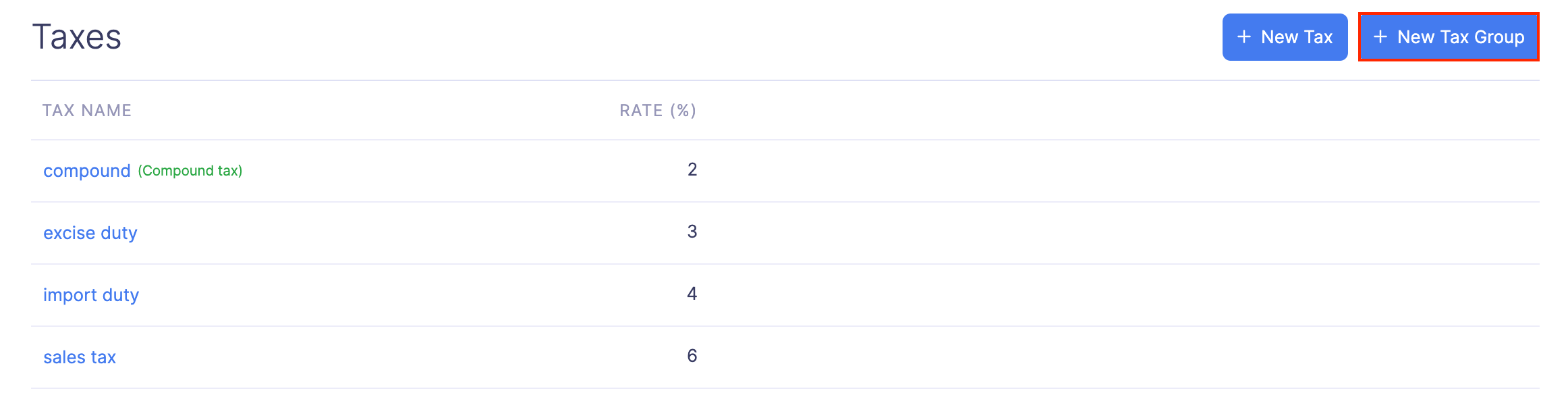

Taxes

Enable taxes and let your employees associate appropriate taxes to the business expenses they record in Zoho Expense.

You can add the tax rates followed in your country in Zoho Expense. Once this is done, every time an employee records a taxable expense, they can apply the appropriate tax to the expense, thereby providing a clear break up of the expense and the tax amount. Also, when you export your expenses to an accounting software, the expenses will be exported along with the taxes and will be properly accounted for. If you would like to know how much your employees have spent on taxes, you can run the Tax Reports analytics.

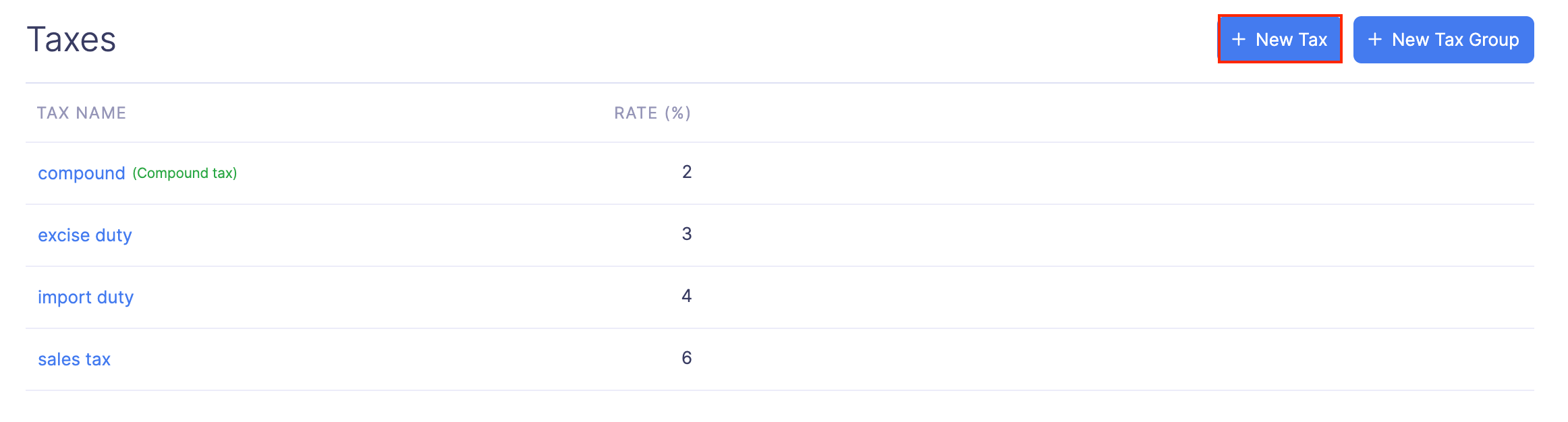

Create a New Tax

You can create the taxes that can be applied to business expenses. To create a new tax:

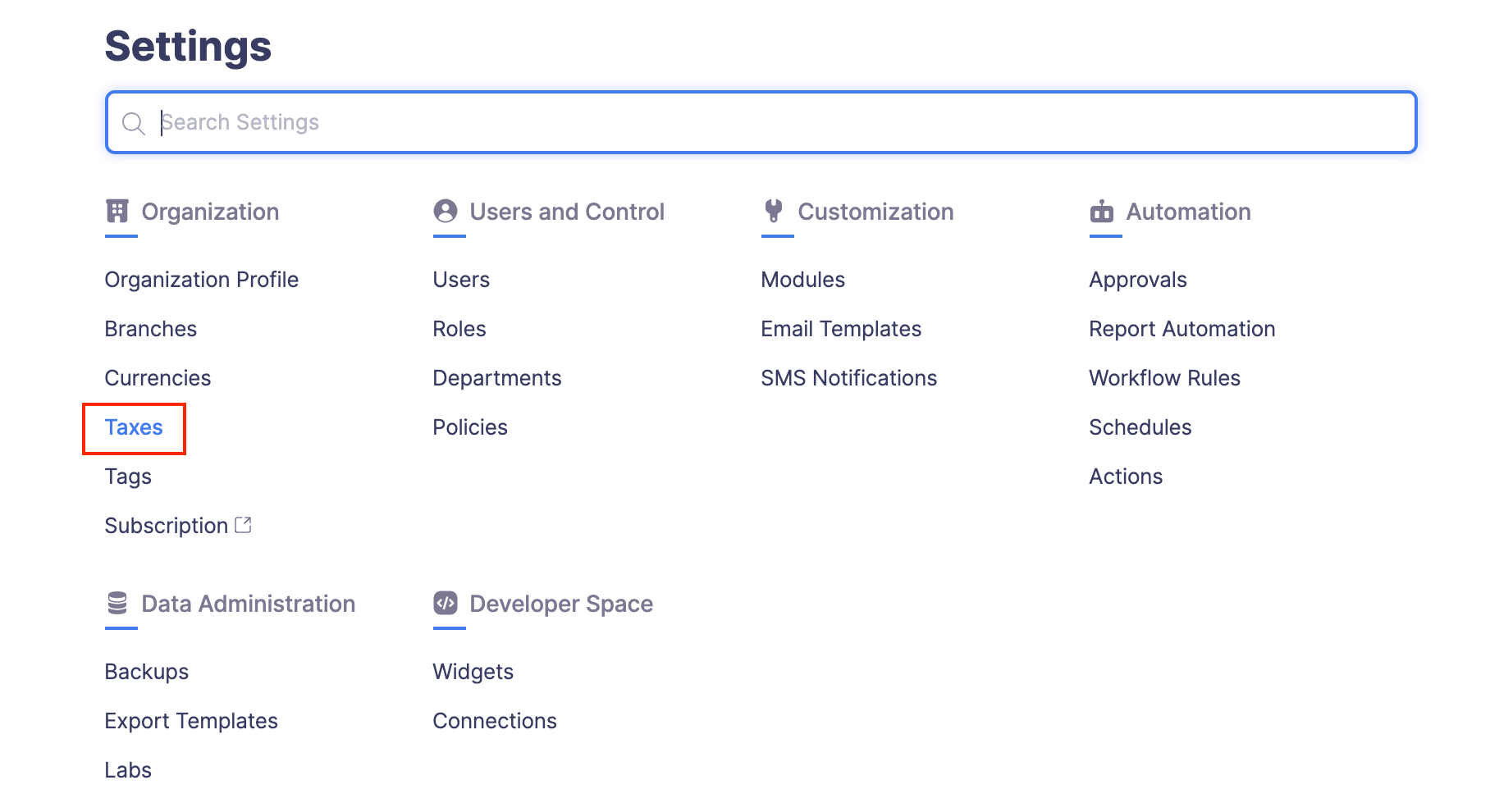

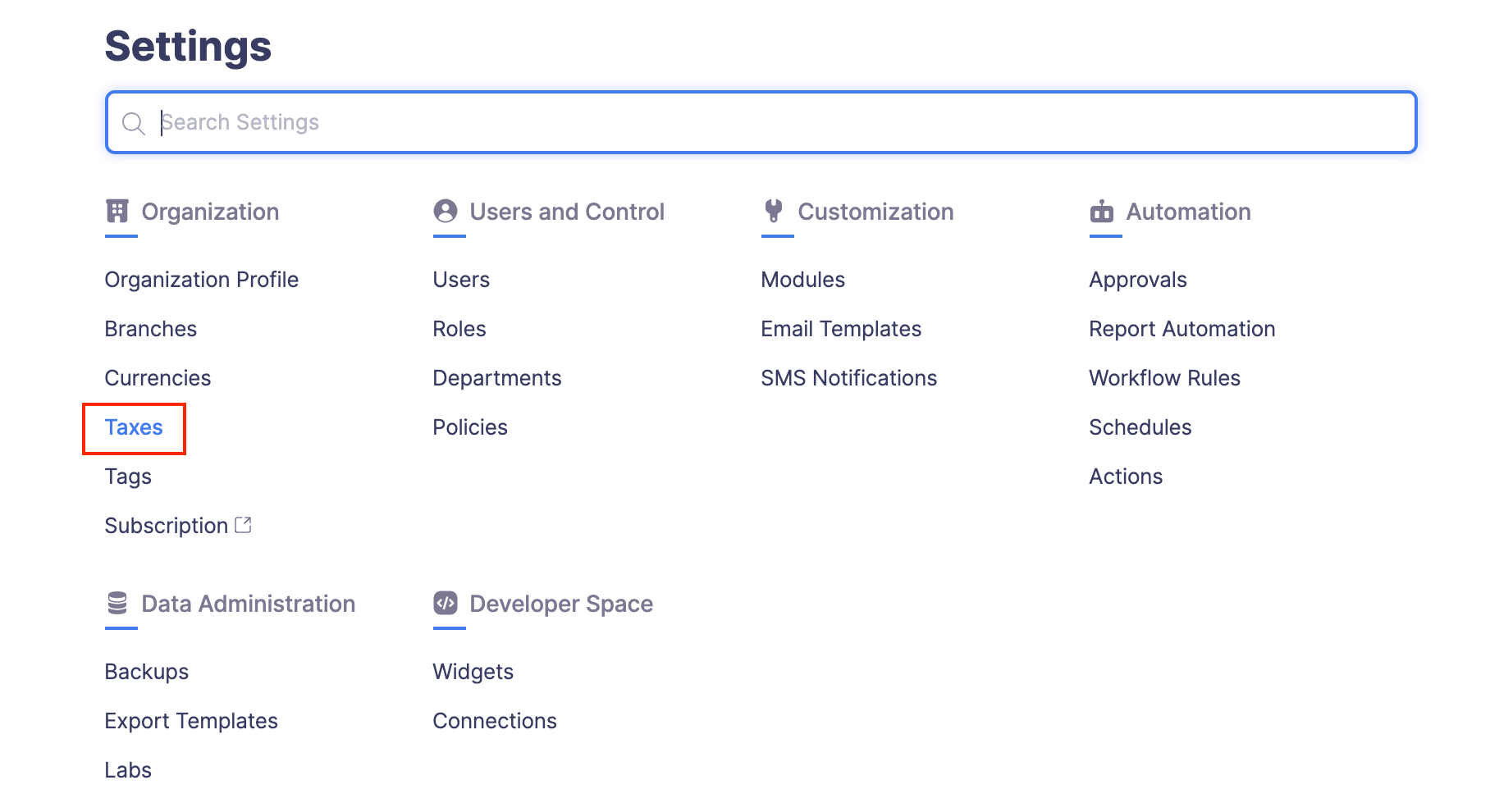

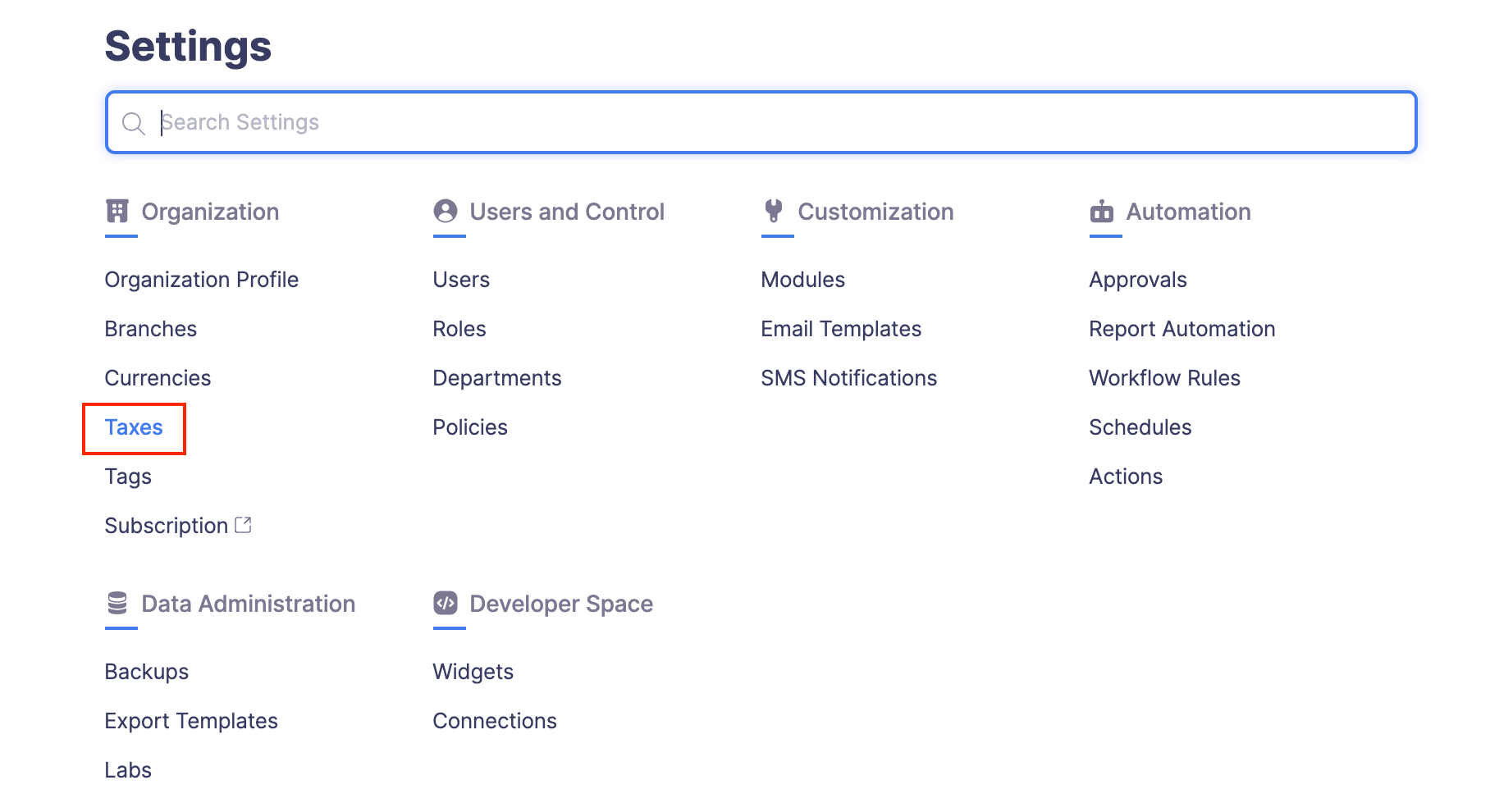

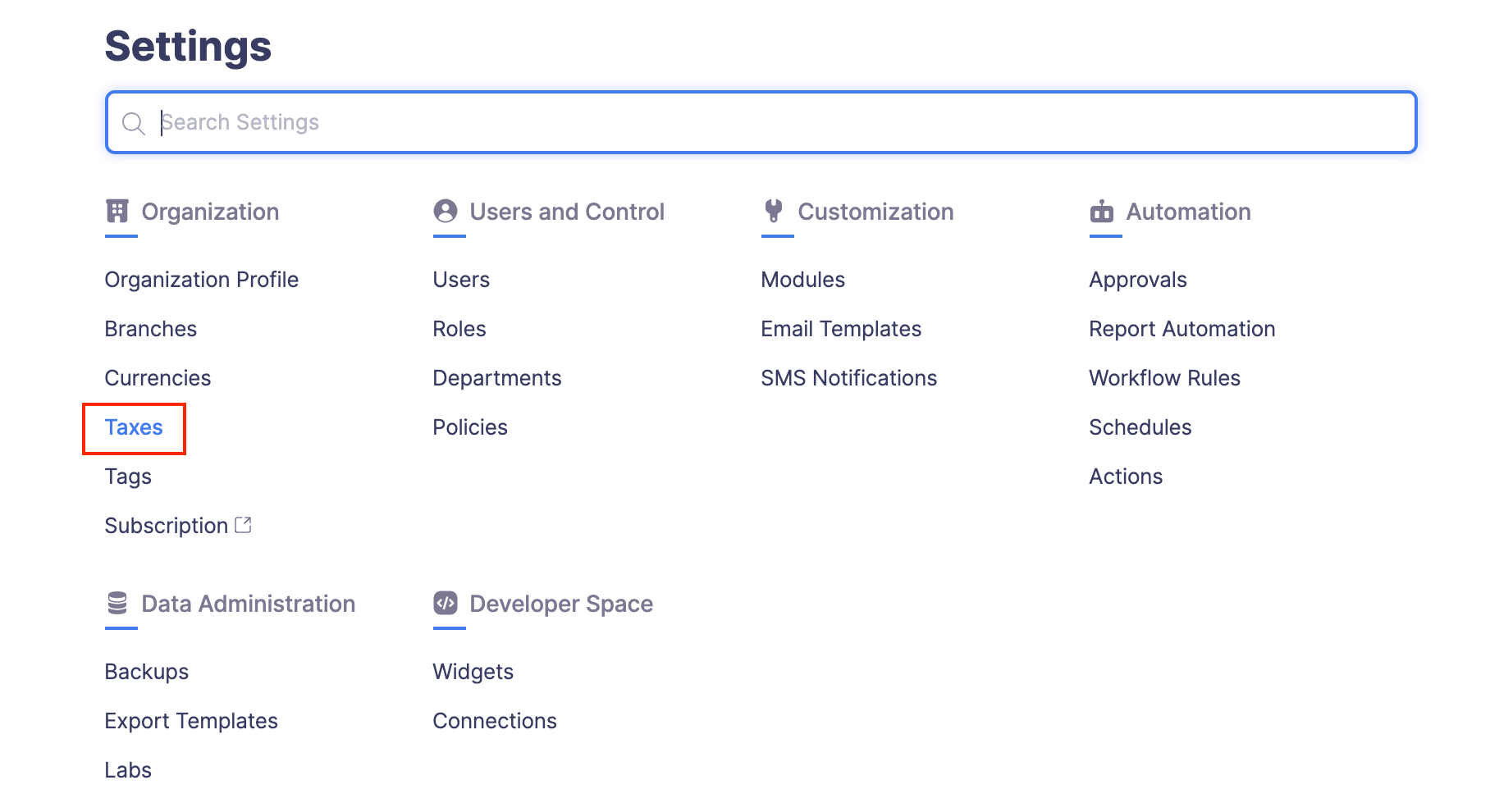

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Go to Taxes under Organization.

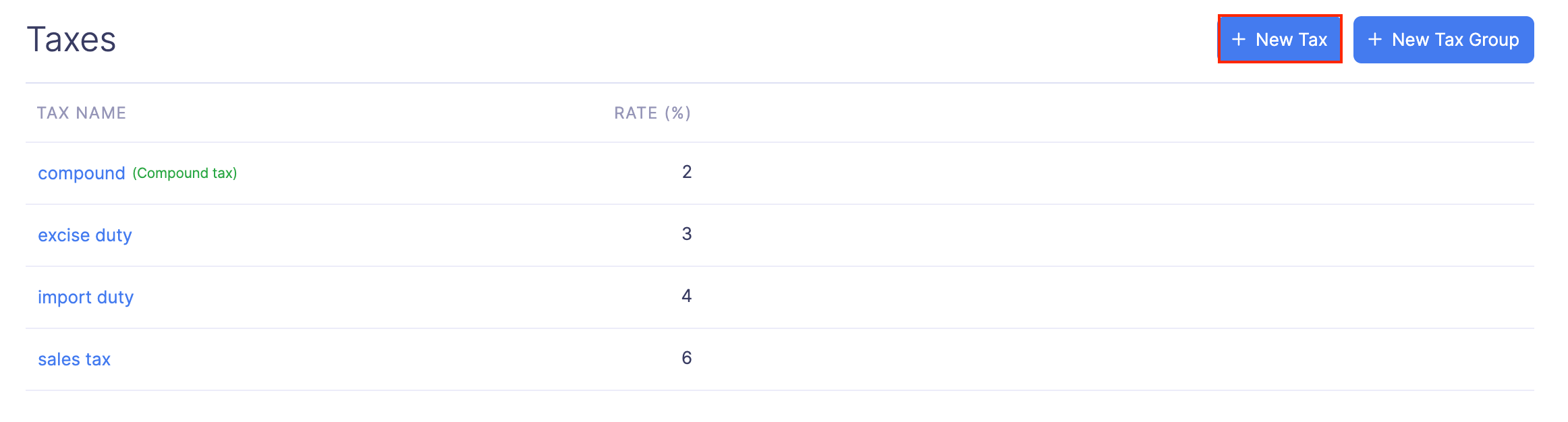

- Click + New Tax at the top right corner.

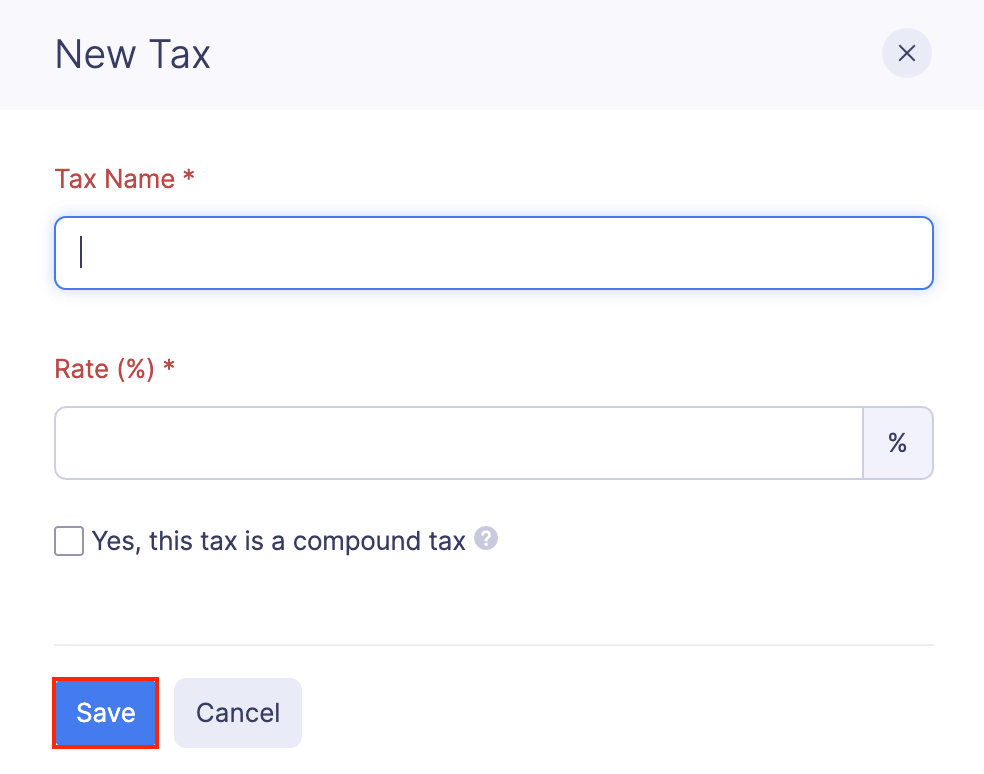

- Enter a name for your tax and set the percentage.

- Click Save to add the newly created tax.

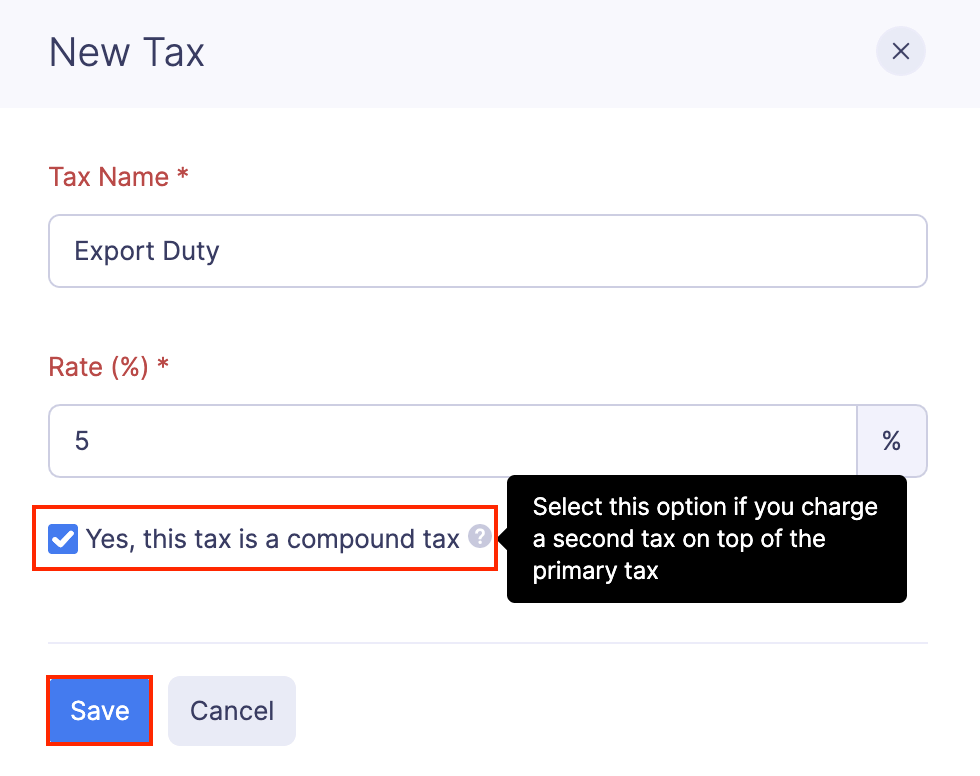

Creating a Compound Tax

Compound tax is a tax that is calculated on top of the primary tax.

To understand compound tax, let’s take an example where the price of an item is $100. After applying 10% primary tax, the value of the item sums up to $110. Now, adding a 10% compound tax will add 10% of $110 to the resultant value. Thus, the end value after applying the compound tax would be $121.

Prerequisite: You should include the compound tax in a tax group which has other tax or taxes, to apply it on top of a primary tax or taxes.

To create a compound tax:

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Go to Taxes under Organization.

- Click + New Tax at the top right corner.

- Enter the Tax Name and Tax Rate. Mark the Yes, this tax is a compound tax option.

- Click Save.

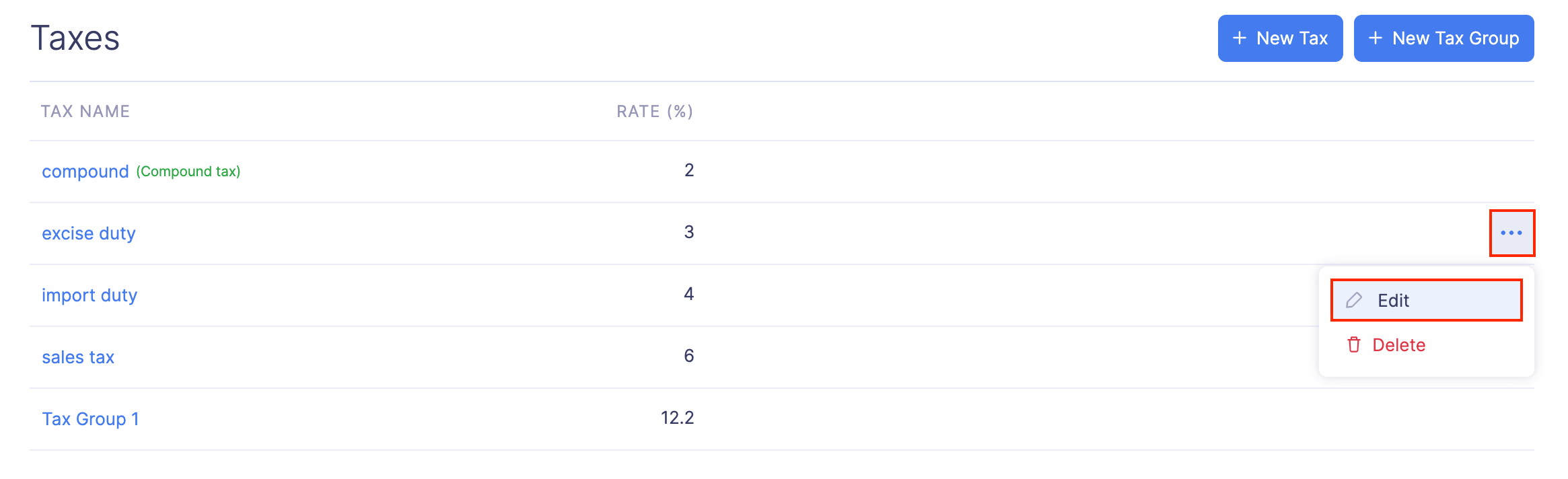

- If you want to convert an existing tax to a compound tax, click the More icon at the right corner of the tax and select Edit.

- Mark the Yes, this tax is a compound tax option and click Save. The tax will be converted into a compound tax.

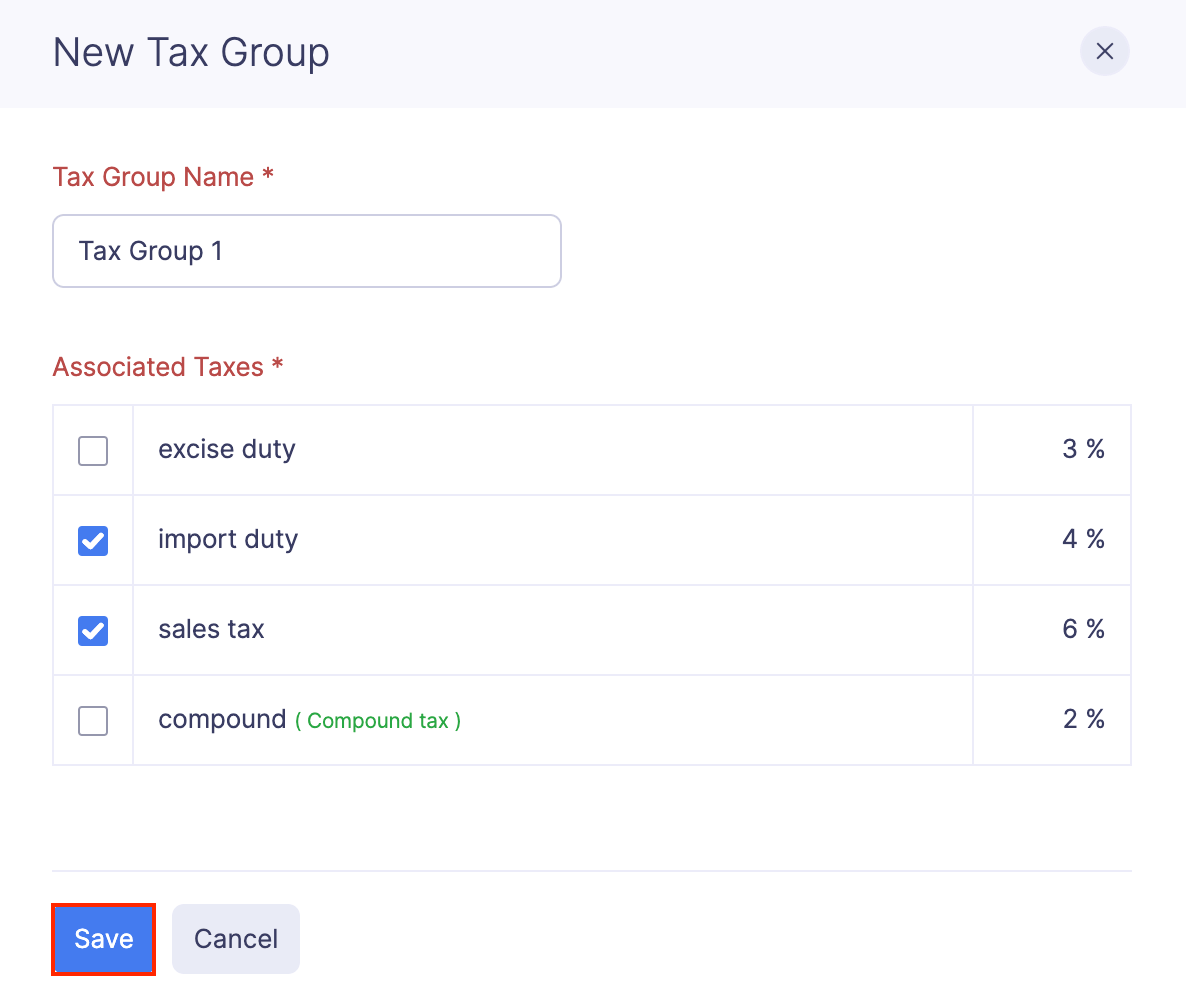

Create a New Tax Group

A tax group is where you can combine multiple taxes into a group, and apply them while creating expenses. You can add a tax group, when most of your employee expenses involve the addition of one or more taxes on a regular basis.

Note: If you include a compound tax in a tax group, the compound tax will be applied on top of the other taxes in the tax group.

To add a tax group:

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Go to Taxes under Organization.

- Click + New Tax Group at the top right corner.

- Enter a name for your tax group and select the taxes which you would like to add to your tax group.

- Click Save to save your newly created tax group.

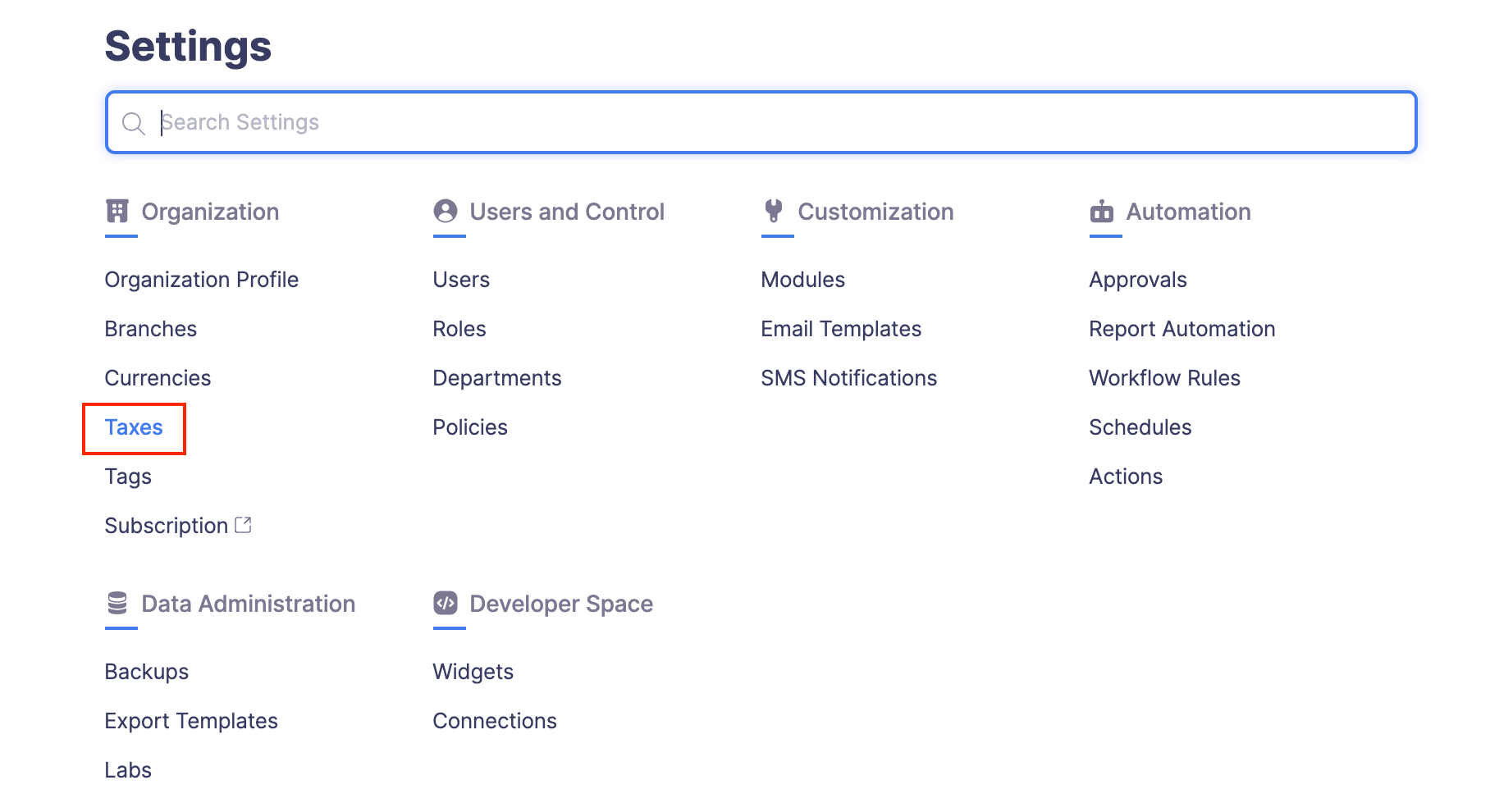

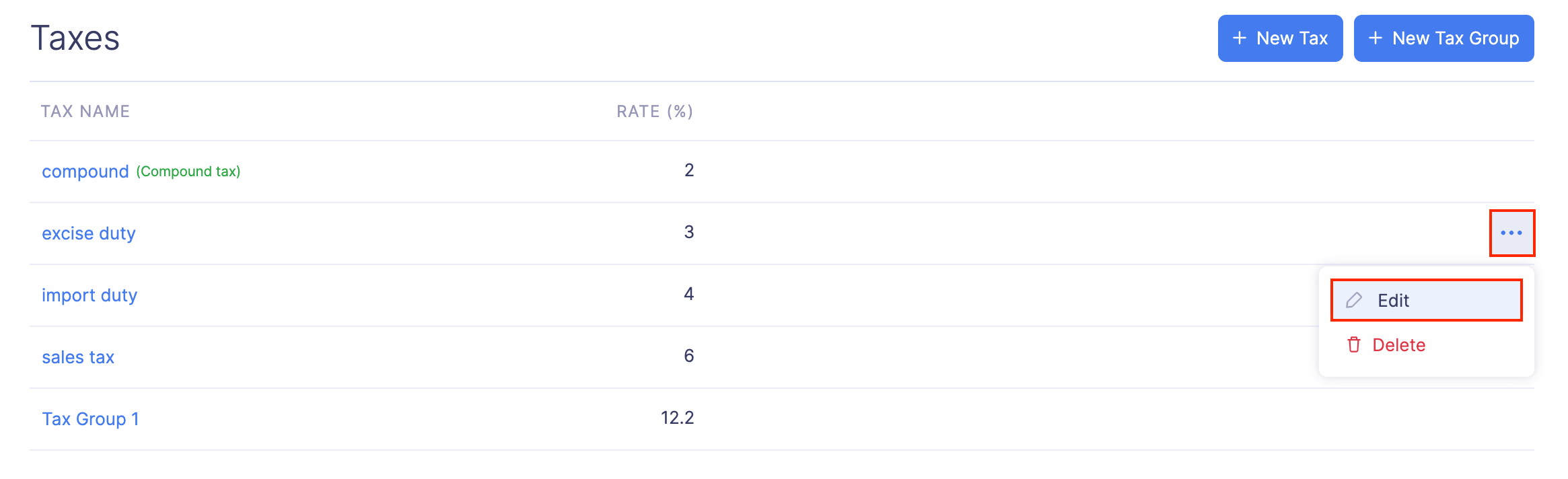

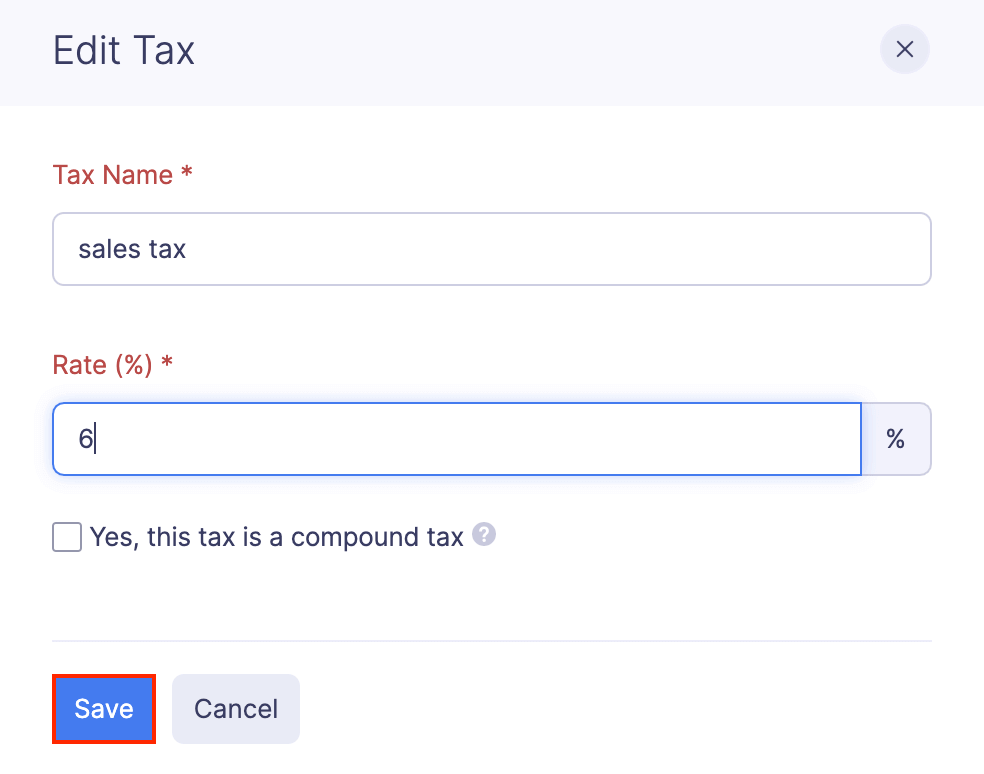

Edit a Tax

You can edit the existing tax rates based on the changes in the taxation laws of your country. To edit a tax rate:

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Go to Taxes under Organization.

- Click the More icon at the right corner of the tax rate you want to edit.

- Click Edit.

- Enter the new tax rate under Rate.

- Click Save.

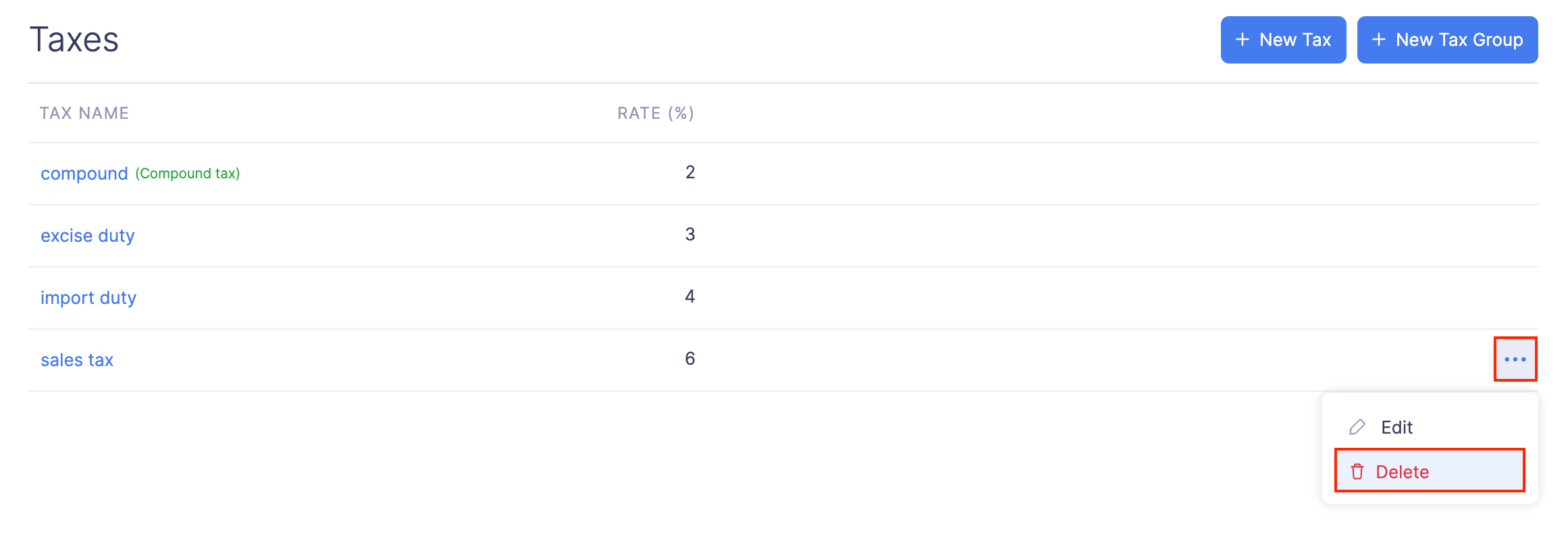

Delete a Tax

If you’ve created a tax and later found it unnecessary, you can delete it.

Prerequisite: The tax that you want to delete must not be associated to a tax group.

To delete a tax:

- Click Admin View.

- Go to Settings on the left sidebar.

(OR)

Click the Gear icon at the top right side.

- Go to Taxes under Organization.

- Click the More icon at the right corner of the tax rate you want to delete.

- Select Delete.

- In the popup that opens, click Delete to delete the tax.

Yes

Yes