Back

Will tax be calculated for each item when I invoice my customer?

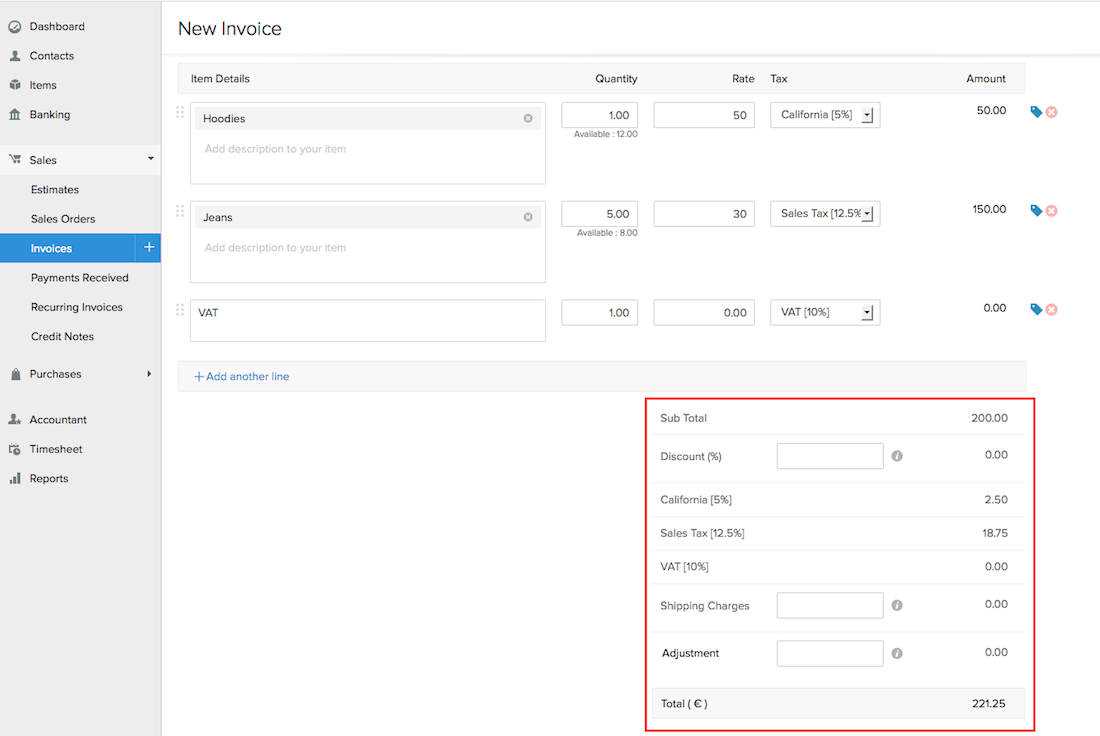

When you create an invoice with multiple items, the total tax liable is calculated on the final invoice amount and displayed at the bottom. The tax amount is split up with respect to the different tax groups the invoice items fall under, rather than the tax calculated on each item.

Consider this scenario.

Item A in your inventory is subject to a regional tax of 5%, while Item B has sales tax of 2% levied on it.

If your invoice consists of 4 pieces of A and 4 pieces of B,

- the total amount due without tax is first calculated and displayed.

- Then, the total regional tax (calculated on the overall sum of A) and total sales tax (calculated on the overall sum of B) are shown separately before,

- The final invoice amount (initial amount + regional tax + sales tax) is displayed.

Yes

Yes