- HOME

- Taxes & compliance

- Understanding VAT Returns in Bahrain

Understanding VAT Returns in Bahrain

What are VAT Returns?

A VAT return is an official document that declares all sales and purchases made during a particular tax period. This record also consists of details regarding the VAT collected and paid on imports, exports, and exempt supplies made during this tax period.

Important Tax Return Filing Dates

The last day for filing returns is based on the annual turnovers of the business.

The timeline for VAT returns in Bahrain can either be semiannually or quarterly based on the annual turnovers of businesses.

Businesses with an annual turnover of over BHD 3 million must file their VAT returns at the end of the month following the tax period. The VAT return timeline for businesses with annual turnovers above BHD 3 million is shown below:

| First Tax Period | VAT Return Due Date |

|---|---|

| January 1st, 2019 to January 31st, 2019 | February 28th, 2019 |

| Subsequent Tax Periods: 1st to last of every month | End of the month following the tax period |

Businesses with annual turnovers that falls below BHD 3 million must file their VAT returns on a quarterly basis and their VAT return must be filed at the end of the month following the tax period. The VAT return timeline for businesses having an annual turnover that falls below BHD 3 million is shown below:

| Tax Period | VAT Return Due Date |

|---|---|

| January 1st, 2019 to March 31st, 2019 | April 30th, 2019 |

| April 1st, 2019 to June 30th, 2019 | July 31st, 2019 |

| July 1st, 2019 to September 30th, 2019 | October 31st, 2019 |

| October 1st, 2019 to December 31st, 2019 | January 31st, 2020 |

Registered taxpayers whose annual value of supplies does not exceed a value of BHD 3 million are permitted to submit a request to the Bureau to change their tax period from a quarterly basis to a monthly basis. Upon the successful processing of the request, the Bureau will notify the registered taxpayer of the applicant’s new tax period.

The NBR (National Bureau for Revenue) has complete authority to change the tax periods of particular registered taxpayers for reasons that they determine. The Bureau will notify the registered taxpayer of the newly formulated tax period, if any, 3 months before the date of the new tax period.

Information Required When Submitting a Tax Return

Taxpayers must submit their returns on or before the last day of the month that follows the end of the tax period. The following information is required to be declared by a taxpayer while filing for returns:

The value of all standard rated supplies and the amount of tax incurred by them during the period in which the tax return is submitted.

The value of all zero-rated supplies for the particular tax period.

The value of all goods and services bought and the amount of tax incurred on these supplies for the tax period.

The amount of tax that you are liable to pay for imports where payment has been deferred for a particular tax period.

If there are any adjustments made to the taxpayers’ tax period, then the value of additional tax that has been incurred must be declared.

The total amount of tax that is due for the particular tax period.

The total value of inputs and the value of deductible tax obtained from these inputs.

The net refundable tax carried over from the previous tax period.

The amount of deductible tax relating to imports.

The value of the excess tax recovered due to an adjustment made to a discount.

If there are any discounts applied for their supplies, the registered tax person must declare the total value of the excess tax that has been recovered by them.

The total amount of tax that is deductible for the particular tax period.

The total amount of net tax that is either payable or refundable.

Submitting a Tax Return

You are required to submit tax returns to the National Bureau for Revenue in the electronic form that has been specifically designed for this purpose.

The following information has to be noted before you file your VAT return:

You need to file your returns to the NBR and this is done electronically.

To access your return form, you need to have an NBR account. You can register by clicking here.

Once you file your return and submit it successfully, the NBR will send you an acknowledgement receipt via email and SMS. This, however, is not considered to be the official receipt. You can access the official receipt in PDF by logging on to your NBR portal.

You officially declare the viability of the information you submit once you do so through the NBR website.

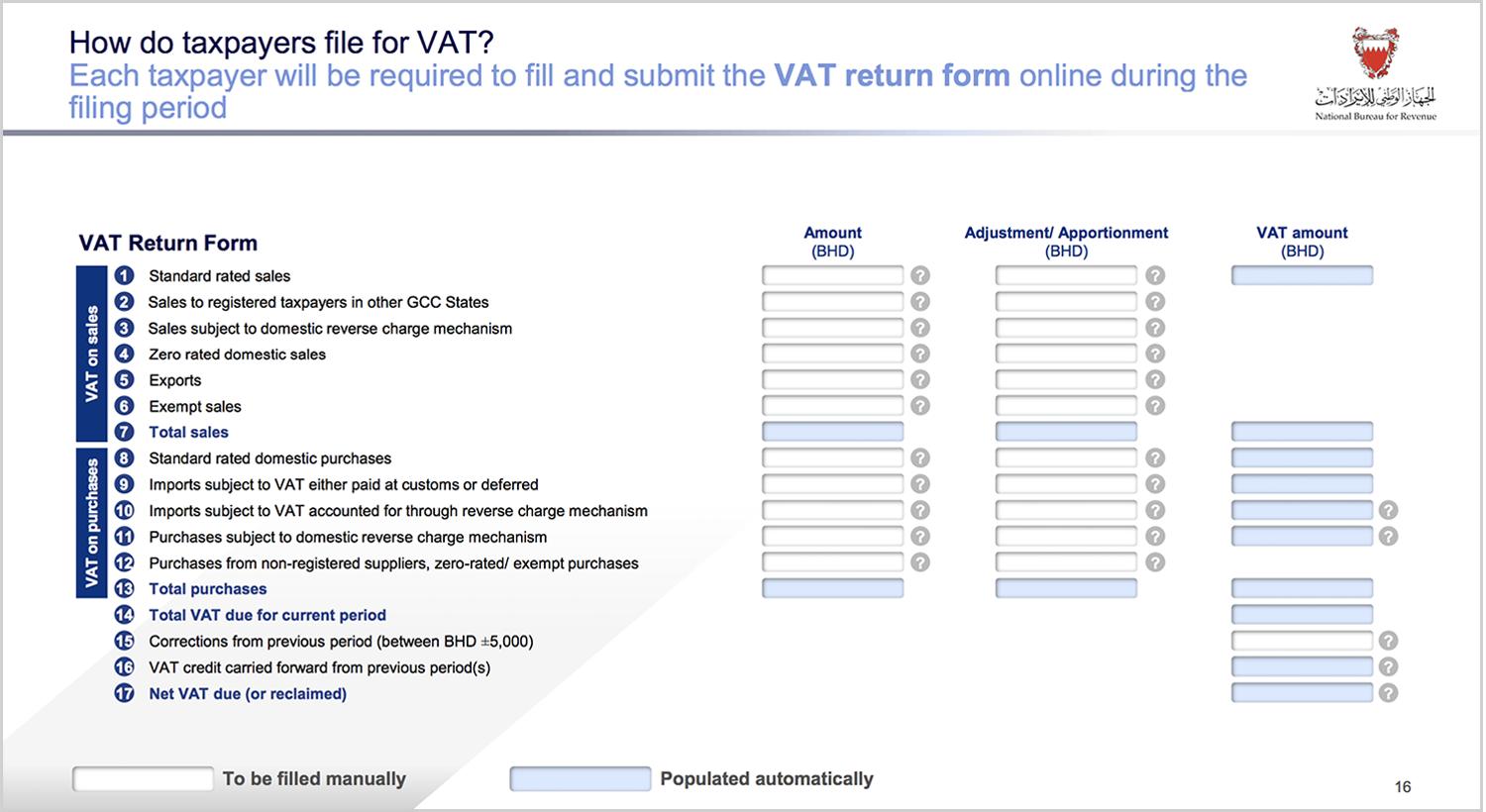

Returns must be filed to the NBR by the last day of the month following the end of the tax period. The VAT return online form and the values you must enter in each field are explained below.

Standard Rated Sales: Enter the total value of all standard rated goods and services sold over the VAT period, excluding the amount of VAT collected. The amount of VAT collected, and adjustments, if any, are entered in the second column. The total value of both sales and adjustments will be displayed automatically in the last column.

Sales to Registered Taxpayers in other GCC States: Enter the total amount of all sales made to other GCC states . However, all adjustments you make to sales you make to registered customers in other GCC states will be considered to be exports, until the integrated GCC customs system is made live. This field will not be editable for now.

Sales Subject to Domestic Reverse-Charge Mechanism: Enter the total amount of all sales and adjustments of standard-rated goods (including ones made in previous tax periods) made to a domestic purchaser who has been granted rights to apply reverse-charge mechanism.

Zero-Rated Domestic Sales: Enter the total value of all the zero-rated goods and services (excluding the amount of VAT collected) sold over the current tax period in the Kingdom or adjustments made to them from previous tax periods.

Exports: Enter the combined value of all taxable (standard and zero-rated) and exempt goods and services (excluding the amount of VAT collected) sold to other countries including adjustments made in the previous tax periods, if any, must be filled here.

Exempt Sales: The total value of all the exempt goods and services you sold (excluding the amount of VAT collected) in the current period, including adjustments from previous periods, if any, must be filled here. Remember that exempt goods and services are not subject to VAT.

Total Sales: The data in the previous entries, from 1 to 6, will be automatically calculated, summed up and displayed here. This amount will be exclusive of VAT.

Standard Rated Domestic Purchases: In this form, you have to enter the total value of all standard rated goods and services that was purchased domestically (excluding the amount of VAT collected) and adjustments from previous periods, if any.*

Imports Subject to VAT Either Paid at Customs or Deferred: In this form, you will have to fill out the total amount of goods (excluding the amount of VAT paid) that you have purchased (paid for or postponed) in the period, that are standard rated and imported including values of adjustments from the previous period, if any. You will also have to specify the standard rated imports or adjustments made to them if you are a designated importer in the Kingdom.*

Imports Subject to VAT Accounted for through the Reverse-Charge Mechanism: Enter the total amount of services (excluding the amount of VAT paid) that you have purchased for the tax period that are standard rated and imported, including adjustments or apportionments. When the reverse-charge mechanism applies, the recipient of the services is accountable for any VAT due instead of the supplier.*

Purchases Subject to Domestic Reverse-Charge Mechanism: Enter the total amount of goods and services (excluding the amount of VAT paid) under a grant by the NBR under the domestic reverse-charge mechanism has to be included here along with adjustments to previous such purchases, if any.*

Purchases from Non-Registered Suppliers, Zero-Rated/Exempt Purchases: Enter the value of all the zero-rated and exempt goods and services (excluding the amount of VAT paid) that are either purchased from the Kingdom or imported from another country from non-registered suppliers, including adjustments (excluding the amount of VAT paid) for goods and services purchased during previous tax periods.

Total Purchases: This box automatically sums up and displays the amount of goods and services (not including VAT) calculated from the boxes 8 to 12.

Total VAT Due for Current Period: This box shows the net and recoverable VAT calculated from VAT amount collected on sales and the amount recoverable from purchases.

Corrections from Previous Period (between BHD 5000 and BHD - 5000): If there are any corrections on previous returns and this entails a VAT liability adjustment of less than BHD 5000 and greater than BHD -5000, then you will have to enter that amount (not the sales or purchase amount) in this field. You can submit a self-amendment form for any other VAT adjustments.

VAT Credit Carried Forward from Previous Period(s): This form automatically calculates and displays the amount of credit in your account from previous returns that has not been used to even out liabilities or refunded using the amount entered in the previous form. The amount displayed here will be used to offset the VAT liability, if applicable.

Net VAT due (or reclaimed): This form automatically calculates and displays the total amount of VAT liability or credit for the return you are filing currently. Negative amounts displayed are VAT credits that can be refunded or ones that can be carried forward to balance out liabilities for subsequent tax periods.

*You can claim input VAT on these purchases only if they are used for making taxable sales. You cannot claim input VAT on parts of these purchases that are used to make exempt goods and services. If you do use these purchases to make exempt goods and services, input tax must be deducted from the claim that you file for. This applies to forms 8, 9, 10, and 11.

Note:

- “VAT on sales” refers to the supplies you have made throughout the VAT period.

- The second line “sales to registered taxpayers in other GCC States” is currently not an editable form. This page will be updated once this field is activated.

- Data must be entered manually in the white-labelled boxes. Blue-labelled boxes will display the an aggregated result of the data entered in the white-labelled ones automatically.

Amendment of Tax Returns

Registered taxpayers have the option to file for amendments if there are errors encountered in the amount of net tax which either causes an increase or decrease in its amount. A registered taxpayer may file for amended tax returns for any errors in value that is less than BHD 5000.

This amendment can be done by following the same steps as when you file normal tax returns with an amended tax return form prepared by the Bureau. This amended document must contain the details mentioned in the original tax return along with the original amount, amended amounts, and the difference between them. The reason for adjustment must also be mentioned.

The amended tax return must be submitted to the Authority within 30 days of the taxpayer being aware of there being an error in the original tax return, before the Bureau begins supervision and inspection procedures. The amended tax return will then serve as a substitute for the original tax return.

If the amendment is submitted within 30 days of receiving the original tax return, there will not be any fines imposed on the taxpayer.

The taxpayer applying for the VAT refund must do so within 5 years after the end of the year in which a qualifying condition has taken place.