- Availing ITC for invoices and debit notes apply only in cases where details of these invoices / debit notes are provided in Form GSTR-1 / IFF and communicated to the registered person in Form GSTR-2B. This is applicable only after section 16(2) (aa) of CGST Act, 2017 is notified.

- HOME

- Taxes & compliance

- Basics of Invoice Furnishing Facility (IFF) in GST

Basics of Invoice Furnishing Facility (IFF) in GST

Invoice Furnishing Facility (IFF)

For taxpayers filing GST returns on a quarterly basis under the QRMP (Quarterly Returns Monthly Payment) scheme, the government has introduced the Invoice Furnishing Facility (IFF) to make tax compliance easier. With this facility, you can file and reconcile returns easily, and also transfer Input Tax Credit (ITC) to your buyers faster. This guide will explain the basics of what you need to know about IFF, as well as when and how to use this facility.

- What is the Invoice Furnishing Facility or IFF?

- Criteria for IFF

- Why is Invoice Furnishing Facility important?

- What to submit in the IFF scheme under GST?

- When to submit the IFF GST return?

- How to submit and file IFF in GST portal?

What is the Invoice Furnishing Facility or IFF?

Effective from January 1, 2021, the Invoice Furnishing Facility is an optional feature that allows you to upload invoices for the first two months of a quarter. You can use IFF to add information related to your B2B invoices and CDNR (Credit/Debit Notes-Registered) during these two months. For the last month of the quarter, you must file returns with Form GSTR-1. For example, for the quarter running from January to March, you can upload invoices through IFF for January and February. Invoices for March have to be uploaded in Form GSTR-1.

Any invoices that you upload in IFF need not be entered again in Form GSTR-1 that you file in the third month. The invoices that you have filed via IFF will be reflected in Form GSTR-2A / 2B of your buyer.

Criteria for IFF

You have to be a quarterly taxpayer filing GSTR-1 under the QRMP scheme. This is a scheme that allows taxpayers to file their returns on a quarterly basis and pay taxes on a monthly basis.

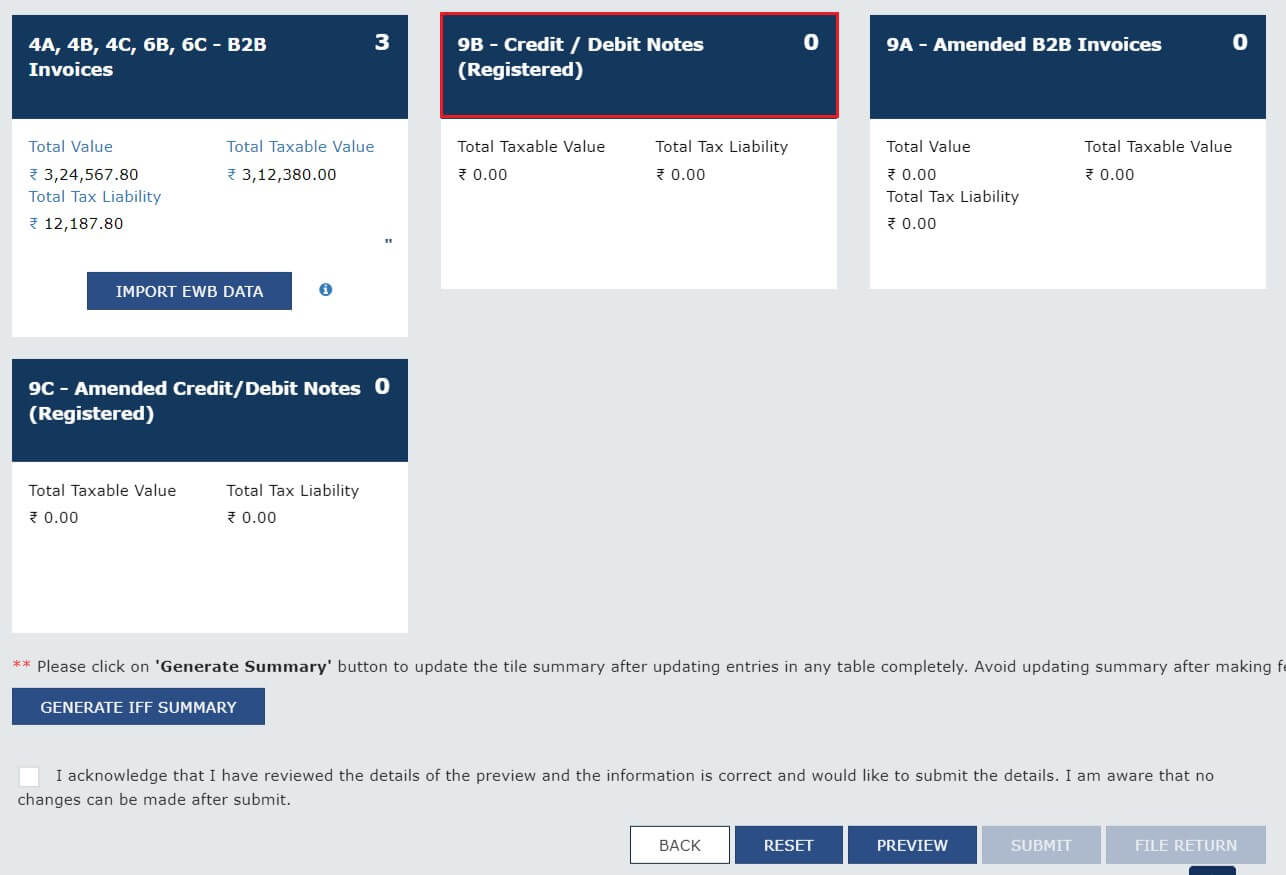

You can only use IFF for B2B invoices and credit/debit notes with the following tables:

- 4A, 4B, 4C, 6B, 6C - to add details of B2B invoices

- 9A - to add details of amended B2B invoices (B2BA)

- 9B - to add details of Credit/Debit Notes-Registered (CDNR)

- 9C - to add details of amended Credit/Debit Notes-Registered (CDNRA)

The total value of invoices for each month cannot exceed 50 lakh INR.

If invoices are not furnished using IFF, you will have to upload the required information for all three months at the end of the quarter in Form GSTR-1.

Why is Invoice Furnishing Facility important?

- This facility is beneficial for you and your buyers, as your buyers can claim Input Tax Credit every month, instead of waiting till the end of each quarter. This helps improve your business as well, as more buyers would approach your business to claim these credits.

- If you have a large number of B2B invoices, this facility to upload invoices each month will ease your tax burden and will reduce the number of invoices that you need to upload at the end of the quarter.

What to submit in the IFF scheme under GST?

While filing your invoices in the first two months, you should submit:

- Details of your B2B invoices

- Details of the credit and debit notes of your B2B invoices issued during that month

To submit this information, you must fill the following tables that appear in the Invoice Details page of the GST portal:

- 4A, 4B, 4C, 6B, 6C - to add details of B2B invoices

- 9A - to add details of amended B2B invoices (B2BA)

- 9B - to add details of Credit / Debit Notes Registered (CDNR)

- 9C - to add details of amended Credit/Debit Notes-Registered (CDNRA)

When to submit the IFF GST return?

You can upload and file invoices for a particular month till the 13th day of the following month. For example, for the month of July, you can upload invoices till the 13th of August. After this date, you cannot use this facility for the previous month’s invoices. In case there are any invoices that you had left out previously, you can upload them via the IFF in the following month or in the quarterly Form GSTR-1.

How to submit and file IFF in GST portal?

To file IFF for the first two months of the quarter:

- Log in to the GST portal.

- Go to Services > Returns > Returns Dashboard.

- In the File Returns page, choose the financial year and the return filing period (first or second month of the quarter) and click Search.

- Choose the IFF option.

- Choose Prepare online if you want to file via the GST portal, or choose Prepare offline if you want to use the Returns Offline Tool and upload the JSON files containing the required details.

- Once you have provided the details, click Generate IFF summary at the bottom of the page, and then click Submit. Once you have submitted this, you cannot delete the information you have provided.

- If you wish to file Form GSTR-1, click File Return to enter the details and choose either file with DSC (Digital Signature Certificate) or file with EVC (Electronic Verification Code).

For more information, you can visit the GST portal to read the step-to-step instructions for completing the filing process.