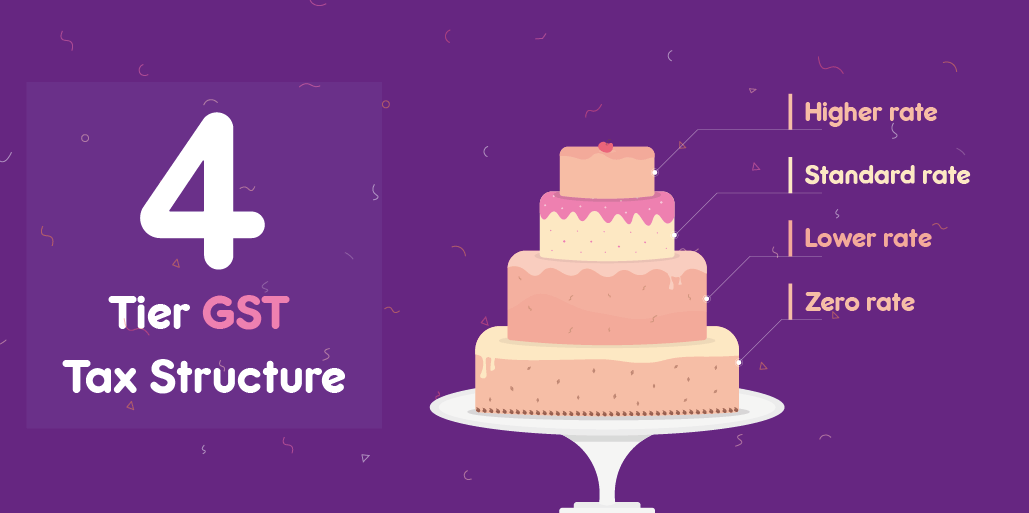

The GST was carefully crafted to keep both the burden of the common man and inflation rates in mind.

The four-tier tax structure contains four separate rates: a zero rate, a lower rate, a standard rate, and a higher rate. This article is aimed at providing a brief overview of each GST rate.

Zero rate

The zero rate tax is a nil tax rate that is applied on goods and services. This is equivalent to tax exemption and does not have any effect on the price of the product. Items that are eligible for zero rate tax are decided by the government.

The zero rate tax is applied on 50% of the items of the consumer price index (CPI) basket - an index that constantly measures prices of commonly purchased consumer goods and services to measure inflation. The zero rate items includes items such as, food grains, milk, curd, and other food items like eggs, cereal and meat. Also, metro travel, education and healthcare are exempted from GST.

The zero rate of the GST structure will keep the prices of basic items in check, regardless of whether the government decides to increase tax rates in the future.

Lower rate

A lower rate of 5% is applied on the rest of the items in the CPI basket and other items of mass consumption. This includes food items like sugar, tea, coffee, oil, and other essentials like PDS kerosene and LPG. Since the taxation on coal has reduced from 11.69% to 5% under the GST regime, electricity generation has said to be less expensive. The GST council had placed transport services in the 5% sector, which is applicable to Ola and Uber aggregators. Air-conditioned train tickets are taxed at a rate of 5%, while non-AC train tickets are exempt from GST. This, along with the zero rate tax, helps prevent inflation from having much of an impact on zero rate and lower rate items, keeping the prices of all essential items in check.

Standard rate

There are two standard rates: 12% and 18%. Finance Minister Arun Jaitley, in his address to the press, said that the Council had finalized two standard rates in order to keep inflation in check.

Imagine a product, which was previously taxed at 13%, charged a rate of 18% GST. This would increase the price of the product by 5%, leading to inflation. To avoid this, the GST council decided to tax all goods and services that were taxed at 9-15% at a standard rate of 12%. Processed foods are taxed at 12%. The rest of the goods and services are taxed the second standard rate of 18%. Toiletries like hair oil, soap, and toothpaste are taxed at 18%. Also, capital goods, industrial intermediaries, iron and steel, financial and telecom services are included under this sector.

Higher rate

A higher rate of 28% is levied on white goods such as washing machines, air conditioners, refrigerators, small cars, etc. Aerated drinks and cement are also included in this tier.

Previously, the tax on white goods was around 27% (including an excise of 12.5% and VAT of 14.5%), but the cascading effect elevated the tax as high as 30-31%. This is minimized by the new higher rate of 28%.

Additional cess

People worried that demerit goods (such as tobacco products and aerated drinks), which were previously taxed at 65% and 40%, would become cheaper and too easily accessible with the new higher rate of GST set at 28%. Keeping this in mind, the GST structure collects an additional cess on top of 28% GST. The cess will only be applied on certain demerit goods. The percentage of additional cess has been fixed by the government as 15% for luxury vehicles, 1% for petrol powered small cars and 3% for diesel powered small cars. Motorcycles with an engine capacity of over 350 cc are liable for an additional cess of 3%.

The idea of the GST structure is to lower the burden of the common man by taxing items of mass consumption at 0-5%, followed by taxing most major goods and services at a standard rate of 18%.