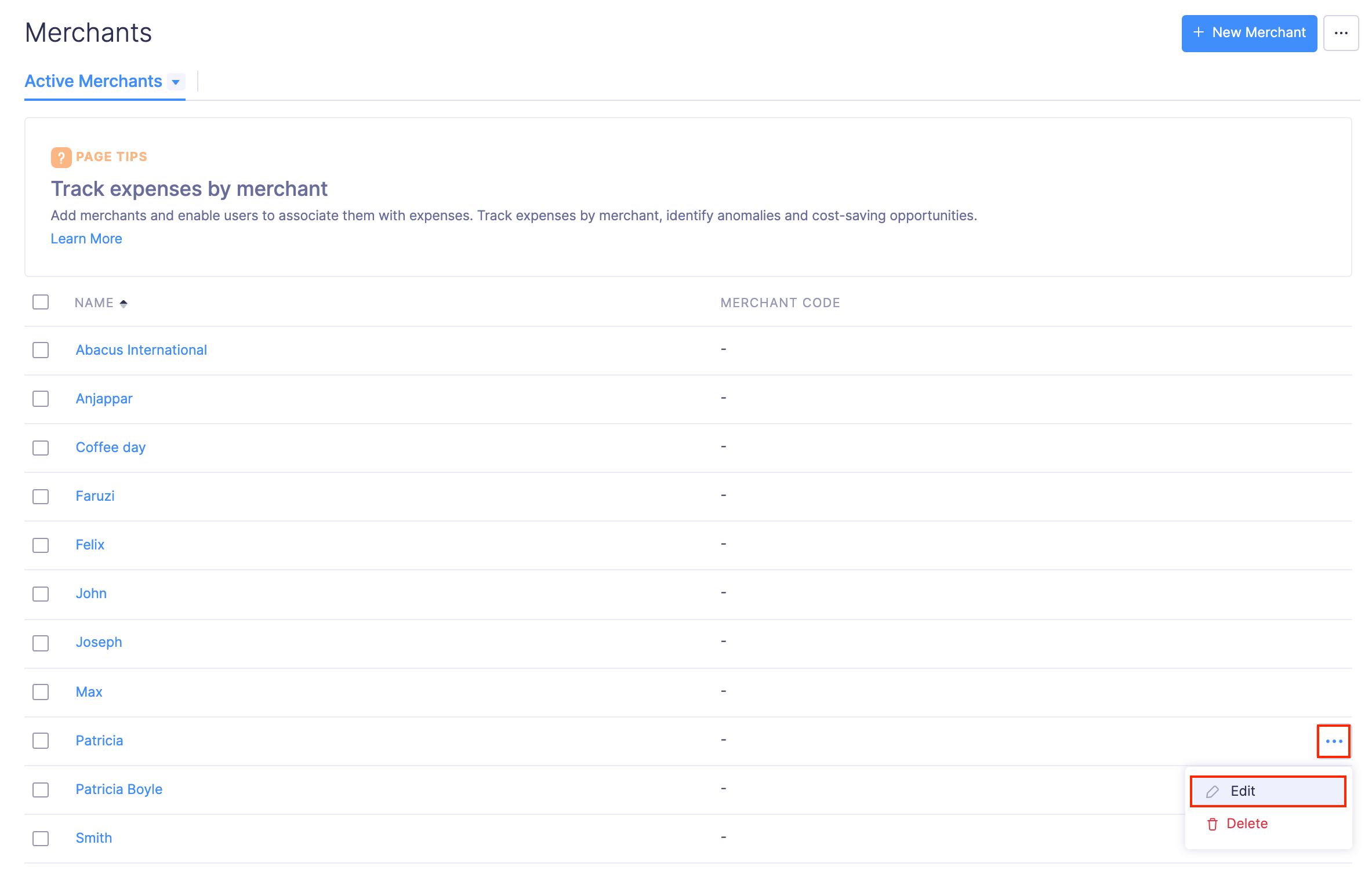

- Hover over the merchant you want to map with the Sage Accounting vendor and click the More icon at the right side of the merchant.

- Select Edit.

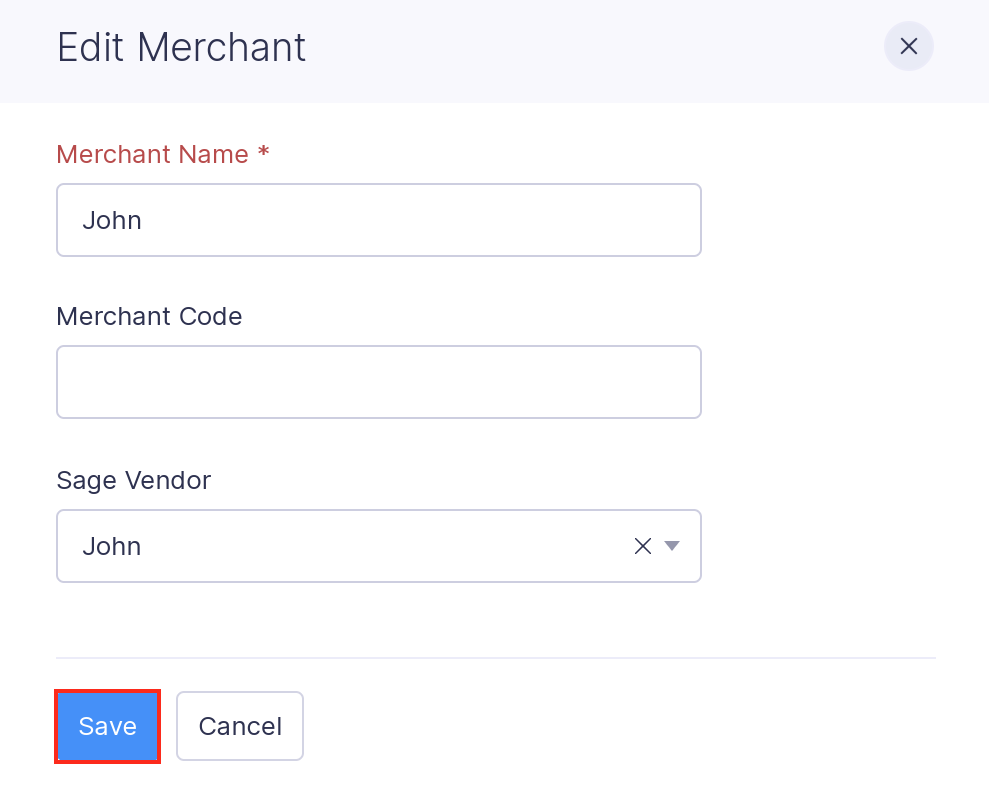

- Select a vendor from the Sage Accounting Vendor dropdown.

- Click Save.

- Once this is done, whenever a non-reimbursable expense with the merchant is exported, the mapped Sage Accounting vendor will be the payee of the other payment.

Pro Tip: If you have not mapped the merchant with the corresponding Sage Accounting vendor while exporting non-reimbursable expenses, a new vendor will be created in Sage Accounting and this vendor will be automatically mapped with the merchant in Zoho Expense.

Export Your Reports to Sage Accounting

Your expense reports can be exported manually or automatically upon approval, as per the configurations made in the Sage Accounting integration page. If you choose to export your reports manually, you can do so.

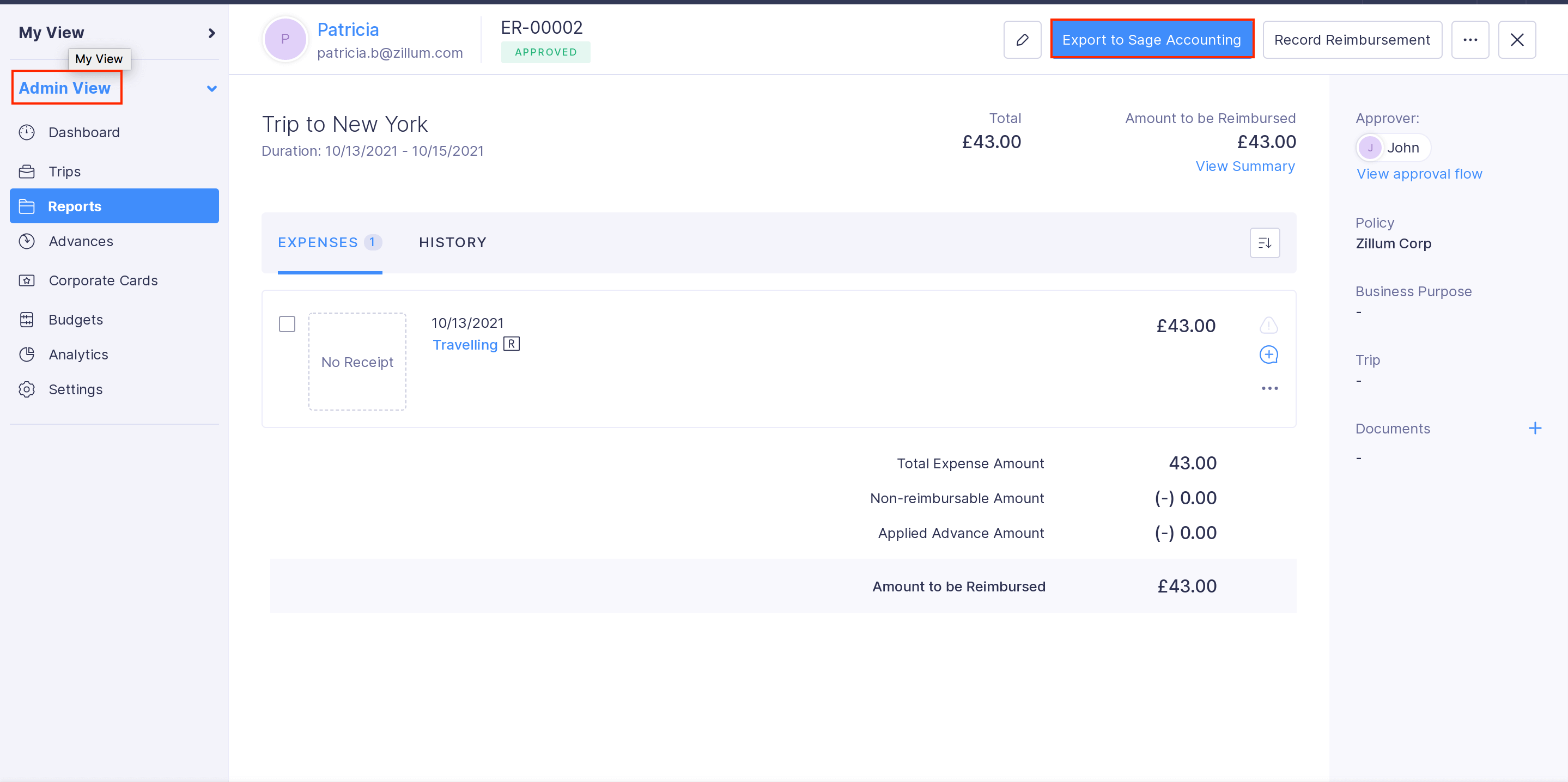

- Click Admin View.

- Go to Reports.

- Click the approved report you want to export to Sage Accounting.

- Click the Export to Sage Accounting button located on top of the report.

- Once that’s done, you will know how each expense was exported. If your report contains both reimbursable and non-reimbursable expenses, each will be exported separately as configured previously.

- For reimbursable expenses, reimbursement has to be recorded manually after making the reimbursement in Sage Accounting.

- If you have made changes in the exported expenses and you want those changes to be updated in Sage Accounting, that can be done by clicking the Export to Sage Accounting button once again. By doing so, the changes made will overwrite the existing records.

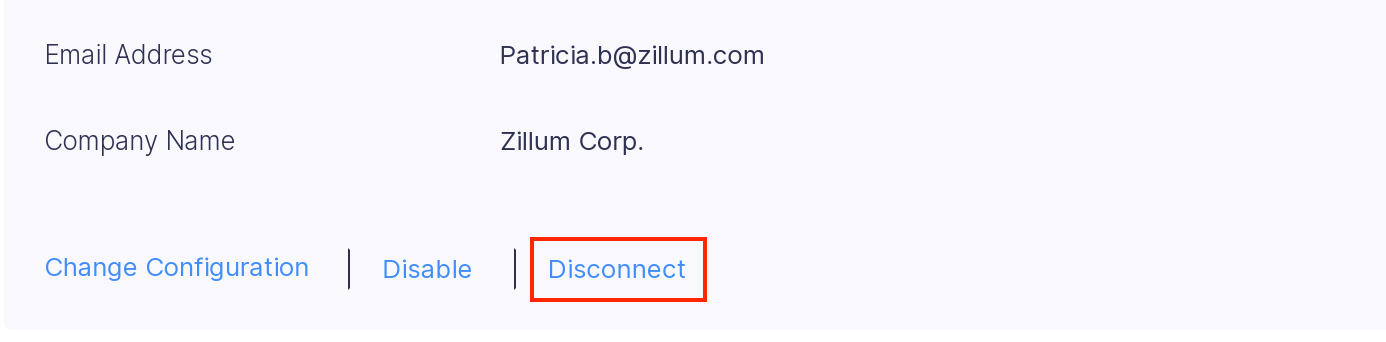

Disconnect the Integration

When you disconnect the integration, you will no longer be able to export your expense reports to Sage Accounting. However, all the imported accounts and customers from Sage Accounting will continue to remain active in Zoho Expense.

To disconnect the integration:

- Click Admin View.

- Go to Settings on the left sidebar.

- Go to Accounting & ERP under Integrations.

- Click Sage Accounting.

- Click Disconnect.

- A pop-up will appear on the screen. Click Confirm to disconnect the integration.