- HOME

- Taxes & compliance

- E-Invoicing in India Simplified: Understanding the Process and Benefits

E-Invoicing in India Simplified: Understanding the Process and Benefits

What is e-invoicing?

An e-invoice, or electronic invoice, is a digital document that is exchanged between a supplier and buyer and validated by the government tax portal. E-invoicing is the proposed system where business-to-business (B2B) invoices are digitally prepared in an e-invoicing format and authenticated by the Goods and Services Tax Network (GSTN). This system ensures that a common format is followed by all businesses before reporting invoices to the GST portal.

In August 2019, the government shared a draft of an e-invoice for public view, which was later modified by the GST Council to be compliant according to their regulations. Not only does the standard format make compliance easier, but because it’s followed across industries, interoperability between GST ecosystems is ensured.

The current system

Today, an invoice generated by the seller needs to be prepared and reported to two different systems: GST Portal and e-Way Bill.

Businesses generate invoices using different software and the invoice details are entered using a suitable API by the taxpayer in a GSTR-1 return. The same information is reflected in a GSTR-2A and made available to recipients with ‘view only’ permission. Simultaneously, transporters are required to generate the e-Way Bill, either directly or by importing the invoices into an excel sheet or JSON manually.

To put an end to this endless trail of paperwork, the GST council introduced the new return system.

The need for a standard e-invoicing system

Tax departments internationally are eager to make the e-invoicing system a success for two reasons:

- Following a standard format allows invoices to be shared easily

- Invoices can be read by the central system

With e-invoicing, fields will be pre-populated while filing returns, thus avoiding discrepancies during data entry and reconciliation.

How to generate an e-invoice under GST

The flow of a GST e-invoice system has two parts:

- Communication between the business and the Invoice Registration Portal (IRP)

- Interaction between the IRP, the GST/ e-Way Bill systems, and the buyer.

Generating an e-invoice

Taxpayers will generate invoices like they normally do, except reporting will now be done electronically. Taxpayers will have to follow the e-invoice schema and submit mandatory details accordingly. Here is a list of mandatory and optional parameters:

- Transaction details like tax scheme, supplier type

- Document details: type, number and date

- Supplier information like legal name, GSTN address, location, PIN code and state code.

- Buyer information like legal name, GSTN number, address, location, state code and PIN code

- Dispatch from address details (mandatory if it is different from supplier details)

- Shipping details (mandatory if it is different from buyer address)

- Item related details like service/ goods, HSN code, total amount, GST rate, Assessable amount, total item value.

- If the items are being moved in batches, then add batch number.

- Invoice details include assessable values and total invoice value.

Besides the mandatory parameters, the Council also listed optional parameters, which are subject to change based on the needs of the business. Once the invoice fields have been finalised, a taxpayer has to decide if the accounting or billing software is capable of creating a JSON file, which can then be upload to the IRP.

Creating a unique IRN

The IRP will generate a hash parameter based on the details submitted by the seller, like GSTIN, document type, document number, and fiscal year. The IRP will then check if the same invoice exists in the Central Registry, and after confirming there are no duplicates, the IRP will add its signature and a QR code in the invoice’s JSON data. The hash generated by the IRP will be the Invoice Reference Number (IRN) for the e-invoice.

Updating the invoice to the GST and e-way bill systems:

The digitally signed JSON with the IRN is sent to the seller. The uploaded invoice data is then shared with the GST and e-Way Bill system. The GST system will update the GSTR-1 for the seller and the GSTR-2A for the buyer, which will help in determining the liability and ITC. The GST e-invoice schema will contain details like ‘Transporter ID’ or ‘Vehicle number,’ which will be used to generate an e-Way Bill.

The government’s tax portal is not responsible for generating the e-invoice. In fact, it will be created with the aid of the seller’s accounting/billing software and their respective ERP systems. The IRP will just receive, validate, and digitally sign the invoices uploaded by the seller.

How to register for an e-invoicing system

Registering on the e-invoicing portal is a very simple process if you are a GST-registered taxpayer with a valid GSTIN number.

If you have registered your business on the e-way bill (EWB) portal, then you can use the same credentials to log in to the e-invoicing portal as well.

If you have not registered in the EWB portal, then you can register in the e-invoicing system directly. The taxpayer should have a GSTIN and mobile number registered in the GST portal.

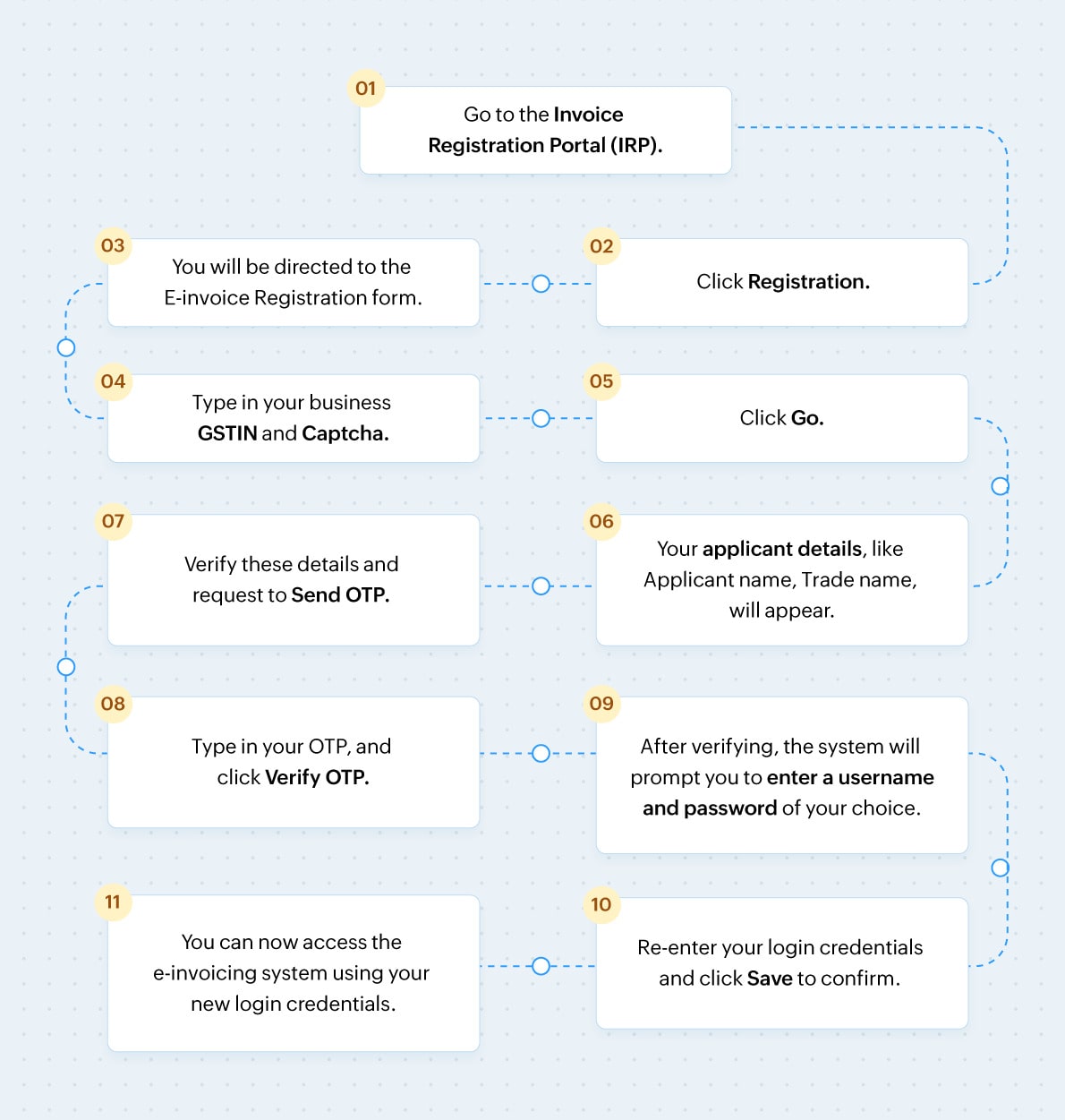

Here’s a flow diagram that you can follow to register:

How will it curb tax fraud?

With the introduction of e-invoicing, tax authorities will now have access to a complete trail of B2B invoices from taxpayers since they will be uploaded in the GST portal. Because invoices are created before any actual transaction takes place, opportunities to manipulate the invoices decrease. The system can identify fake invoices by matching the input tax credit to output tax on the GSTN portal, preventing tax crimes.

Benefits of having an e-invoicing system

Generating a GST e-invoice is usually the responsibility of a taxpayer who reports to the IRP in GST. Next, the IRP will generate a unique IRN and a QR code. The taxpayer will be able to scan this QR code, extract the IRN, and fetch invoice details.

Here are some benefits of e-invoicing for businesses:

E-invoicing helps you with data reconciliation and accuracy during manual data entry.

It allows interoperability across businesses.

You can track the e-invoices in real-time.

The e-invoice details will be auto-populated on tax return forms and e-way bills, making the tax return process easy.

All transaction details will be available online at all times. This would eliminate the need for frequent audits and surveys. Differences in data can be caught by comparing input credit and output tax.

This initiative will also build efficiency within the tax administration by helping to identify fake invoices.