With the rollout of GST in July, one of the most important concepts that every tax payer needs to understand is input tax credit(ITC). Before diving into details, let’s have a thorough understanding of input tax credit.

What is Input Tax Credit in GST?

GST taxation structure allows businesses across India to claim input credit for the tax they paid while purchasing capital goods for their company.

- If taxpayers have availed and used ineligible ITC, interest of 18% has to be paid. Interest need not be paid if ineligible ITC is only availed, without being used.

- Goods subjected to export duty (to be paid at the time of export) will be covered under the restriction (imposed under section 54(3) of CGST Act, 2017, which states that a registered person can claim refund of unutilized ITC at the end of a tax period) from availing any refund of accumulated ITC.

- Availing ITC for invoices and debit notes apply only in cases where details of these invoices / debit notes are provided in Form GSTR-1 / IFF and communicated to the registered person in Form GSTR-2B. This is applicable only after section 16(2) (aa) of CGST Act, 2017 is notified.

- Taxpayers with an annual aggregate turnover exceeding INR 5 crores in the preceding financial year will have to file Form ITC-04 once in six months.

- Taxpayers with an annual aggregate turnover of up to INR 5 crores in the preceding financial year will have to file Form ITC-04 once in a year.

How does it work?

At each stage of the supply chain, the buyer gets credit for the input tax paid, and they can use it to offset the GST that needs to be paid to the Centre and State governments. To understand this concept better, let’s take the example of a company called MK Kitchen Knives which sells custom-made kitchen knives.

- They purchase steel and plastic worth Rs.2000 from a vendor at a GST rate of 12.5%. Thus, the input tax they pay is Rs.250.

- The company now sells the manufactured knives for Rs.4000, plus an output tax of 12.5%, making the total selling price Rs.4500 (Rs.4000 + Rs.500).

Thus, the tax that MK Kitchen Knives owes to the Government = Output tax - Input tax credit = Rs.500 - Rs.250 = Rs.250

GST Input Tax Credit Rules

Businesses need to adhere to the following rules to claim input tax credit.

- The buyer must possess a valid tax invoice, debit note, or other prescribed document issued by a registered dealer.

- The buyer must have received the good or service. If the product is being received in instalments, then the credit can be claimed against the tax invoice for the last instalment.

- The supplier must have paid the tax due on the buyer’s purchases to the government either in cash or by claiming input tax credit.

- Finally, the supplier must have filed GST returns. The most unique and unprecedented change GST brings to this entire tax setup is that you are allowed to claim input tax credit on your purchases only if your supplier is GST compliant and has paid the tax they had collected from you.

- Availing ITC for invoices and debit notes apply only in cases where details of these invoices / debit notes are provided in Form GSTR-1 / IFF and communicated to the registered person in Form GSTR-2B. This is applicable only after section 16(2) (aa) of CGST Act, 2017 is notified.

- To claim ITC, the buyer should pay the supplier for the supplies received (inclusive of tax) within 180 days from the date of issuing the invoice. If the buyer fails to do so, the amount of credit they would have availed, will be added to their output tax liability. Once the buyer pays the amount due to the supplier by the taxpayer, they will be able to avail ITC. In case of partial payment, credits proportionate to the payment can be availed.

- Motor vehicles used to transport people (seating capacity of more than thirteen including driver), vessels and aircrafts, and money for or by a banking company or financial institution.

- General insurance, repair and maintenance with respect to motor vehicles, vessels and aircrafts.

- Goods or services that are mandatory for an employer to provide to their employees, under any law.

Ineligible to claim ITC

ITC cannot be claimed in the following cases:

- Purchase of capital goods used for non-business purposes.

- Composition dealers

- Purchase of capital goods used for manufacturing exempted goods

- Blocked credits [Section17 (5)]

Note: If taxpayers have availed and used ineligible ITC, interest of 18% has to be paid. Interest need not be paid if ineligible ITC is only availed, without being used.

Documents required for availing ITC

The documents required to avail ITC are:

- Invoice issued by the supplier

- Invoice issued similar to Bill of Supply, in cases where the total amount is less than Rs. 200 or reverse charge mechanism is applicable

- Debit note issued by the supplier (if any)

- Bill of Entry or similar documents issued by the Customs Department

- Bill of Supply issued by the supplier

- Document issued by ISD, could be an invoice or credit note

Time limits for claiming ITC under GST

ITC can only be claimed for tax invoices and debit notes which are less than a year old. In any other case, the last date to claim ITC is the earlier of the following:

- Before filing valid GST returns for month of September following the end of the financial year applicable to that invoice. For example, for an invoice issued on June 26, 2018, ITC should be claimed by September 2019.

- Before filing a relevant annual return.

Claiming and reconciling ITC under GST with example

The GST comprises of 3 types of taxes: CGST, SGST and IGST.

CGST (Central GST) - Collected by the Central Government for transactions within one state.

SGST (State GST) - Collected by the State Governments for transactions within one state.

IGST (Integrated GST) - Single levy collected by the Central Government for transactions between states.

The three tax credits can be used to offset one another.

- CGST credit can be used to offset CGST liability; if there is credit left over, it can be applied toward IGST liability next.

- SGST credit can be used to offset SGST liability; if there is credit left over, it can be applied toward IGST liability next.

- IGST credit can be used to offset IGST liability; if there is credit left over, it can be applied toward CGST liability first and then toward SGST liability.

Reconciliation of these credits is done by matching your transactions with those of your customers or vendors. This will help the Tax Department verify the transactions from both ends. The GST Identification Number (GSTIN) is used to match transactions together.

Let us now use an example to understand how this reconciliation process works:

Suppose MK Kitchen Knives (recipient) purchased 10 tons of steel from GH Steelware Inc. (supplier) which is also registered for GST. The two companies will reconcile their transactions, and the recipient will claim the input tax credit, as follows:

GH Steelware Inc. will file the GSTR-1 report (Details of outward supply).

The details furnished in the GSTR-1 will be automatically fetched in the GSTR-2A (Details of inward supply) for MK Kitchen Knives, where they will be able to see the transaction details.

MK Kitchen Knives will then check the records and make any necessary modifications/additions. Once the changes are made, this information will be automatically pulled when they will file the GSTR-2. The correct input credits will then be credited to their electronic credit ledger.

GH Steelware Inc can then use the GSTR-1A form to view and accept the changes that MK Kitchen Knives made in the GSTR-2.

Finally, once GH Steelware Inc. has filed the monthly returns (GSTR-3), MK Kitchen Knives will be able to avail the input tax credit and apply it to future output tax liabilities.

In cases where the tax on purchases is higher than the tax on sales, the extra input credit can be carried forward or claim a refund. Existing CENVAT) credits can be converted to GST input tax credits as well.

Adjusting ITC for inter-state and intra-state transactions

Let’s now look at how Input Tax Credit can be used to offset output tax liabilities for both inter-state and intra-state transactions.

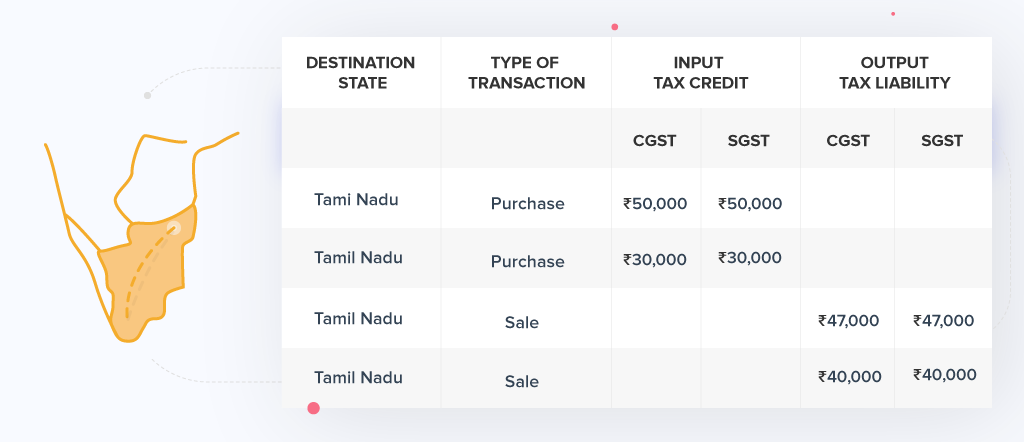

Let’s say MK Kitchen Knives is based in Tamil Nadu. The details of their last four intra-state transactions are tabulated below, including the tax liability.

- In the above example, MK Kitchen Knives has a total input tax credit of Rs.80,000 (Rs.50,000 + Rs.30,000) from both CGST and SGST.

- Based on the tax offsetting rules under GST, they use the CGST input tax credit worth Rs.80,000 to offset the CGST liability of Rs.87,000 (Rs.47,000 + Rs.40,000). Once this adjustment is completed, the remaining CGST liability is Rs.7,000 (Rs.87,000 - Rs.80,000).

- Similarly, they use the SGST input tax credit worth Rs.80,000 to offset the SGST liability of Rs.87,000 (Rs.47,000 + Rs.40,000). Upon completion, the SGST liability amounts to Rs.7,000 (Rs.87,000 - Rs.80,000).

- The total tax liability is thus Rs. 14,000 (Rs.7,000 + Rs.7,000).

If there is any CGST credit left over after setting off the CGST tax liability, it cannot be used to offset SGST. Thus, the balance of the CGST credit will be carried over to the next tax period. The same applies to unused SGST credit; it can only be carried forward, not applied to CGST liability.

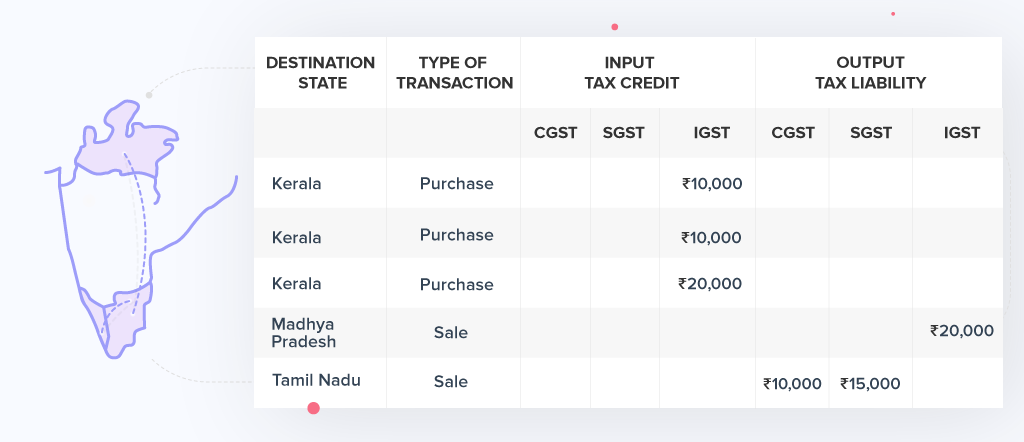

Consider another set of transactions for MK Kitchen Knives. This time, it’s a mix of inter-state and intra-state transactions.

- As illustrated above, MK Kitchen Knives has an IGST credit of Rs.40,000 (Rs.10,000 + Rs.10,000 + Rs. 20,000), and tax liabilities of IGST 20,000, CGST 10,000 and SGST 15,000.

- According to the tax offsetting rules under GST, IGST credit needs to be used first to offset IGST tax liability. Whatever IGST credit is left can be used against CGST liability, then against SGST liability (in that order).

- MK Kitchen Knives first uses their IGST credit to offset their IGST liability of Rs.20,000.

- The remaining credit of Rs.20,000 (Rs. 40,000 - Rs.20,000) is used to offset the CGST liability of Rs.10,000.

- After this adjustment, the remaining IGST credit of Rs.10,000 can be used to offset part of the SGST liability worth Rs.15,000.

- Once the entire IGST credit has been utilized, we’re left with a SGST liability of Rs.5,000 (Rs.15,000 - Rs.10,000).

Note: Goods subjected to export duty (to be paid at the time of export) will be covered under the restriction (imposed under section 54(3) of CGST Act, 2017, which states that a registered person can claim refund of unutilized ITC at the end of a tax period) from availing any refund of accumulated ITC.

Availing ITC

Here are a few specific cases in which ITC can be availed:

- When goods/services are used partly for business purposes and partly for other purposes, then ITC can be availed only on the inputs used for business purposes.

- When goods/services are used partly for furtherance of taxable supplies and partly for exempt supplies, ITC can be availed only on the inputs used for making taxable, and zero rated supplies.

- A taxpayer switching from composition scheme to the normal scheme, can avail ITC on the following:

- Purchases held as stocks (this could include semi-finished/finished goods)

- Capital goods held till their last day as a composition dealer

- When an exempt supply of goods and/or services become taxable, the supplier can claim ITC for the goods held as stock (this could include semi-finished/finished goods) relatable to exempt supplies. The supplier will also be liable to claim credit on capital goods used exclusively for the exempt supply.

- When vehicles that have a seating capacity of more than thirteen (including the driver), used to transport people.

- When vehicles are used to transport vessels and aircrafts.

- When vehicles are used to transport money for a financial institution.

- When certain services such as, insurance, repair or maintenance of vehicles, vessels and aircrafts for which credit is applicable.

- For goods or services that an employer must provide their employees, under any law.

NOTE: In the last two cases, ITC should be availed within 1 year from the date of issue of invoice by the supplier.

ITC Utilization

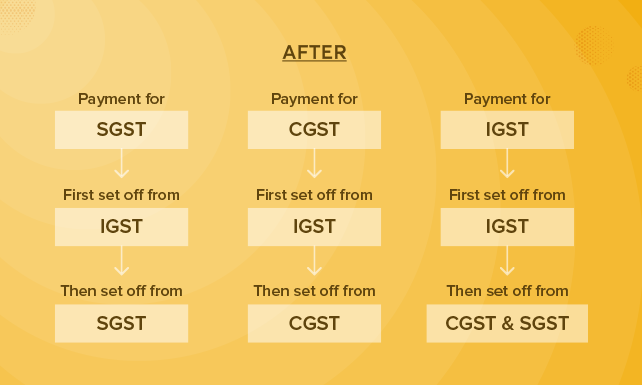

As per Rule 88A from a notification released by the CBIC (Central Board of Indirect Taxes and Customs), taxpayers must first use the ITC available from integrated tax to pay off all of their applicable integrated tax. Any ITC remaining after this, can then be used towards paying CGST, SGST, and UGST. This rule is only applicable if the ITC availed from integrated tax is used completely, before the ITC availed from CGST, SGST, and UGST are used.

Here is how ITC was utilized before Rule 88A was implemented.

Here is how ITC is utilized after the implementation of Rule 88A.

Taxpayers with an annual aggregate turnover exceeding INR 5 crores in the preceding financial year will have to file Form ITC-04 once in six months. Meanwhile, taxpayers with an annual aggregate turnover of up to INR 5 crores in the preceding financial year will have to file Form ITC-04 once in a year.