- HOME

- Taxes & compliance

- Impact of GST on your company’s working capital

Impact of GST on your company’s working capital

With the rollout of GST, business owners have geared up to adapt to the entirely new tax structure. One important component that they have to prepare themselves and their business for, is the optimization of their working capital.

Working capital is the fuel of every business. It is the money available for your company’s day-to-day operations, and it reflects the short-term financial health of the company.

In the next few sections, we’ll take a look at the effect of GST on various business scenarios and see how it will directly or indirectly impact a company’s working capital.

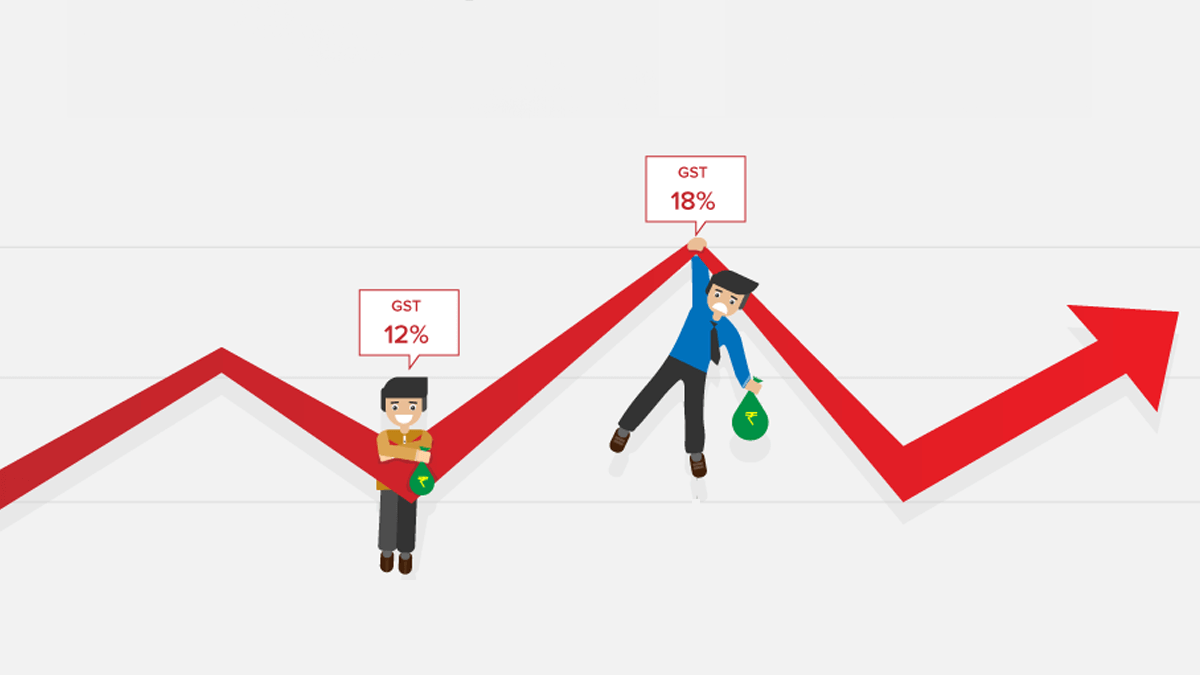

Services are likely to become expensive

The impact of GST varies with the type of business. For example, the services industry will be taxed at 18% under GST instead of the previous 15%. This means a considerable increase in the amount of taxes paid by these businesses.

Keeping this in mind, service-based businesses should consider how much working capital they’ll need for their company’s day-to-day operations under the new tax rate. This will help them prepare for the transition and make sure they have the right resources available.

GST is taxed during the sale of goods and services

Under GST, tax is levied upon the transfer of stock, so businesses can’t claim their tax credits until the shipped goods are sold. This can sometimes take months, during which the paid tax money won’t reach the business.

The standard GST rate of 18% could also increase costs for businesses that procure a majority of their raw materials from other countries.

For instance, imagine a company that manufactures industrial solvents and imports all its raw materials from Japan. Under the old tax system, they would pay an import duty of 14%, but with the introduction of GST, they’ll now pay the standard rate of 18%. This 4% increase in tax will mean a significant increase in their working capital.

On the other hand, GST can be beneficial when it comes to the concept of input tax credit. Under the previous taxation structure, input tax credit was available only on items that were linked to a taxable output. But under the GST regime, you can claim input tax credit even on the tax paid for services that help facilitate your business such as advertising and marketing costs.

Free movement of goods

Many businesses currently manage multiple warehouses across the country to avoid paying extra taxes for shipping goods across state borders. Each of these warehouses has to comply with the tax laws and rates of the state in which it’s located. This burden of tax compliance adds to the cost of running each warehouse, increasing the company’s operational costs and therefore its working capital needs.

Under GST, companies won’t need to comply with CST, Octroi, or entry taxes, so it will be simpler and more affordable to move goods across the country. This will help businesses operate their warehouses more efficiently and locate them where it makes the best business sense.

Let’s look at an example where a company manufactures its product at a facility in Gujarat and transports it to all the warehouses in bulk. It has to pay a Central Sales Tax (CST) of 2% at every state border, and an Octroi or entry tax of 1% when the goods enter the state where they will be sold. All of these taxes add to the price of the product, but the company isn’t given the chance to claim any tax credit for them.

Each warehouse supplies goods based on the demand it receives in its own state, so the company’s operating costs are high because it’s managing so many separate warehouses. Having a minimal number of warehouses instead isn’t an option, because it would force the company to pay CST and entry taxes every time their goods are transported to another state for sale.

Either way, the company needs a lot of working capital to manage their day-to-day operations.

Under GST, the company can strategically set up 4 or 5 warehouses to fulfil their demand across all the states as they would not have to pay CST and entry taxes at every state border. Even though this arrangement might look expensive, the company will still save a lot of money by not managing twenty different warehouses. This will help them save big on working capital.

The above mentioned scenarios would help you get a basic idea of how GST affects your company’s working capital.

If you’ve got any comments or suggestions you’d like to share with us, feel free to leave your comments below.